| __timestamp | TransUnion | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 429400000 | 3509000000 |

| Thursday, January 1, 2015 | 478200000 | 3342000000 |

| Friday, January 1, 2016 | 585300000 | 3713000000 |

| Sunday, January 1, 2017 | 701100000 | 3996000000 |

| Monday, January 1, 2018 | 819800000 | 4212000000 |

| Tuesday, January 1, 2019 | 993200000 | 4344000000 |

| Wednesday, January 1, 2020 | 883400000 | 4149000000 |

| Friday, January 1, 2021 | 1010500000 | 4956000000 |

| Saturday, January 1, 2022 | 1173800000 | 5466000000 |

| Sunday, January 1, 2023 | 667300000 | 5592000000 |

| Monday, January 1, 2024 | 1204100000 | 5128000000 |

In pursuit of knowledge

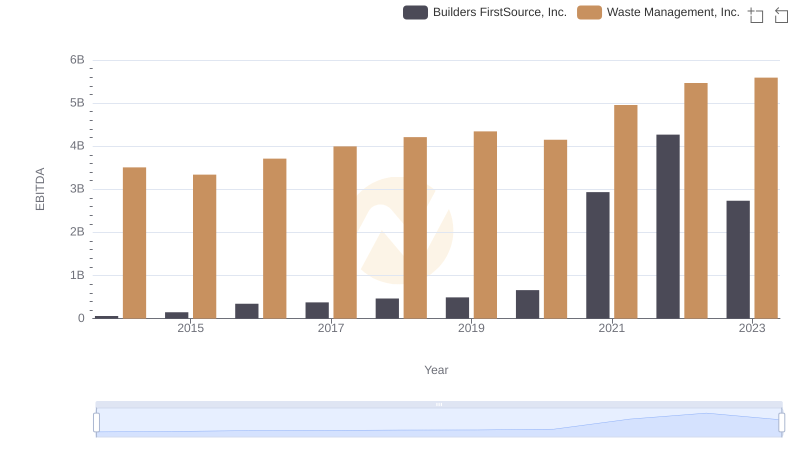

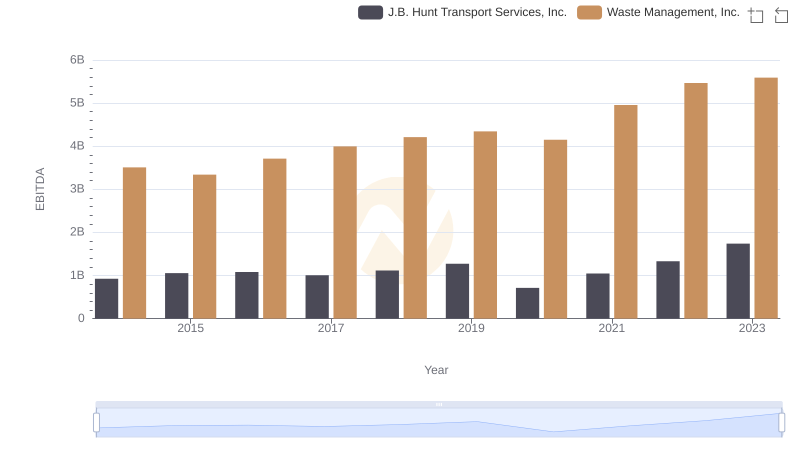

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. Over the past decade, Waste Management, Inc. has consistently outperformed TransUnion, showcasing a robust growth trajectory. From 2014 to 2023, Waste Management's EBITDA surged by approximately 60%, peaking at $5.6 billion in 2023. In contrast, TransUnion's EBITDA, while growing, experienced a more modest increase of around 55%, reaching its zenith in 2022 before a slight dip in 2023.

This comparison highlights Waste Management's resilience and strategic prowess in maintaining a steady upward trend, even amidst economic fluctuations. Meanwhile, TransUnion's performance, though commendable, reflects the challenges faced in a competitive market. As we look to the future, these insights underscore the importance of strategic adaptability and operational efficiency in sustaining financial growth.

