| __timestamp | Jacobs Engineering Group Inc. | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1545716000 | 192800000 |

| Thursday, January 1, 2015 | 1522811000 | 233900000 |

| Friday, January 1, 2016 | 1429233000 | 292700000 |

| Sunday, January 1, 2017 | 1379983000 | 322300000 |

| Monday, January 1, 2018 | 2180399000 | 410400000 |

| Tuesday, January 1, 2019 | 2072177000 | 547300000 |

| Wednesday, January 1, 2020 | 2050695000 | 578800000 |

| Friday, January 1, 2021 | 2355683000 | 201500000 |

| Saturday, January 1, 2022 | 2409190000 | 411300000 |

| Sunday, January 1, 2023 | 2398078000 | 674400000 |

| Monday, January 1, 2024 | 2140320000 | 757200000 |

Igniting the spark of knowledge

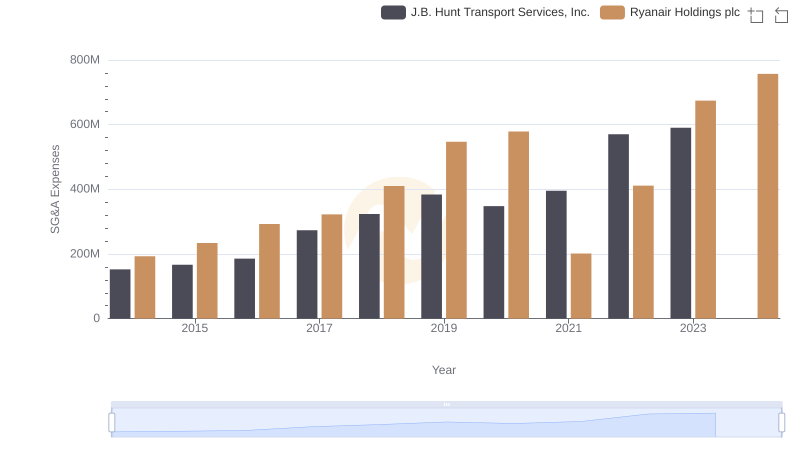

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis compares Ryanair Holdings plc and Jacobs Engineering Group Inc. over a decade, from 2014 to 2024. Ryanair, known for its cost-effective operations, has consistently maintained lower SG&A expenses, averaging around 420 million annually. In contrast, Jacobs Engineering, a leader in engineering solutions, has averaged nearly five times higher at approximately 1.95 billion.

This data highlights the strategic differences in cost management between a low-cost airline and a global engineering firm, offering valuable insights for investors and industry analysts.

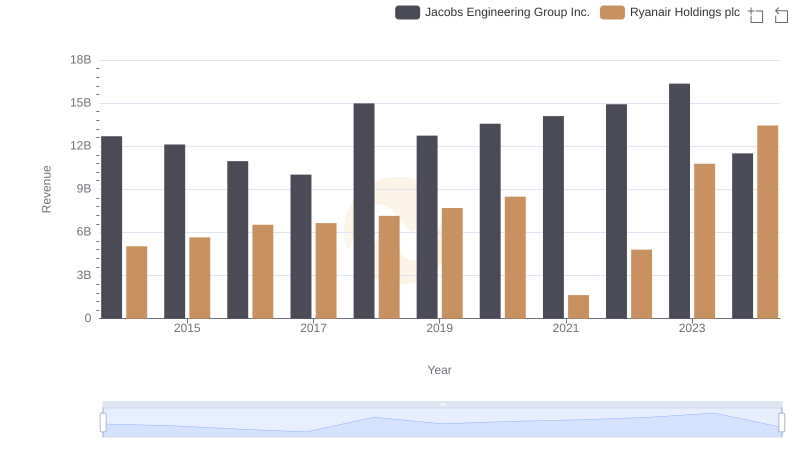

Who Generates More Revenue? Ryanair Holdings plc or Jacobs Engineering Group Inc.

