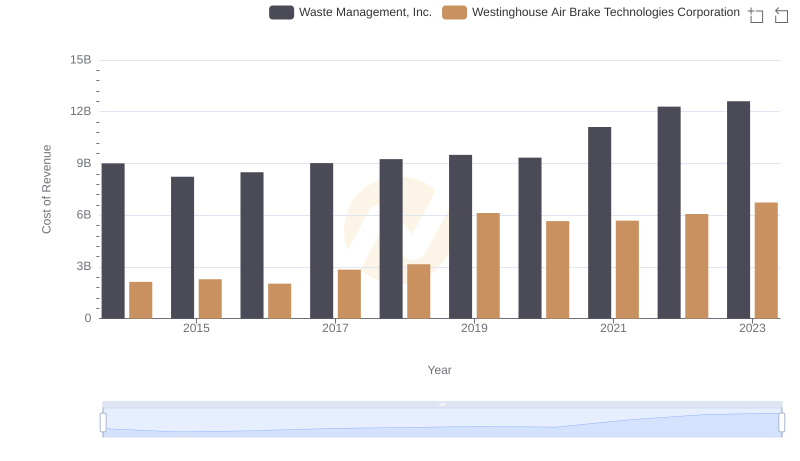

| __timestamp | Waste Management, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 13996000000 | 3044454000 |

| Thursday, January 1, 2015 | 12961000000 | 3307998000 |

| Friday, January 1, 2016 | 13609000000 | 2931188000 |

| Sunday, January 1, 2017 | 14485000000 | 3881756000 |

| Monday, January 1, 2018 | 14914000000 | 4363547000 |

| Tuesday, January 1, 2019 | 15455000000 | 8200000000 |

| Wednesday, January 1, 2020 | 15218000000 | 7556100000 |

| Friday, January 1, 2021 | 17931000000 | 7822000000 |

| Saturday, January 1, 2022 | 19698000000 | 8362000000 |

| Sunday, January 1, 2023 | 20426000000 | 9677000000 |

| Monday, January 1, 2024 | 22063000000 | 10387000000 |

Unlocking the unknown

In the ever-evolving landscape of industrial giants, Waste Management, Inc. and Westinghouse Air Brake Technologies Corporation have been pivotal players. Over the past decade, Waste Management has consistently outperformed its counterpart, showcasing a robust revenue growth of approximately 46% from 2014 to 2023. In contrast, Westinghouse Air Brake Technologies has seen its revenue more than triple, reflecting a dynamic expansion strategy.

From 2014 to 2023, Waste Management's revenue surged from $14 billion to over $20 billion, highlighting its dominance in the waste management sector. Meanwhile, Westinghouse Air Brake Technologies, with a revenue increase from $3 billion to nearly $10 billion, has demonstrated significant growth in the transportation industry.

This data underscores the resilience and strategic prowess of these companies, each carving out a formidable presence in their respective fields.

Revenue Showdown: Waste Management, Inc. vs Old Dominion Freight Line, Inc.

