| __timestamp | AMETEK, Inc. | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 573700000 |

| Thursday, January 1, 2015 | 448592000 | 580500000 |

| Friday, January 1, 2016 | 462970000 | 621000000 |

| Sunday, January 1, 2017 | 533645000 | 637700000 |

| Monday, January 1, 2018 | 584022000 | 608200000 |

| Tuesday, January 1, 2019 | 610280000 | 585900000 |

| Wednesday, January 1, 2020 | 515630000 | 555900000 |

| Friday, January 1, 2021 | 603944000 | 598900000 |

| Saturday, January 1, 2022 | 644577000 | 627200000 |

| Sunday, January 1, 2023 | 677006000 | 705500000 |

| Monday, January 1, 2024 | 696905000 | 730600000 |

Unleashing the power of data

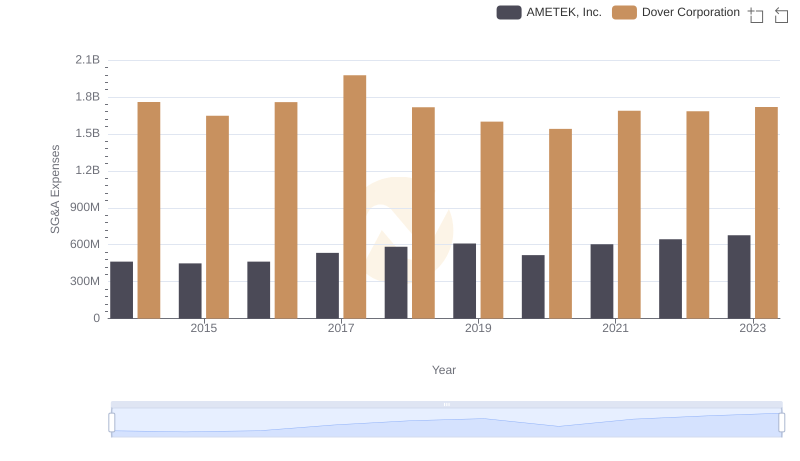

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, AMETEK, Inc. and Lennox International Inc. have shown distinct strategies in handling these costs. From 2014 to 2023, Lennox International consistently reported higher SG&A expenses, peaking at approximately 7.3% more than AMETEK in 2023. Interestingly, AMETEK's SG&A expenses grew by about 46% over this period, while Lennox's increased by roughly 23%. This suggests that while Lennox maintains higher absolute costs, AMETEK's expenses are rising at a faster rate. The data for 2024 is incomplete, but the trend indicates a continued focus on cost management by both companies. Understanding these dynamics offers valuable insights into their operational efficiencies and strategic priorities.

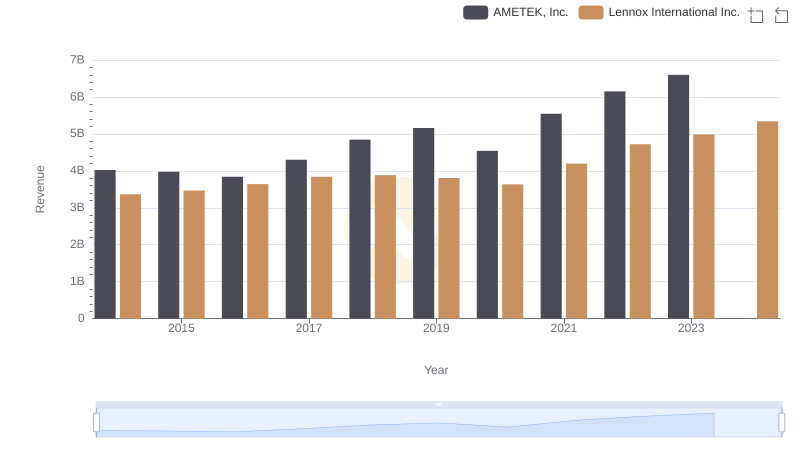

Annual Revenue Comparison: AMETEK, Inc. vs Lennox International Inc.

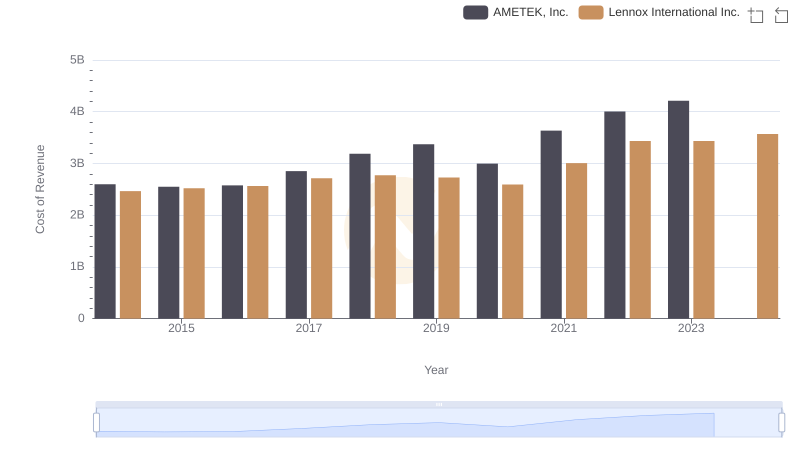

Cost of Revenue Comparison: AMETEK, Inc. vs Lennox International Inc.

