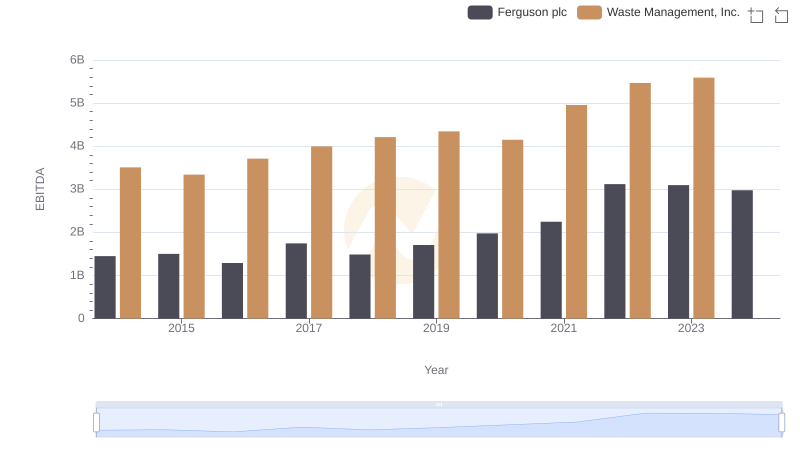

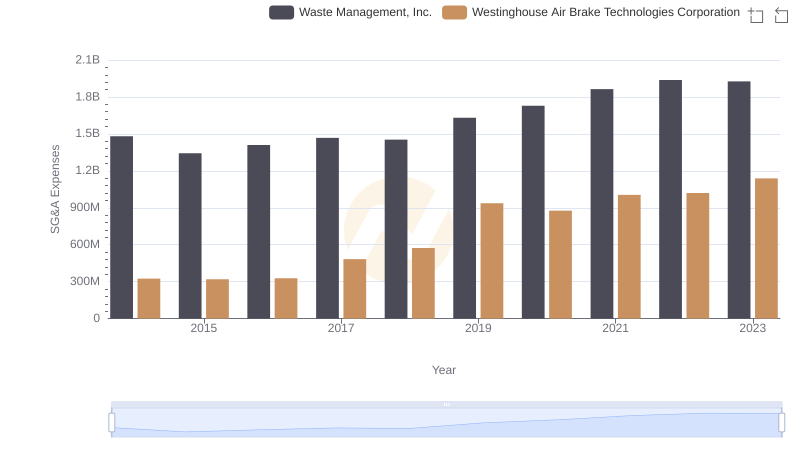

| __timestamp | Waste Management, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3509000000 | 588370000 |

| Thursday, January 1, 2015 | 3342000000 | 672301000 |

| Friday, January 1, 2016 | 3713000000 | 535893000 |

| Sunday, January 1, 2017 | 3996000000 | 532795000 |

| Monday, January 1, 2018 | 4212000000 | 584199000 |

| Tuesday, January 1, 2019 | 4344000000 | 1067300000 |

| Wednesday, January 1, 2020 | 4149000000 | 1229400000 |

| Friday, January 1, 2021 | 4956000000 | 1405000000 |

| Saturday, January 1, 2022 | 5466000000 | 1519000000 |

| Sunday, January 1, 2023 | 5592000000 | 1787000000 |

| Monday, January 1, 2024 | 5128000000 | 1609000000 |

Unleashing the power of data

In the past decade, Waste Management, Inc. has consistently outperformed Westinghouse Air Brake Technologies Corporation in terms of EBITDA, a key indicator of financial health. From 2014 to 2023, Waste Management's EBITDA grew by approximately 59%, reaching a peak in 2023. In contrast, Westinghouse Air Brake Technologies saw a more modest increase of around 204% over the same period, reflecting its smaller base.

Waste Management's steady growth highlights its robust business model and market dominance in the waste management sector. Meanwhile, Westinghouse Air Brake Technologies, despite its smaller EBITDA, has shown resilience and potential for growth in the transportation industry. This comparison underscores the diverse strategies and market conditions influencing these two industry leaders. As we look to the future, both companies are poised to navigate the evolving economic landscape with their unique strengths.

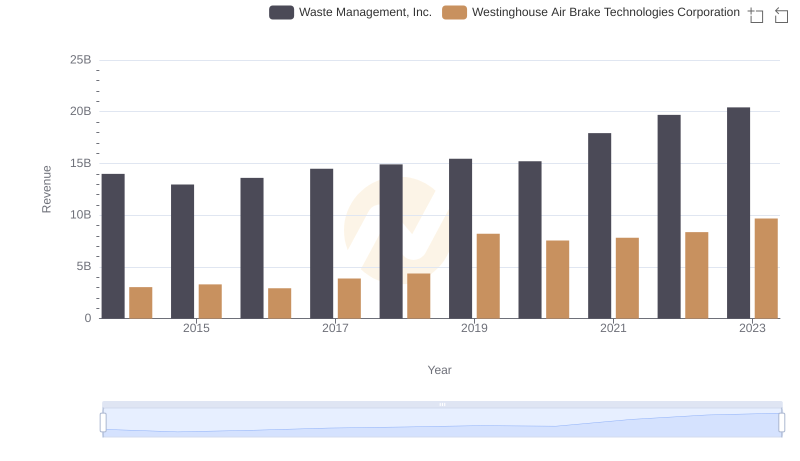

Revenue Showdown: Waste Management, Inc. vs Westinghouse Air Brake Technologies Corporation

