| __timestamp | Axon Enterprise, Inc. | ITT Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 519500000 |

| Thursday, January 1, 2015 | 69698000 | 441500000 |

| Friday, January 1, 2016 | 108076000 | 444100000 |

| Sunday, January 1, 2017 | 138692000 | 433700000 |

| Monday, January 1, 2018 | 156886000 | 427300000 |

| Tuesday, January 1, 2019 | 212959000 | 420000000 |

| Wednesday, January 1, 2020 | 307286000 | 347200000 |

| Friday, January 1, 2021 | 515007000 | 365100000 |

| Saturday, January 1, 2022 | 401575000 | 368500000 |

| Sunday, January 1, 2023 | 496874000 | 476600000 |

| Monday, January 1, 2024 | 502300000 |

Cracking the code

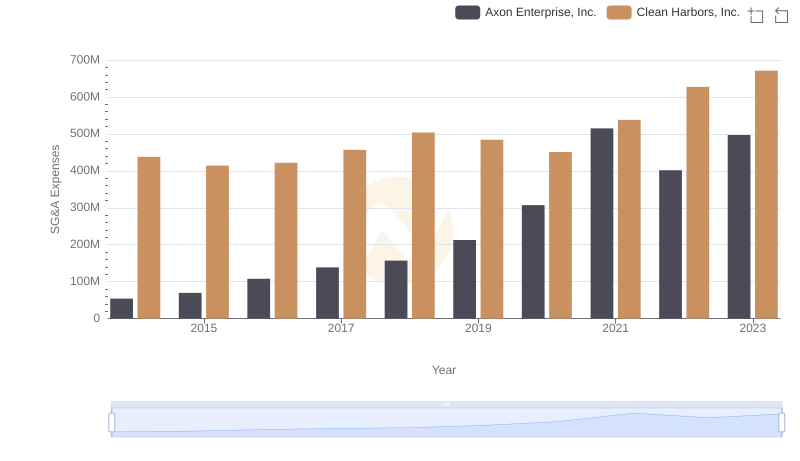

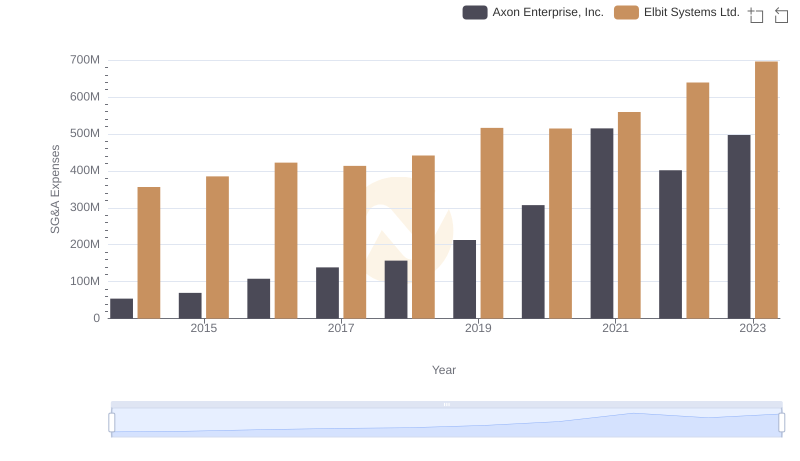

In the ever-evolving landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses is crucial for investors and analysts alike. Over the past decade, Axon Enterprise, Inc. has seen a remarkable increase in its SG&A expenses, growing by approximately 817% from 2014 to 2023. This surge reflects the company's aggressive expansion and investment in operational capabilities. In contrast, ITT Inc. has maintained a more stable SG&A expense profile, with a modest decline of about 8% over the same period, indicating a focus on efficiency and cost management.