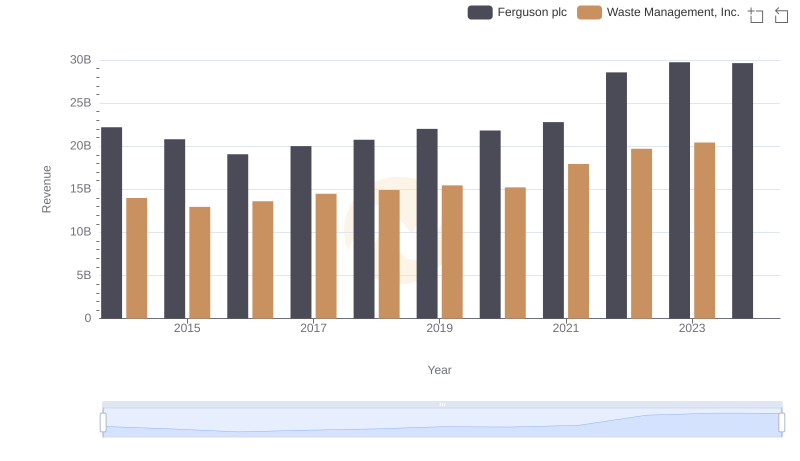

Revenue Insights: Waste Management, Inc. and Ferguson plc Performance Compared

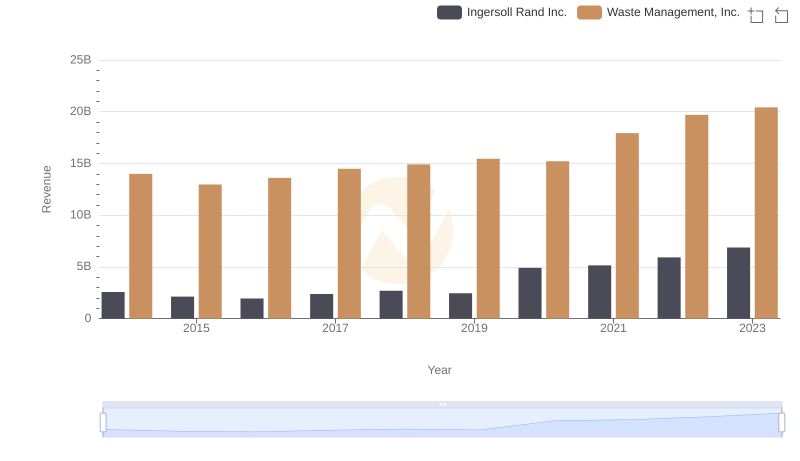

Annual Revenue Comparison: Waste Management, Inc. vs Ingersoll Rand Inc.

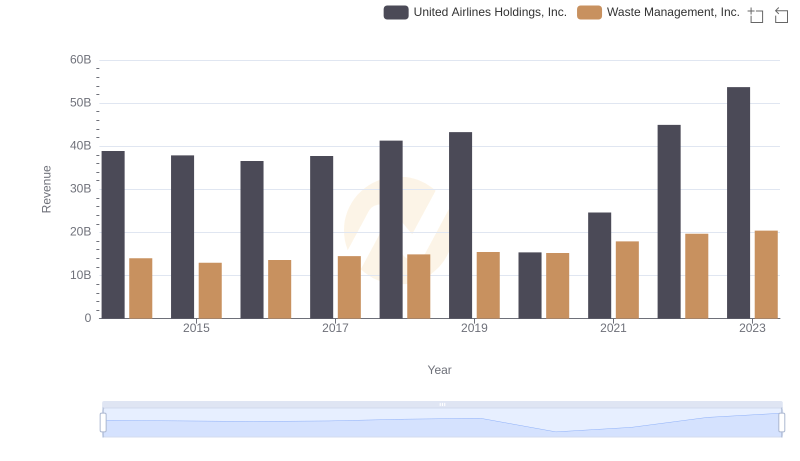

Waste Management, Inc. and United Airlines Holdings, Inc.: A Comprehensive Revenue Analysis

Cost of Revenue Comparison: Waste Management, Inc. vs Westinghouse Air Brake Technologies Corporation

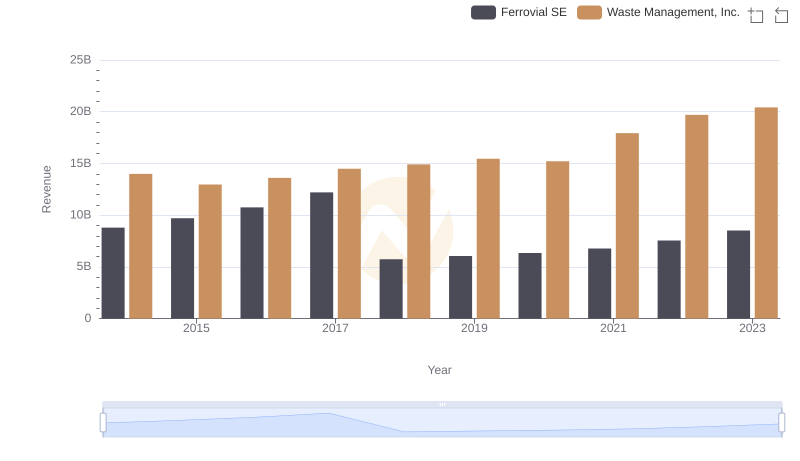

Waste Management, Inc. or Ferrovial SE: Who Leads in Yearly Revenue?

