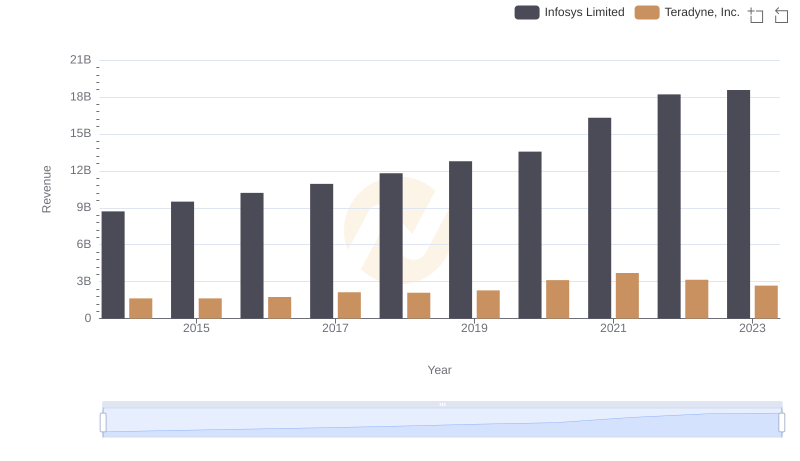

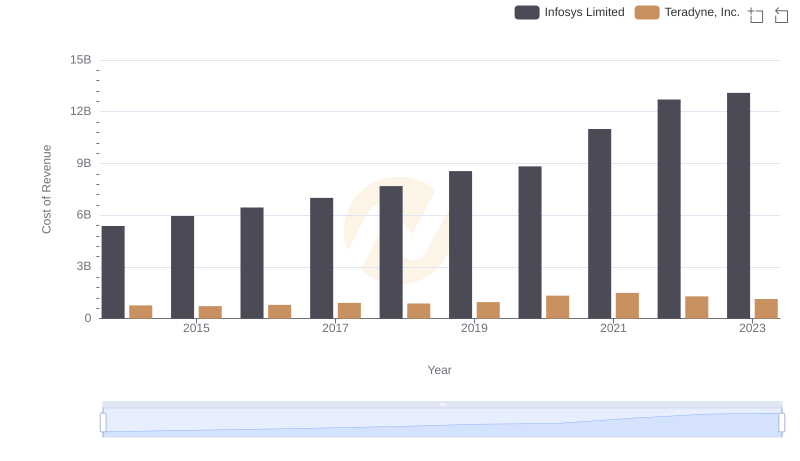

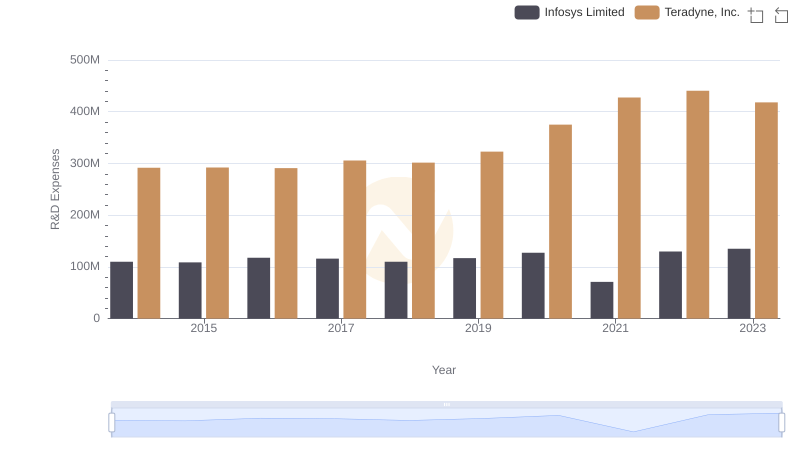

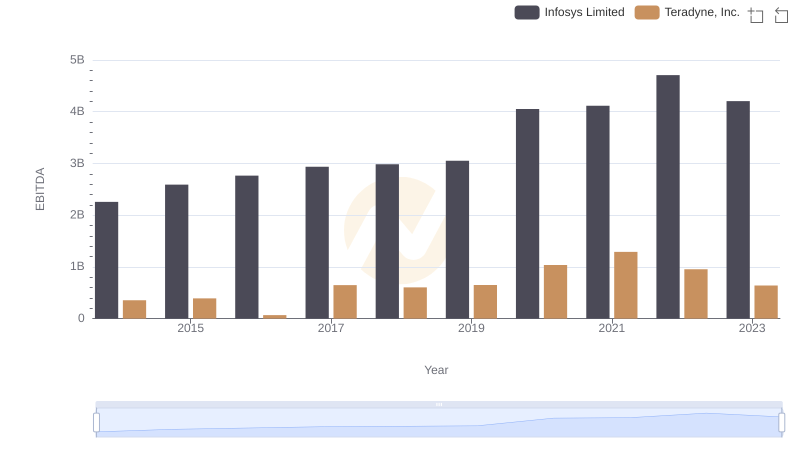

| __timestamp | Infosys Limited | Teradyne, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3337000000 | 878808000 |

