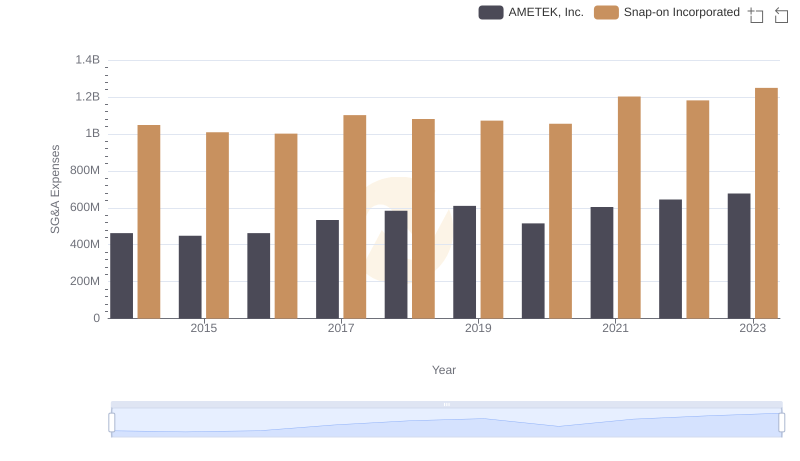

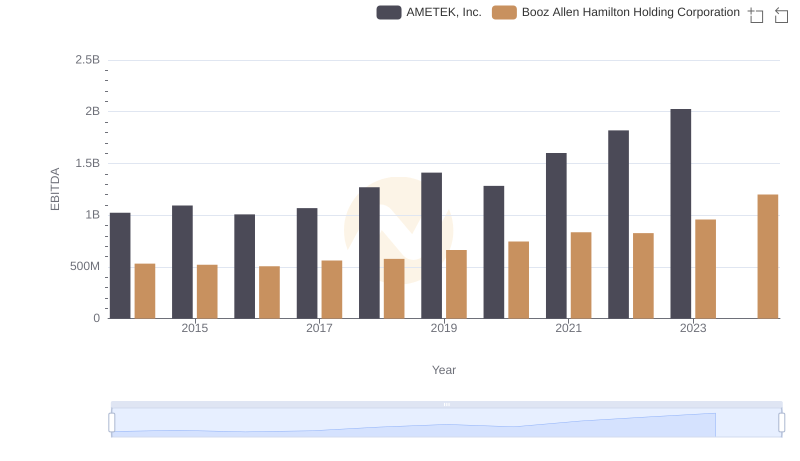

| __timestamp | AMETEK, Inc. | Booz Allen Hamilton Holding Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 2229642000 |

| Thursday, January 1, 2015 | 448592000 | 2159439000 |

| Friday, January 1, 2016 | 462970000 | 2319592000 |

| Sunday, January 1, 2017 | 533645000 | 2568511000 |

| Monday, January 1, 2018 | 584022000 | 2719909000 |

| Tuesday, January 1, 2019 | 610280000 | 2932602000 |

| Wednesday, January 1, 2020 | 515630000 | 3334378000 |

| Friday, January 1, 2021 | 603944000 | 3362722000 |

| Saturday, January 1, 2022 | 644577000 | 3633150000 |

| Sunday, January 1, 2023 | 677006000 | 4341769000 |

| Monday, January 1, 2024 | 696905000 | 1281443000 |

Cracking the code

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. AMETEK, Inc. and Booz Allen Hamilton Holding Corporation, two industry giants, have demonstrated contrasting approaches over the past decade. From 2014 to 2023, AMETEK's SG&A expenses grew by approximately 46%, reflecting a steady increase in operational costs. In contrast, Booz Allen Hamilton's expenses surged by nearly 95%, indicating a more aggressive expansion strategy.

While AMETEK maintained a more conservative growth in SG&A costs, Booz Allen Hamilton's expenses nearly doubled, suggesting a focus on scaling operations. This divergence highlights the strategic choices companies make in balancing growth and cost management. Notably, data for 2024 is incomplete, emphasizing the need for continuous monitoring. As businesses navigate economic uncertainties, effective SG&A management remains a pivotal factor in sustaining competitive advantage.

