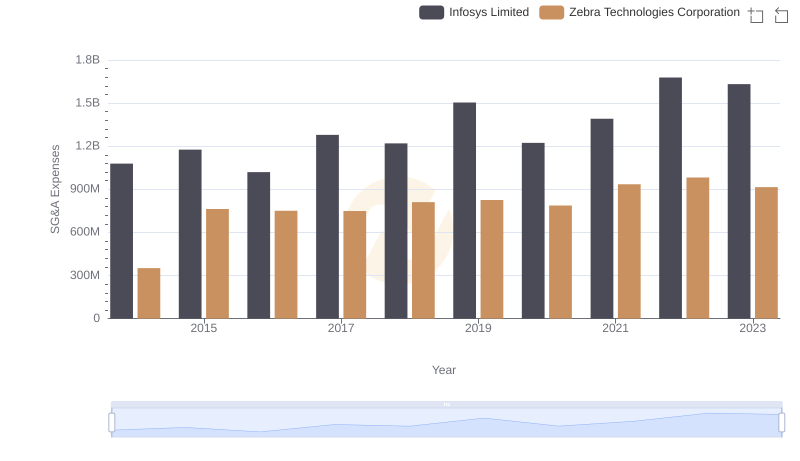

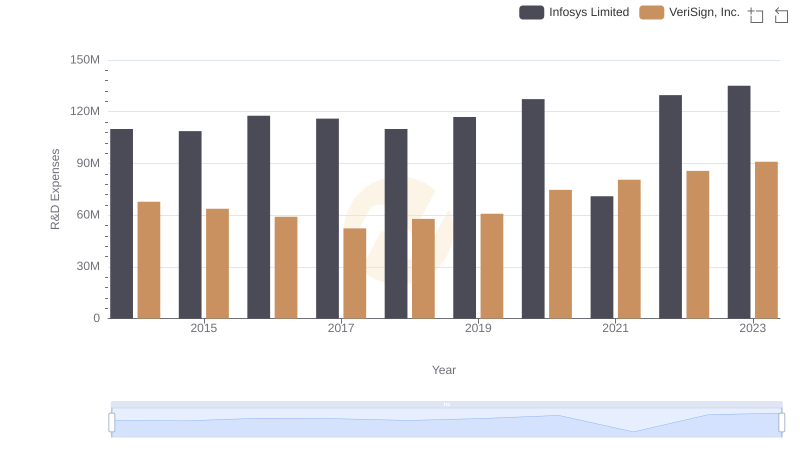

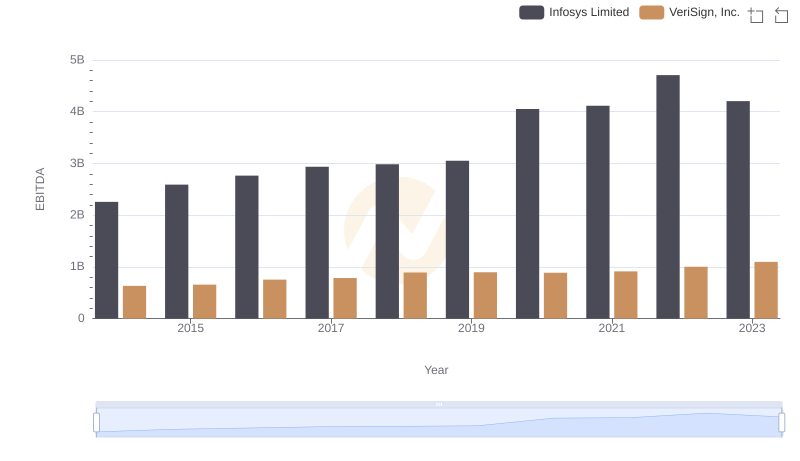

| __timestamp | Infosys Limited | VeriSign, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 189488000 |

| Thursday, January 1, 2015 | 1176000000 | 196914000 |

| Friday, January 1, 2016 | 1020000000 | 198253000 |

| Sunday, January 1, 2017 | 1279000000 | 211705000 |

| Monday, January 1, 2018 | 1220000000 | 197559000 |

| Tuesday, January 1, 2019 | 1504000000 | 184262000 |

| Wednesday, January 1, 2020 | 1223000000 | 186003000 |

| Friday, January 1, 2021 | 1391000000 | 188311000 |

| Saturday, January 1, 2022 | 1678000000 | 195400000 |

| Sunday, January 1, 2023 | 1632000000 | 204200000 |

| Monday, January 1, 2024 | 211100000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, understanding cost management is crucial for maintaining profitability. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Infosys Limited and VeriSign, Inc., from 2014 to 2023.

