| __timestamp | Axon Enterprise, Inc. | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 62977000 | 4563000000 |

| Thursday, January 1, 2015 | 69245000 | 4263200000 |

| Friday, January 1, 2016 | 97709000 | 3095900000 |

| Sunday, January 1, 2017 | 136710000 | 3107400000 |

| Monday, January 1, 2018 | 161485000 | 1917400000 |

| Tuesday, January 1, 2019 | 223574000 | 1905700000 |

| Wednesday, January 1, 2020 | 264672000 | 1960200000 |

| Friday, January 1, 2021 | 322471000 | 2445600000 |

| Saturday, January 1, 2022 | 461297000 | 2757200000 |

| Sunday, January 1, 2023 | 608009000 | 2585300000 |

| Monday, January 1, 2024 | 2484000000 |

Data in motion

In the ever-evolving landscape of corporate finance, understanding cost efficiency is paramount. This analysis delves into the cost of revenue trends for Axon Enterprise, Inc. and Pentair plc from 2014 to 2023. Over this period, Axon Enterprise, Inc. demonstrated a remarkable growth trajectory, with its cost of revenue increasing by approximately 866%, from $63 million in 2014 to $608 million in 2023. This reflects the company's strategic expansion and investment in operational capabilities.

Conversely, Pentair plc experienced a 43% reduction in its cost of revenue, from $4.56 billion in 2014 to $2.59 billion in 2023. This decline suggests a significant enhancement in operational efficiency, possibly through cost-cutting measures or improved production processes. The contrasting trends between these two companies offer valuable insights into their strategic priorities and market positioning over the past decade.

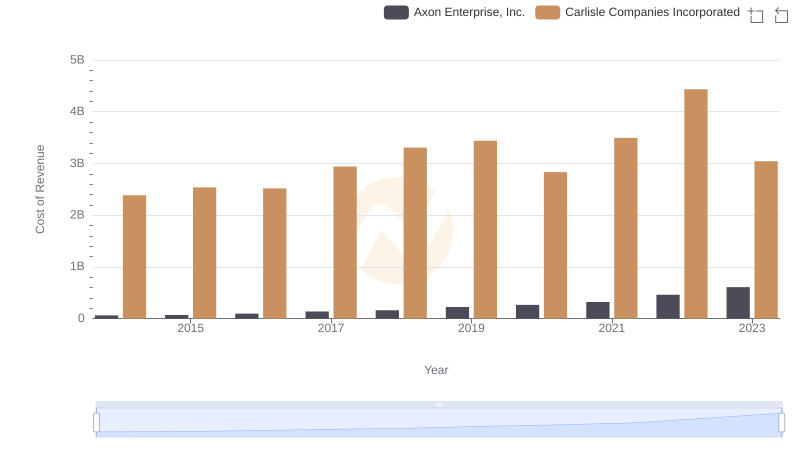

Cost Insights: Breaking Down Axon Enterprise, Inc. and Carlisle Companies Incorporated's Expenses

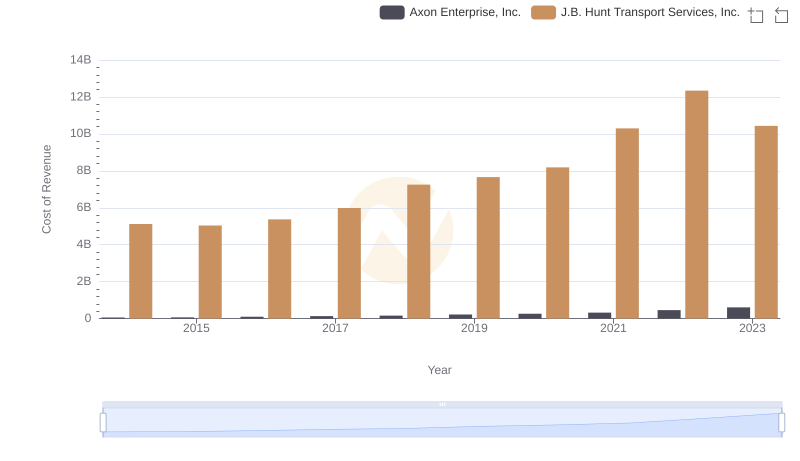

Cost of Revenue Trends: Axon Enterprise, Inc. vs J.B. Hunt Transport Services, Inc.