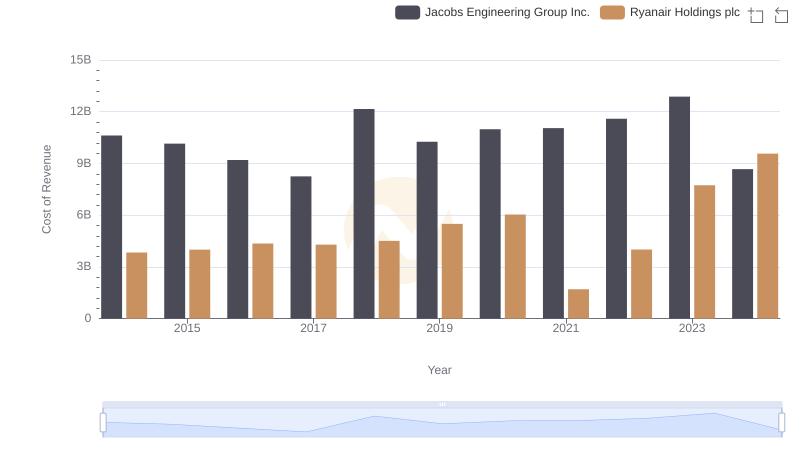

Cost of Revenue: Key Insights for Ryanair Holdings plc and Jacobs Engineering Group Inc.

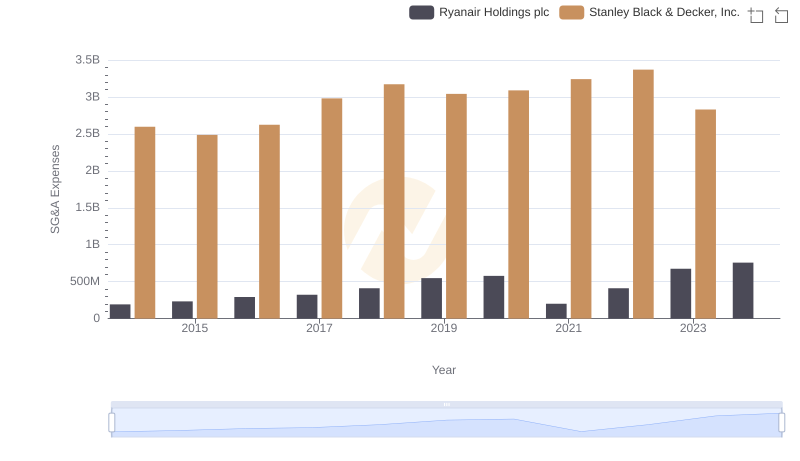

Operational Costs Compared: SG&A Analysis of Ryanair Holdings plc and Stanley Black & Decker, Inc.

Selling, General, and Administrative Costs: Ryanair Holdings plc vs J.B. Hunt Transport Services, Inc.

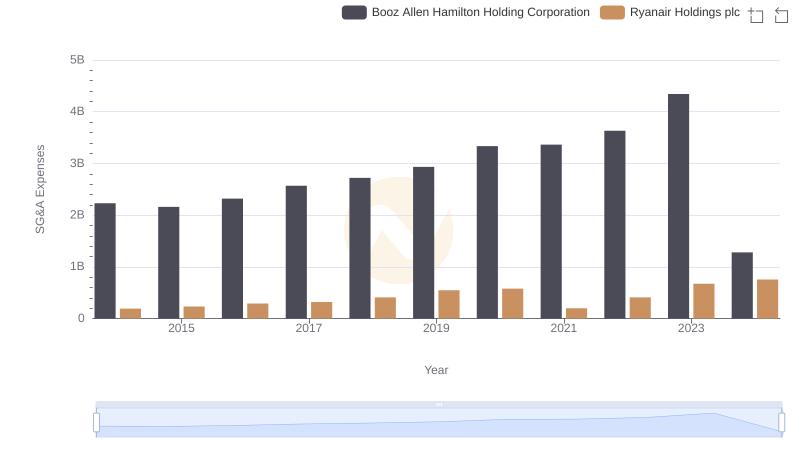

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and Booz Allen Hamilton Holding Corporation

