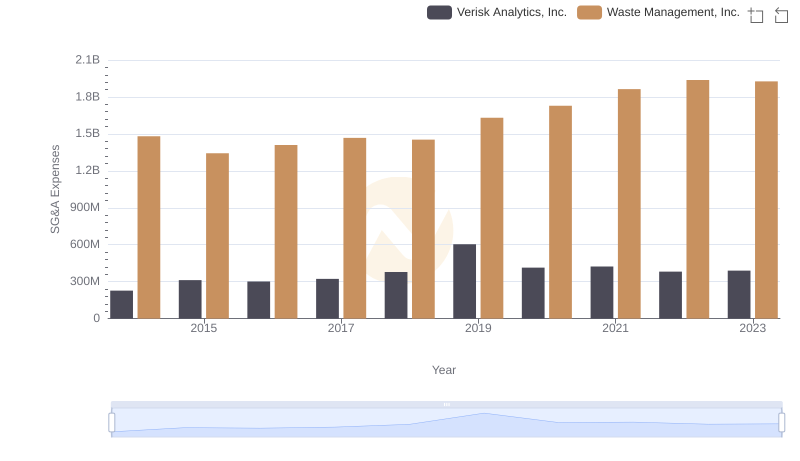

| __timestamp | Equifax Inc. | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 1481000000 |

| Thursday, January 1, 2015 | 884300000 | 1343000000 |

| Friday, January 1, 2016 | 948200000 | 1410000000 |

| Sunday, January 1, 2017 | 1039100000 | 1468000000 |

| Monday, January 1, 2018 | 1213300000 | 1453000000 |

| Tuesday, January 1, 2019 | 1990200000 | 1631000000 |

| Wednesday, January 1, 2020 | 1322500000 | 1728000000 |

| Friday, January 1, 2021 | 1324600000 | 1864000000 |

| Saturday, January 1, 2022 | 1328900000 | 1938000000 |

| Sunday, January 1, 2023 | 1385700000 | 1926000000 |

| Monday, January 1, 2024 | 1450500000 | 2264000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses is crucial for investors and analysts alike. Over the past decade, Waste Management, Inc. and Equifax Inc. have shown distinct trajectories in their SG&A expenses, reflecting their strategic priorities and market conditions.

From 2014 to 2023, Waste Management, Inc. consistently outpaced Equifax Inc. in SG&A expenses, with a notable 30% increase from 2014 to 2023. This growth underscores Waste Management's commitment to expanding its operational capabilities and enhancing customer service. In contrast, Equifax Inc. experienced a more volatile trend, with a significant spike in 2019, marking a 60% increase from 2014, likely due to heightened investments in data security and compliance post-2017 data breach.

These trends highlight the dynamic nature of corporate strategies and the importance of SG&A management in sustaining competitive advantage.

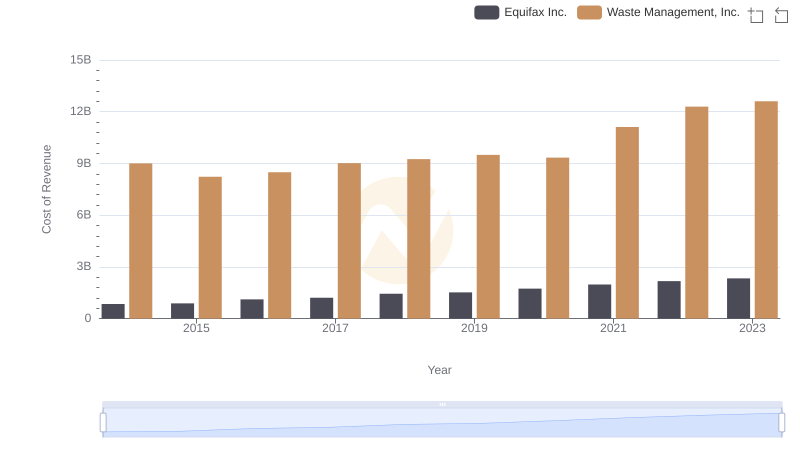

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs Equifax Inc.

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Old Dominion Freight Line, Inc.

Breaking Down SG&A Expenses: Waste Management, Inc. vs Verisk Analytics, Inc.

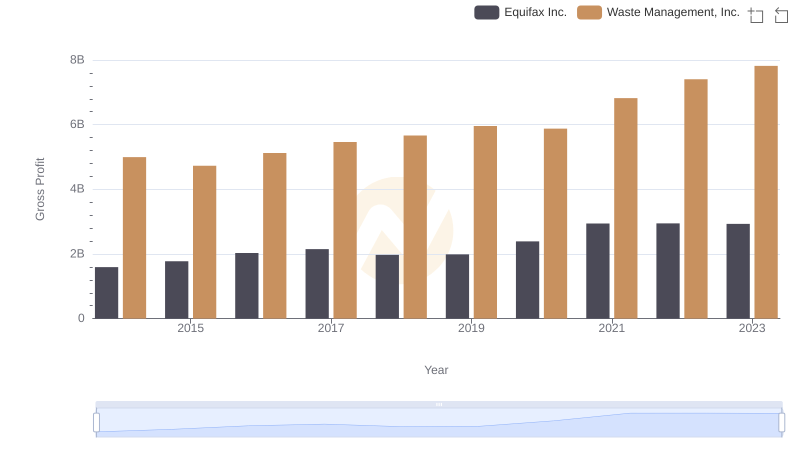

Gross Profit Trends Compared: Waste Management, Inc. vs Equifax Inc.

