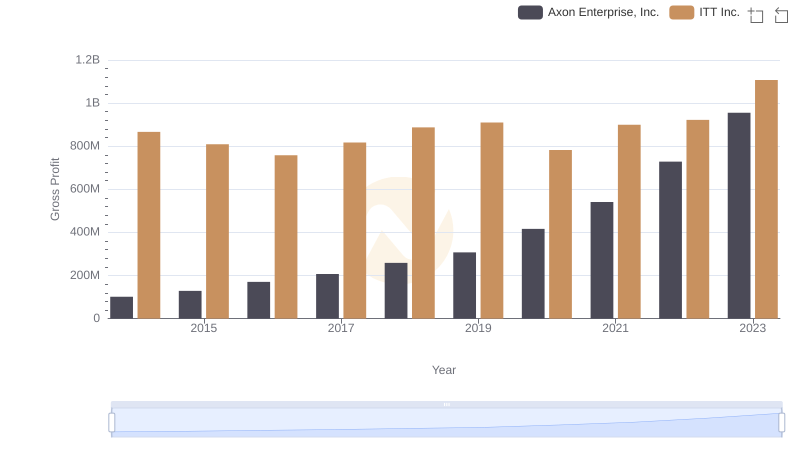

| __timestamp | Axon Enterprise, Inc. | ITT Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 62977000 | 1788200000 |

| Thursday, January 1, 2015 | 69245000 | 1676500000 |

| Friday, January 1, 2016 | 97709000 | 1647200000 |

| Sunday, January 1, 2017 | 136710000 | 1768100000 |

| Monday, January 1, 2018 | 161485000 | 1857900000 |

| Tuesday, January 1, 2019 | 223574000 | 1936300000 |

| Wednesday, January 1, 2020 | 264672000 | 1695600000 |

| Friday, January 1, 2021 | 322471000 | 1865500000 |

| Saturday, January 1, 2022 | 461297000 | 2065400000 |

| Sunday, January 1, 2023 | 608009000 | 2175700000 |

| Monday, January 1, 2024 | 2383400000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, understanding the cost of revenue is crucial for evaluating a company's efficiency and profitability. This analysis delves into the cost of revenue trends for Axon Enterprise, Inc. and ITT Inc. over the past decade, from 2014 to 2023.

Axon Enterprise, Inc. has seen a remarkable increase in its cost of revenue, growing by approximately 866% from 2014 to 2023. This surge reflects the company's expansion and scaling efforts. In contrast, ITT Inc. has maintained a more stable trajectory, with a modest 22% increase over the same period, indicating a consistent operational strategy.

These trends highlight the dynamic nature of business strategies and their impact on financial metrics. Investors and analysts should consider these patterns when assessing the long-term viability and growth potential of these companies.

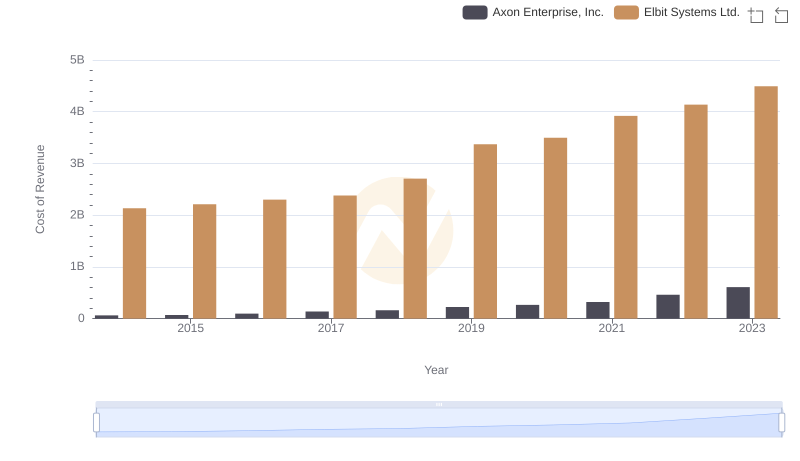

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Elbit Systems Ltd.

