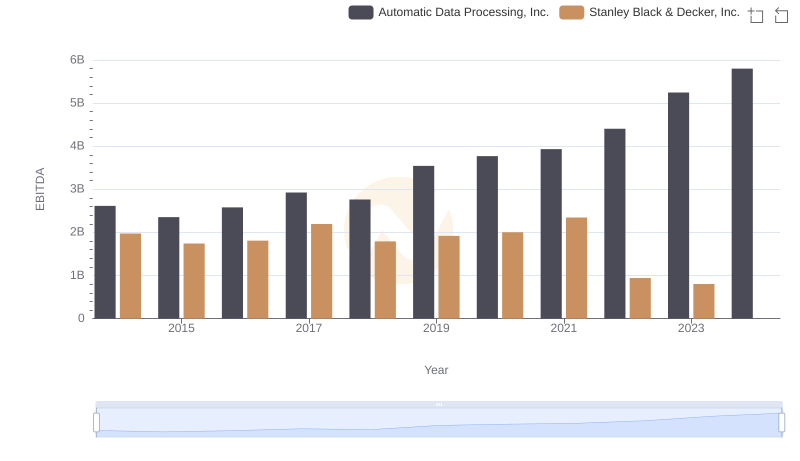

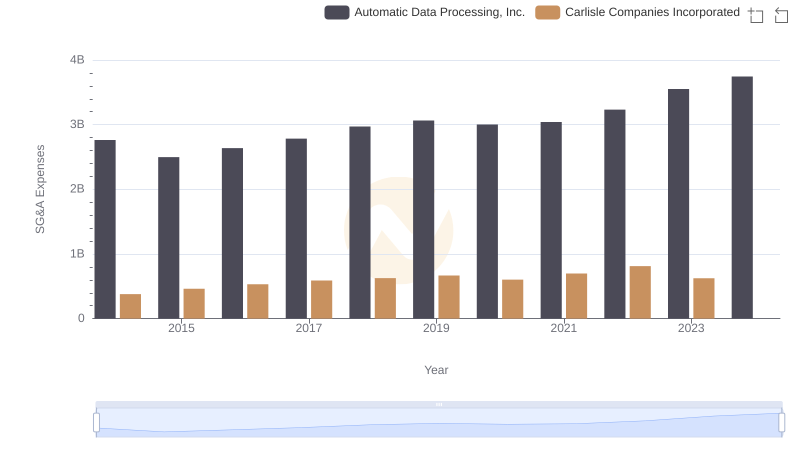

| __timestamp | Automatic Data Processing, Inc. | Carlisle Companies Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 512300000 |

| Thursday, January 1, 2015 | 2355100000 | 631900000 |

| Friday, January 1, 2016 | 2579500000 | 580200000 |

| Sunday, January 1, 2017 | 2927200000 | 609300000 |

| Monday, January 1, 2018 | 2762900000 | 696100000 |

| Tuesday, January 1, 2019 | 3544500000 | 851000000 |

| Wednesday, January 1, 2020 | 3769700000 | 733100000 |

| Friday, January 1, 2021 | 3931600000 | 816100000 |

| Saturday, January 1, 2022 | 4405500000 | 1483400000 |

| Sunday, January 1, 2023 | 5244600000 | 1210700000 |

| Monday, January 1, 2024 | 5800000000 | 1356800000 |

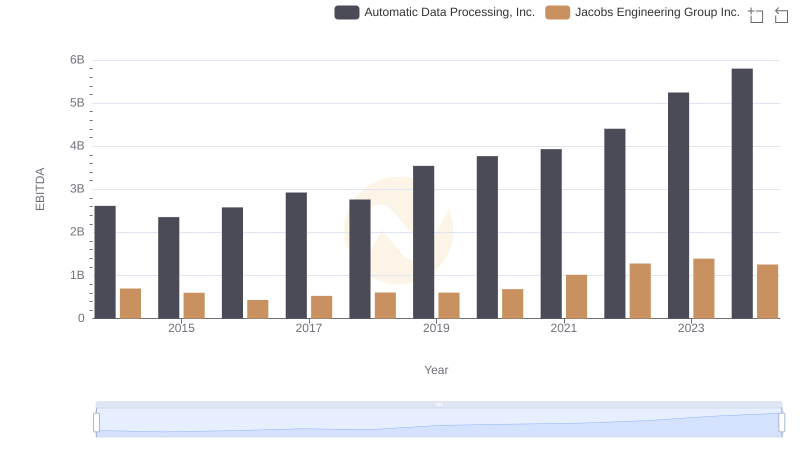

Cracking the code

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. Over the past decade, Automatic Data Processing, Inc. (ADP) has demonstrated a robust growth trajectory, with its EBITDA increasing by approximately 122% from 2014 to 2023. In contrast, Carlisle Companies Incorporated has shown a more modest growth of around 136% over the same period, albeit from a smaller base.