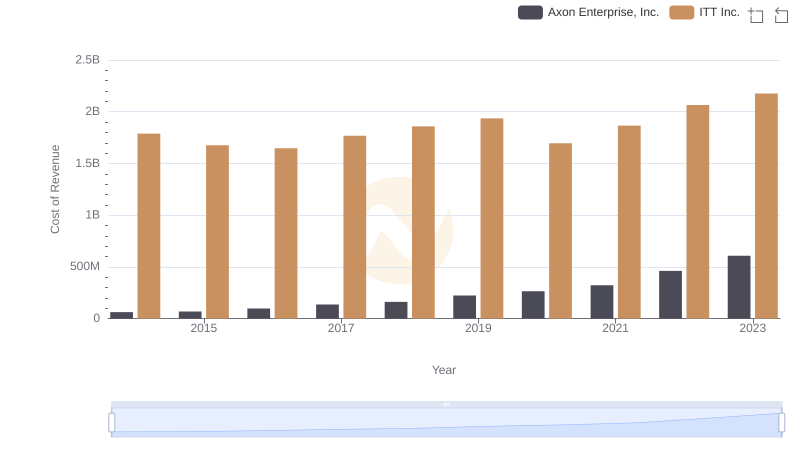

Analyzing Cost of Revenue: Axon Enterprise, Inc. and ITT Inc.

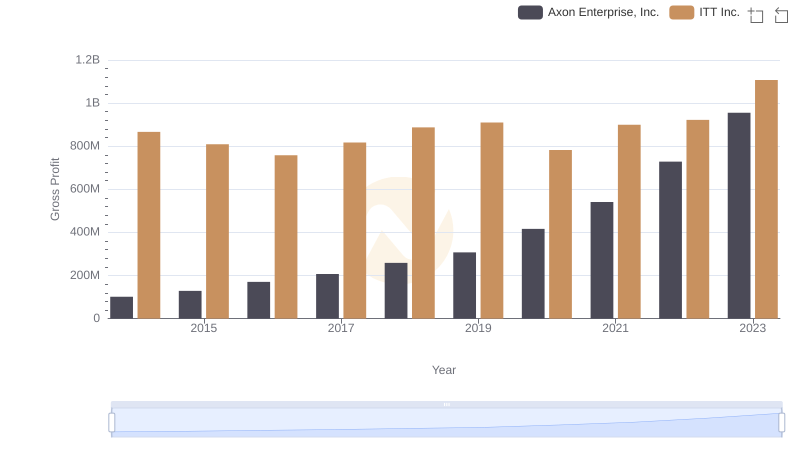

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and ITT Inc.

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Clean Harbors, Inc. Trends and Insights

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Elbit Systems Ltd. Trends and Insights

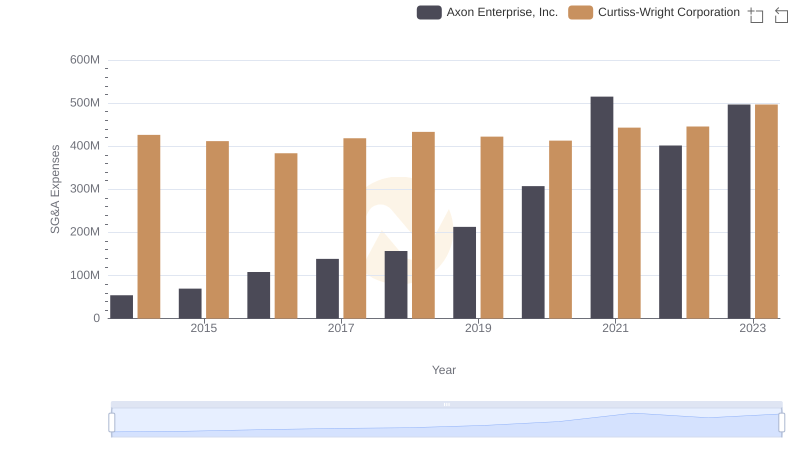

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Curtiss-Wright Corporation Trends and Insights

