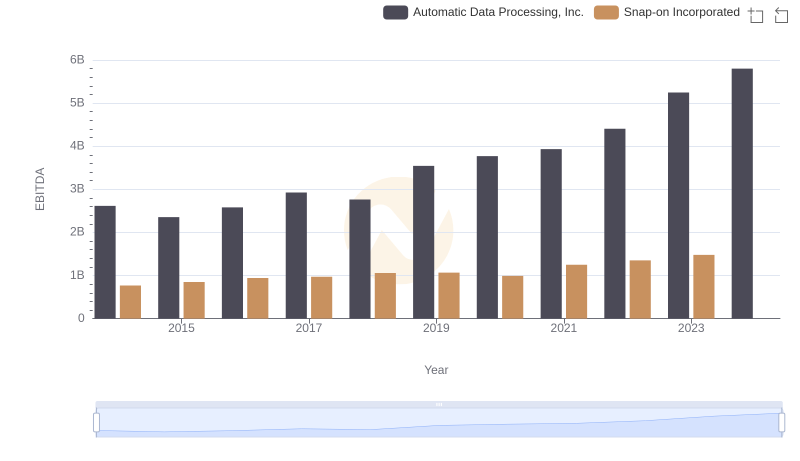

| __timestamp | Automatic Data Processing, Inc. | Booz Allen Hamilton Holding Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 531144000 |

| Thursday, January 1, 2015 | 2355100000 | 520410000 |

| Friday, January 1, 2016 | 2579500000 | 506120000 |

| Sunday, January 1, 2017 | 2927200000 | 561524000 |

| Monday, January 1, 2018 | 2762900000 | 577061000 |

| Tuesday, January 1, 2019 | 3544500000 | 663731000 |

| Wednesday, January 1, 2020 | 3769700000 | 745424000 |

| Friday, January 1, 2021 | 3931600000 | 834449000 |

| Saturday, January 1, 2022 | 4405500000 | 826865000 |

| Sunday, January 1, 2023 | 5244600000 | 958150000 |

| Monday, January 1, 2024 | 5800000000 | 1199992000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial indicator of a company's operational efficiency. From 2014 to 2024, Automatic Data Processing, Inc. (ADP) and Booz Allen Hamilton Holding Corporation have demonstrated intriguing trends in their EBITDA performance. ADP's EBITDA has surged by approximately 122%, reflecting robust growth and strategic financial management. In contrast, Booz Allen Hamilton has experienced a commendable 126% increase, showcasing its resilience and adaptability in a competitive market.

These trends offer valuable insights into the financial health and strategic direction of these industry giants.

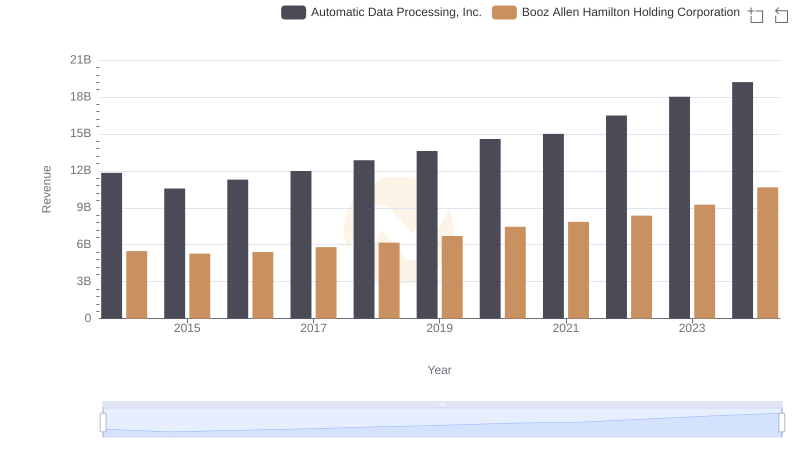

Who Generates More Revenue? Automatic Data Processing, Inc. or Booz Allen Hamilton Holding Corporation

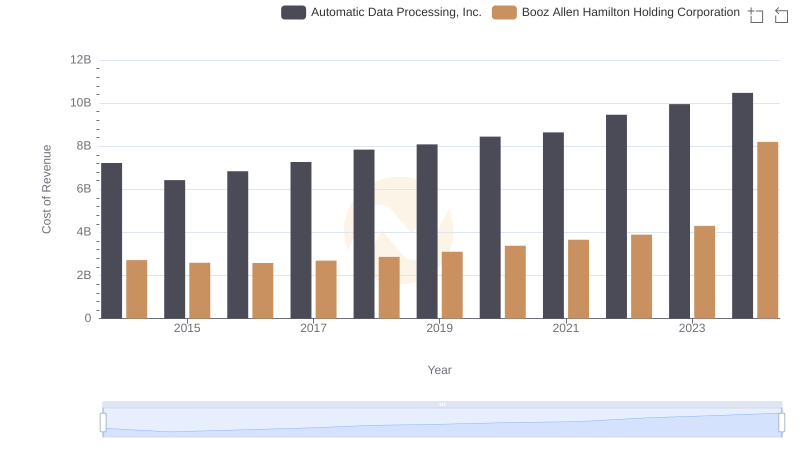

Automatic Data Processing, Inc. vs Booz Allen Hamilton Holding Corporation: Efficiency in Cost of Revenue Explored