| Thursday, January 1, 2015 | 3551000000 | 915643000 |

| Friday, January 1, 2016 | 3762000000 | 959567000 |

| Sunday, January 1, 2017 | 3938000000 | 1223872000 |

| Monday, January 1, 2018 | 4112000000 | 1220394000 |

| Tuesday, January 1, 2019 | 4228000000 | 1339829000 |

| Wednesday, January 1, 2020 | 4733000000 | 1785741000 |

| Friday, January 1, 2021 | 5315000000 | 2206656000 |

| Saturday, January 1, 2022 | 5503000000 | 1867151000 |

| Sunday, January 1, 2023 | 5466000000 | 1536748000 |

| Monday, January 1, 2024 | 1648927000 |

Infusing magic into the data realm

In the ever-evolving landscape of technology, the financial performance of industry giants like Infosys Limited and Teradyne, Inc. offers a fascinating glimpse into their strategic prowess. Over the past decade, Infosys has consistently outperformed Teradyne in terms of gross profit, showcasing a robust growth trajectory. From 2014 to 2023, Infosys's gross profit surged by approximately 64%, peaking in 2022. In contrast, Teradyne experienced a more modest growth of around 75% during the same period, with its highest gross profit recorded in 2021.

This performance disparity highlights Infosys's ability to leverage its global presence and diversified service offerings, while Teradyne's growth reflects its focus on automation and semiconductor testing solutions. As the tech industry continues to expand, these financial insights underscore the importance of strategic adaptability and innovation in maintaining competitive advantage.

Gross Profit Trends Compared: Infosys Limited vs ASE Technology Holding Co., Ltd.

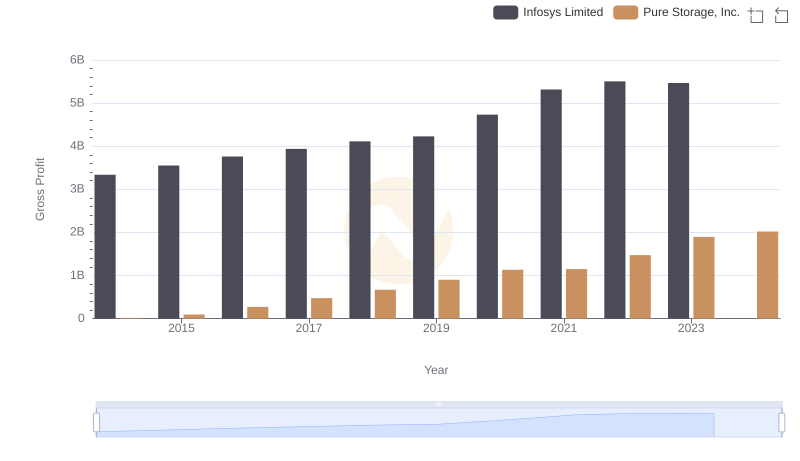

Infosys Limited and Pure Storage, Inc.: A Detailed Gross Profit Analysis

Who Generates More Revenue? Infosys Limited or Teradyne, Inc.

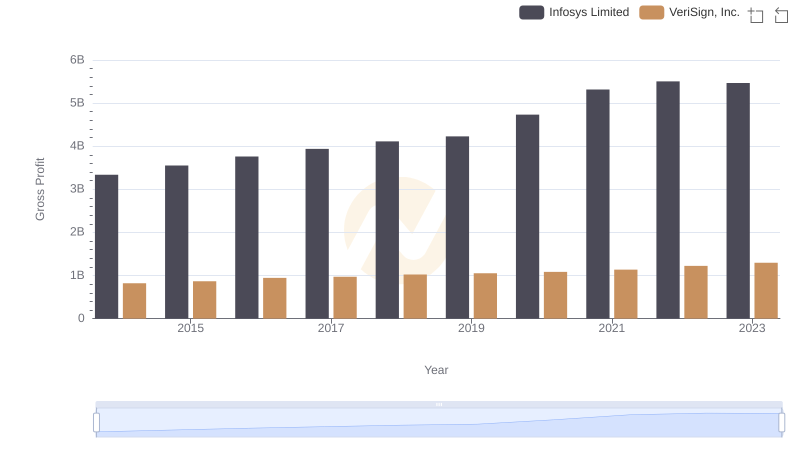

Key Insights on Gross Profit: Infosys Limited vs VeriSign, Inc.

