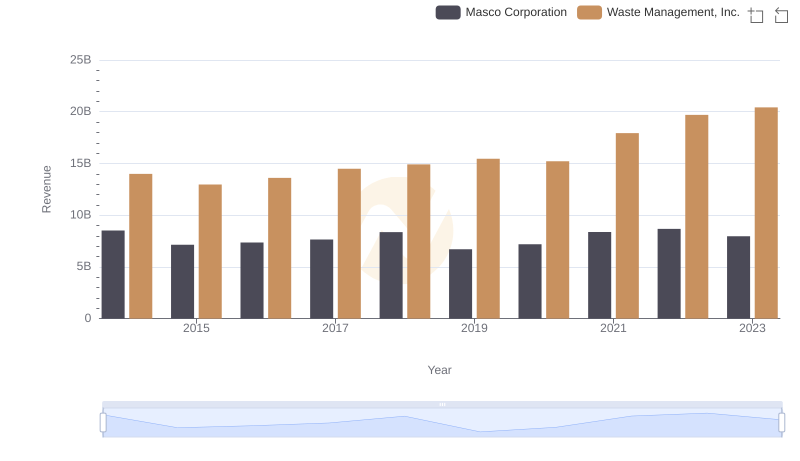

| __timestamp | TransUnion | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1304700000 | 13996000000 |

| Thursday, January 1, 2015 | 1506800000 | 12961000000 |

| Friday, January 1, 2016 | 1704900000 | 13609000000 |

| Sunday, January 1, 2017 | 1933800000 | 14485000000 |

| Monday, January 1, 2018 | 2317200000 | 14914000000 |

| Tuesday, January 1, 2019 | 2656100000 | 15455000000 |

| Wednesday, January 1, 2020 | 2716600000 | 15218000000 |

| Friday, January 1, 2021 | 2960200000 | 17931000000 |

| Saturday, January 1, 2022 | 3709900000 | 19698000000 |

| Sunday, January 1, 2023 | 3831200000 | 20426000000 |

| Monday, January 1, 2024 | 4183800000 | 22063000000 |

Unleashing insights

In the ever-evolving landscape of American business, Waste Management, Inc. and TransUnion have emerged as significant players, each carving out a unique niche. Over the past decade, from 2014 to 2023, these companies have demonstrated remarkable revenue growth, reflecting their strategic prowess and market adaptability.

Waste Management, Inc., a leader in waste disposal and environmental services, has seen its revenue soar by approximately 46%, reaching over $20 billion in 2023. This growth underscores the increasing demand for sustainable waste solutions in a world grappling with environmental challenges.

Meanwhile, TransUnion, a titan in the credit reporting industry, has experienced a staggering 194% increase in revenue, climbing to nearly $3.8 billion in 2023. This surge highlights the growing importance of data analytics and credit information in the digital age.

As these companies continue to innovate, their financial trajectories offer valuable insights into the broader economic trends shaping the future.

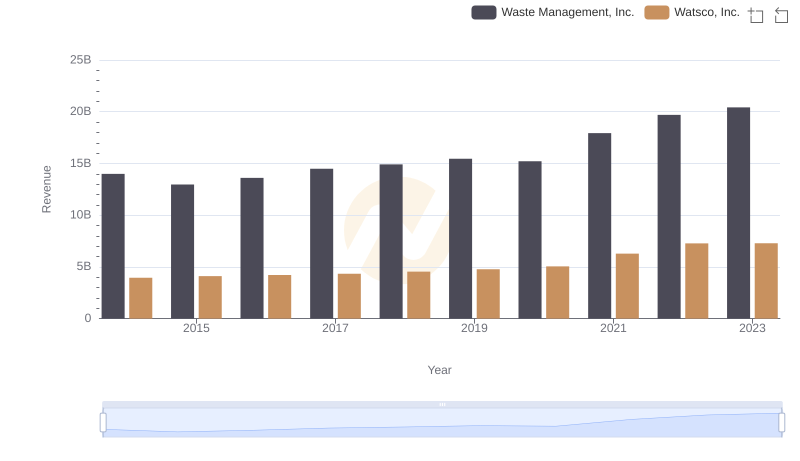

Revenue Showdown: Waste Management, Inc. vs Watsco, Inc.