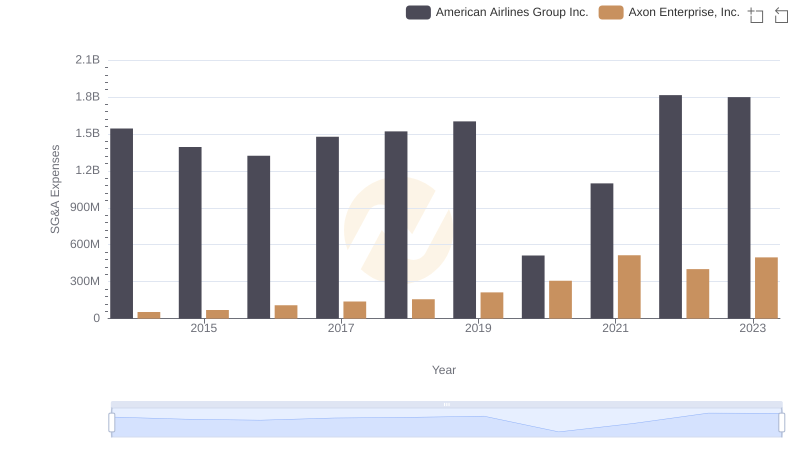

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or American Airlines Group Inc.

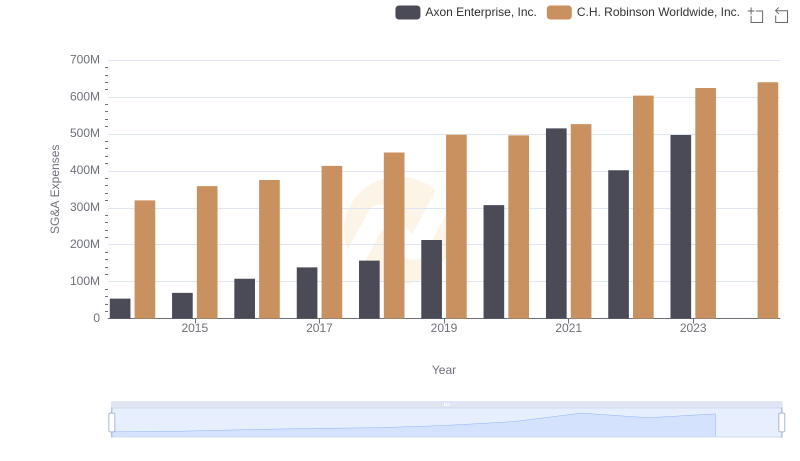

Axon Enterprise, Inc. vs C.H. Robinson Worldwide, Inc.: SG&A Expense Trends

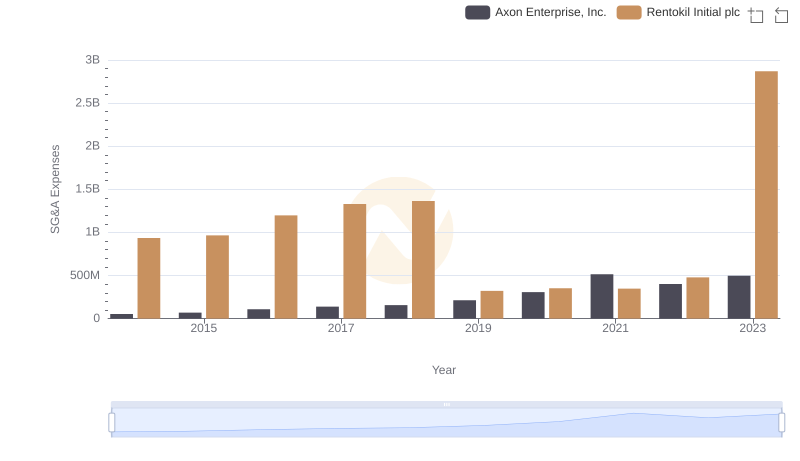

Axon Enterprise, Inc. vs Rentokil Initial plc: SG&A Expense Trends

