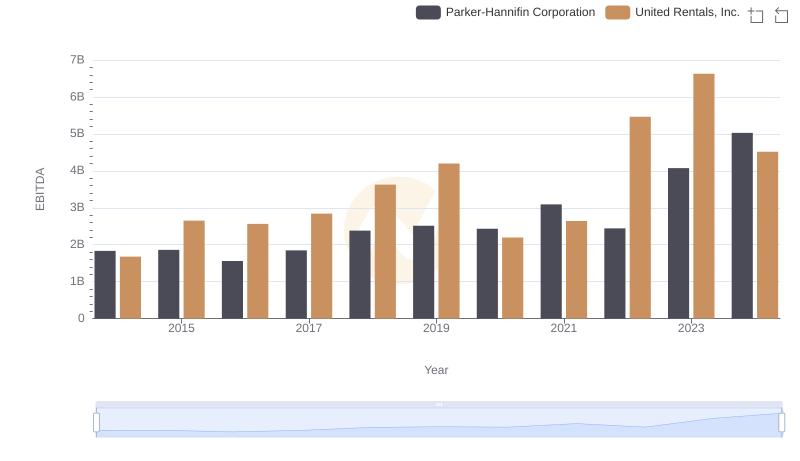

| __timestamp | Parker-Hannifin Corporation | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1633992000 | 758000000 |

| Thursday, January 1, 2015 | 1544746000 | 714000000 |

| Friday, January 1, 2016 | 1359360000 | 719000000 |

| Sunday, January 1, 2017 | 1453935000 | 903000000 |

| Monday, January 1, 2018 | 1657152000 | 1038000000 |

| Tuesday, January 1, 2019 | 1543939000 | 1092000000 |

| Wednesday, January 1, 2020 | 1656553000 | 979000000 |

| Friday, January 1, 2021 | 1527302000 | 1199000000 |

| Saturday, January 1, 2022 | 1627116000 | 1400000000 |

| Sunday, January 1, 2023 | 3354103000 | 1527000000 |

| Monday, January 1, 2024 | 3315177000 | 1645000000 |

Cracking the code

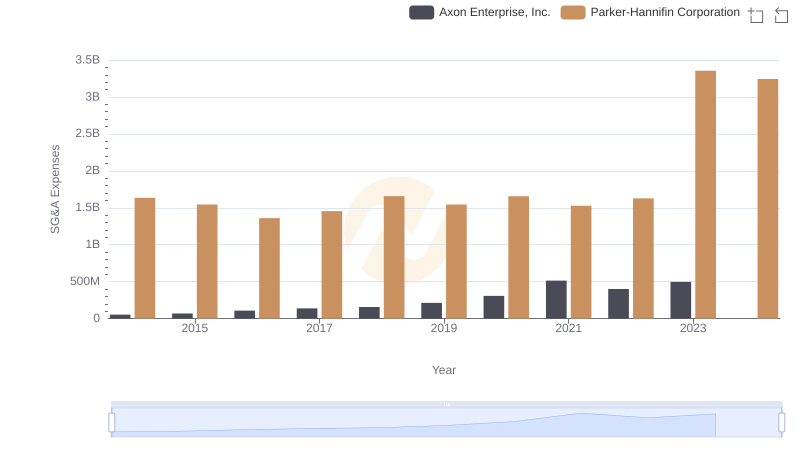

In the competitive landscape of industrial and rental services, Parker-Hannifin Corporation and United Rentals, Inc. stand out as leaders. Over the past decade, these companies have demonstrated distinct strategies in managing Selling, General, and Administrative (SG&A) expenses. From 2014 to 2024, Parker-Hannifin's SG&A expenses have seen a significant increase, peaking in 2023 with a 105% rise compared to 2014. In contrast, United Rentals has maintained a more consistent trajectory, with a 117% increase over the same period.

Parker-Hannifin's expenses surged notably in 2023, suggesting strategic investments or operational shifts. Meanwhile, United Rentals' steady growth reflects a balanced approach to cost management. This comparison highlights the diverse strategies employed by industry leaders to optimize operational efficiency. As businesses navigate economic fluctuations, understanding these trends offers valuable insights into effective cost management strategies.

