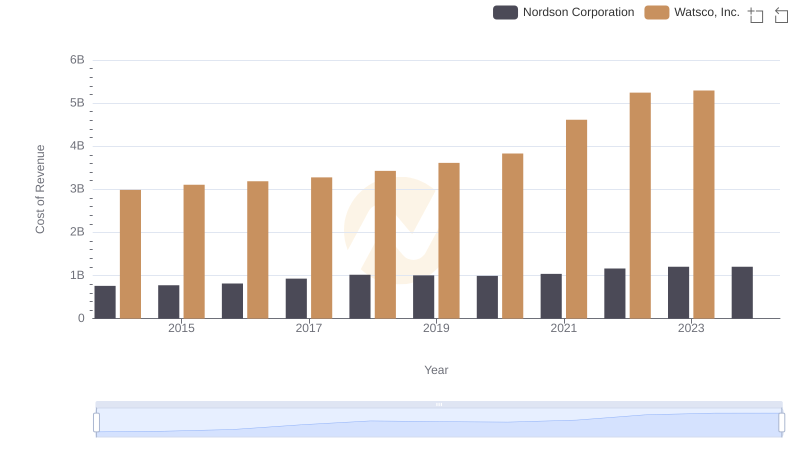

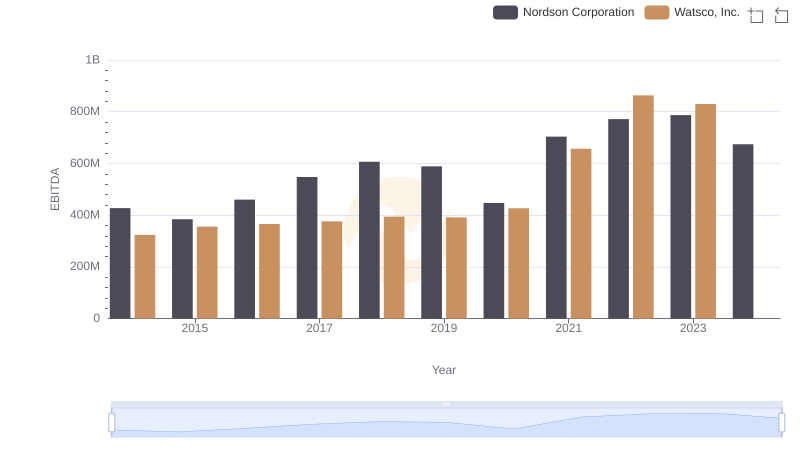

| __timestamp | Nordson Corporation | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 577993000 | 650655000 |

| Thursday, January 1, 2015 | 596234000 | 670609000 |

| Friday, January 1, 2016 | 605068000 | 688952000 |

| Sunday, January 1, 2017 | 681299000 | 715671000 |

| Monday, January 1, 2018 | 741408000 | 757452000 |

| Tuesday, January 1, 2019 | 708990000 | 800328000 |

| Wednesday, January 1, 2020 | 693552000 | 833051000 |

| Friday, January 1, 2021 | 708953000 | 1058316000 |

| Saturday, January 1, 2022 | 724176000 | 1221382000 |

| Sunday, January 1, 2023 | 681244000 | 1185626000 |

| Monday, January 1, 2024 | 812128000 | 1262938000 |

Infusing magic into the data realm

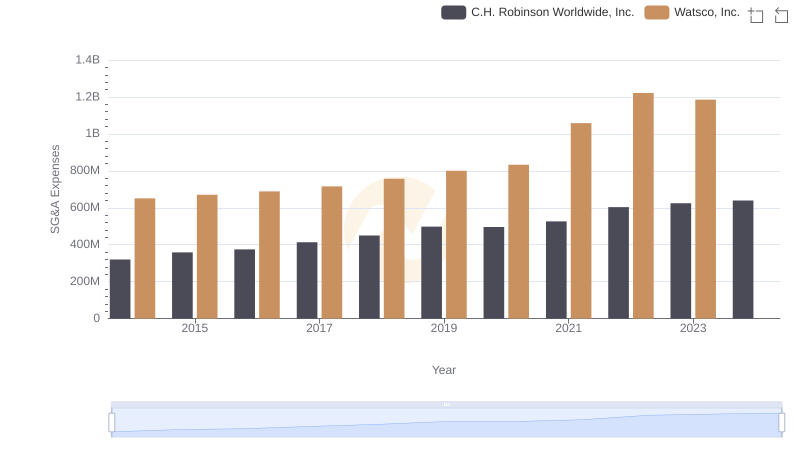

In the competitive landscape of industrial and commercial sectors, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Watsco, Inc. and Nordson Corporation have demonstrated contrasting strategies in optimizing these costs.

From 2014 to 2023, Watsco, Inc. has seen a significant increase in SG&A expenses, peaking at over 1.2 billion in 2022, reflecting a growth of approximately 87% from 2014. This trend suggests a strategic investment in administrative capabilities to support expansion. In contrast, Nordson Corporation maintained a more stable SG&A trajectory, with a modest increase of around 40% over the same period, indicating a focus on cost efficiency.

While Watsco's data for 2024 is unavailable, Nordson's expenses surged, hinting at potential strategic shifts. This comparison highlights the diverse approaches companies take in financial management, offering valuable insights for investors and industry analysts.