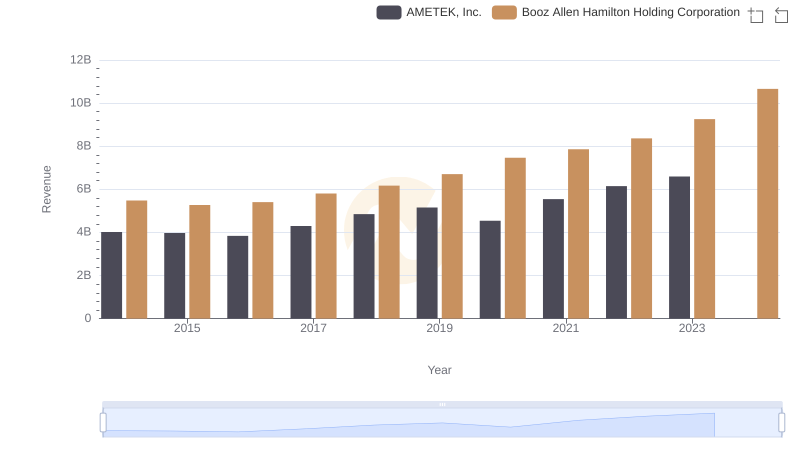

AMETEK, Inc. vs Booz Allen Hamilton Holding Corporation: Examining Key Revenue Metrics

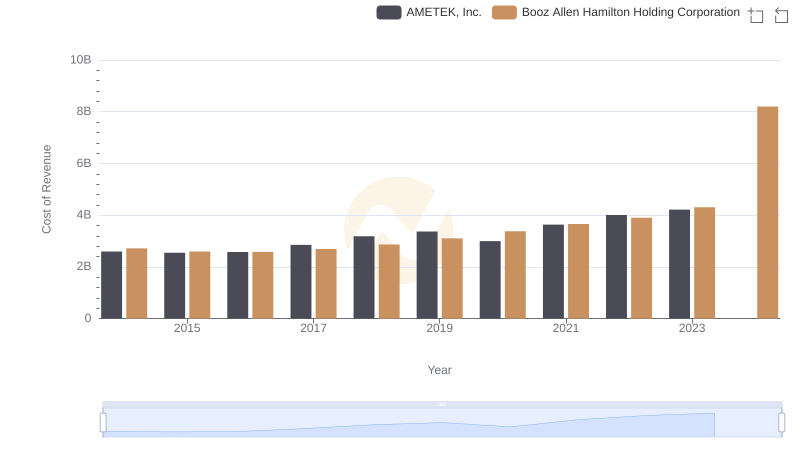

Cost of Revenue Comparison: AMETEK, Inc. vs Booz Allen Hamilton Holding Corporation

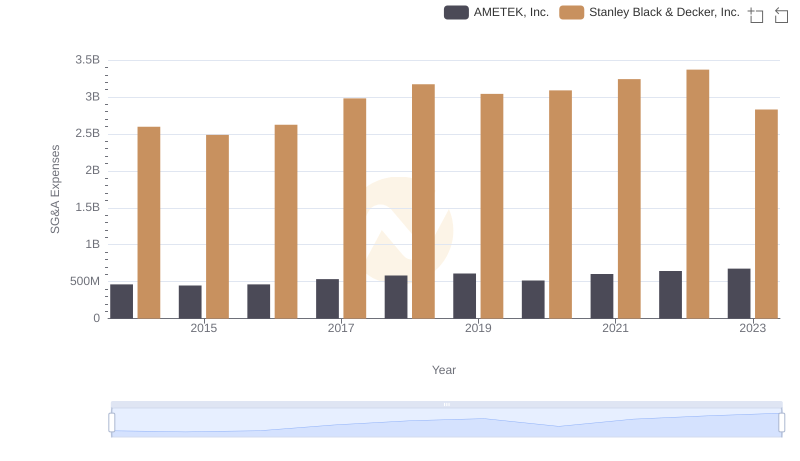

AMETEK, Inc. and Stanley Black & Decker, Inc.: SG&A Spending Patterns Compared

AMETEK, Inc. or TransUnion: Who Manages SG&A Costs Better?

AMETEK, Inc. vs Snap-on Incorporated: SG&A Expense Trends

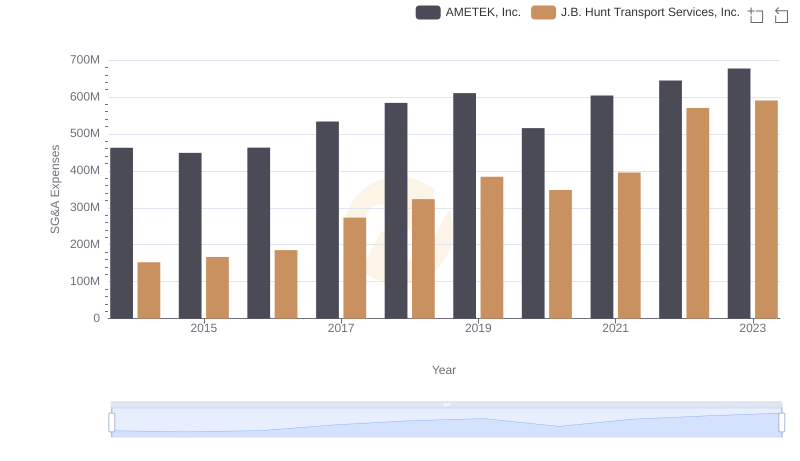

AMETEK, Inc. and J.B. Hunt Transport Services, Inc.: SG&A Spending Patterns Compared

