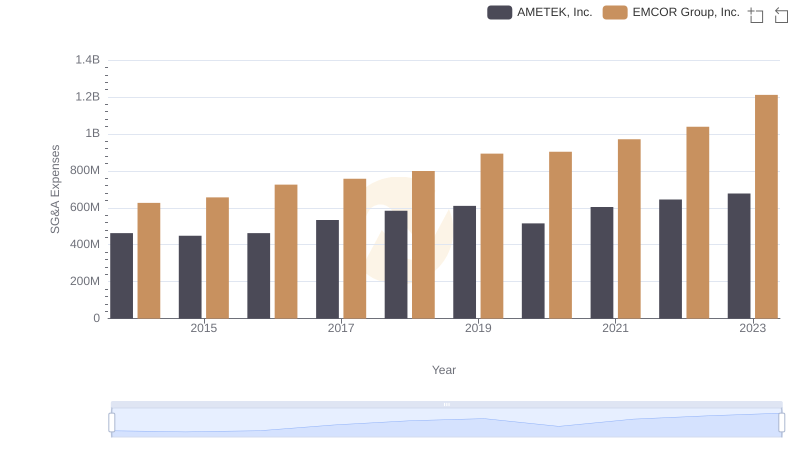

| __timestamp | AMETEK, Inc. | TransUnion |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 436000000 |

| Thursday, January 1, 2015 | 448592000 | 499700000 |

| Friday, January 1, 2016 | 462970000 | 560100000 |

| Sunday, January 1, 2017 | 533645000 | 585400000 |

| Monday, January 1, 2018 | 584022000 | 707700000 |

| Tuesday, January 1, 2019 | 610280000 | 812100000 |

| Wednesday, January 1, 2020 | 515630000 | 860300000 |

| Friday, January 1, 2021 | 603944000 | 943900000 |

| Saturday, January 1, 2022 | 644577000 | 1337400000 |

| Sunday, January 1, 2023 | 677006000 | 1171600000 |

| Monday, January 1, 2024 | 696905000 | 1239300000 |

Cracking the code

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, AMETEK, Inc. and TransUnion have shown distinct strategies in handling these costs. AMETEK, Inc. maintained a steady increase in SG&A expenses, with a 46% rise over the decade, peaking at approximately $677 million in 2023. In contrast, TransUnion's SG&A expenses surged by 169%, reaching around $1.17 billion in the same year. This stark difference highlights TransUnion's aggressive expansion and investment strategy, while AMETEK, Inc. appears to focus on more controlled growth. The data suggests that while both companies have increased their SG&A expenses, TransUnion's rapid escalation may indicate a more ambitious growth trajectory. Investors and analysts should consider these trends when evaluating the financial health and strategic direction of these industry players.