Analyzing Cost of Revenue: Infosys Limited and Teradyne, Inc.

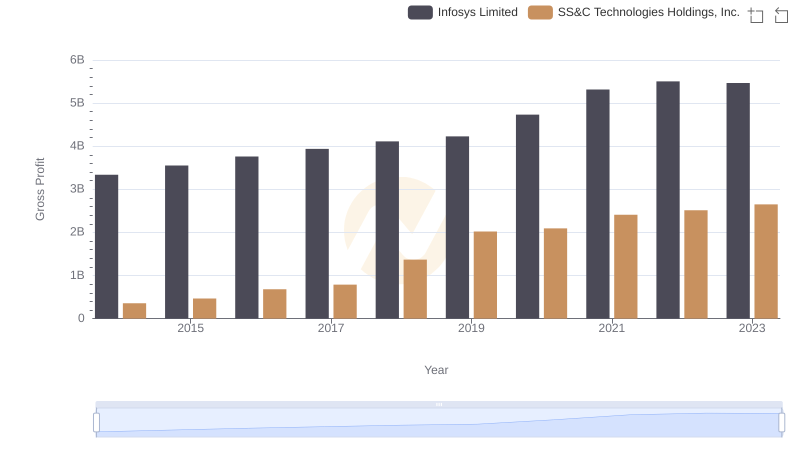

Gross Profit Comparison: Infosys Limited and SS&C Technologies Holdings, Inc. Trends

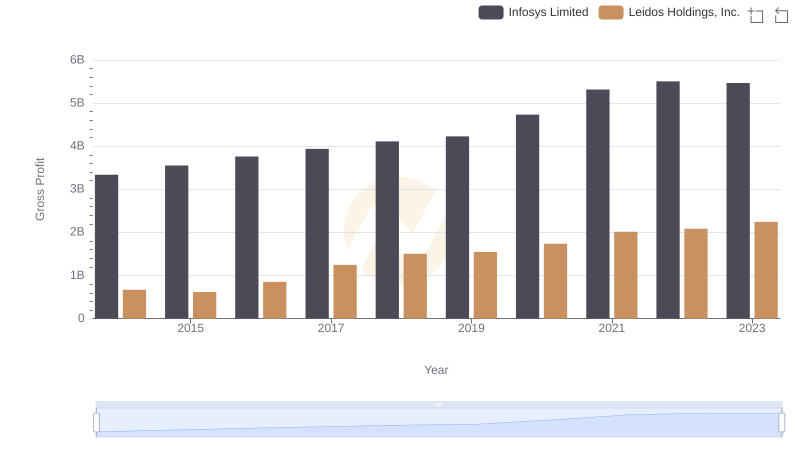

Infosys Limited and Leidos Holdings, Inc.: A Detailed Gross Profit Analysis

Who Prioritizes Innovation? R&D Spending Compared for Infosys Limited and Teradyne, Inc.

Key Insights on Gross Profit: Infosys Limited vs Trimble Inc.

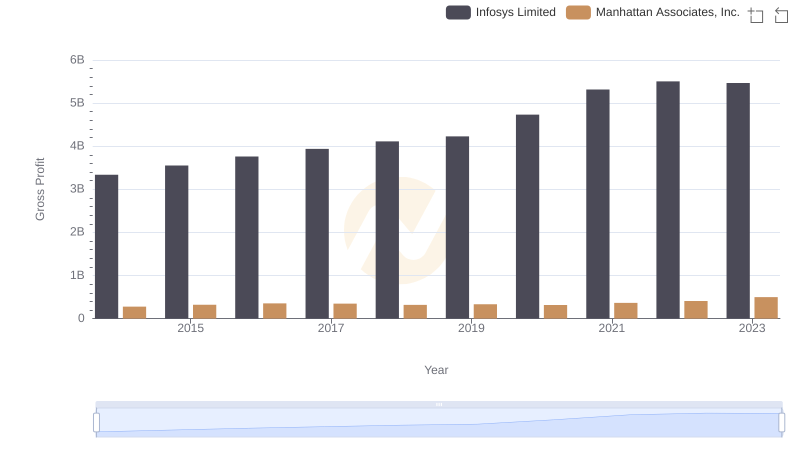

Who Generates Higher Gross Profit? Infosys Limited or Manhattan Associates, Inc.

Breaking Down SG&A Expenses: Infosys Limited vs Teradyne, Inc.

EBITDA Metrics Evaluated: Infosys Limited vs Teradyne, Inc.