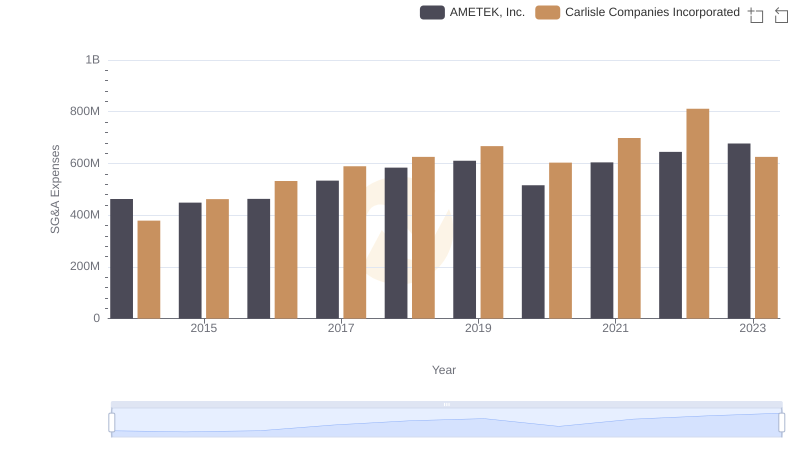

AMETEK, Inc. and Carlisle Companies Incorporated: SG&A Spending Patterns Compared

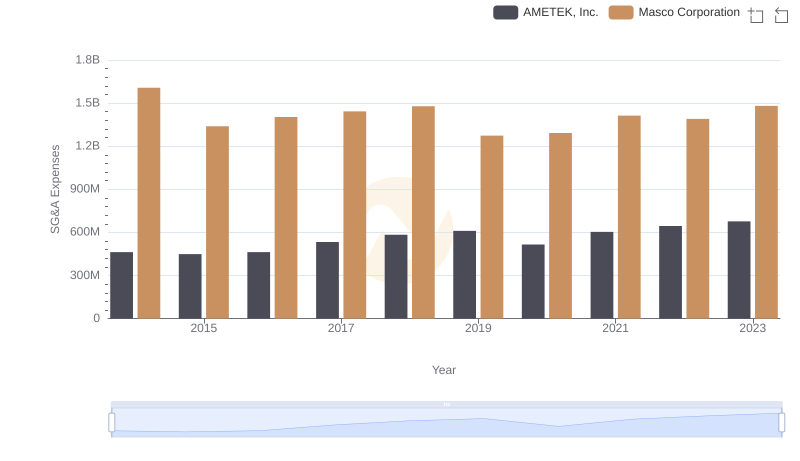

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Masco Corporation

EBITDA Metrics Evaluated: AMETEK, Inc. vs Booz Allen Hamilton Holding Corporation

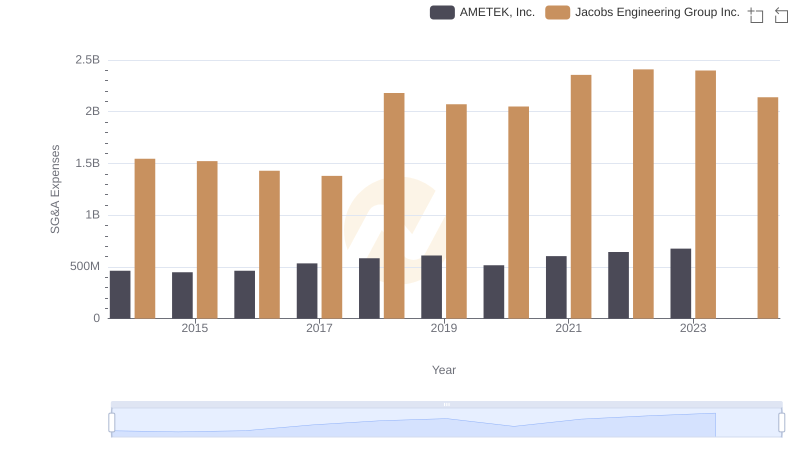

Who Optimizes SG&A Costs Better? AMETEK, Inc. or Jacobs Engineering Group Inc.