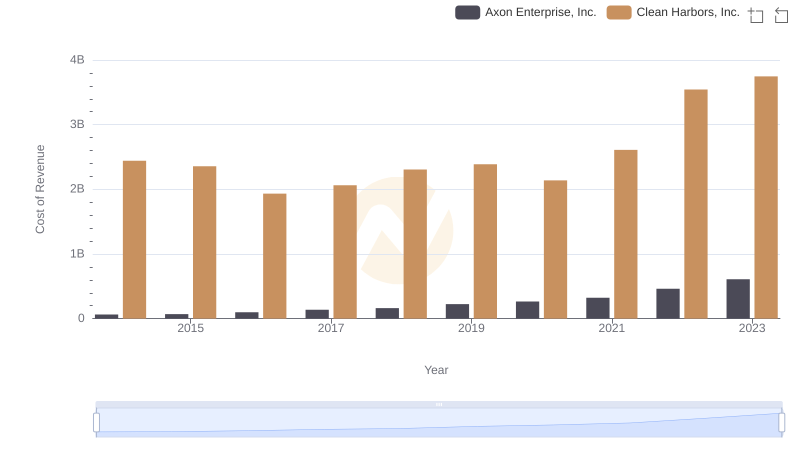

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Clean Harbors, Inc.

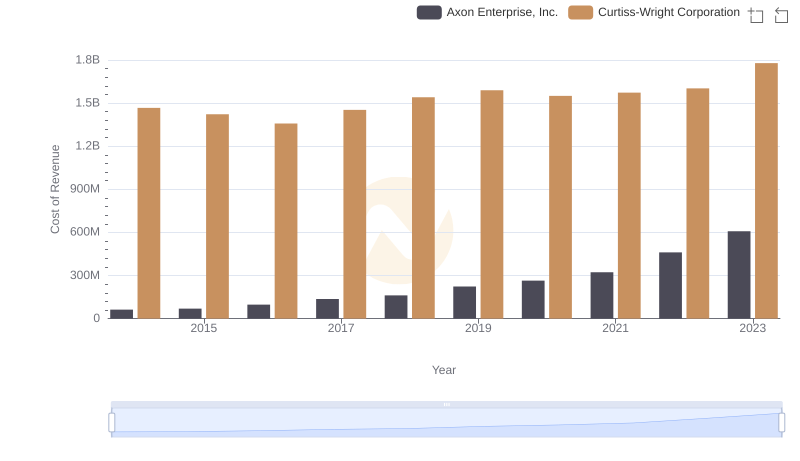

Cost of Revenue Trends: Axon Enterprise, Inc. vs Curtiss-Wright Corporation

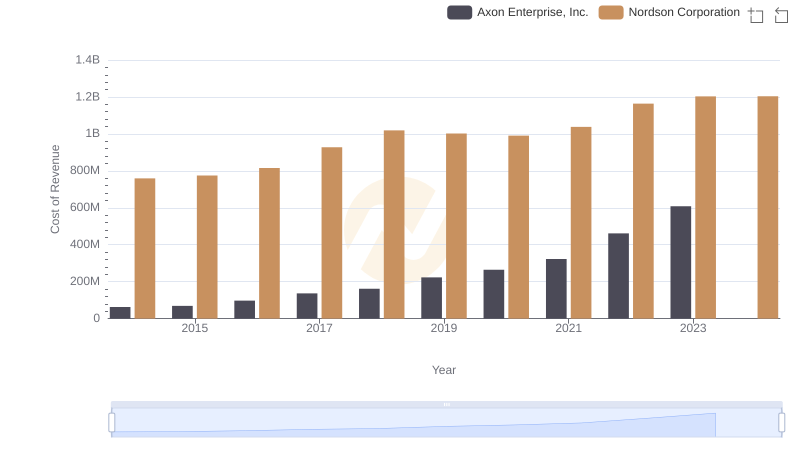

Cost of Revenue Trends: Axon Enterprise, Inc. vs Nordson Corporation

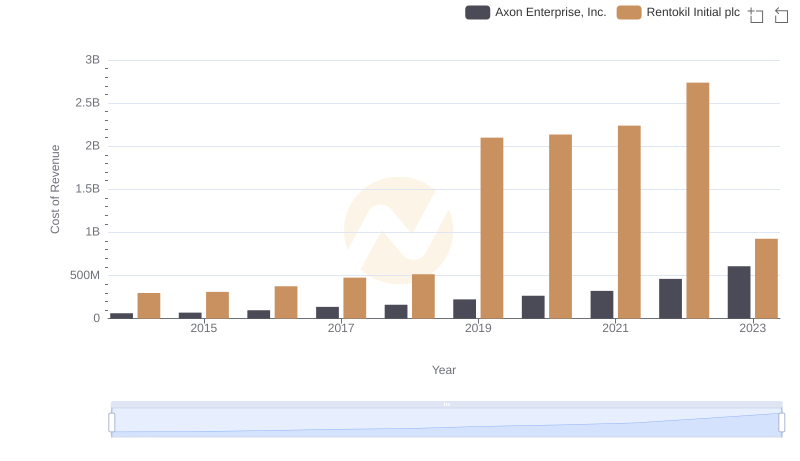

Axon Enterprise, Inc. vs Rentokil Initial plc: Efficiency in Cost of Revenue Explored

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and ITT Inc.

