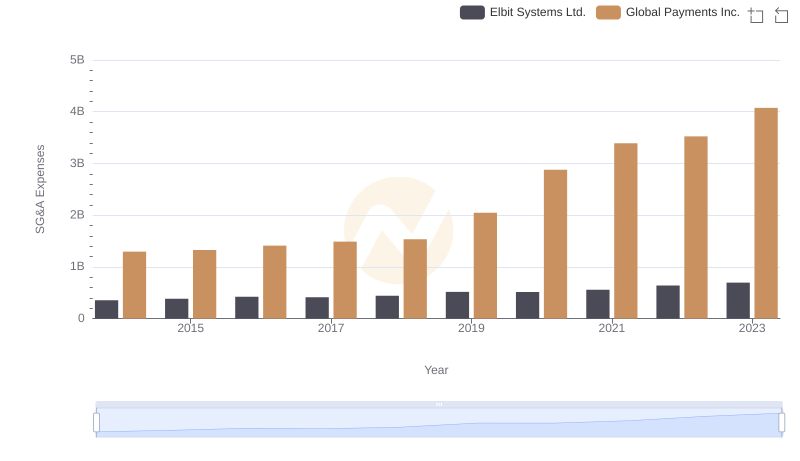

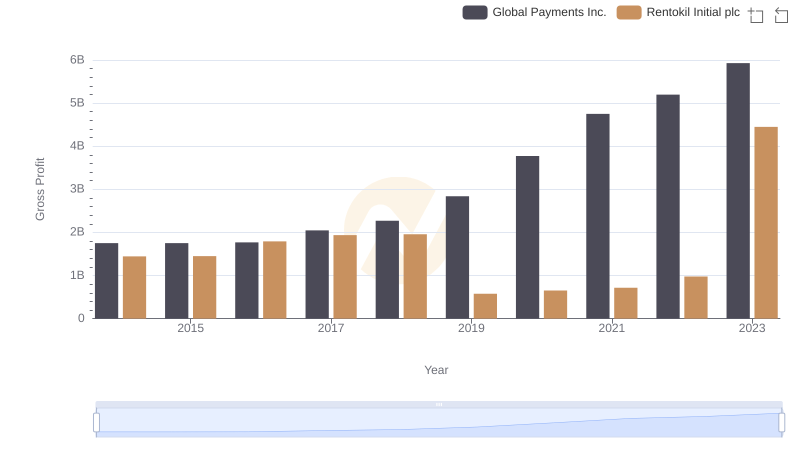

| __timestamp | Global Payments Inc. | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1295014000 | 935700000 |

| Thursday, January 1, 2015 | 1325567000 | 965700000 |

| Friday, January 1, 2016 | 1411096000 | 1197600000 |

| Sunday, January 1, 2017 | 1488258000 | 1329600000 |

| Monday, January 1, 2018 | 1534297000 | 1364000000 |

| Tuesday, January 1, 2019 | 2046672000 | 322500000 |

| Wednesday, January 1, 2020 | 2878878000 | 352000000 |

| Friday, January 1, 2021 | 3391161000 | 348600000 |

| Saturday, January 1, 2022 | 3524578000 | 479000000 |

| Sunday, January 1, 2023 | 4073768000 | 2870000000 |

| Monday, January 1, 2024 | 4285307000 |

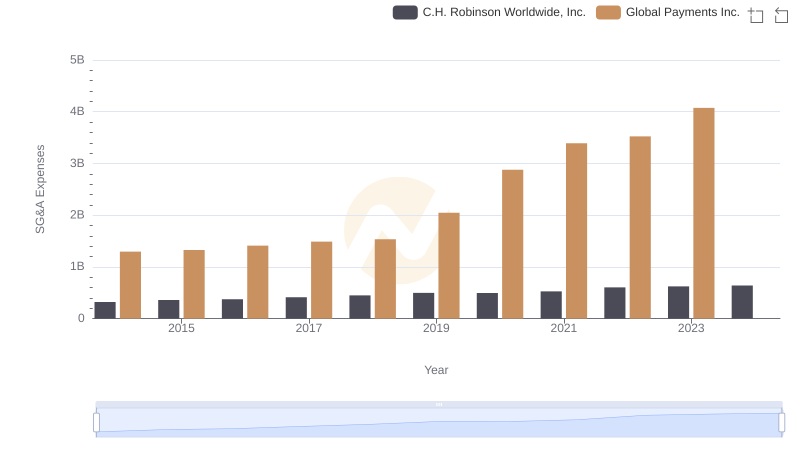

Unleashing the power of data

In the ever-evolving landscape of corporate finance, effective cost management is crucial for maintaining competitive advantage. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Global Payments Inc. and Rentokil Initial plc, from 2014 to 2023.