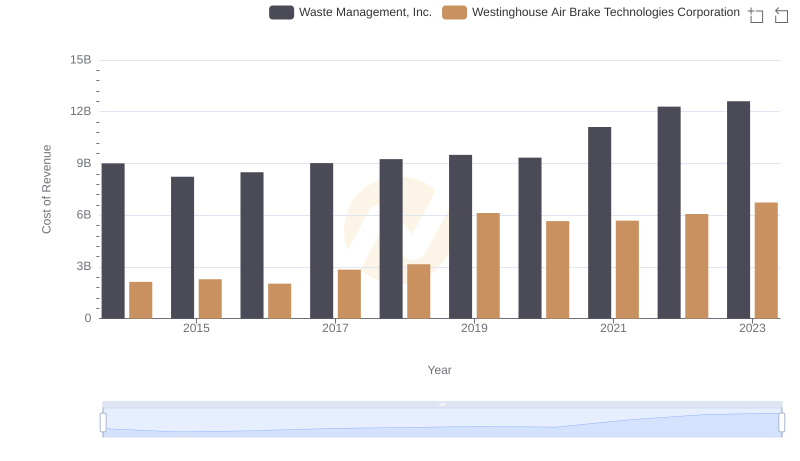

Cost of Revenue Comparison: Waste Management, Inc. vs Westinghouse Air Brake Technologies Corporation

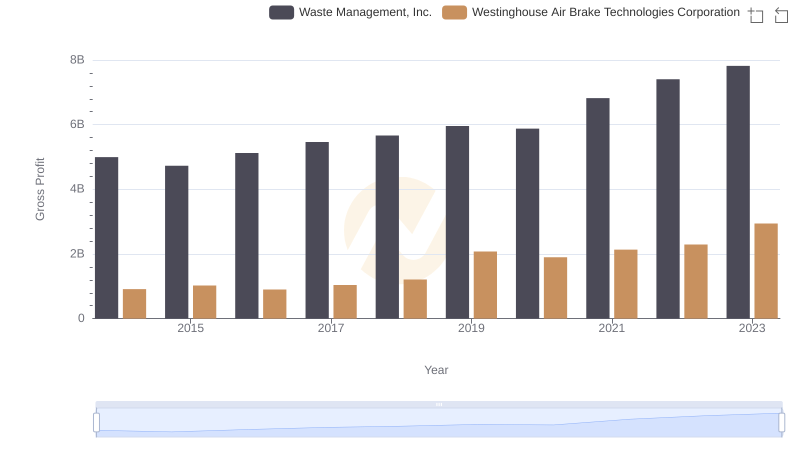

Who Generates Higher Gross Profit? Waste Management, Inc. or Westinghouse Air Brake Technologies Corporation

Waste Management, Inc. and Ferguson plc: A Detailed Examination of EBITDA Performance

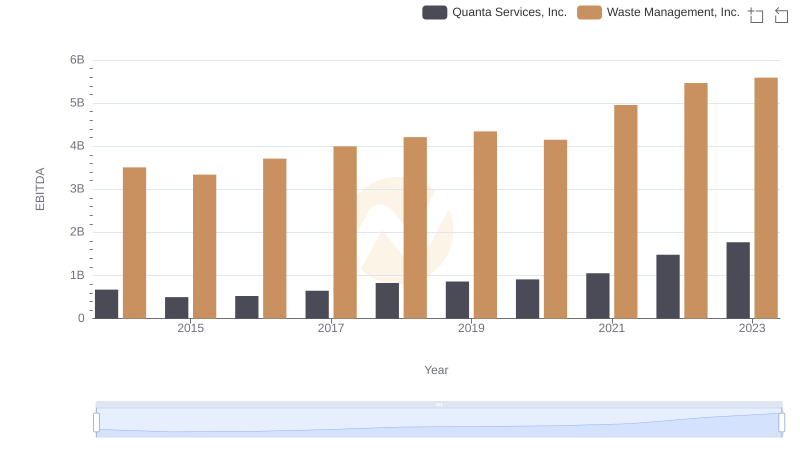

Professional EBITDA Benchmarking: Waste Management, Inc. vs Quanta Services, Inc.