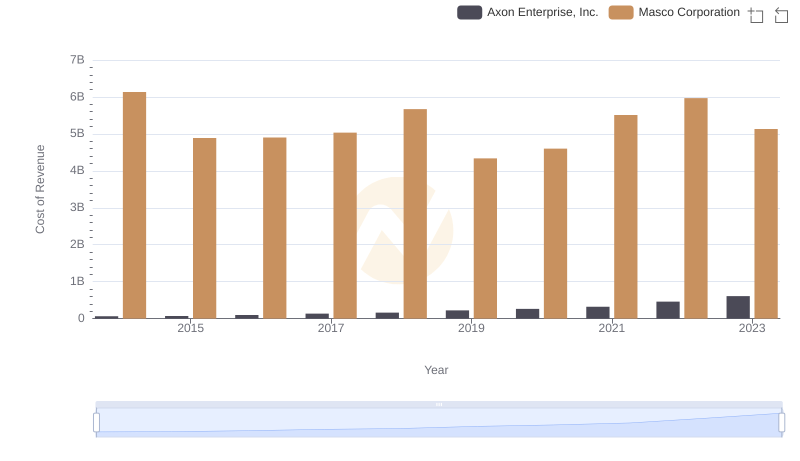

Cost of Revenue Comparison: Axon Enterprise, Inc. vs Masco Corporation

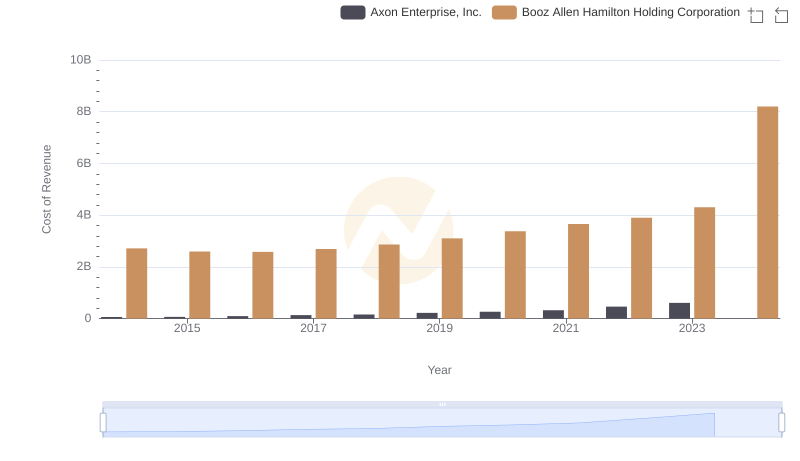

Cost of Revenue: Key Insights for Axon Enterprise, Inc. and Booz Allen Hamilton Holding Corporation

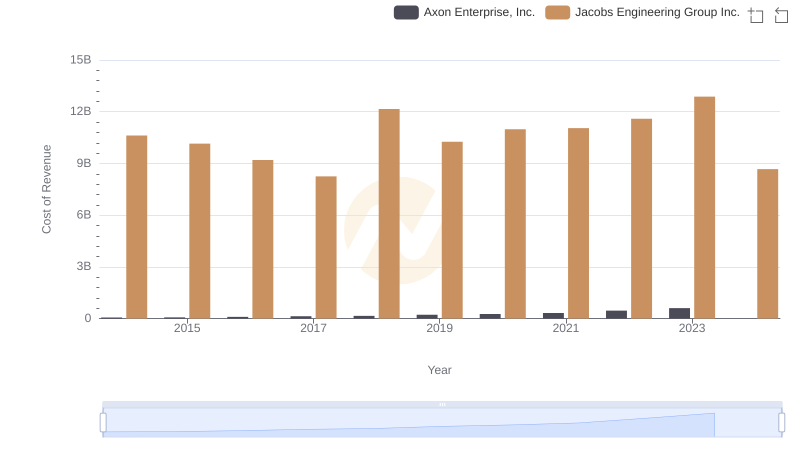

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Jacobs Engineering Group Inc.

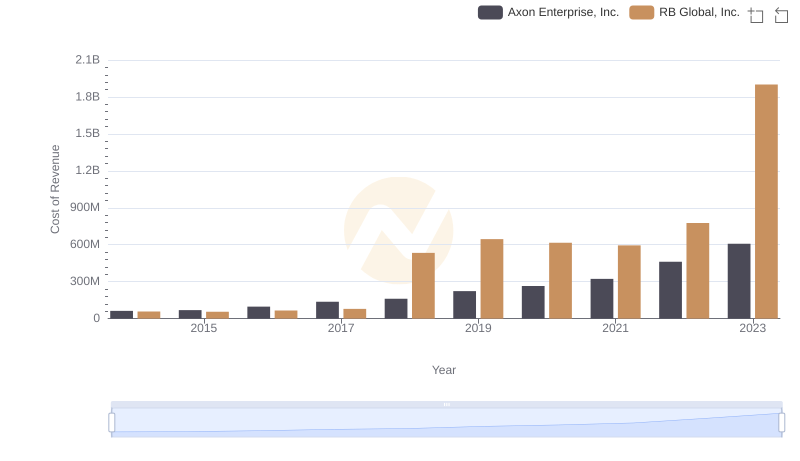

Cost Insights: Breaking Down Axon Enterprise, Inc. and RB Global, Inc.'s Expenses

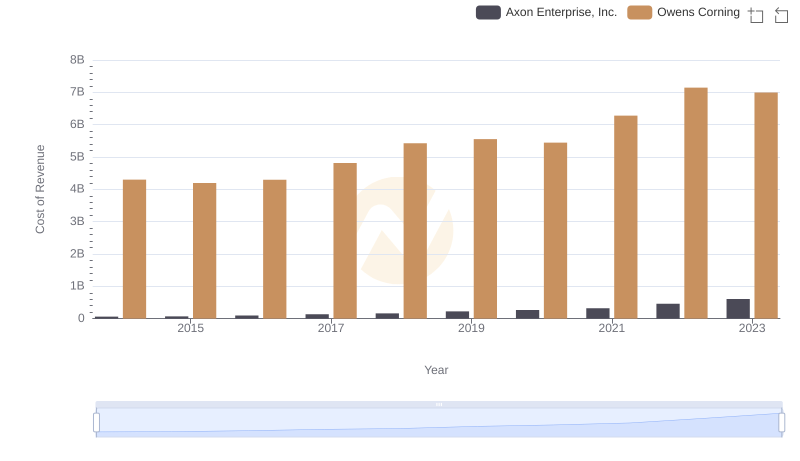

Cost of Revenue: Key Insights for Axon Enterprise, Inc. and Owens Corning

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or Pentair plc