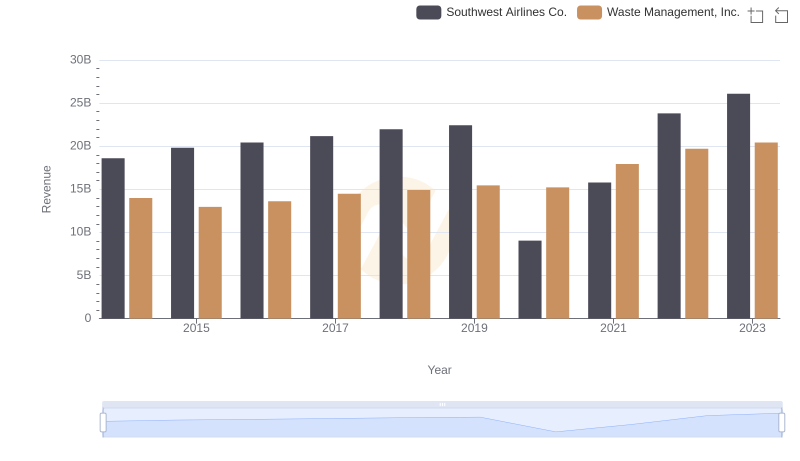

Revenue Insights: Waste Management, Inc. and Southwest Airlines Co. Performance Compared

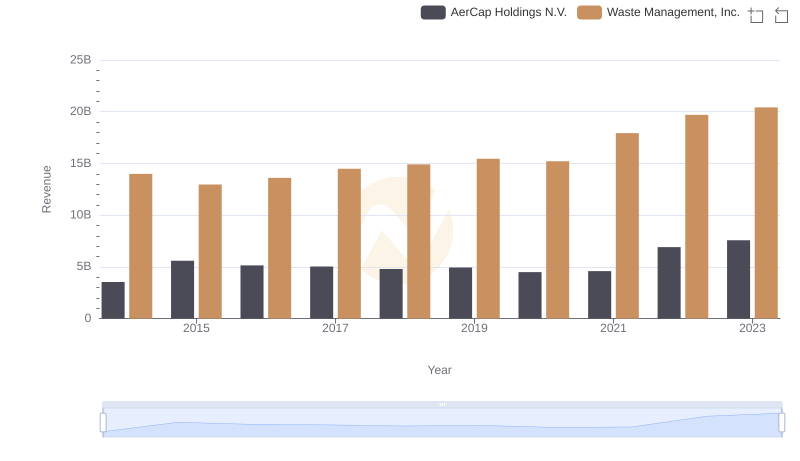

Annual Revenue Comparison: Waste Management, Inc. vs AerCap Holdings N.V.

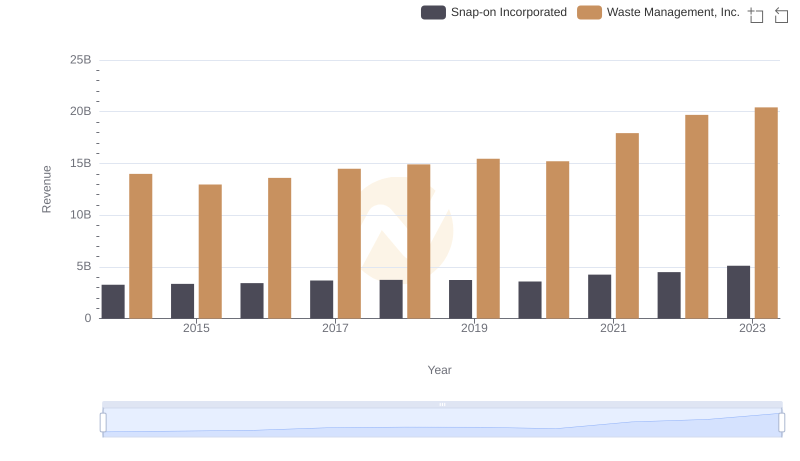

Waste Management, Inc. and Snap-on Incorporated: A Comprehensive Revenue Analysis

