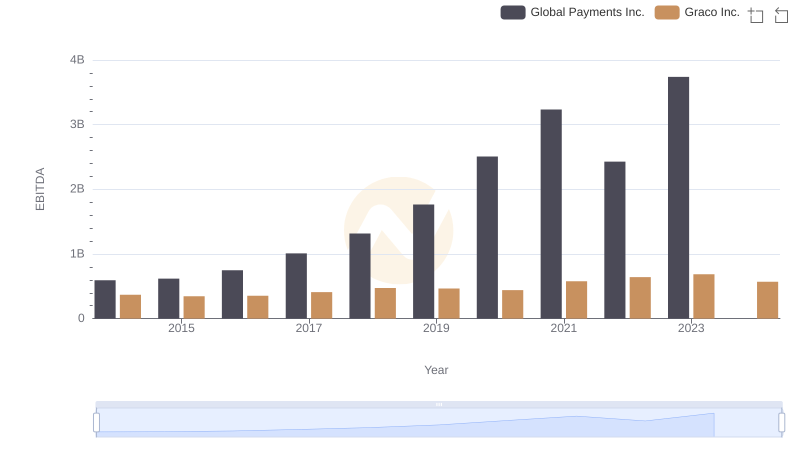

| __timestamp | AECOM | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 417662000 | 594102000 |

| Thursday, January 1, 2015 | 1020478000 | 618109000 |

| Friday, January 1, 2016 | 926466000 | 748136000 |

| Sunday, January 1, 2017 | 920292000 | 1010019000 |

| Monday, January 1, 2018 | 680801000 | 1315968000 |

| Tuesday, January 1, 2019 | 573352000 | 1764994000 |

| Wednesday, January 1, 2020 | 580017000 | 2508393000 |

| Friday, January 1, 2021 | 813356000 | 3233589000 |

| Saturday, January 1, 2022 | 826856000 | 2427684000 |

| Sunday, January 1, 2023 | 543642000 | 3606789000 |

| Monday, January 1, 2024 | 1082384000 | 2333605000 |

Data in motion

In the ever-evolving landscape of global finance, understanding a company's EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is crucial for investors. Over the past decade, AECOM and Global Payments Inc. have showcased intriguing financial trajectories.

From 2014 to 2024, AECOM's EBITDA has seen a consistent upward trend, peaking in 2024 with a remarkable 159% increase from its 2014 figures. This growth reflects AECOM's strategic expansions and operational efficiencies.

Conversely, Global Payments Inc. experienced a more volatile journey. Despite a dip in 2022, the company rebounded in 2023, achieving a staggering 530% growth from 2014. This volatility highlights the dynamic nature of the payments industry.

Both companies demonstrate resilience and adaptability, yet their paths diverge, offering valuable insights for potential investors.

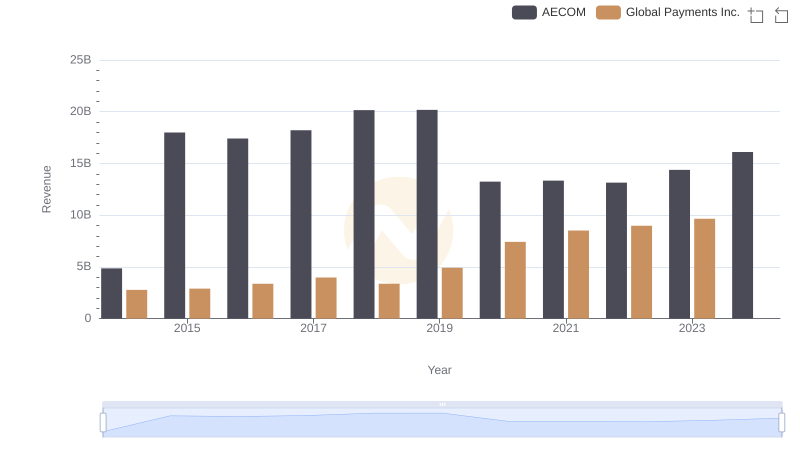

Annual Revenue Comparison: Global Payments Inc. vs AECOM

Comparing Cost of Revenue Efficiency: Global Payments Inc. vs AECOM

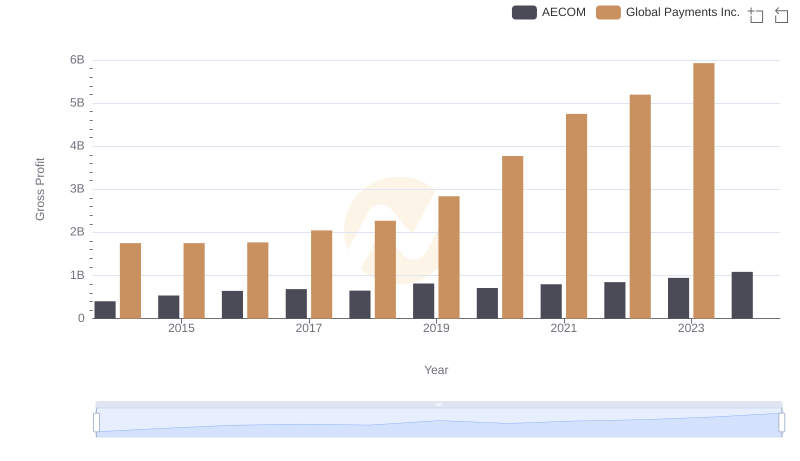

Global Payments Inc. and AECOM: A Detailed Gross Profit Analysis

Global Payments Inc. and ZTO Express (Cayman) Inc.: A Detailed Examination of EBITDA Performance

