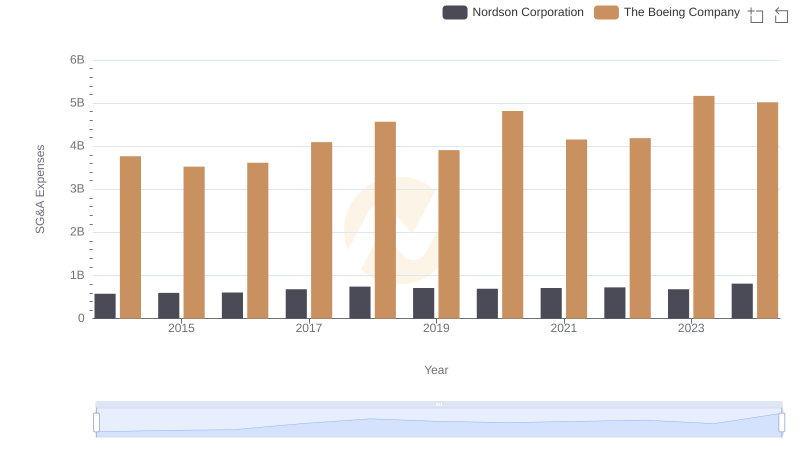

| __timestamp | Elbit Systems Ltd. | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 356171000 | 3767000000 |

| Thursday, January 1, 2015 | 385059000 | 3525000000 |

| Friday, January 1, 2016 | 422390000 | 3616000000 |

| Sunday, January 1, 2017 | 413560000 | 4094000000 |

| Monday, January 1, 2018 | 441362000 | 4567000000 |

| Tuesday, January 1, 2019 | 516149000 | 3909000000 |

| Wednesday, January 1, 2020 | 514638000 | 4817000000 |

| Friday, January 1, 2021 | 559113000 | 4157000000 |

| Saturday, January 1, 2022 | 639067000 | 4187000000 |

| Sunday, January 1, 2023 | 696022000 | 5168000000 |

| Monday, January 1, 2024 | 5021000000 |

In pursuit of knowledge

In the ever-evolving aerospace and defense industry, operational efficiency is paramount. Over the past decade, The Boeing Company and Elbit Systems Ltd. have showcased contrasting trends in their Selling, General, and Administrative (SG&A) expenses. Boeing, a titan in the aerospace sector, has consistently maintained SG&A expenses around 4 billion USD annually, peaking at 5.2 billion USD in 2023. This represents a 37% increase from 2015, reflecting strategic investments and operational scaling.

Conversely, Elbit Systems, a key player in defense electronics, has seen a more pronounced rise. From 2014 to 2023, their SG&A expenses surged by nearly 95%, reaching approximately 696 million USD. This growth underscores Elbit's expanding footprint and increased market activities. Notably, data for 2024 is incomplete, hinting at potential shifts. As these giants navigate the future, their SG&A strategies will be pivotal in shaping their competitive edge.

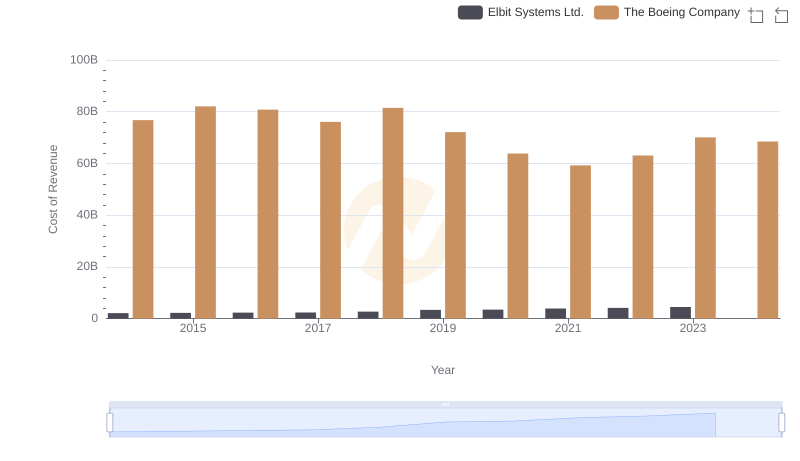

Cost Insights: Breaking Down The Boeing Company and Elbit Systems Ltd.'s Expenses