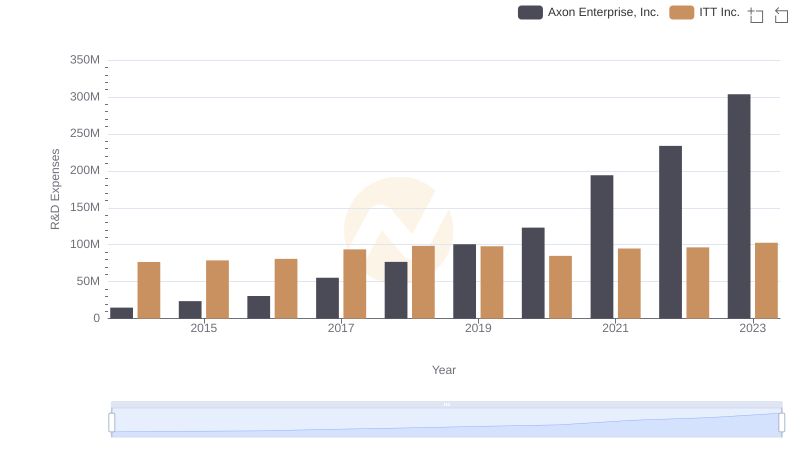

R&D Spending Showdown: Axon Enterprise, Inc. vs ITT Inc.

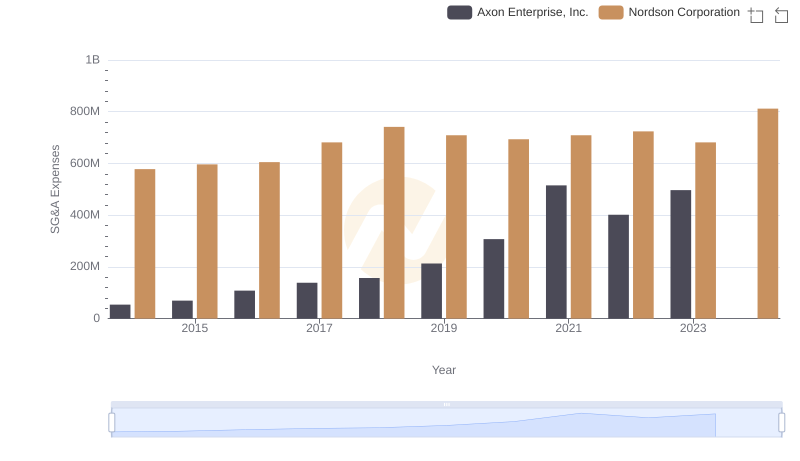

Axon Enterprise, Inc. and Nordson Corporation: SG&A Spending Patterns Compared

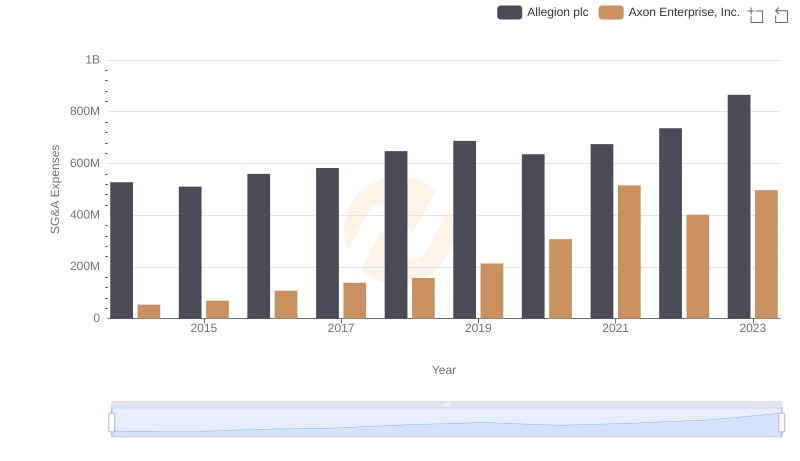

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or Allegion plc