Infosys, a leader in IT services, has seen its SG&A expenses grow by approximately 51% over the past decade. Notably, 2019 marked a significant spike, with expenses reaching their peak in 2022, reflecting strategic investments in global expansion and digital transformation.

VeriSign, a key player in domain name registry services, maintained a more stable SG&A trajectory, with a modest increase of around 8% over the same period. The highest expenses were recorded in 2017 and 2023, indicating focused efforts on cybersecurity enhancements.

This comparative analysis highlights the distinct cost management strategies employed by these companies, offering valuable insights for investors and industry analysts.

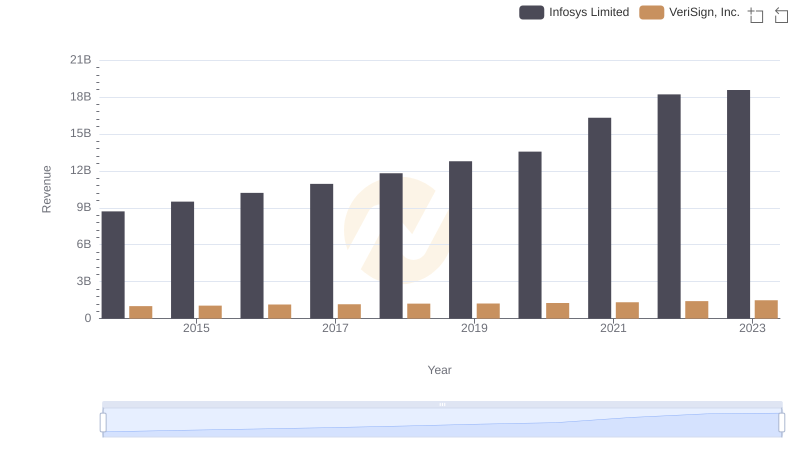

Infosys Limited and VeriSign, Inc.: A Comprehensive Revenue Analysis

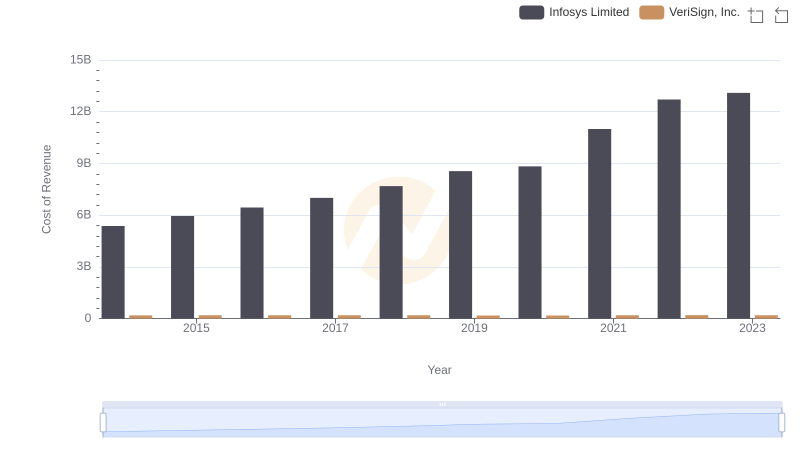

Cost of Revenue: Key Insights for Infosys Limited and VeriSign, Inc.

