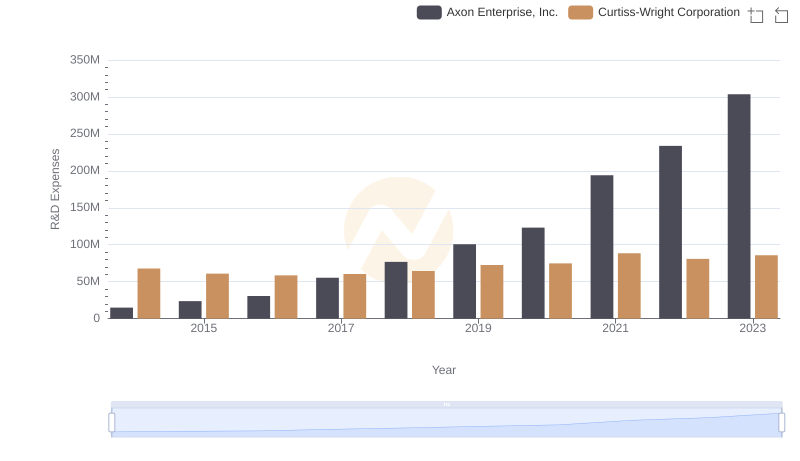

| __timestamp | Axon Enterprise, Inc. | Curtiss-Wright Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 426301000 |

| Thursday, January 1, 2015 | 69698000 | 411801000 |

| Friday, January 1, 2016 | 108076000 | 383793000 |

| Sunday, January 1, 2017 | 138692000 | 418544000 |

| Monday, January 1, 2018 | 156886000 | 433110000 |

| Tuesday, January 1, 2019 | 212959000 | 422272000 |

| Wednesday, January 1, 2020 | 307286000 | 412825000 |

| Friday, January 1, 2021 | 515007000 | 443096000 |

| Saturday, January 1, 2022 | 401575000 | 445679000 |

| Sunday, January 1, 2023 | 496874000 | 496812000 |

| Monday, January 1, 2024 | 518857000 |

Data in motion

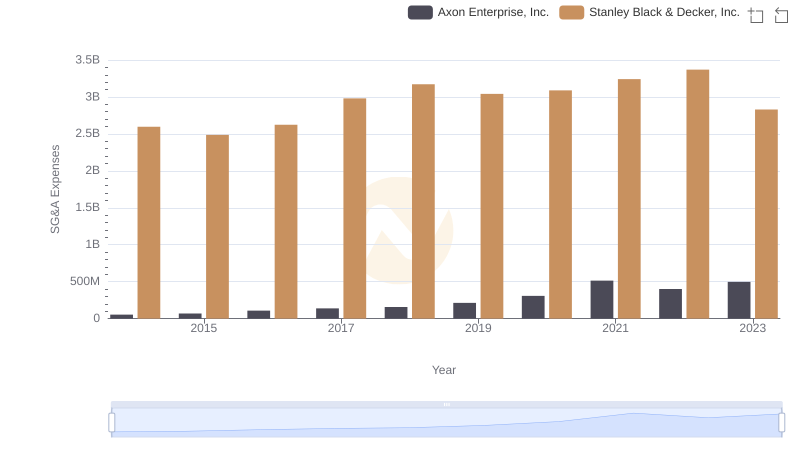

In the ever-evolving landscape of corporate finance, Selling, General, and Administrative (SG&A) expenses serve as a critical indicator of a company's operational efficiency. This analysis juxtaposes the SG&A trends of Axon Enterprise, Inc. and Curtiss-Wright Corporation from 2014 to 2023.

Axon Enterprise, Inc. has witnessed a remarkable surge in SG&A expenses, growing by over 800% from 2014 to 2023. This increase reflects Axon's aggressive expansion and investment in administrative capabilities. Notably, the year 2021 marked a peak, with expenses reaching nearly 515 million, a 70% rise from the previous year.

In contrast, Curtiss-Wright Corporation's SG&A expenses have remained relatively stable, fluctuating around the 400 million mark. The company's strategic focus on cost control is evident, with only a modest 17% increase over the decade.

This comparative analysis underscores the diverse strategies employed by these industry players, offering valuable insights into their financial trajectories.