Over the past decade, Global Payments Inc. has seen a significant increase in SG&A expenses, rising by approximately 215% from 2014 to 2023. This upward trend reflects strategic investments in growth and expansion. In contrast, Rentokil Initial plc experienced a more modest increase of around 207% over the same period, with a notable spike in 2023.

These trends highlight differing strategic approaches: Global Payments Inc. focuses on aggressive expansion, while Rentokil Initial plc maintains a steady growth trajectory. Understanding these patterns offers valuable insights into each company's financial strategy and market positioning.

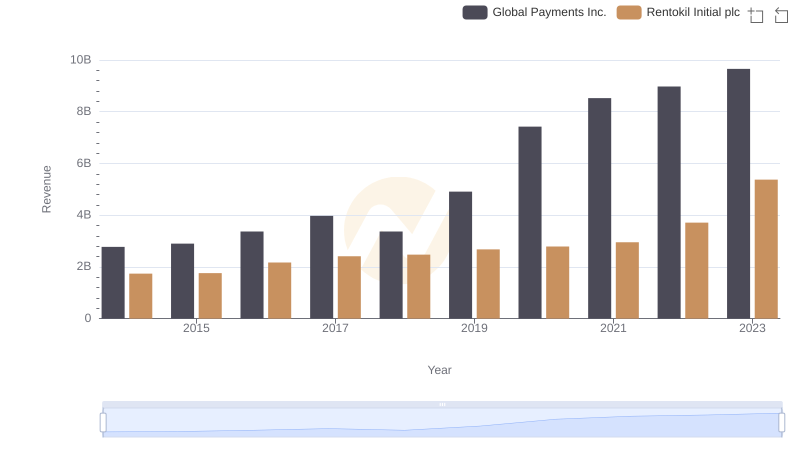

Global Payments Inc. or Rentokil Initial plc: Who Leads in Yearly Revenue?

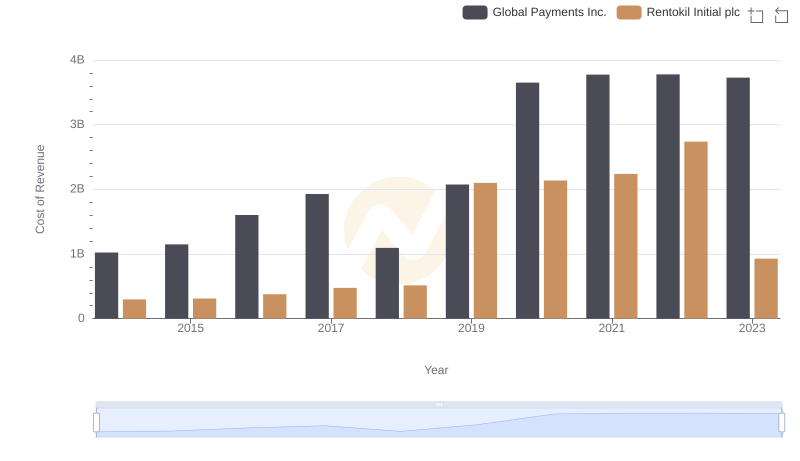

Analyzing Cost of Revenue: Global Payments Inc. and Rentokil Initial plc

Global Payments Inc. or Elbit Systems Ltd.: Who Manages SG&A Costs Better?

Who Optimizes SG&A Costs Better? Global Payments Inc. or C.H. Robinson Worldwide, Inc.

Global Payments Inc. vs Rentokil Initial plc: A Gross Profit Performance Breakdown

Who Optimizes SG&A Costs Better? Global Payments Inc. or Clean Harbors, Inc.

Global Payments Inc. or ITT Inc.: Who Manages SG&A Costs Better?