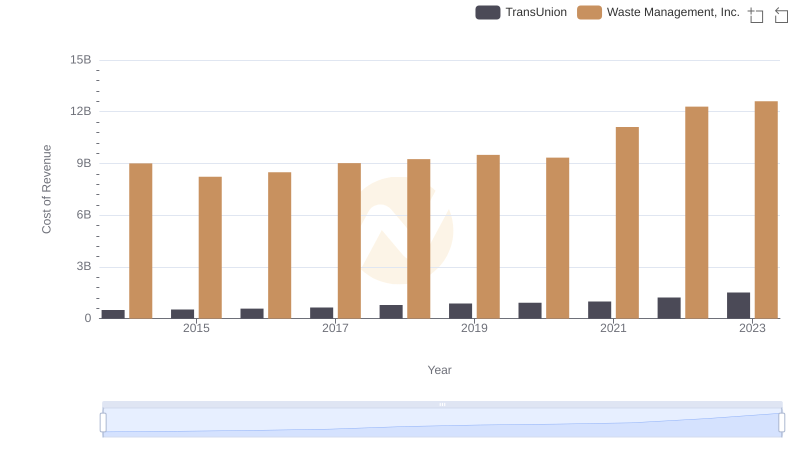

Analyzing Cost of Revenue: Waste Management, Inc. and TransUnion

Waste Management, Inc. vs Carlisle Companies Incorporated: Examining Key Revenue Metrics

Revenue Showdown: Waste Management, Inc. vs Masco Corporation

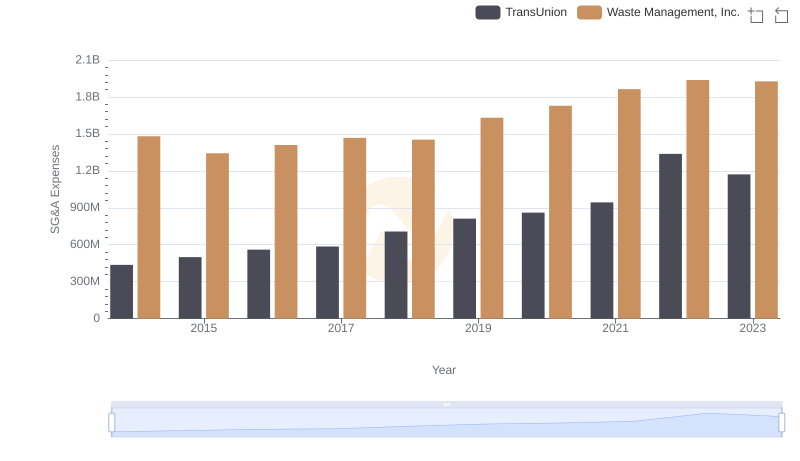

Breaking Down SG&A Expenses: Waste Management, Inc. vs TransUnion

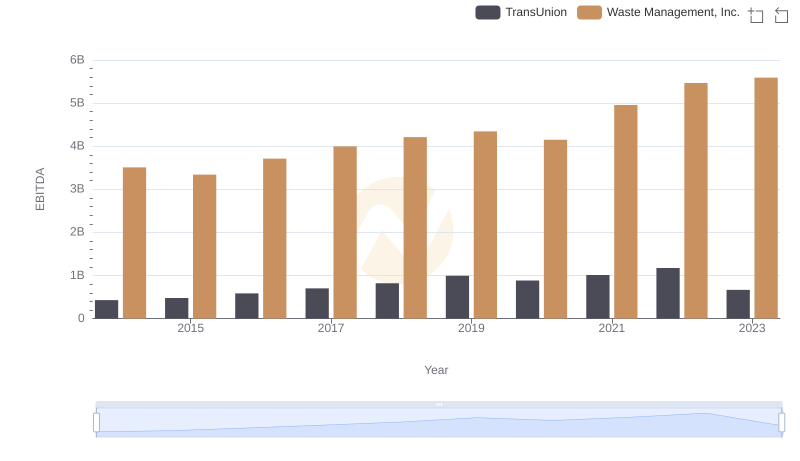

A Professional Review of EBITDA: Waste Management, Inc. Compared to TransUnion