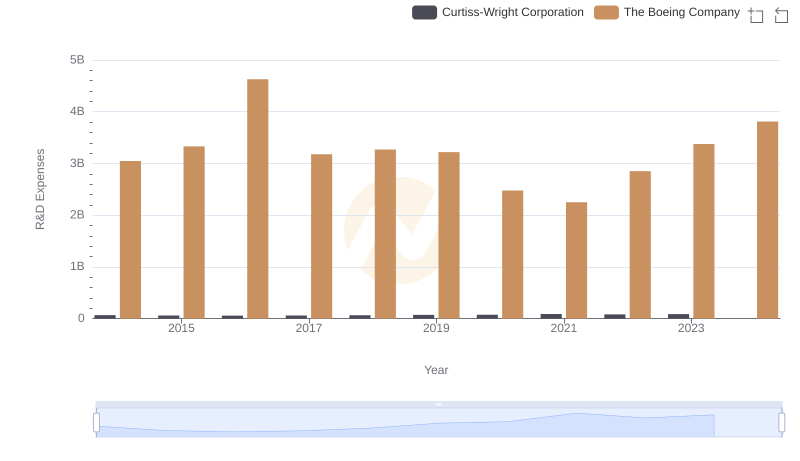

| __timestamp | Curtiss-Wright Corporation | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 426301000 | 3767000000 |

| Thursday, January 1, 2015 | 411801000 | 3525000000 |

| Friday, January 1, 2016 | 383793000 | 3616000000 |

| Sunday, January 1, 2017 | 418544000 | 4094000000 |

| Monday, January 1, 2018 | 433110000 | 4567000000 |

| Tuesday, January 1, 2019 | 422272000 | 3909000000 |

| Wednesday, January 1, 2020 | 412825000 | 4817000000 |

| Friday, January 1, 2021 | 443096000 | 4157000000 |

| Saturday, January 1, 2022 | 445679000 | 4187000000 |

| Sunday, January 1, 2023 | 496812000 | 5168000000 |

| Monday, January 1, 2024 | 518857000 | 5021000000 |

Unleashing the power of data

In the competitive aerospace and defense industry, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Curtiss-Wright Corporation and The Boeing Company have demonstrated contrasting approaches to SG&A optimization. From 2014 to 2023, Curtiss-Wright consistently maintained its SG&A expenses around $430 million, showcasing a stable cost management strategy. In contrast, Boeing's SG&A expenses fluctuated significantly, peaking at over $5 billion in 2023, a 37% increase from its 2015 low. This disparity highlights Boeing's challenges in cost control amidst its expansive operations. Interestingly, Curtiss-Wright's expenses saw a notable increase in 2023, reaching nearly $497 million, suggesting potential strategic investments or operational shifts. As the industry evolves, these companies' ability to optimize SG&A costs will be pivotal in sustaining their competitive edge.

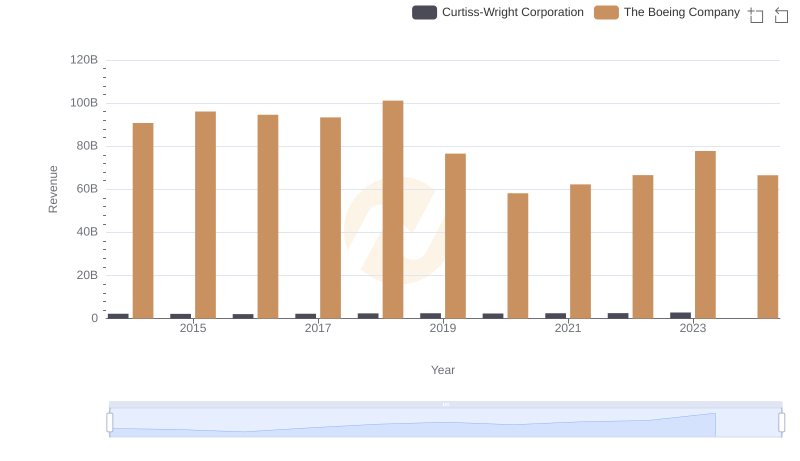

The Boeing Company and Curtiss-Wright Corporation: A Comprehensive Revenue Analysis

