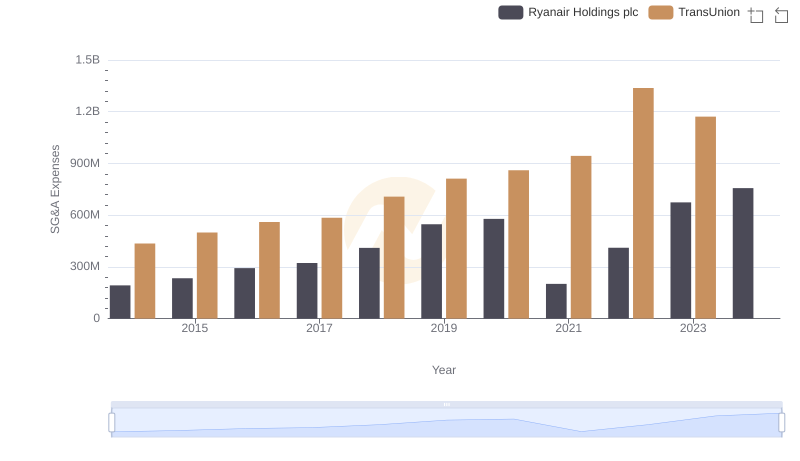

| __timestamp | AerCap Holdings N.V. | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 299900000 | 192800000 |

| Thursday, January 1, 2015 | 381308000 | 233900000 |

| Friday, January 1, 2016 | 351012000 | 292700000 |

| Sunday, January 1, 2017 | 348291000 | 322300000 |

| Monday, January 1, 2018 | 305226000 | 410400000 |

| Tuesday, January 1, 2019 | 267458000 | 547300000 |

| Wednesday, January 1, 2020 | 242161000 | 578800000 |

| Friday, January 1, 2021 | 317888000 | 201500000 |

| Saturday, January 1, 2022 | 399530000 | 411300000 |

| Sunday, January 1, 2023 | 464128000 | 674400000 |

| Monday, January 1, 2024 | 757200000 |

Igniting the spark of knowledge

In the ever-evolving landscape of aviation, understanding the financial strategies of industry giants is crucial. Over the past decade, Ryanair Holdings plc and AerCap Holdings N.V. have showcased distinct trends in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Ryanair's SG&A expenses surged by approximately 250%, peaking in 2023, while AerCap's expenses increased by about 55% over the same period. Notably, Ryanair's spending in 2023 was nearly 45% higher than AerCap's, highlighting its aggressive expansion and operational strategies. The data reveals a missing value for AerCap in 2024, suggesting potential reporting delays or strategic shifts. As the aviation sector rebounds post-pandemic, these financial patterns offer insights into each company's priorities and market positioning. Investors and industry analysts should closely monitor these trends to gauge future performance and strategic direction.

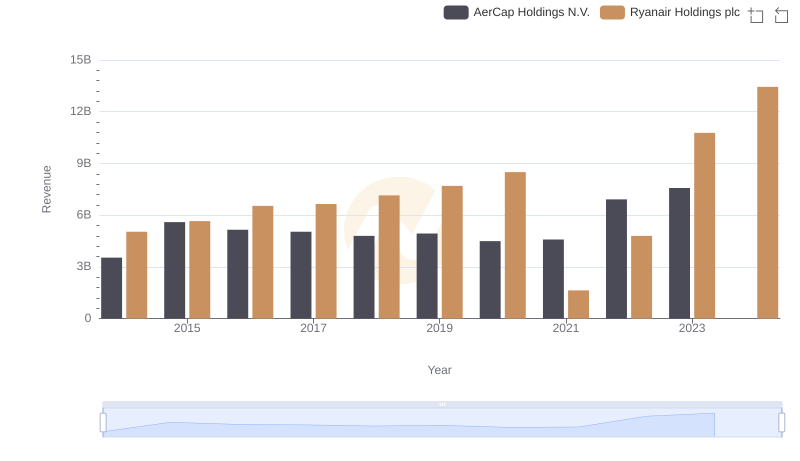

Revenue Showdown: Ryanair Holdings plc vs AerCap Holdings N.V.