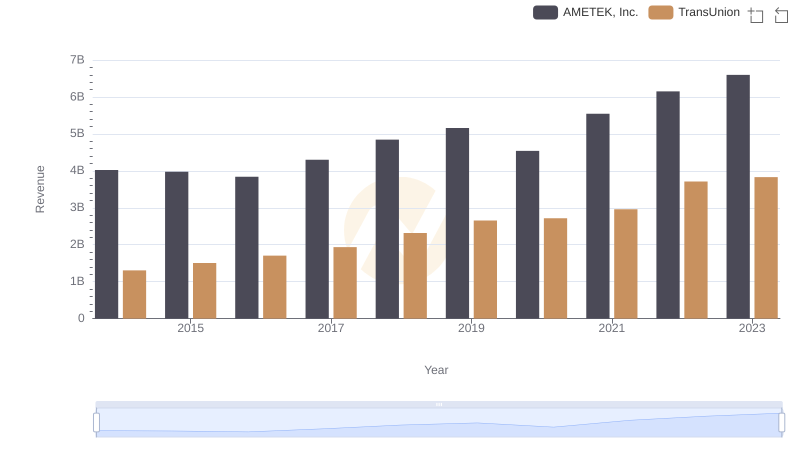

AMETEK, Inc. vs TransUnion: Examining Key Revenue Metrics

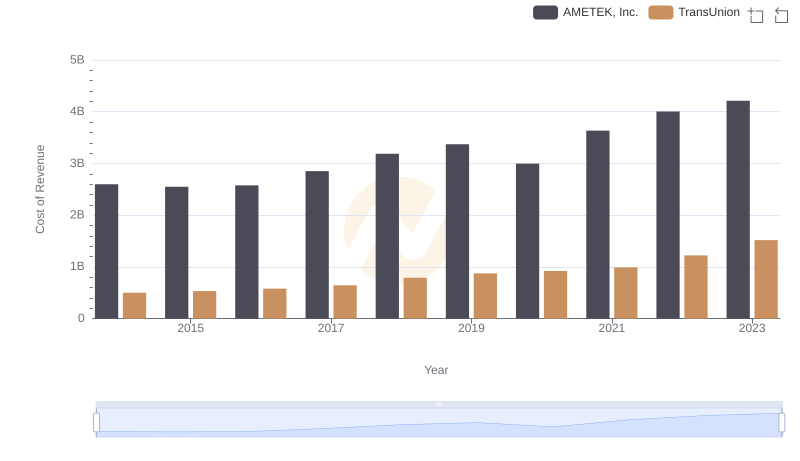

Cost of Revenue: Key Insights for AMETEK, Inc. and TransUnion

Selling, General, and Administrative Costs: AMETEK, Inc. vs EMCOR Group, Inc.

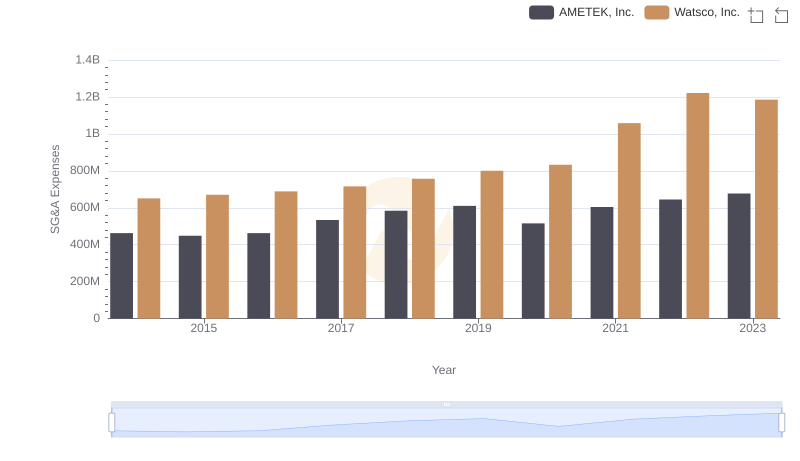

Comparing SG&A Expenses: AMETEK, Inc. vs Watsco, Inc. Trends and Insights

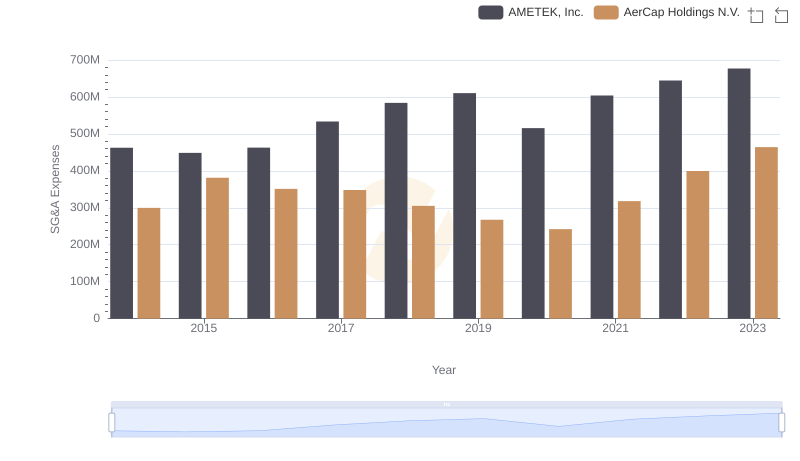

Selling, General, and Administrative Costs: AMETEK, Inc. vs AerCap Holdings N.V.