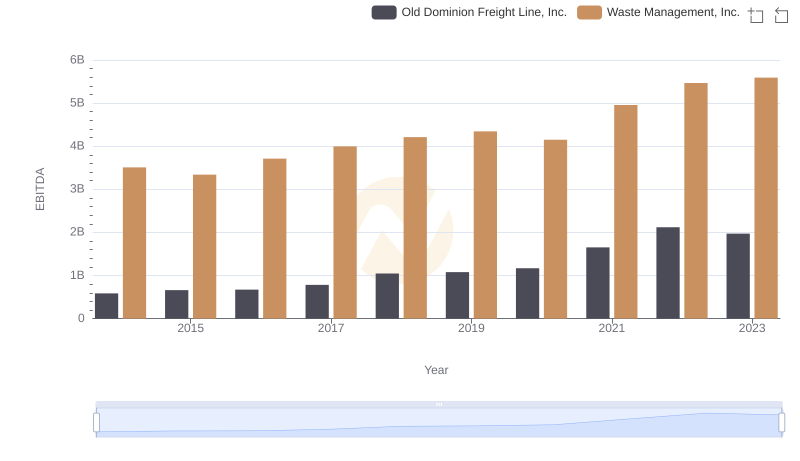

A Professional Review of EBITDA: Waste Management, Inc. Compared to Old Dominion Freight Line, Inc.

Who Optimizes SG&A Costs Better? Waste Management, Inc. or Westinghouse Air Brake Technologies Corporation

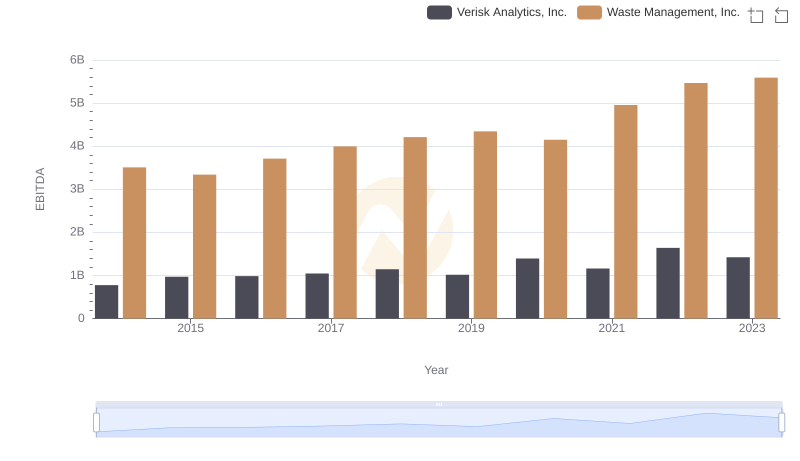

A Professional Review of EBITDA: Waste Management, Inc. Compared to Verisk Analytics, Inc.

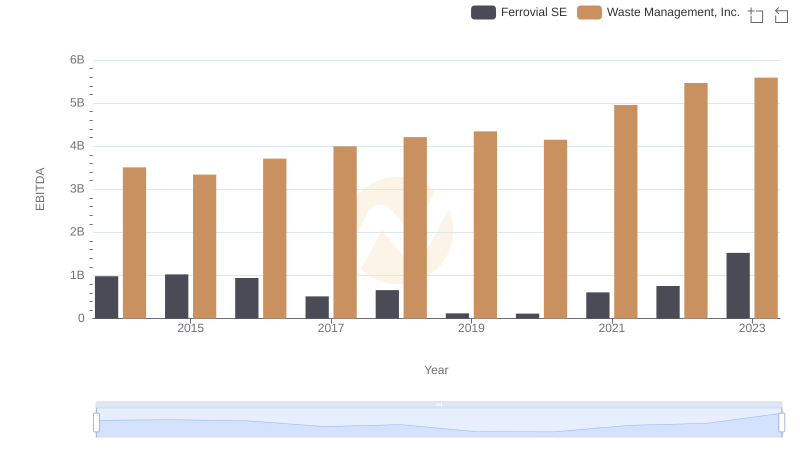

Waste Management, Inc. vs Ferrovial SE: In-Depth EBITDA Performance Comparison

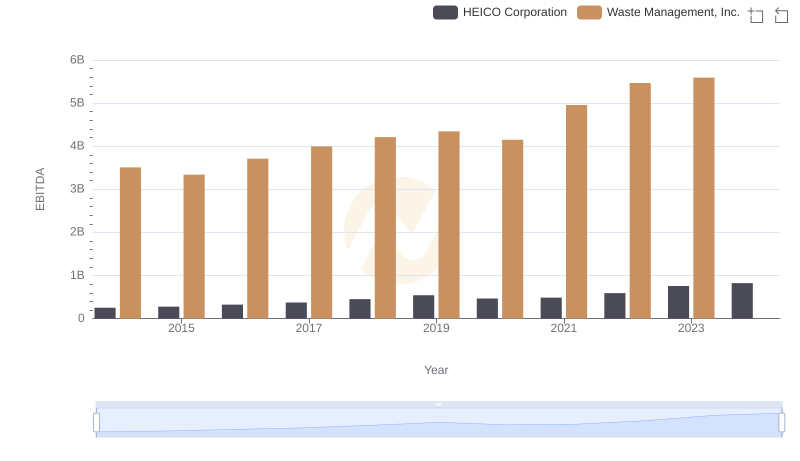

A Side-by-Side Analysis of EBITDA: Waste Management, Inc. and HEICO Corporation