ADP's EBITDA surged from $2.6 billion in 2014 to an impressive $5.2 billion in 2023, reflecting its strategic focus on efficiency and expansion. Meanwhile, Carlisle's EBITDA rose from $512 million to $1.2 billion, highlighting its steady yet significant growth. Notably, data for 2024 is incomplete, indicating potential future insights. This analysis underscores the importance of EBITDA as a key indicator of financial health and strategic success.

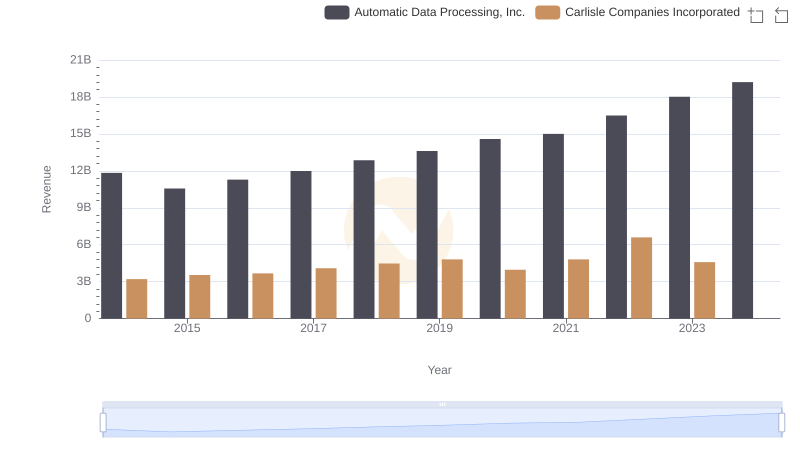

Automatic Data Processing, Inc. vs Carlisle Companies Incorporated: Examining Key Revenue Metrics

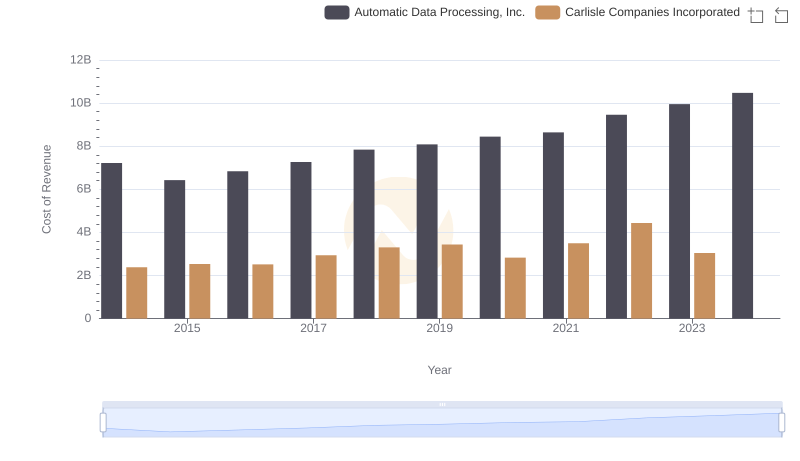

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Carlisle Companies Incorporated

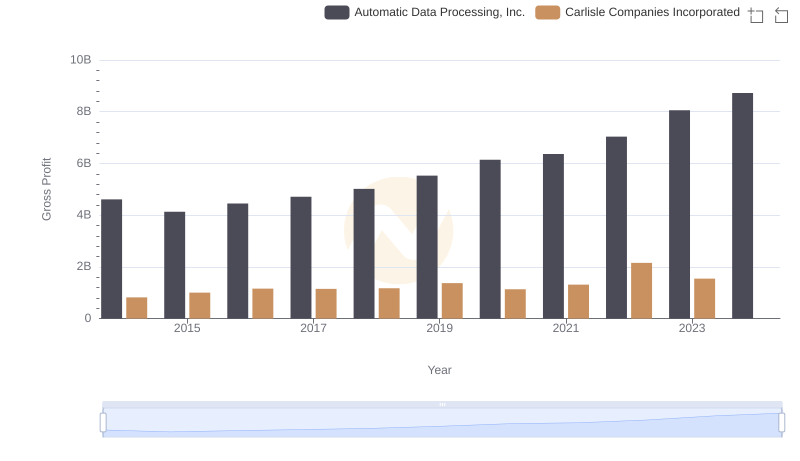

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or Carlisle Companies Incorporated

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

Automatic Data Processing, Inc. and Carlisle Companies Incorporated: SG&A Spending Patterns Compared

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.