Analyzing Cost of Revenue: Watsco, Inc. and Nordson Corporation

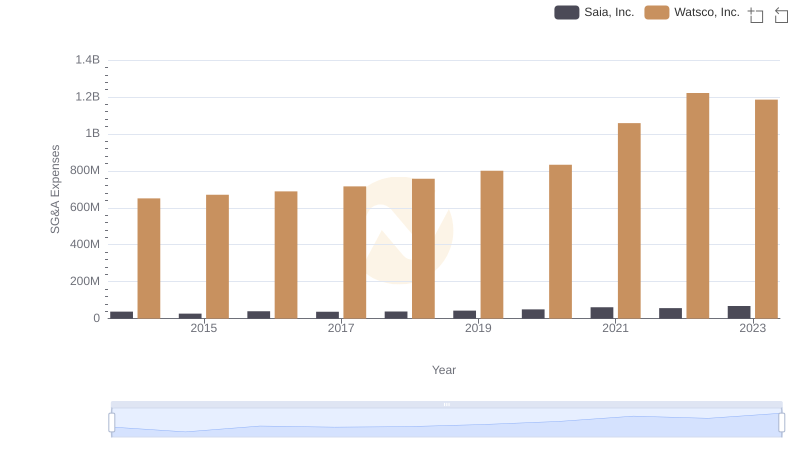

Breaking Down SG&A Expenses: Watsco, Inc. vs Saia, Inc.

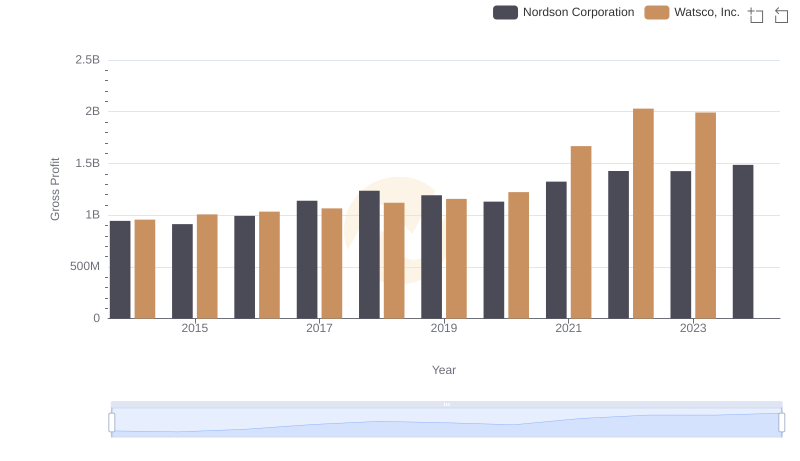

Watsco, Inc. and Nordson Corporation: A Detailed Gross Profit Analysis

Watsco, Inc. or C.H. Robinson Worldwide, Inc.: Who Manages SG&A Costs Better?

Operational Costs Compared: SG&A Analysis of Watsco, Inc. and Clean Harbors, Inc.

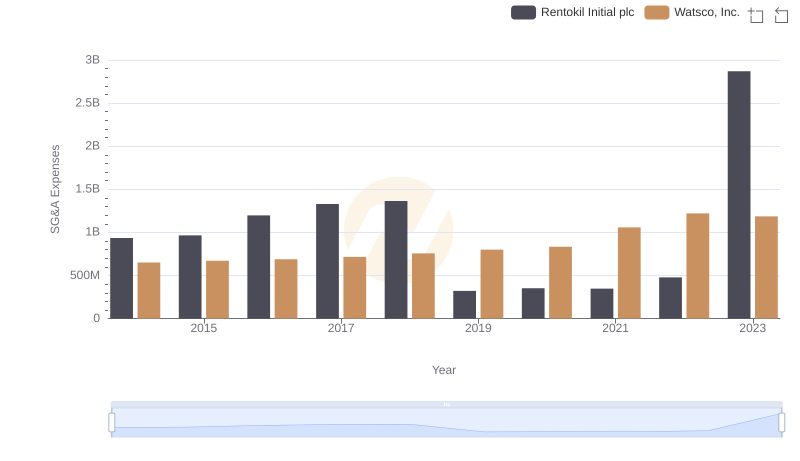

SG&A Efficiency Analysis: Comparing Watsco, Inc. and Rentokil Initial plc

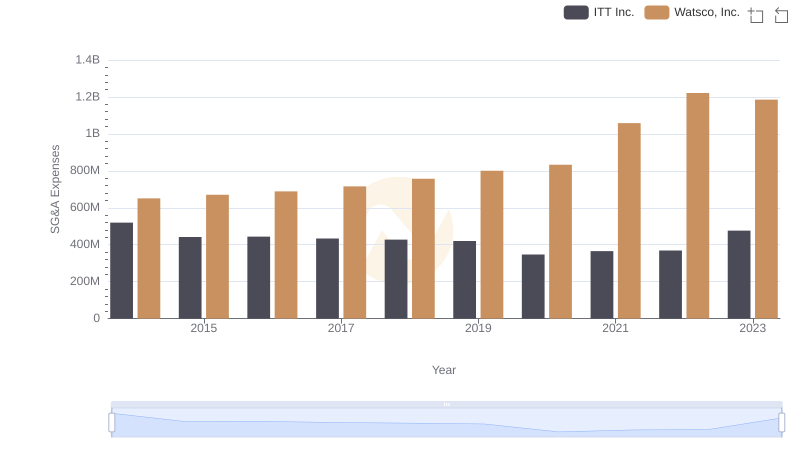

Watsco, Inc. or ITT Inc.: Who Manages SG&A Costs Better?

A Side-by-Side Analysis of EBITDA: Watsco, Inc. and Nordson Corporation