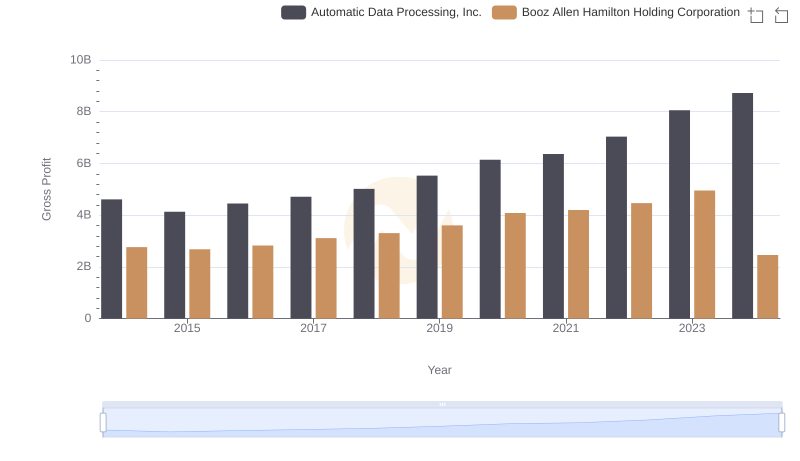

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Booz Allen Hamilton Holding Corporation