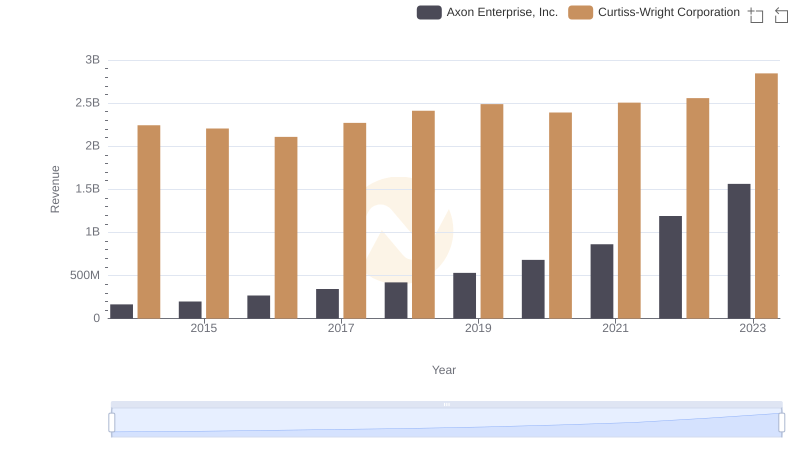

Annual Revenue Comparison: Axon Enterprise, Inc. vs Curtiss-Wright Corporation

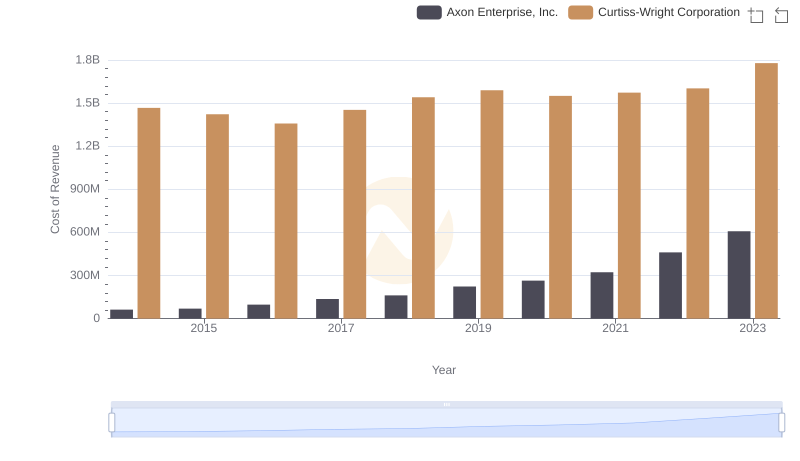

Cost of Revenue Trends: Axon Enterprise, Inc. vs Curtiss-Wright Corporation

Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.: SG&A Expense Trends

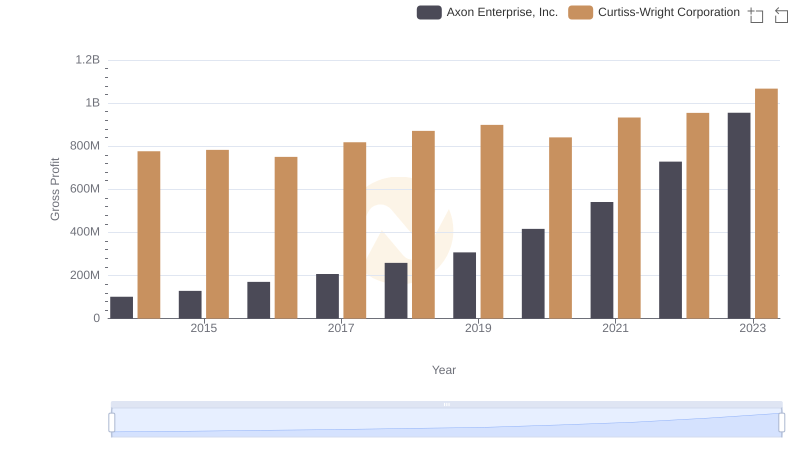

Gross Profit Trends Compared: Axon Enterprise, Inc. vs Curtiss-Wright Corporation