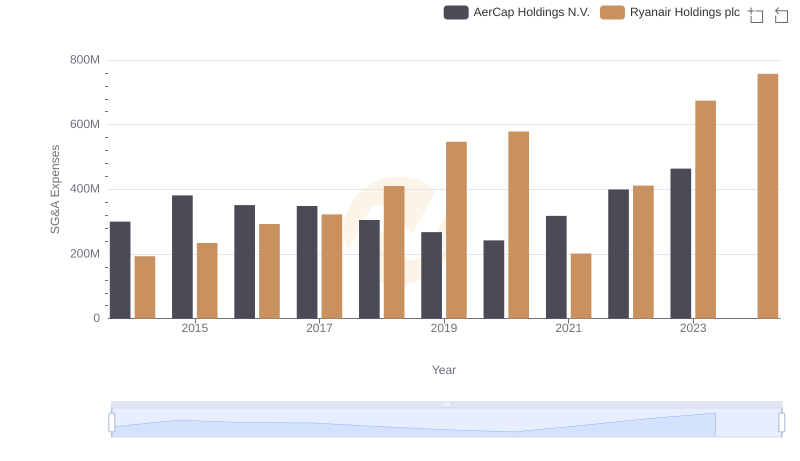

Ryanair Holdings plc and AerCap Holdings N.V.: SG&A Spending Patterns Compared

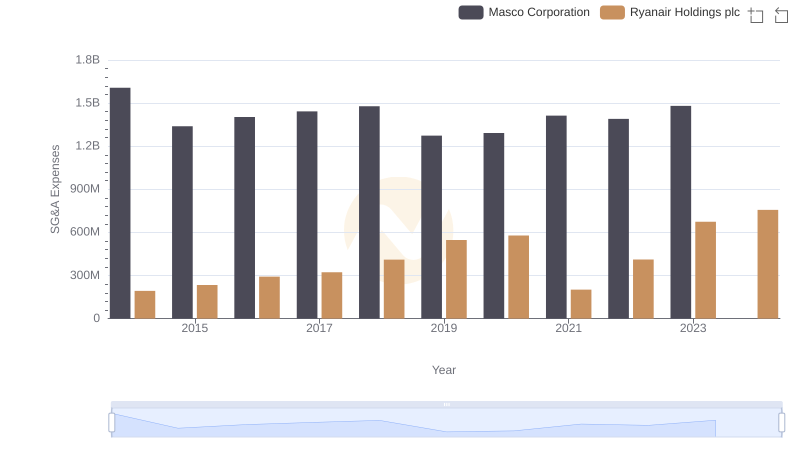

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and Masco Corporation

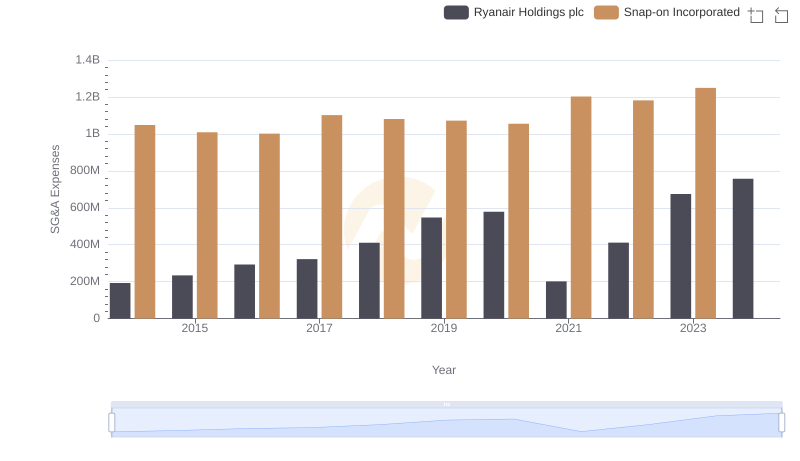

Comparing SG&A Expenses: Ryanair Holdings plc vs Snap-on Incorporated Trends and Insights

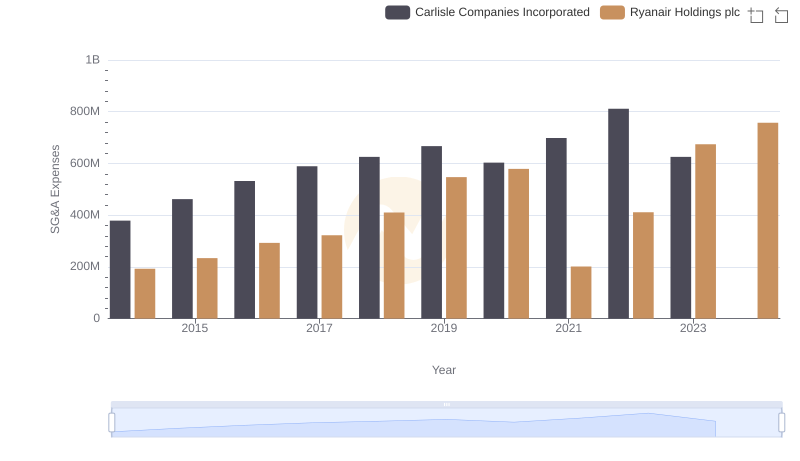

Selling, General, and Administrative Costs: Ryanair Holdings plc vs Carlisle Companies Incorporated