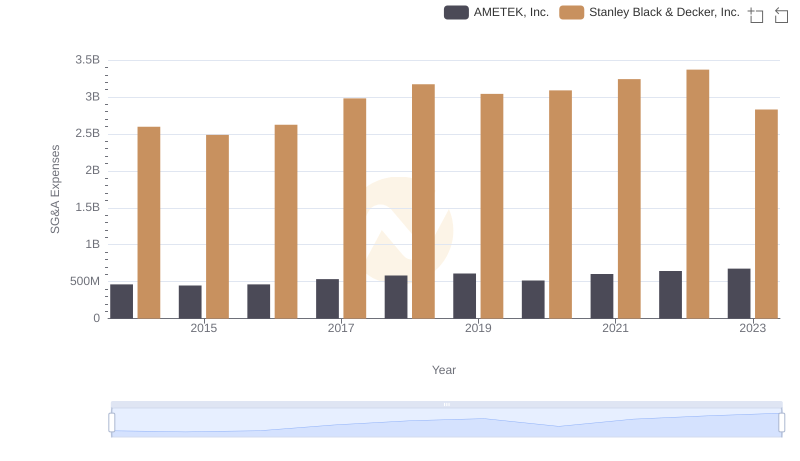

AMETEK, Inc. and Stanley Black & Decker, Inc.: SG&A Spending Patterns Compared

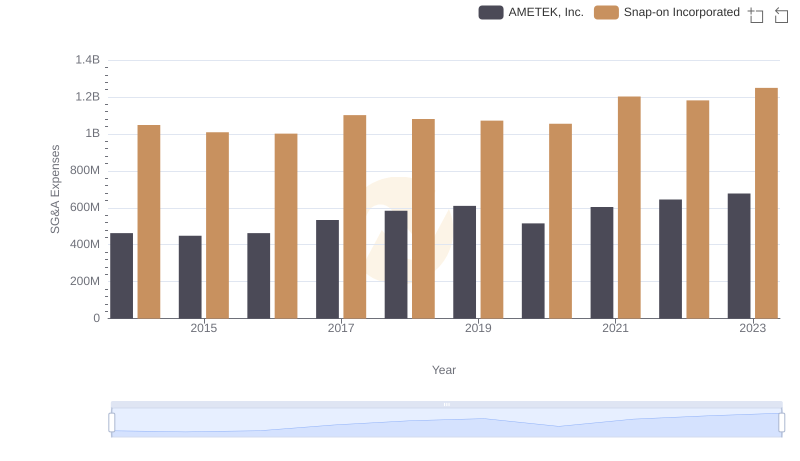

AMETEK, Inc. vs Snap-on Incorporated: SG&A Expense Trends

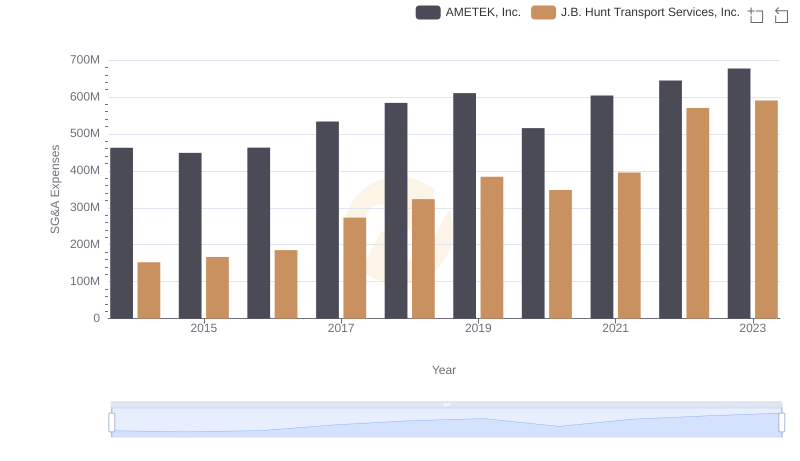

AMETEK, Inc. and J.B. Hunt Transport Services, Inc.: SG&A Spending Patterns Compared