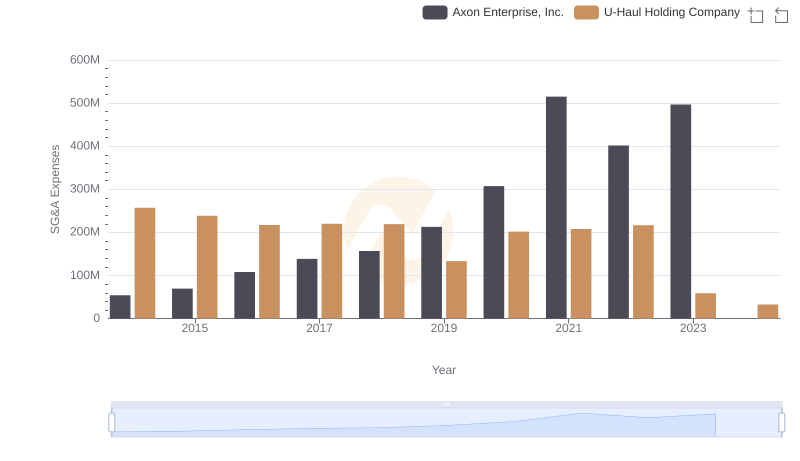

Cost Management Insights: SG&A Expenses for Axon Enterprise, Inc. and U-Haul Holding Company

Research and Development Expenses Breakdown: Axon Enterprise, Inc. vs Curtiss-Wright Corporation

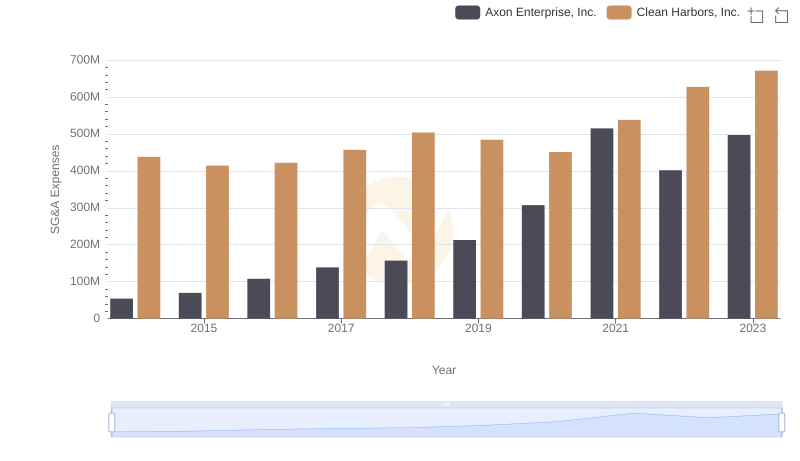

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Clean Harbors, Inc. Trends and Insights

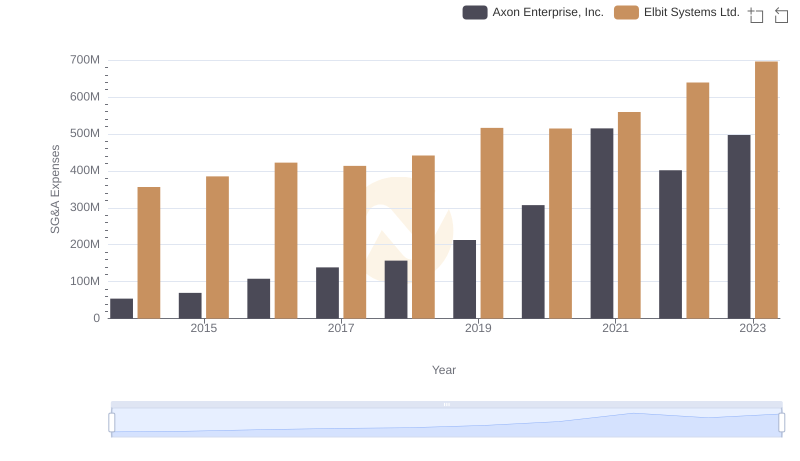

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Elbit Systems Ltd. Trends and Insights

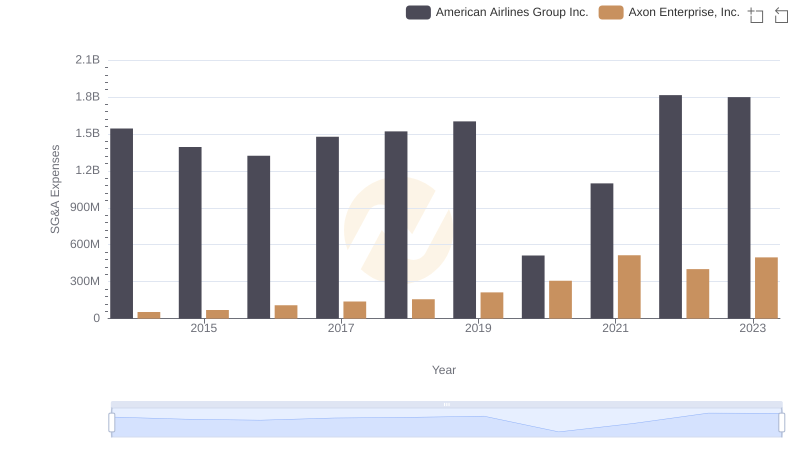

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or American Airlines Group Inc.