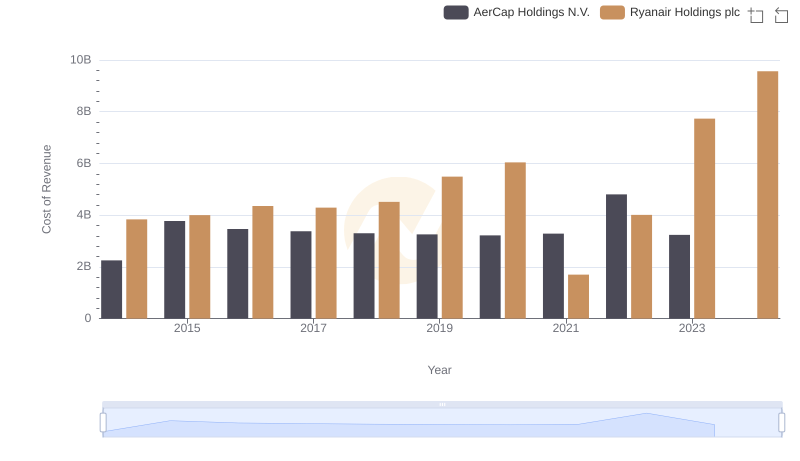

Cost of Revenue: Key Insights for Ryanair Holdings plc and AerCap Holdings N.V.

Comparing SG&A Expenses: Ryanair Holdings plc vs TransUnion Trends and Insights

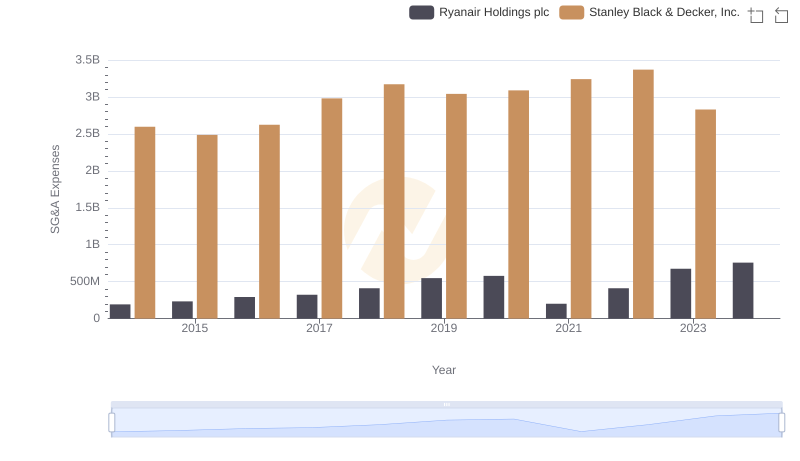

Operational Costs Compared: SG&A Analysis of Ryanair Holdings plc and Stanley Black & Decker, Inc.

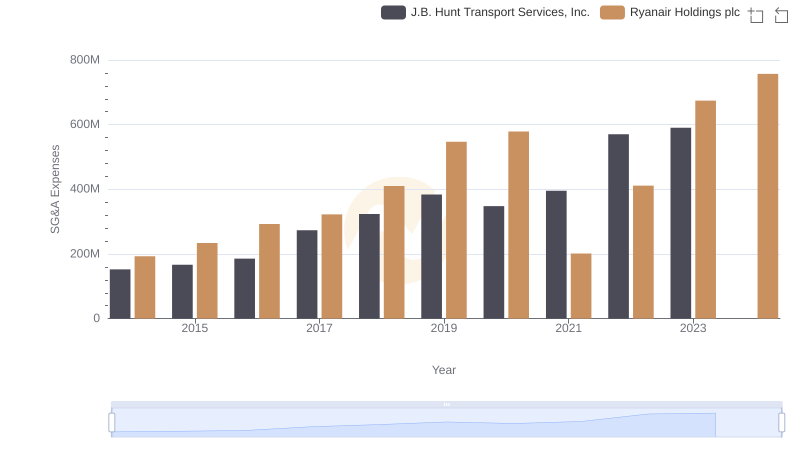

Selling, General, and Administrative Costs: Ryanair Holdings plc vs J.B. Hunt Transport Services, Inc.