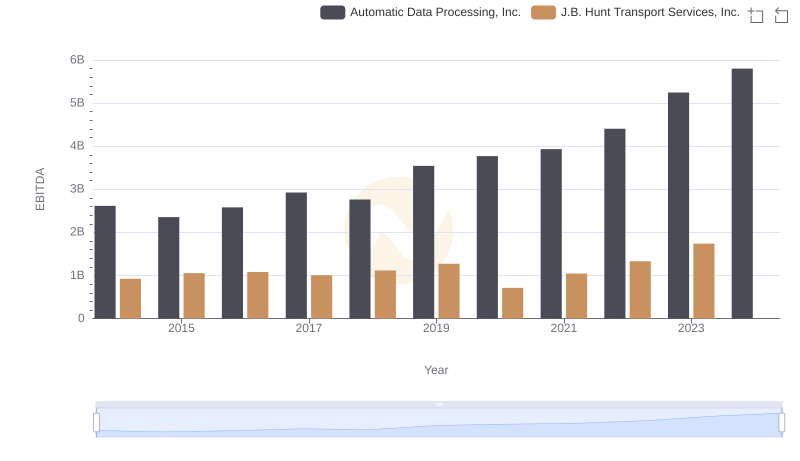

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to J.B. Hunt Transport Services, Inc.

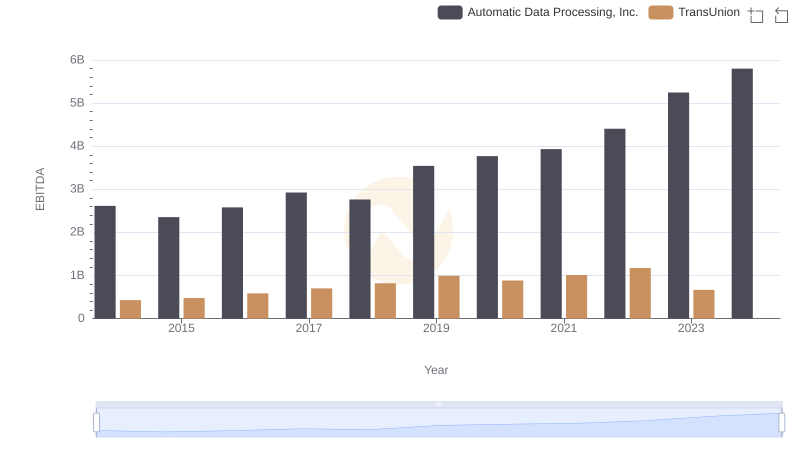

Automatic Data Processing, Inc. vs TransUnion: In-Depth EBITDA Performance Comparison

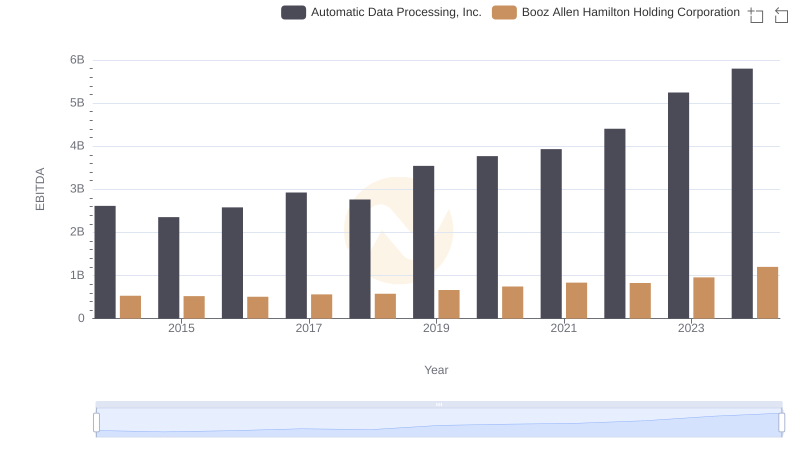

Automatic Data Processing, Inc. and Booz Allen Hamilton Holding Corporation: A Detailed Examination of EBITDA Performance