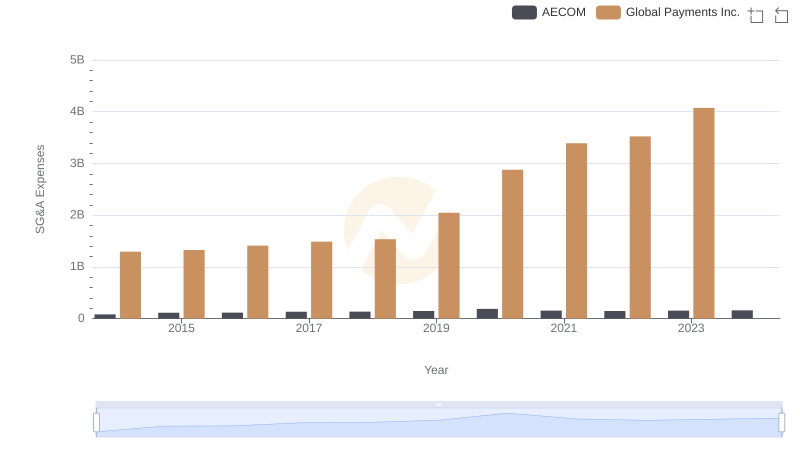

Global Payments Inc. and AECOM: SG&A Spending Patterns Compared

A Side-by-Side Analysis of EBITDA: Global Payments Inc. and Graco Inc.

Comprehensive EBITDA Comparison: Global Payments Inc. vs XPO Logistics, Inc.

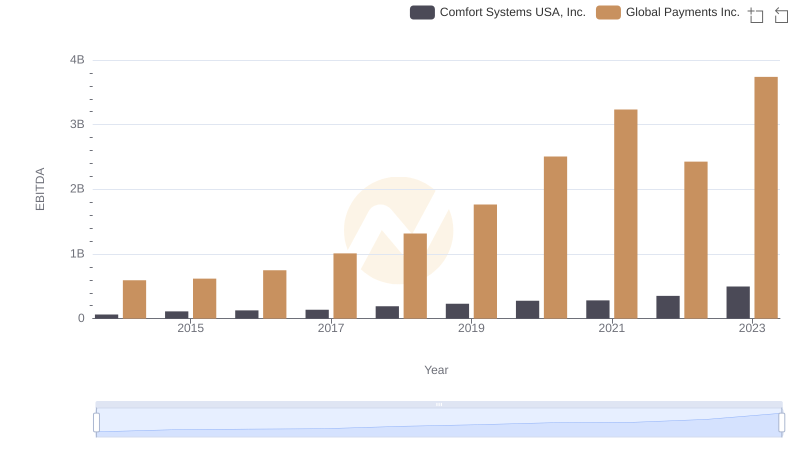

A Side-by-Side Analysis of EBITDA: Global Payments Inc. and Comfort Systems USA, Inc.

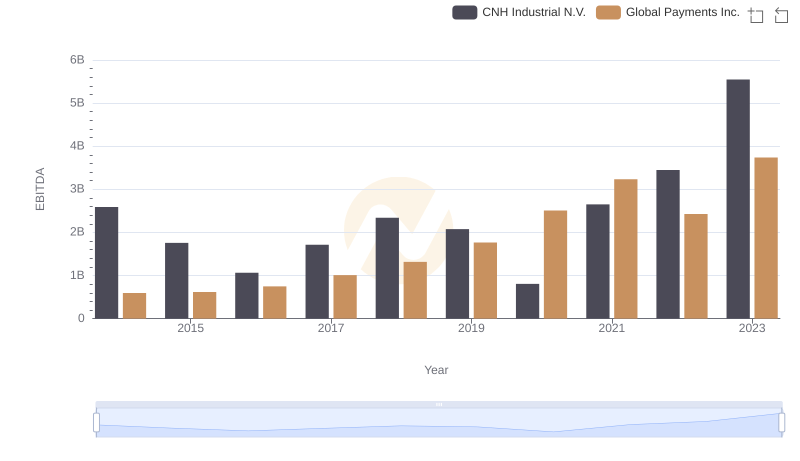

A Side-by-Side Analysis of EBITDA: Global Payments Inc. and CNH Industrial N.V.

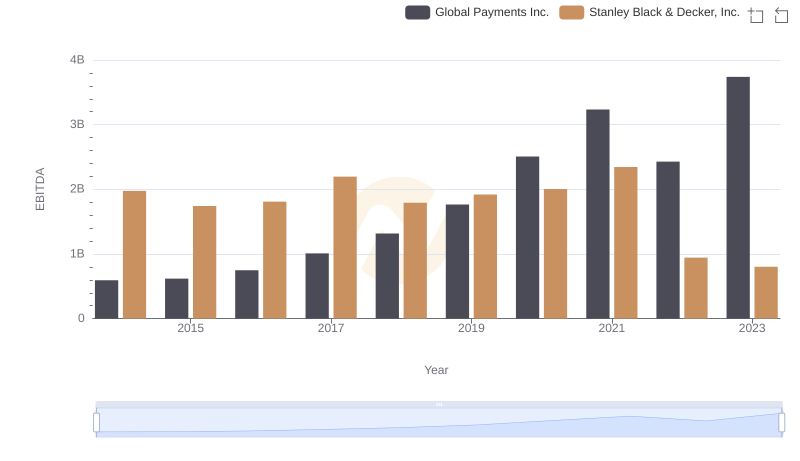

Comprehensive EBITDA Comparison: Global Payments Inc. vs Stanley Black & Decker, Inc.