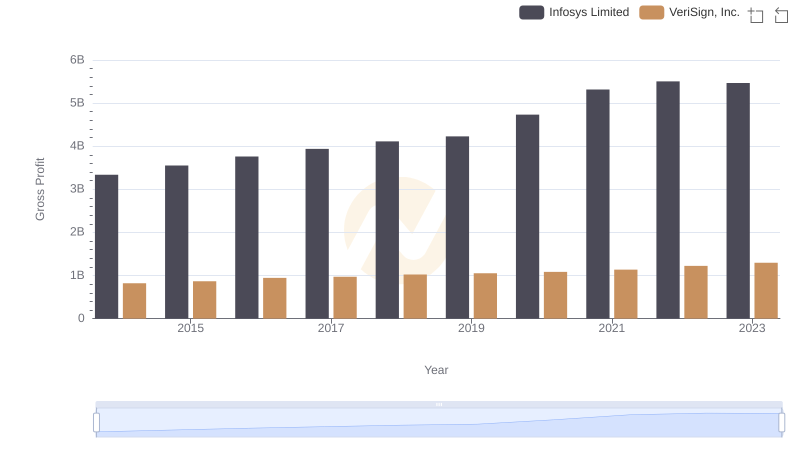

Key Insights on Gross Profit: Infosys Limited vs VeriSign, Inc.

SG&A Efficiency Analysis: Comparing Infosys Limited and Zebra Technologies Corporation

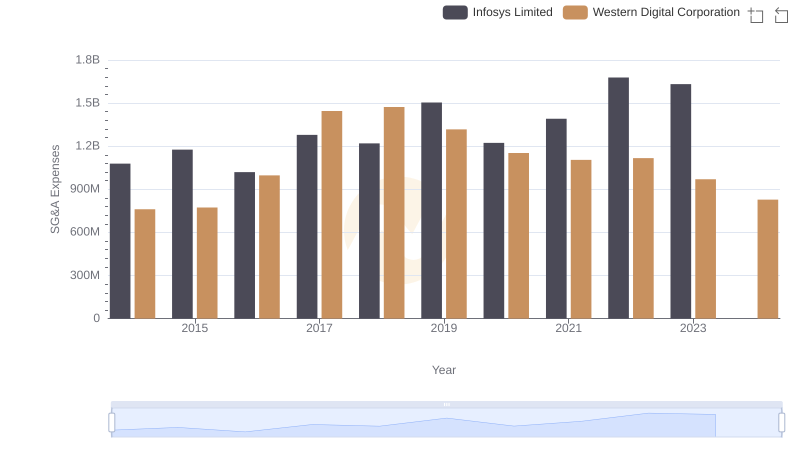

Who Optimizes SG&A Costs Better? Infosys Limited or Western Digital Corporation

Infosys Limited or VeriSign, Inc.: Who Invests More in Innovation?

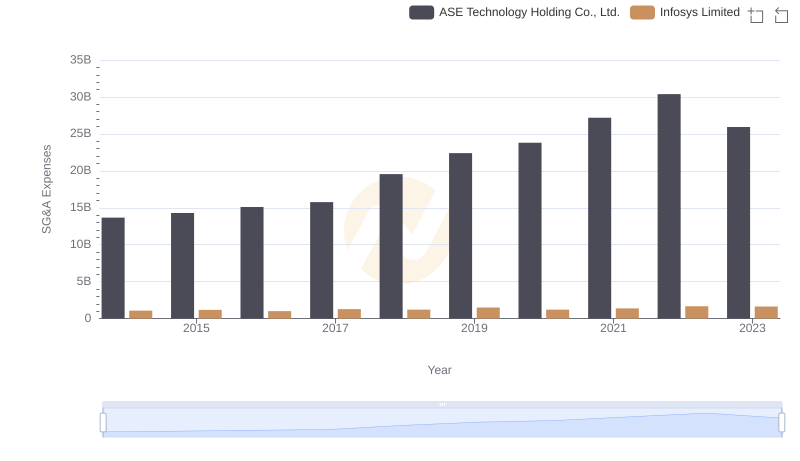

Selling, General, and Administrative Costs: Infosys Limited vs ASE Technology Holding Co., Ltd.