Comparing SG&A Expenses: Waste Management, Inc. vs Ingersoll Rand Inc. Trends and Insights

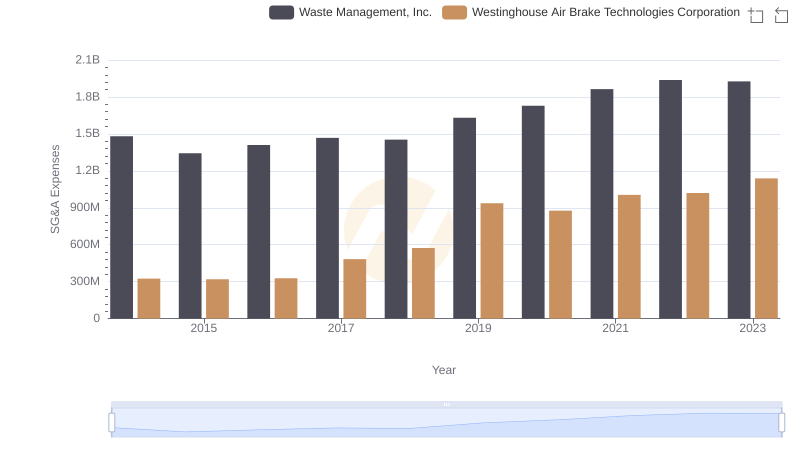

Who Optimizes SG&A Costs Better? Waste Management, Inc. or Westinghouse Air Brake Technologies Corporation

Waste Management, Inc. vs United Airlines Holdings, Inc.: SG&A Expense Trends

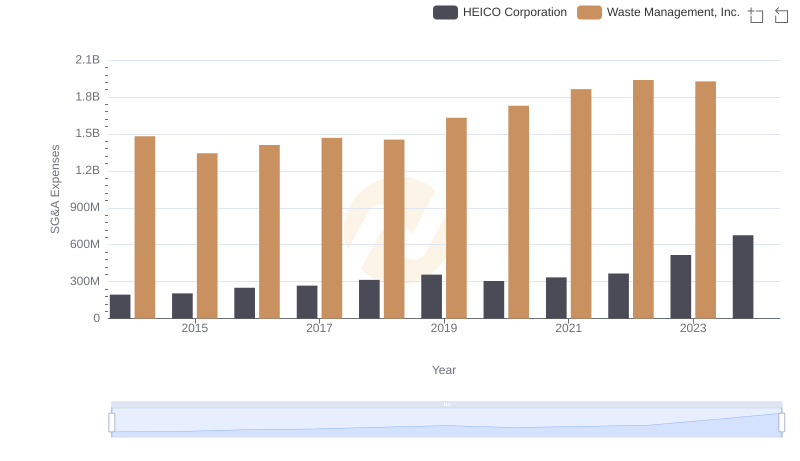

Breaking Down SG&A Expenses: Waste Management, Inc. vs HEICO Corporation

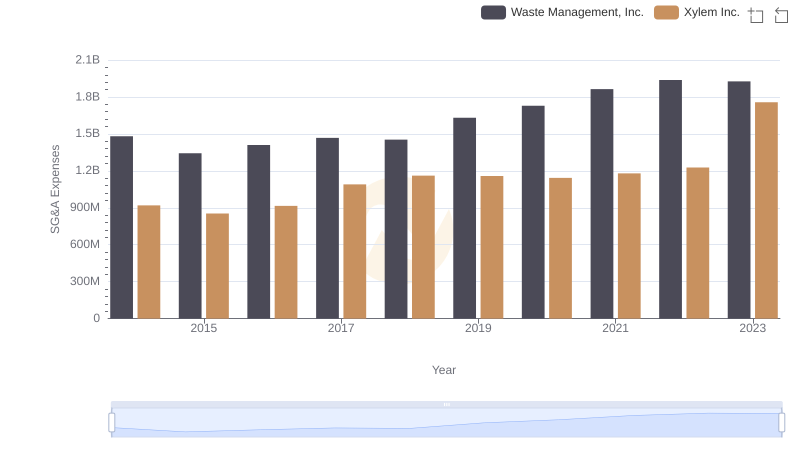

Breaking Down SG&A Expenses: Waste Management, Inc. vs Xylem Inc.

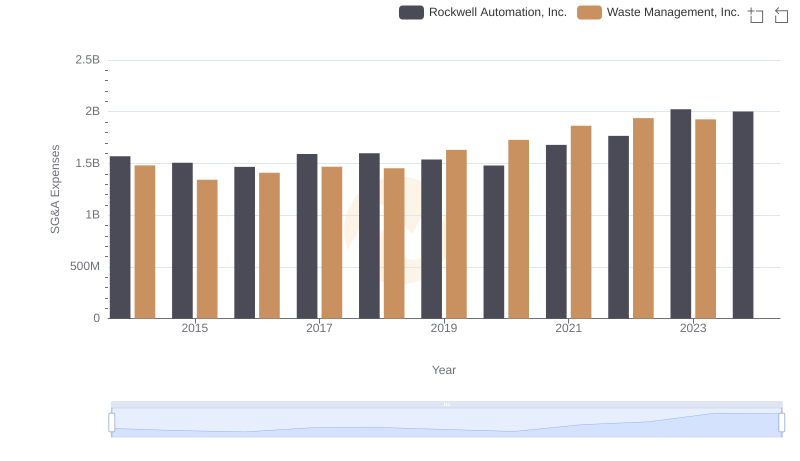

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and Rockwell Automation, Inc.