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Snap-on Incorporated

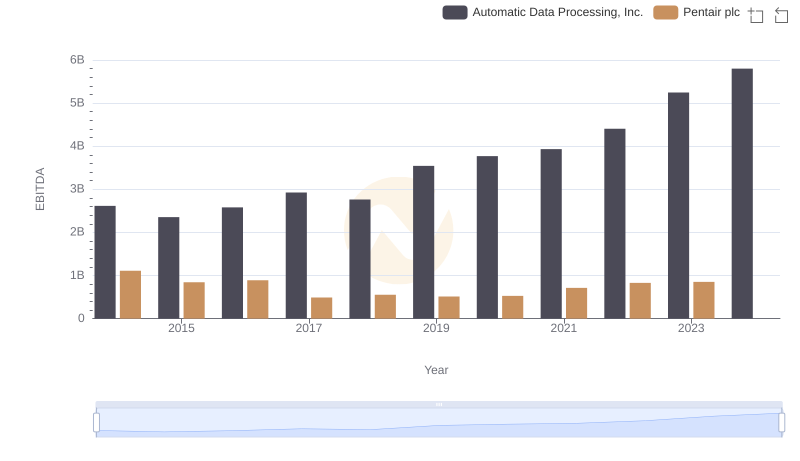

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Pentair plc

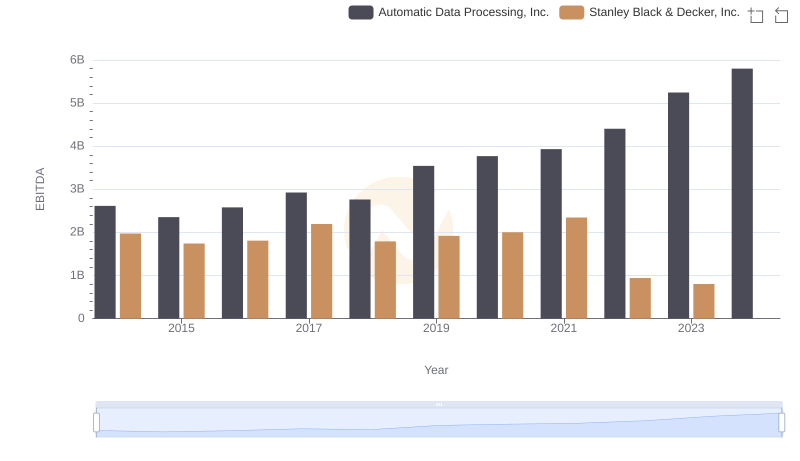

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

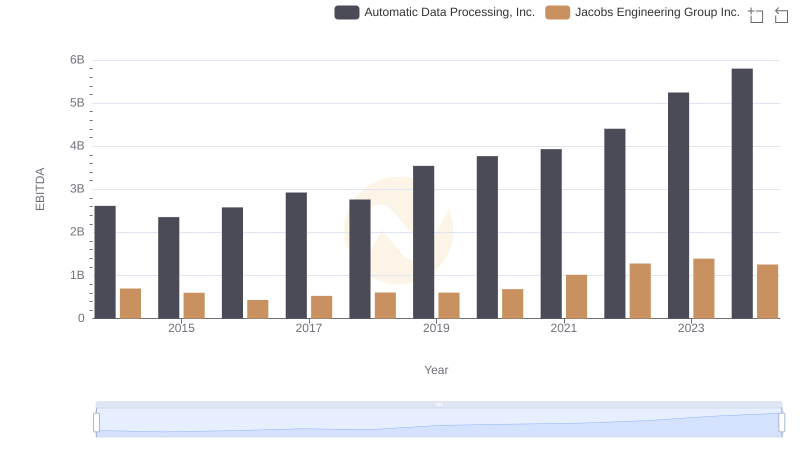

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.

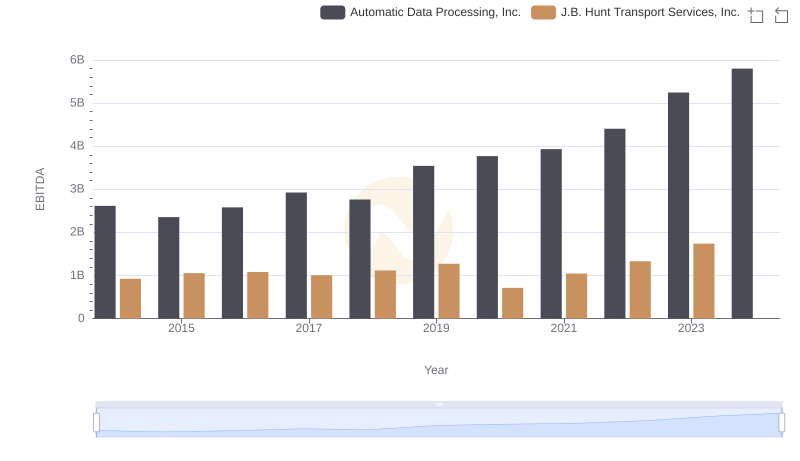

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to J.B. Hunt Transport Services, Inc.

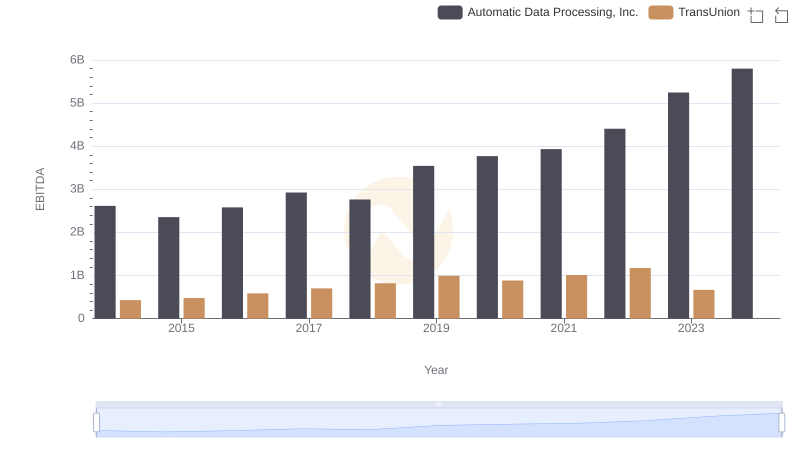

Automatic Data Processing, Inc. vs TransUnion: In-Depth EBITDA Performance Comparison

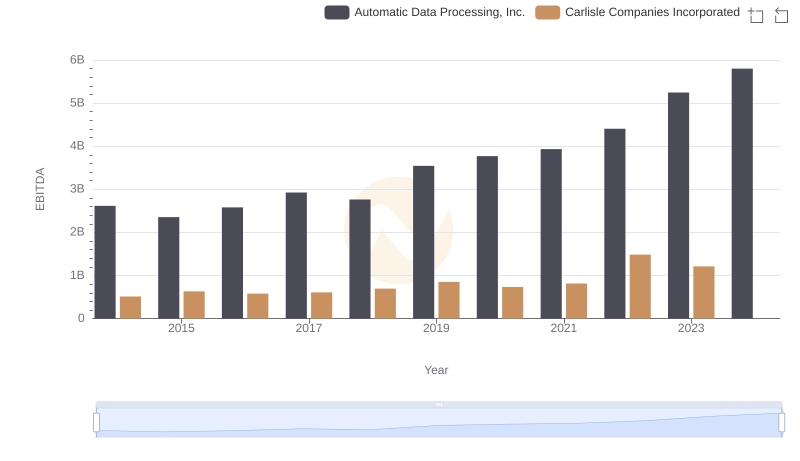

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Carlisle Companies Incorporated