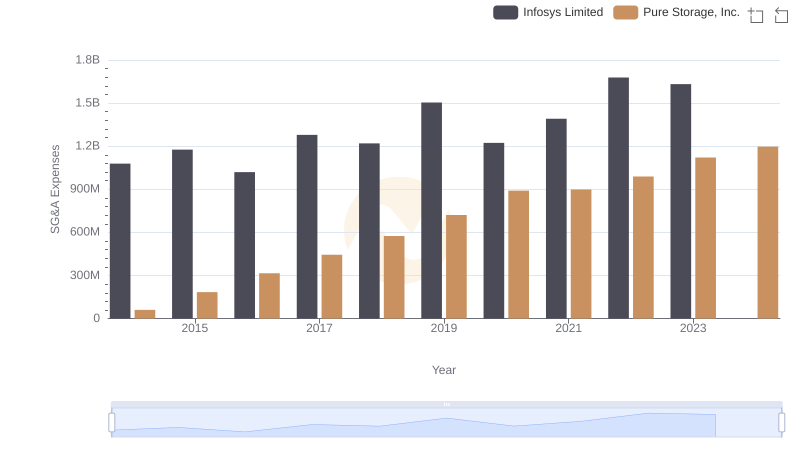

Infosys Limited and Pure Storage, Inc.: SG&A Spending Patterns Compared

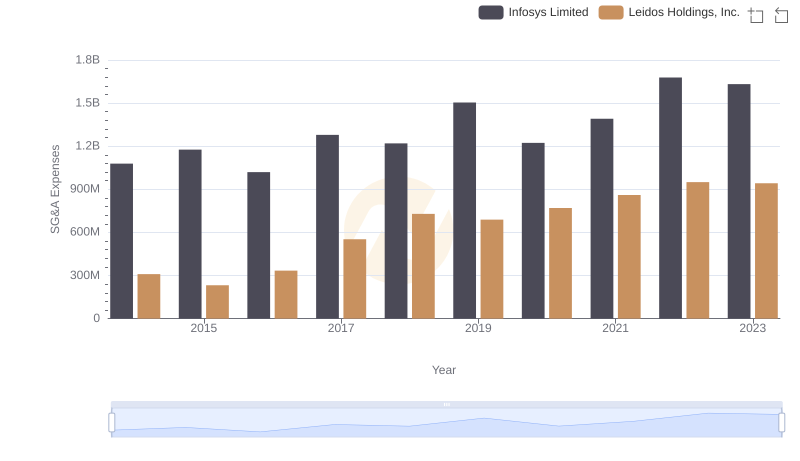

SG&A Efficiency Analysis: Comparing Infosys Limited and Leidos Holdings, Inc.

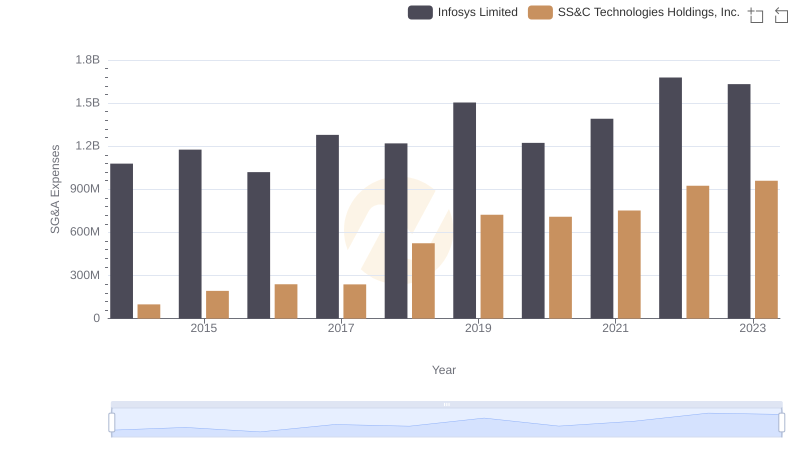

Breaking Down SG&A Expenses: Infosys Limited vs SS&C Technologies Holdings, Inc.

EBITDA Analysis: Evaluating Infosys Limited Against VeriSign, Inc.

Breaking Down SG&A Expenses: Infosys Limited vs Teradyne, Inc.