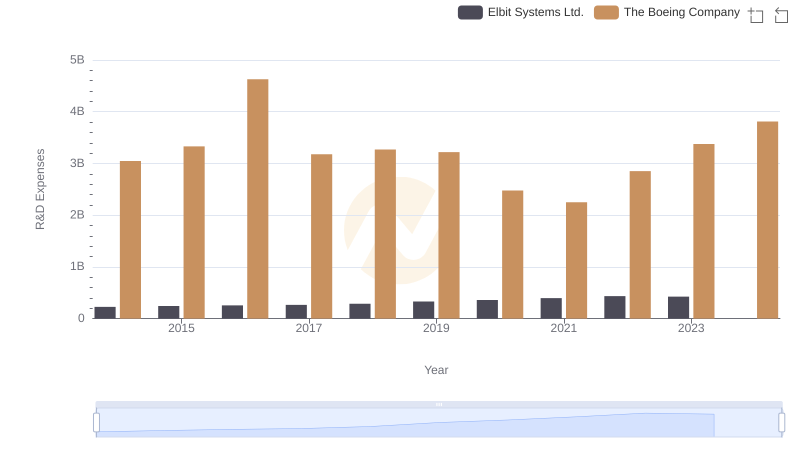

Who Prioritizes Innovation? R&D Spending Compared for The Boeing Company and Elbit Systems Ltd.

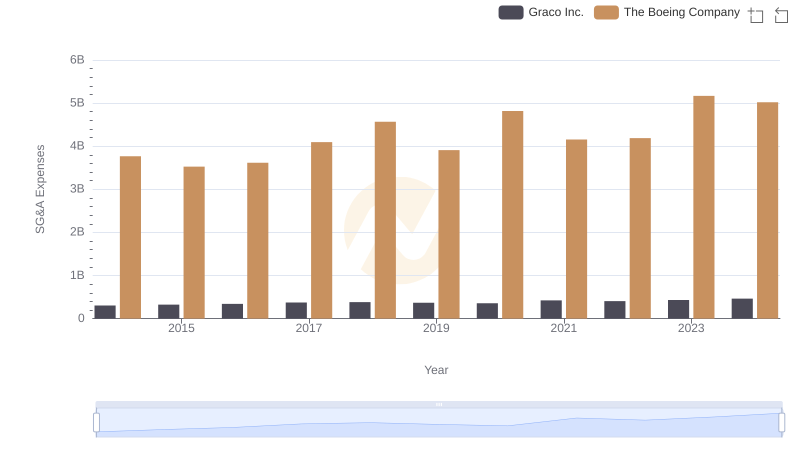

The Boeing Company and Graco Inc.: SG&A Spending Patterns Compared

Operational Costs Compared: SG&A Analysis of The Boeing Company and Nordson Corporation

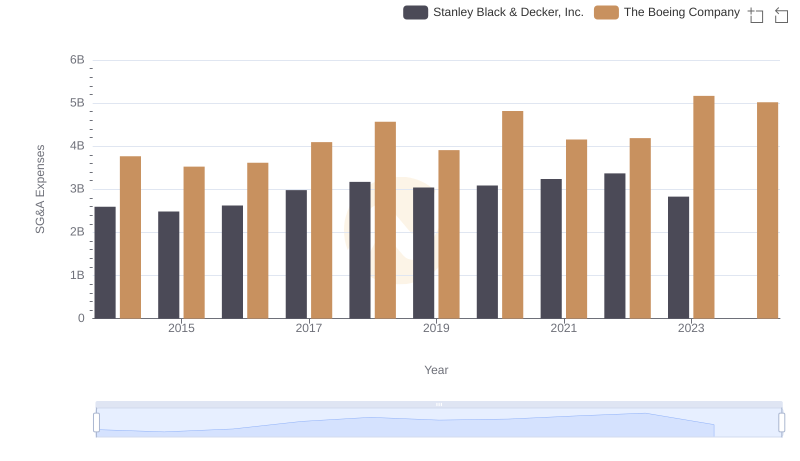

The Boeing Company or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?

Who Optimizes SG&A Costs Better? The Boeing Company or Curtiss-Wright Corporation