AMETEK, Inc. or Dover Corporation: Who Manages SG&A Costs Better?

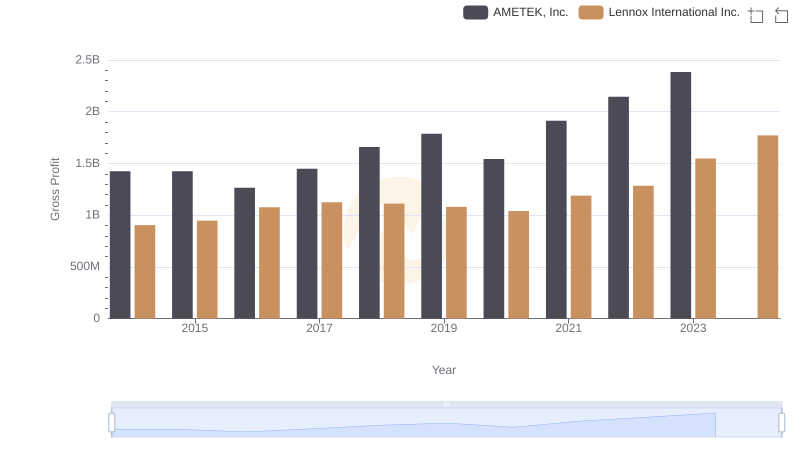

Gross Profit Analysis: Comparing AMETEK, Inc. and Lennox International Inc.

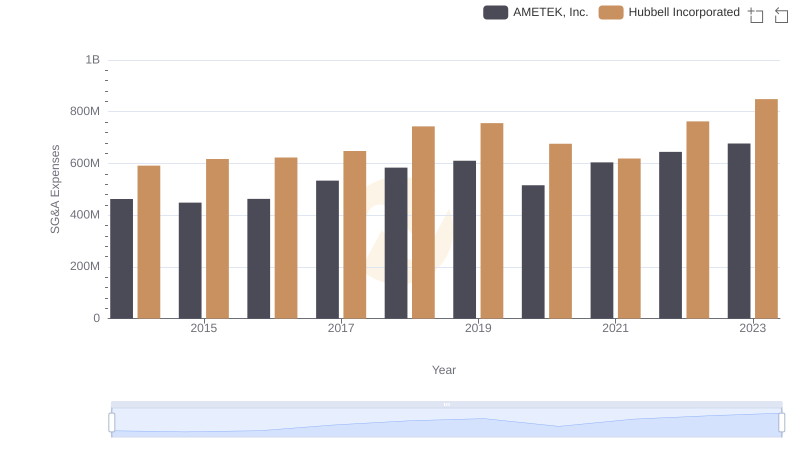

Breaking Down SG&A Expenses: AMETEK, Inc. vs Hubbell Incorporated

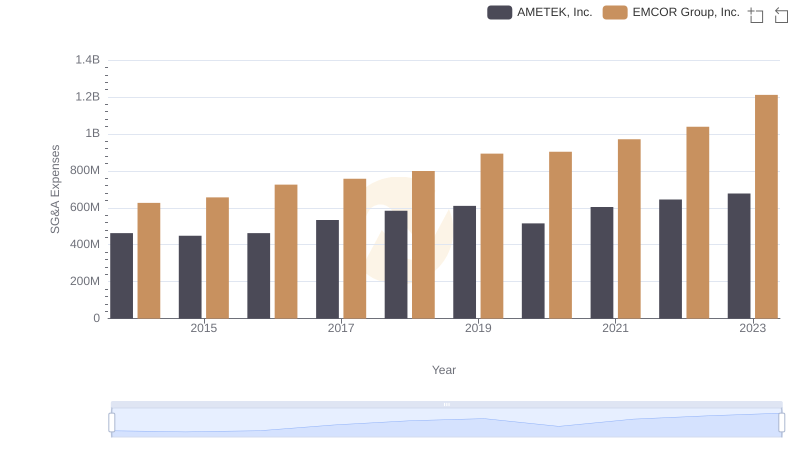

Selling, General, and Administrative Costs: AMETEK, Inc. vs EMCOR Group, Inc.