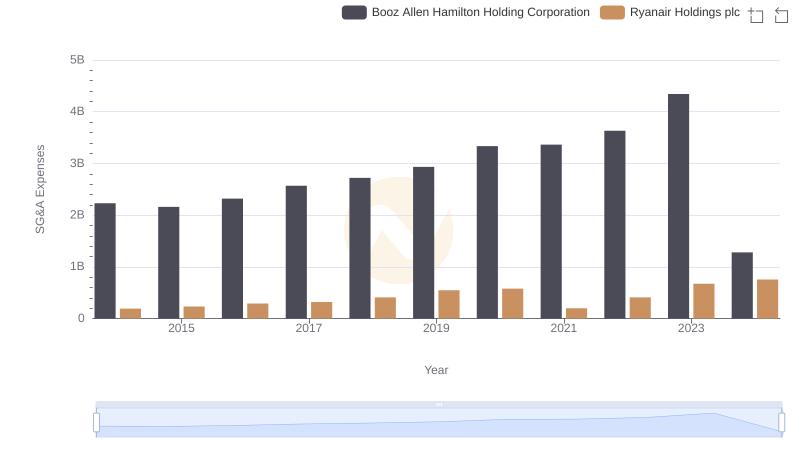

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and Booz Allen Hamilton Holding Corporation

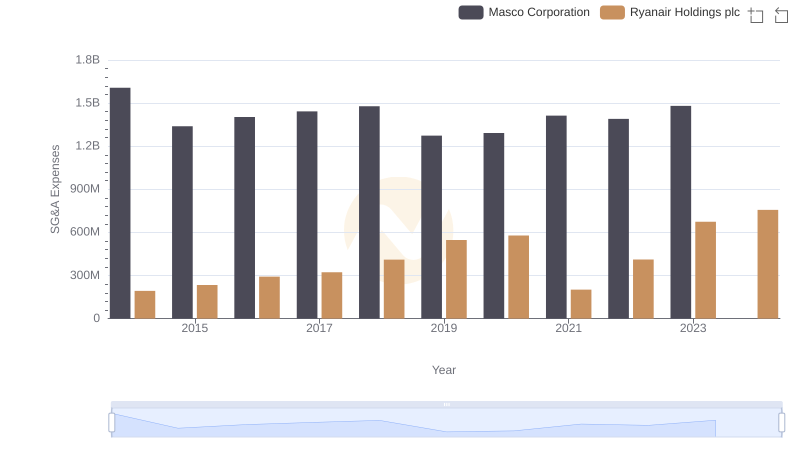

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and Masco Corporation

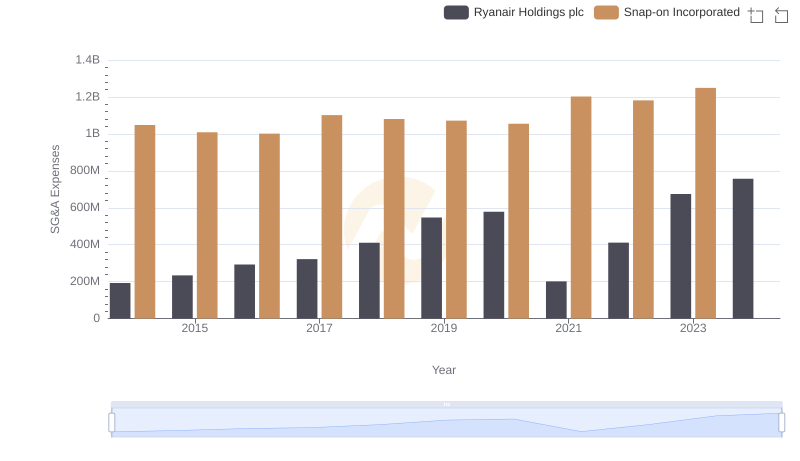

Comparing SG&A Expenses: Ryanair Holdings plc vs Snap-on Incorporated Trends and Insights

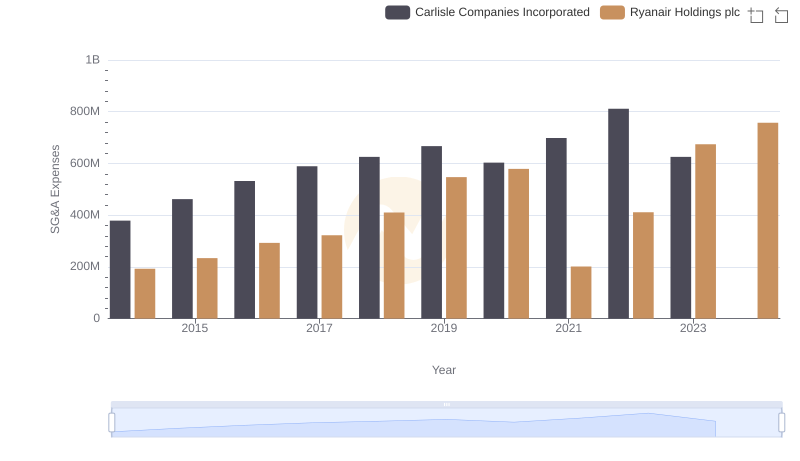

Selling, General, and Administrative Costs: Ryanair Holdings plc vs Carlisle Companies Incorporated

