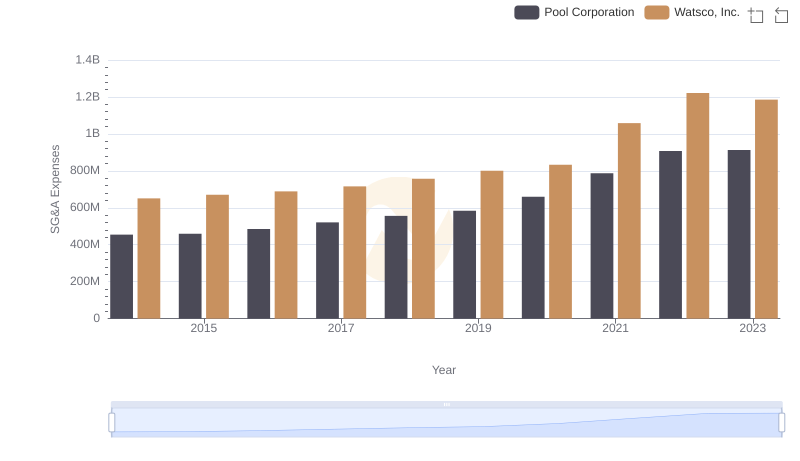

| __timestamp | C.H. Robinson Worldwide, Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 320213000 | 650655000 |

| Thursday, January 1, 2015 | 358760000 | 670609000 |

| Friday, January 1, 2016 | 375061000 | 688952000 |

| Sunday, January 1, 2017 | 413404000 | 715671000 |

| Monday, January 1, 2018 | 449610000 | 757452000 |

| Tuesday, January 1, 2019 | 497806000 | 800328000 |

| Wednesday, January 1, 2020 | 496122000 | 833051000 |

| Friday, January 1, 2021 | 526371000 | 1058316000 |

| Saturday, January 1, 2022 | 603415000 | 1221382000 |

| Sunday, January 1, 2023 | 624266000 | 1185626000 |

| Monday, January 1, 2024 | 639624000 | 1262938000 |

Data in motion

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, Watsco, Inc. and C.H. Robinson Worldwide, Inc. have shown distinct strategies in handling these costs. Watsco, Inc. has seen a consistent rise in SG&A expenses, peaking at approximately $1.22 billion in 2022, reflecting a 87% increase from 2014. Meanwhile, C.H. Robinson Worldwide, Inc. has managed a steadier growth, with expenses increasing by about 100% over the same period, reaching around $639 million in 2023. This data suggests that while both companies have increased their SG&A expenses, Watsco's growth rate is more pronounced. However, the absence of 2024 data for Watsco leaves room for speculation on future trends. Understanding these dynamics offers valuable insights into each company's operational efficiency and strategic priorities.

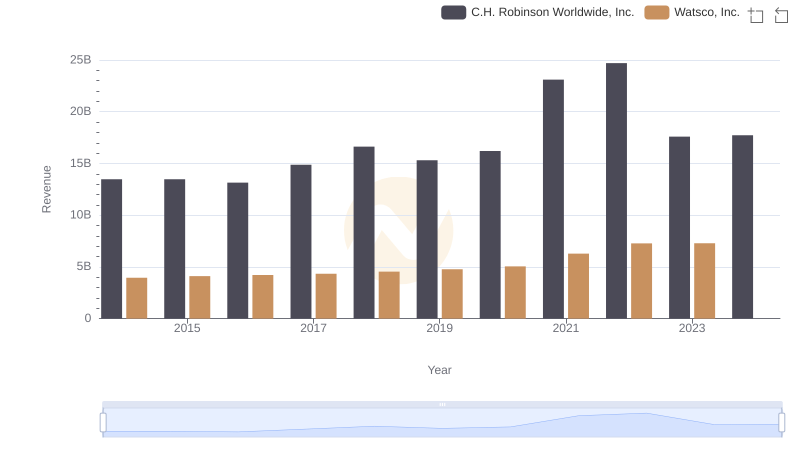

Annual Revenue Comparison: Watsco, Inc. vs C.H. Robinson Worldwide, Inc.

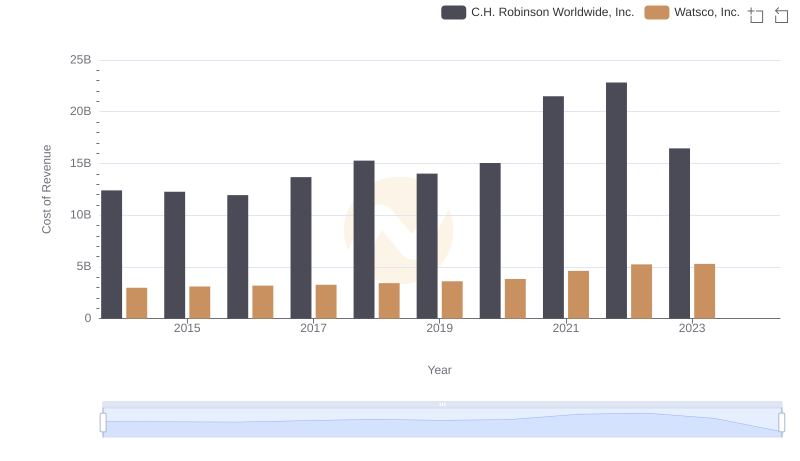

Cost of Revenue Comparison: Watsco, Inc. vs C.H. Robinson Worldwide, Inc.