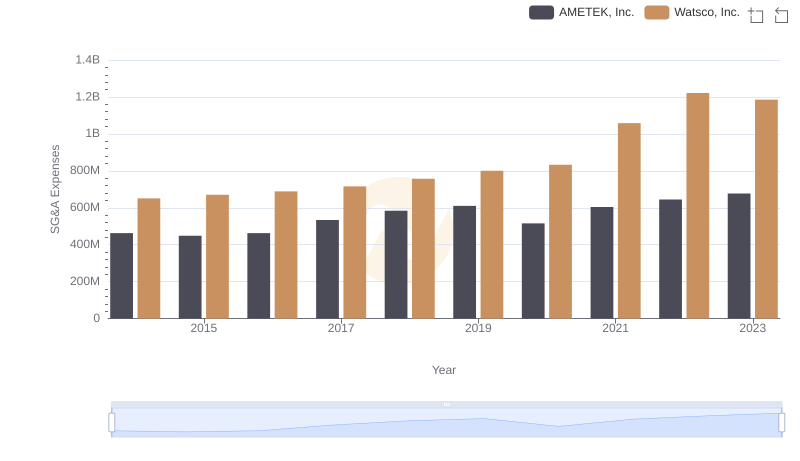

Comparing SG&A Expenses: AMETEK, Inc. vs Watsco, Inc. Trends and Insights

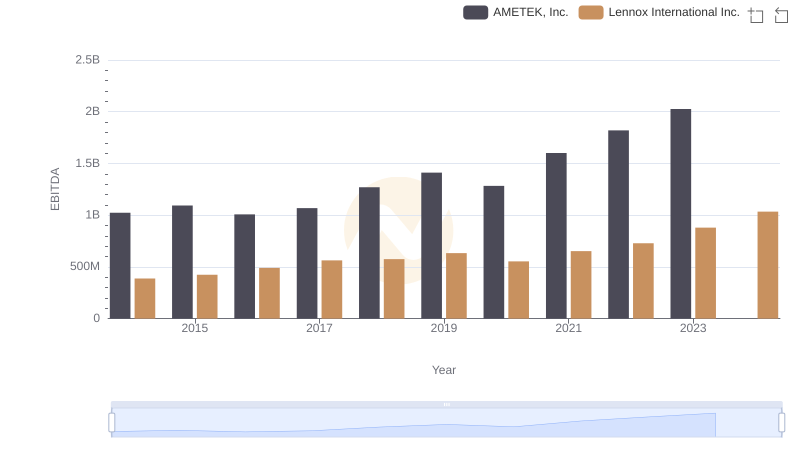

AMETEK, Inc. vs Lennox International Inc.: In-Depth EBITDA Performance Comparison

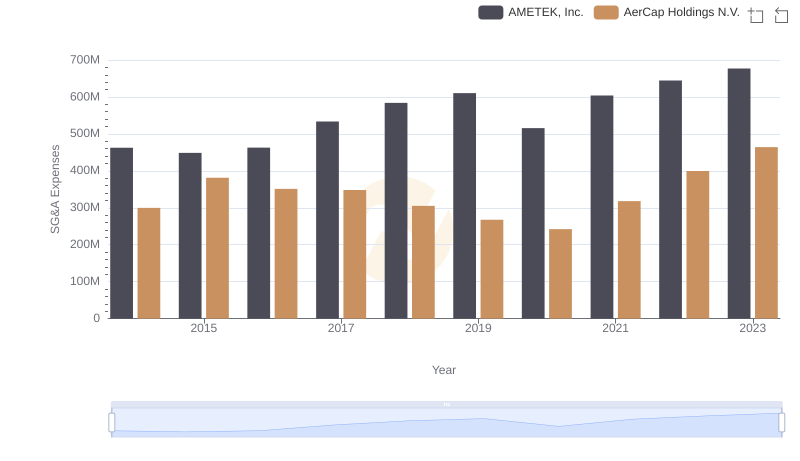

Selling, General, and Administrative Costs: AMETEK, Inc. vs AerCap Holdings N.V.

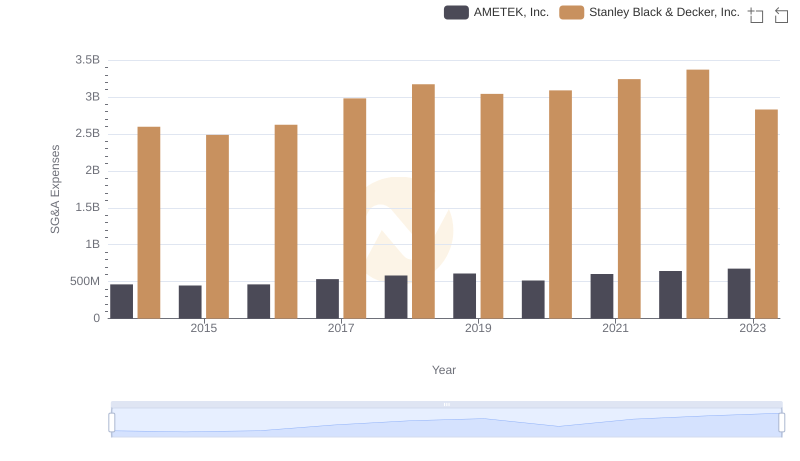

AMETEK, Inc. and Stanley Black & Decker, Inc.: SG&A Spending Patterns Compared