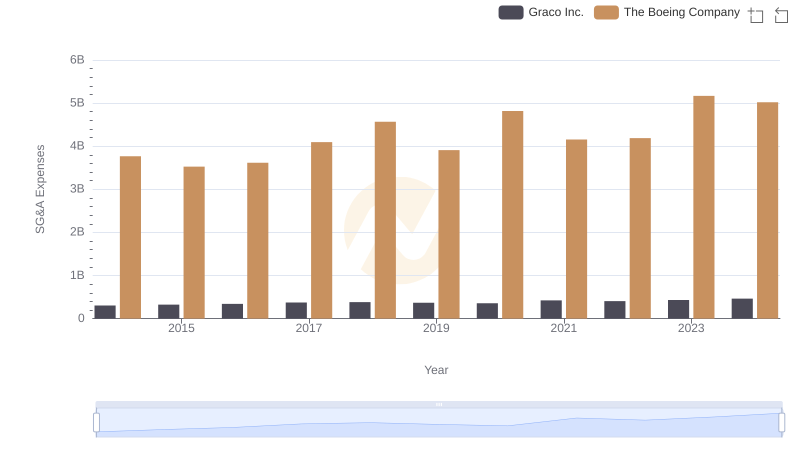

The Boeing Company and Graco Inc.: SG&A Spending Patterns Compared

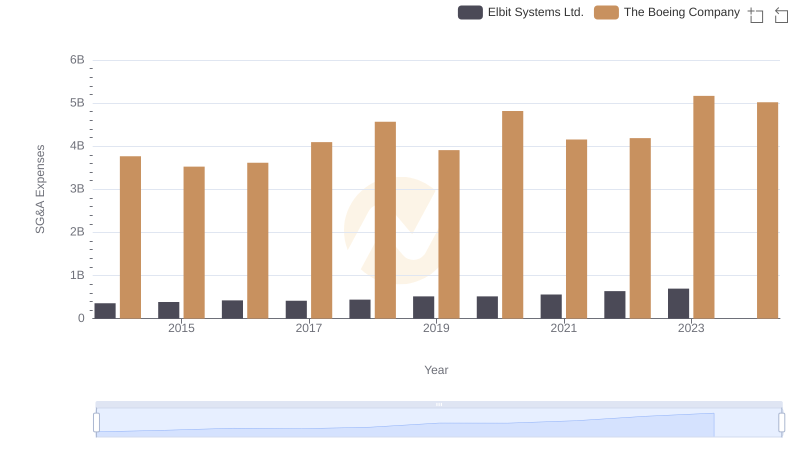

Operational Costs Compared: SG&A Analysis of The Boeing Company and Elbit Systems Ltd.

Research and Development Expenses Breakdown: The Boeing Company vs Curtiss-Wright Corporation

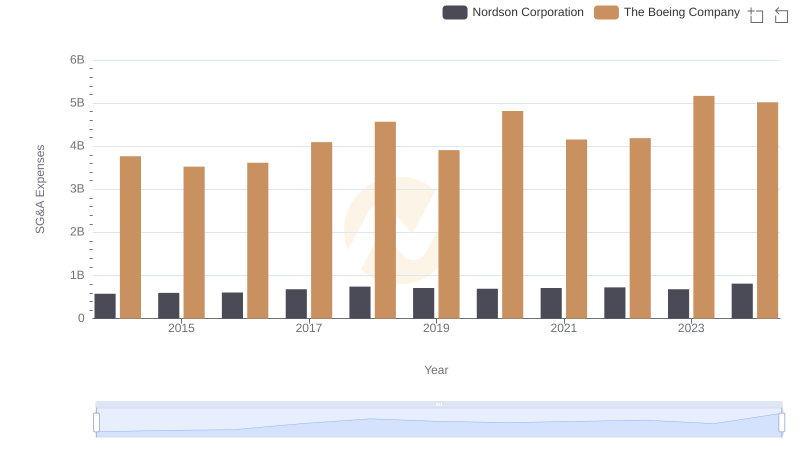

Operational Costs Compared: SG&A Analysis of The Boeing Company and Nordson Corporation

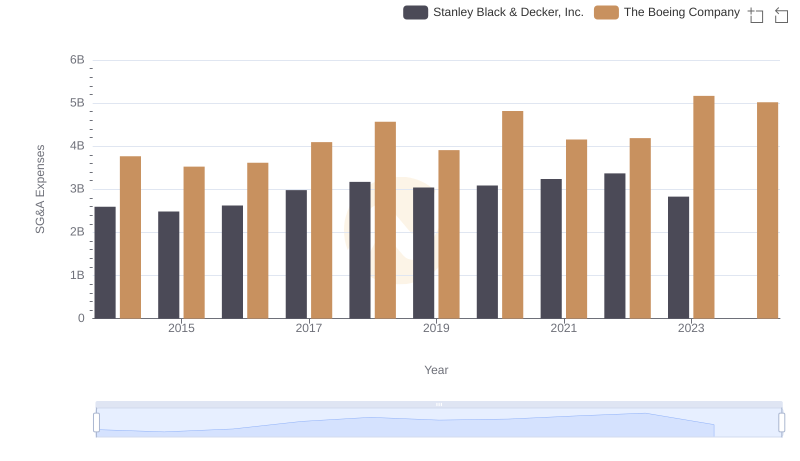

The Boeing Company or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?

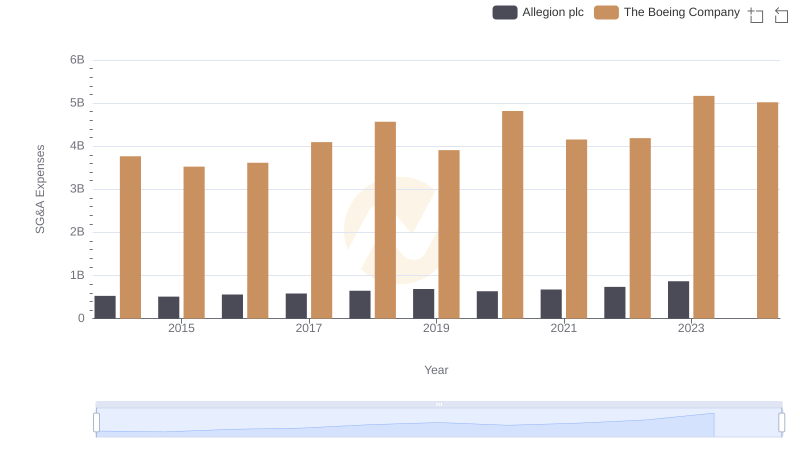

The Boeing Company and Allegion plc: SG&A Spending Patterns Compared