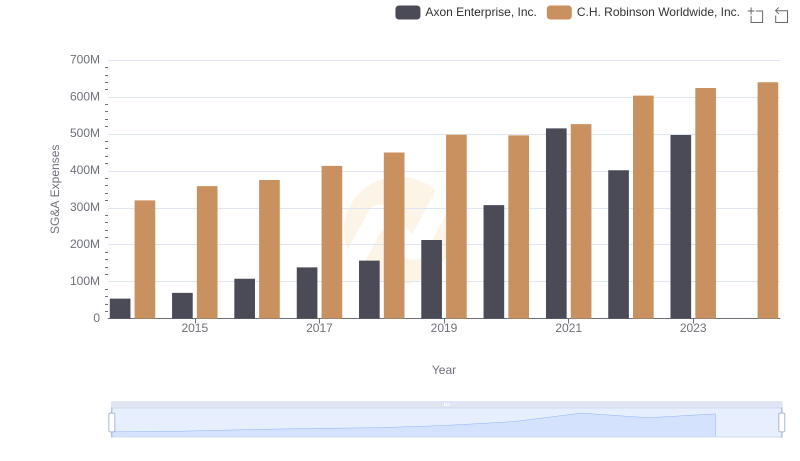

Axon Enterprise, Inc. vs C.H. Robinson Worldwide, Inc.: SG&A Expense Trends

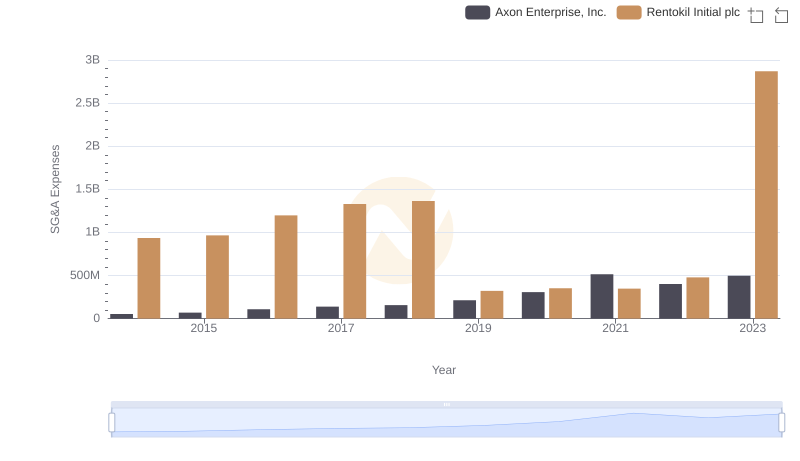

Axon Enterprise, Inc. vs Rentokil Initial plc: SG&A Expense Trends

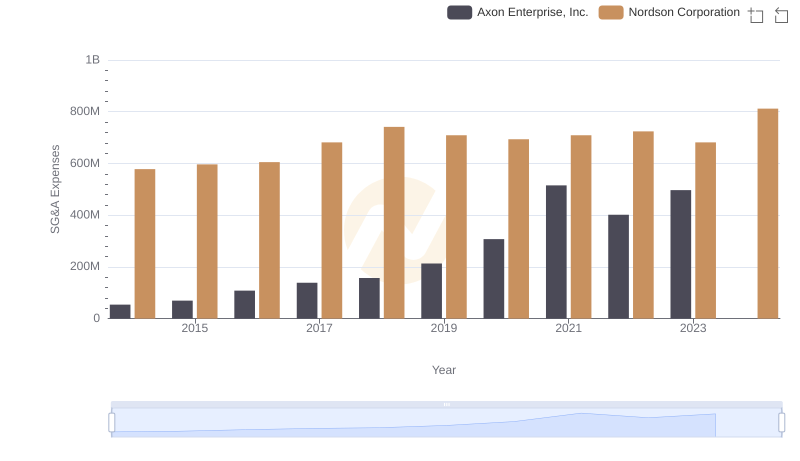

Axon Enterprise, Inc. and Nordson Corporation: SG&A Spending Patterns Compared