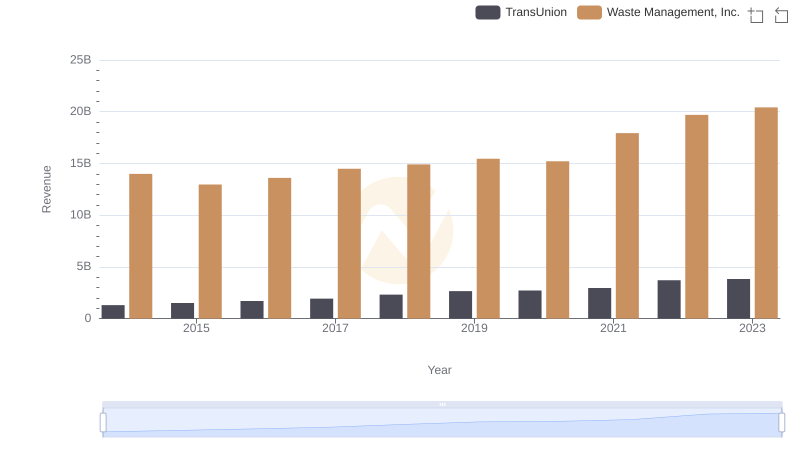

Waste Management, Inc. and TransUnion: A Comprehensive Revenue Analysis

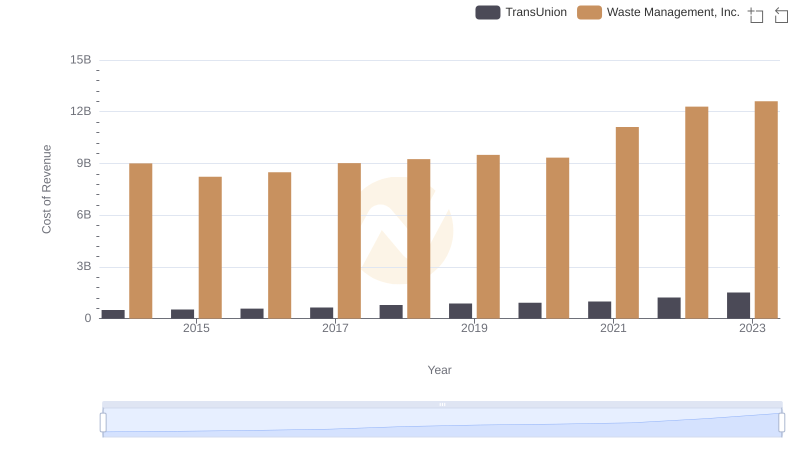

Analyzing Cost of Revenue: Waste Management, Inc. and TransUnion

EBITDA Performance Review: Waste Management, Inc. vs Builders FirstSource, Inc.

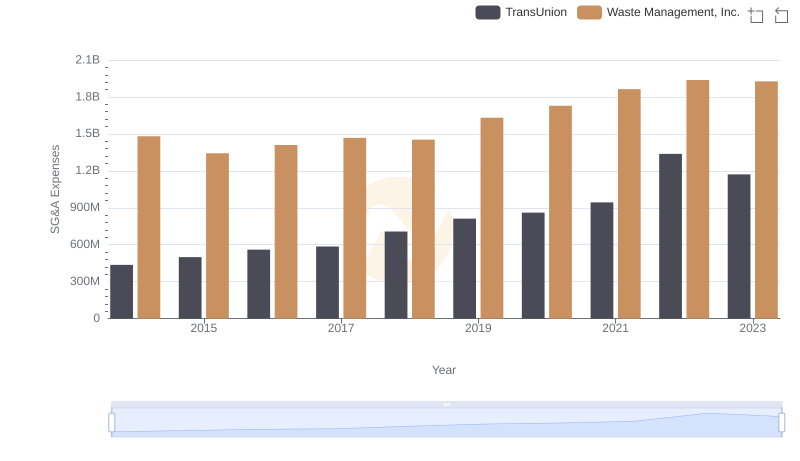

Breaking Down SG&A Expenses: Waste Management, Inc. vs TransUnion

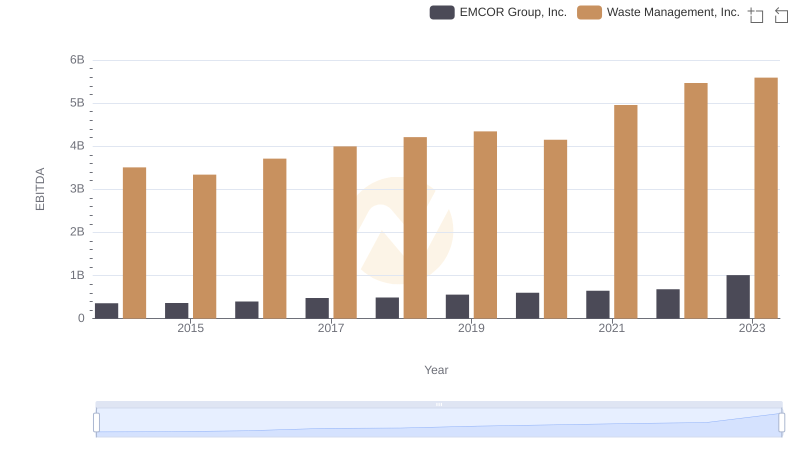

Comprehensive EBITDA Comparison: Waste Management, Inc. vs EMCOR Group, Inc.