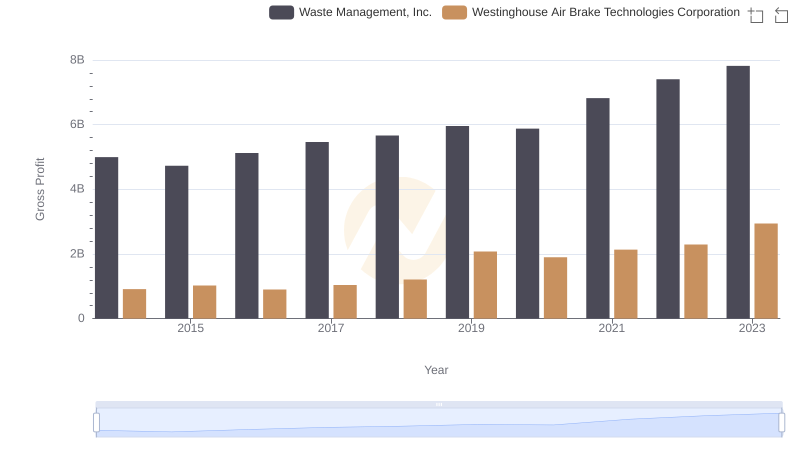

Who Generates Higher Gross Profit? Waste Management, Inc. or Westinghouse Air Brake Technologies Corporation

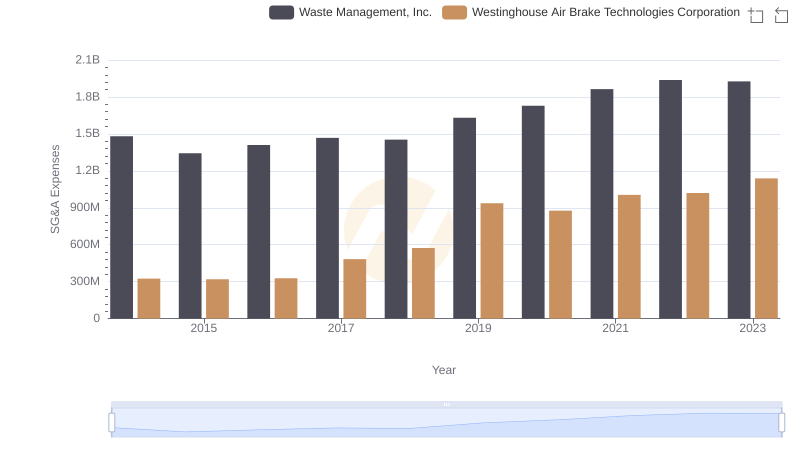

Who Optimizes SG&A Costs Better? Waste Management, Inc. or Westinghouse Air Brake Technologies Corporation

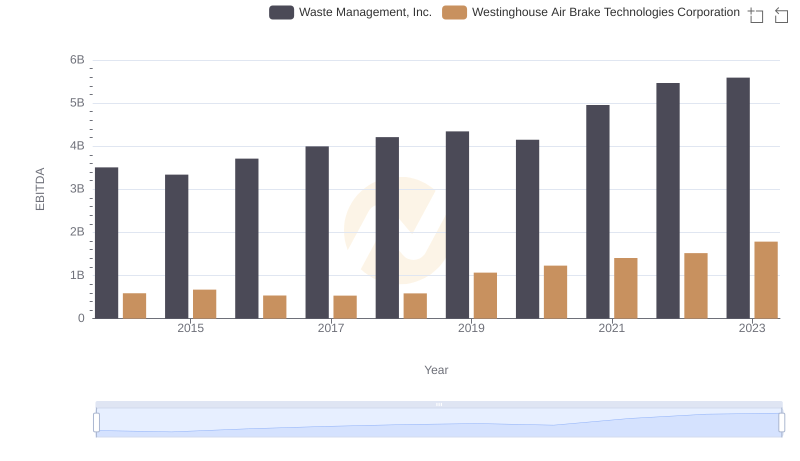

A Professional Review of EBITDA: Waste Management, Inc. Compared to Westinghouse Air Brake Technologies Corporation