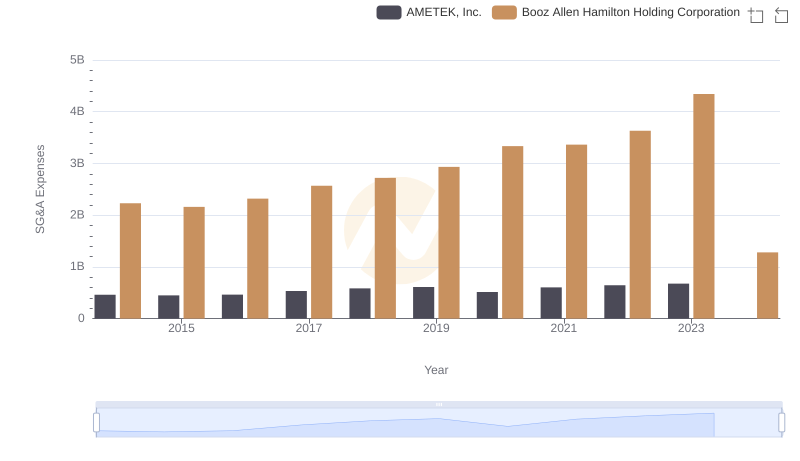

AMETEK, Inc. or Booz Allen Hamilton Holding Corporation: Who Manages SG&A Costs Better?

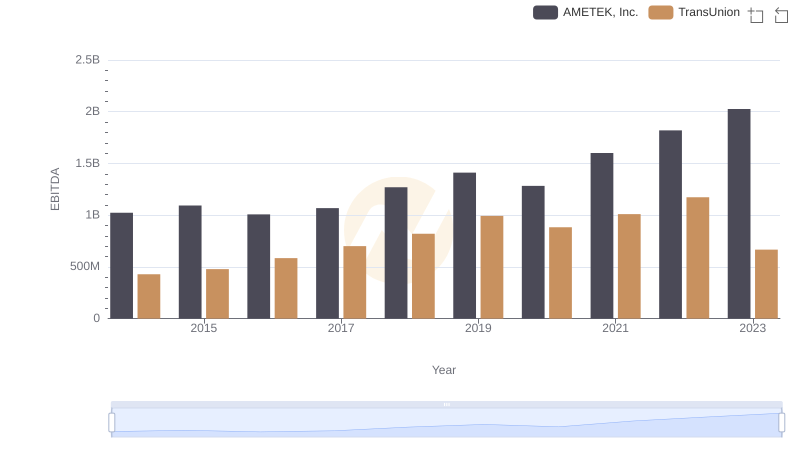

A Professional Review of EBITDA: AMETEK, Inc. Compared to TransUnion

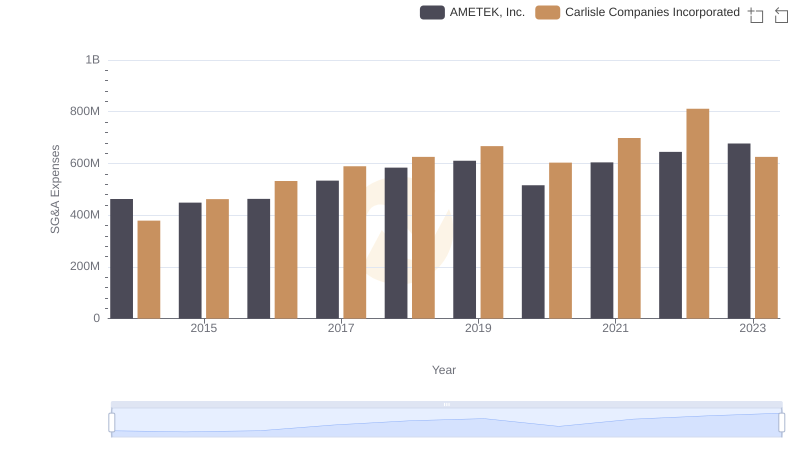

AMETEK, Inc. and Carlisle Companies Incorporated: SG&A Spending Patterns Compared