Breaking Down SG&A Expenses: Watsco, Inc. vs Pool Corporation

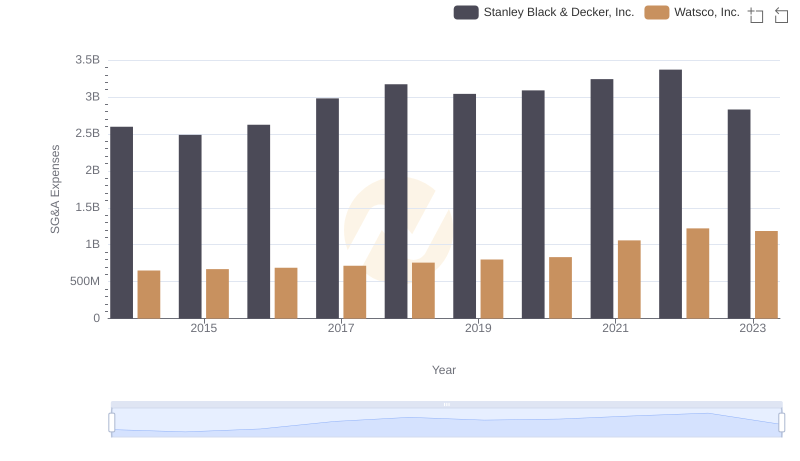

Cost Management Insights: SG&A Expenses for Watsco, Inc. and Stanley Black & Decker, Inc.

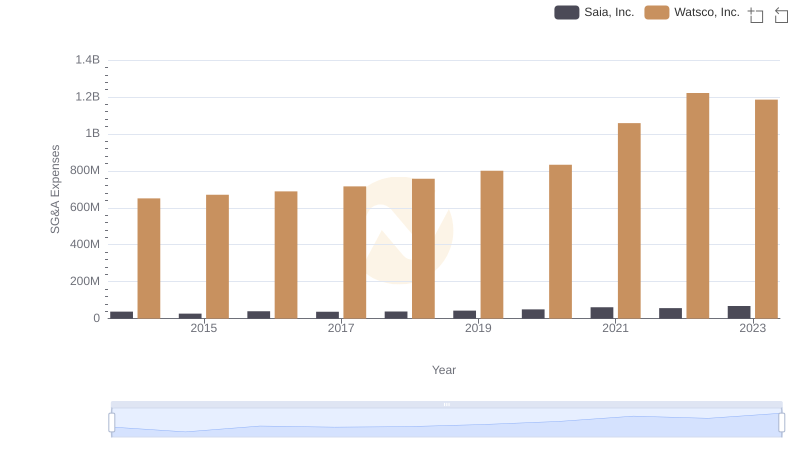

Breaking Down SG&A Expenses: Watsco, Inc. vs Saia, Inc.

Operational Costs Compared: SG&A Analysis of Watsco, Inc. and Clean Harbors, Inc.

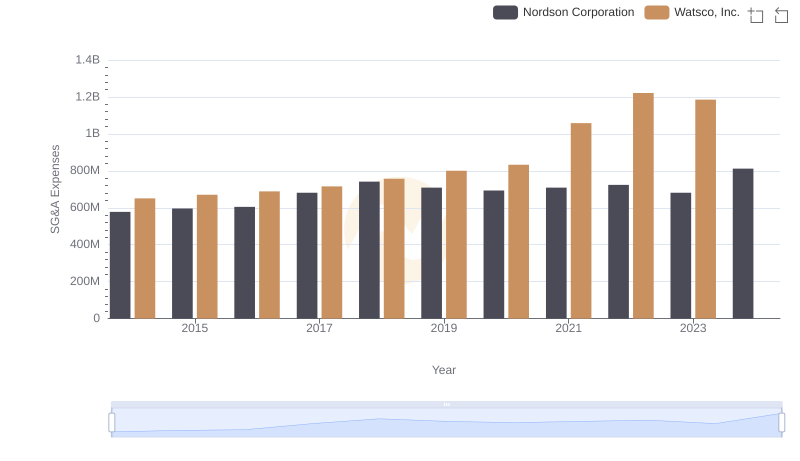

Who Optimizes SG&A Costs Better? Watsco, Inc. or Nordson Corporation