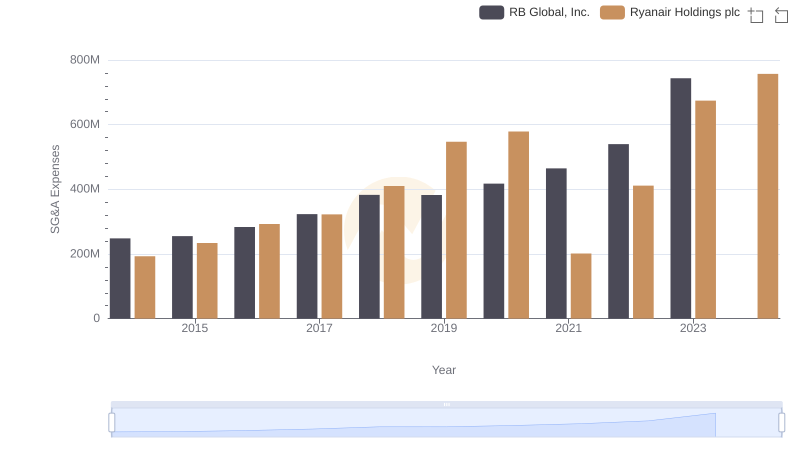

Comparing SG&A Expenses: Ryanair Holdings plc vs RB Global, Inc. Trends and Insights

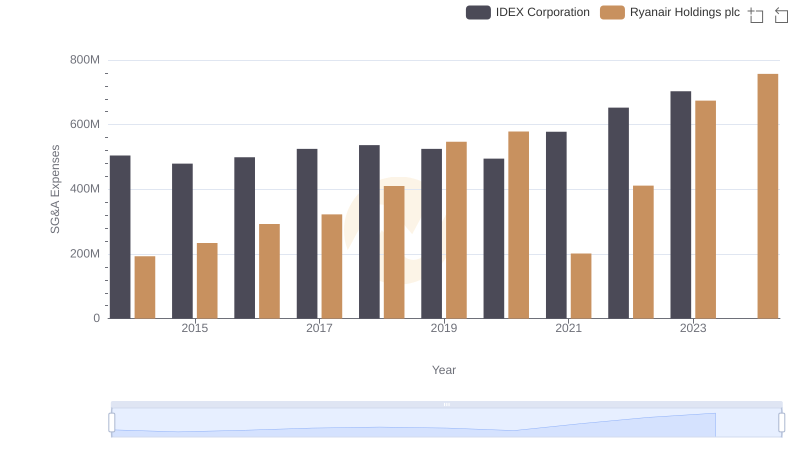

Ryanair Holdings plc and IDEX Corporation: SG&A Spending Patterns Compared

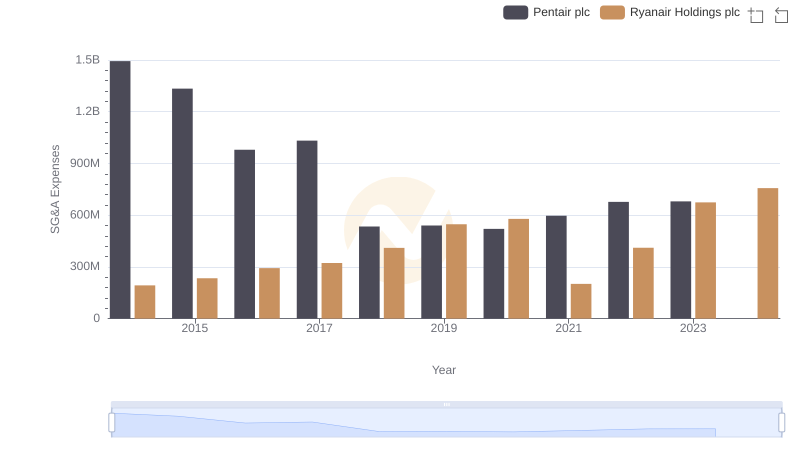

Ryanair Holdings plc and Pentair plc: SG&A Spending Patterns Compared