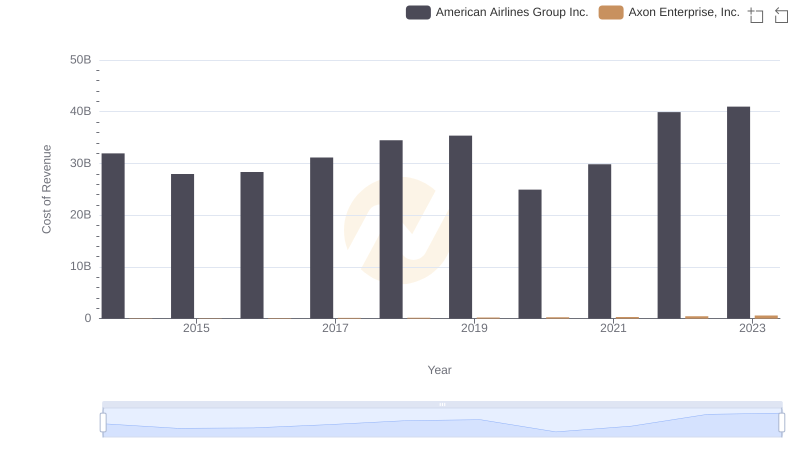

Cost Insights: Breaking Down Axon Enterprise, Inc. and American Airlines Group Inc.'s Expenses

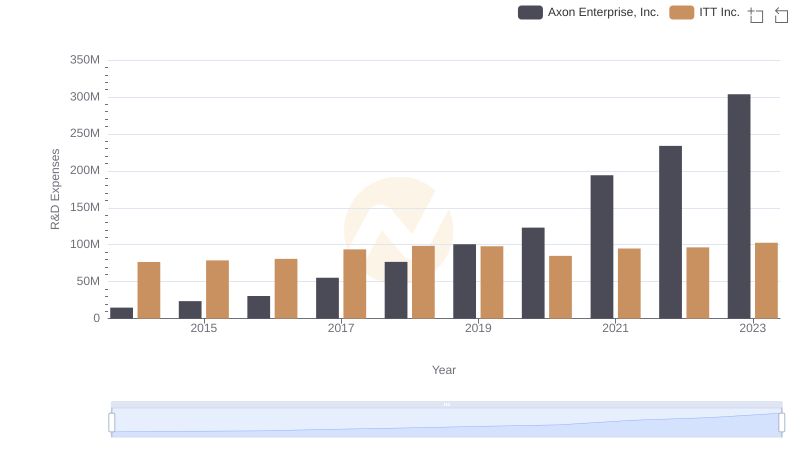

R&D Spending Showdown: Axon Enterprise, Inc. vs ITT Inc.

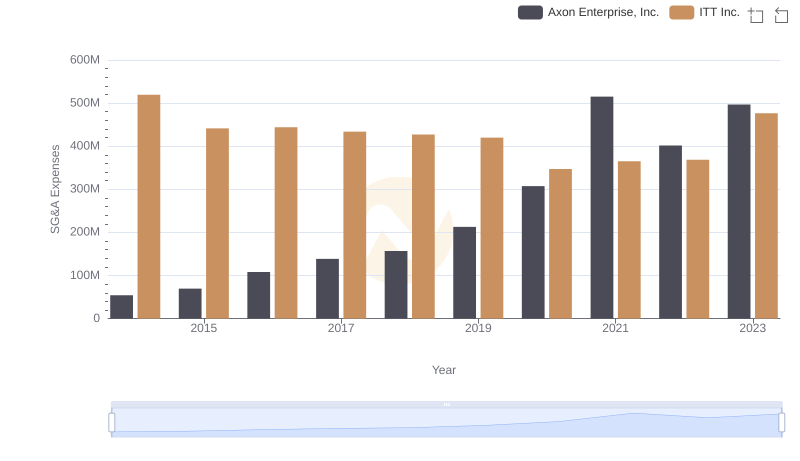

Axon Enterprise, Inc. vs ITT Inc.: SG&A Expense Trends