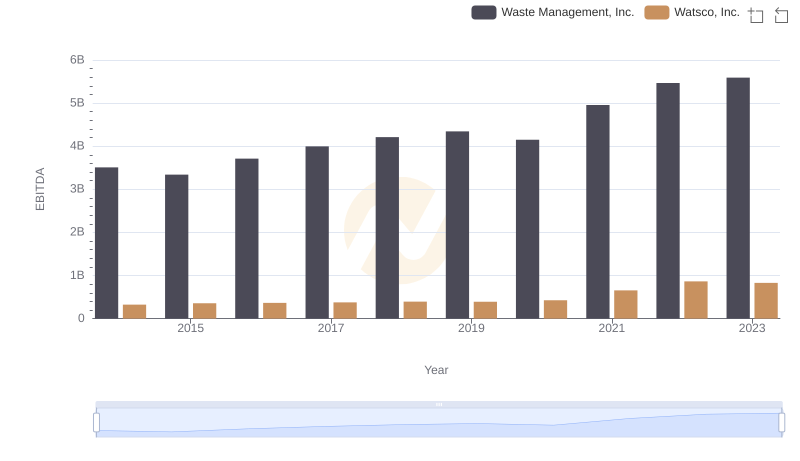

Professional EBITDA Benchmarking: Waste Management, Inc. vs Watsco, Inc.

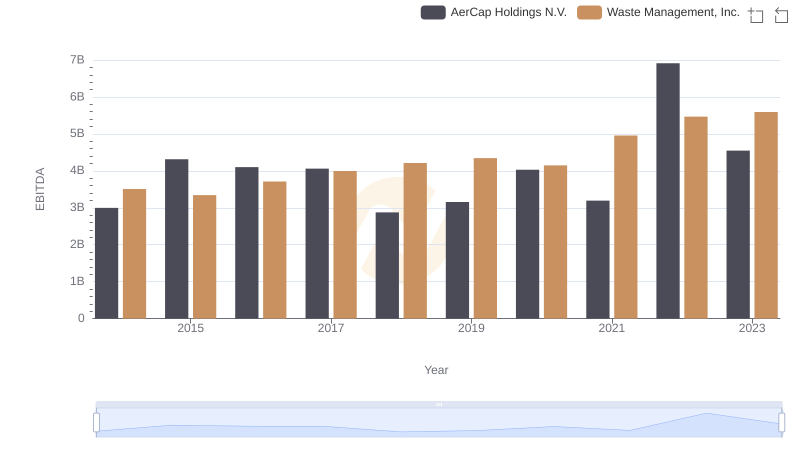

Professional EBITDA Benchmarking: Waste Management, Inc. vs AerCap Holdings N.V.

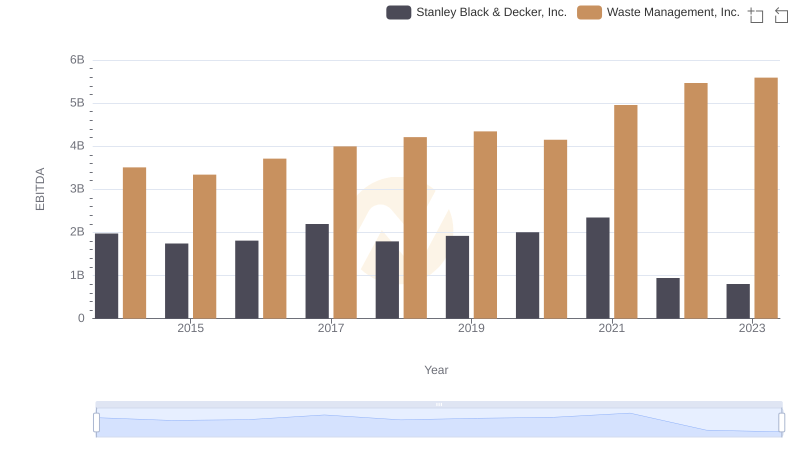

EBITDA Metrics Evaluated: Waste Management, Inc. vs Stanley Black & Decker, Inc.

EBITDA Performance Review: Waste Management, Inc. vs J.B. Hunt Transport Services, Inc.