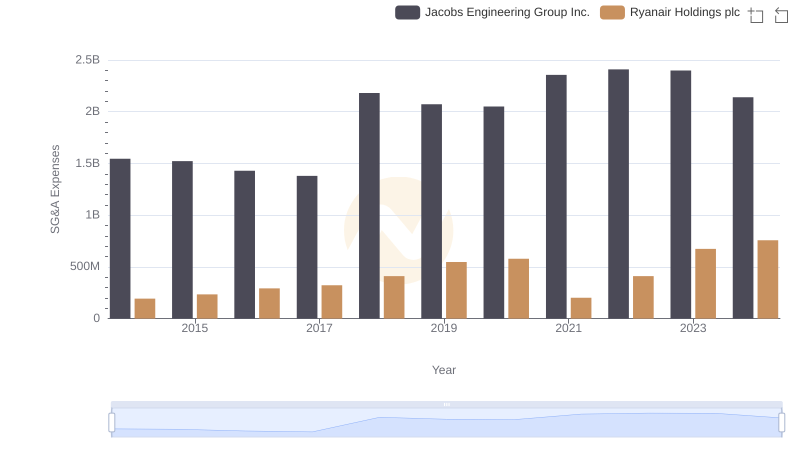

Who Optimizes SG&A Costs Better? Ryanair Holdings plc or Jacobs Engineering Group Inc.

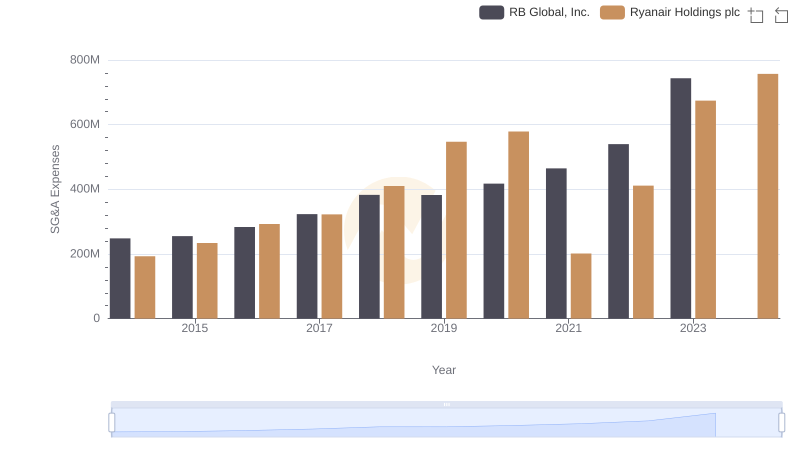

Comparing SG&A Expenses: Ryanair Holdings plc vs RB Global, Inc. Trends and Insights

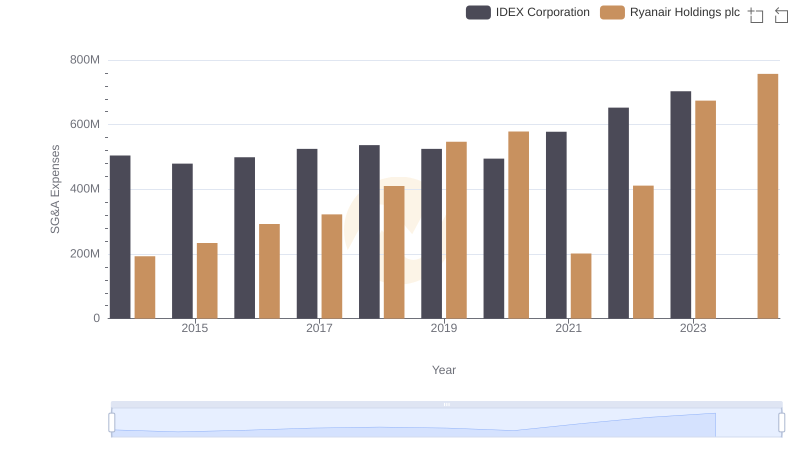

Ryanair Holdings plc and IDEX Corporation: SG&A Spending Patterns Compared