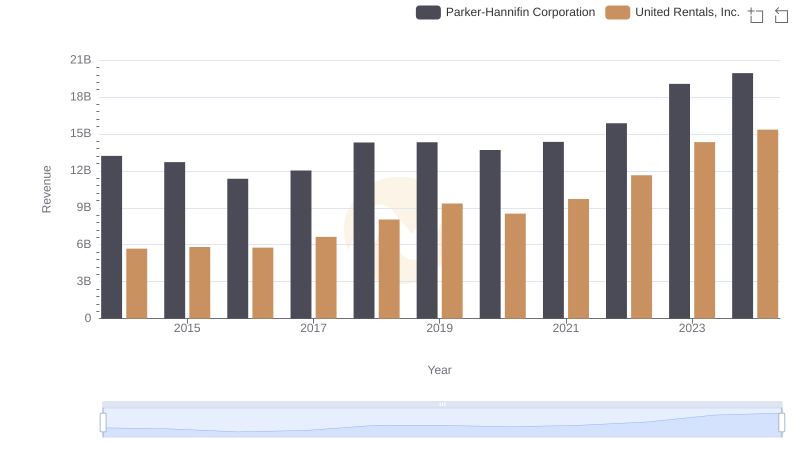

Parker-Hannifin Corporation vs United Rentals, Inc.: Examining Key Revenue Metrics

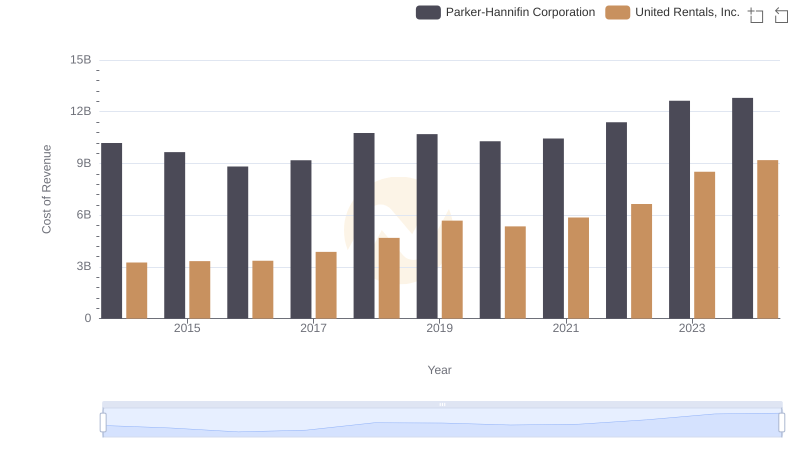

Analyzing Cost of Revenue: Parker-Hannifin Corporation and United Rentals, Inc.

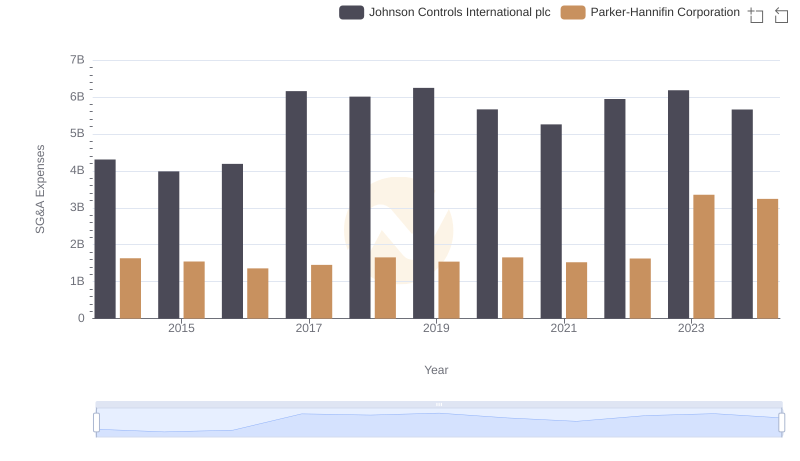

Parker-Hannifin Corporation or Johnson Controls International plc: Who Manages SG&A Costs Better?

Parker-Hannifin Corporation and Roper Technologies, Inc.: SG&A Spending Patterns Compared

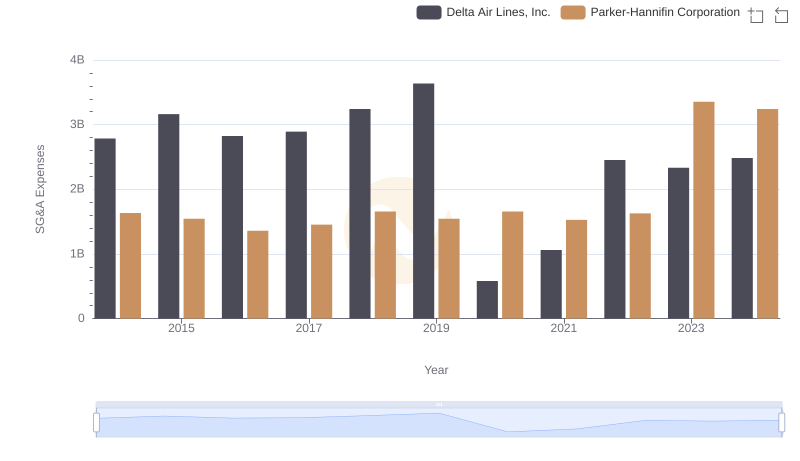

Comparing SG&A Expenses: Parker-Hannifin Corporation vs Delta Air Lines, Inc. Trends and Insights

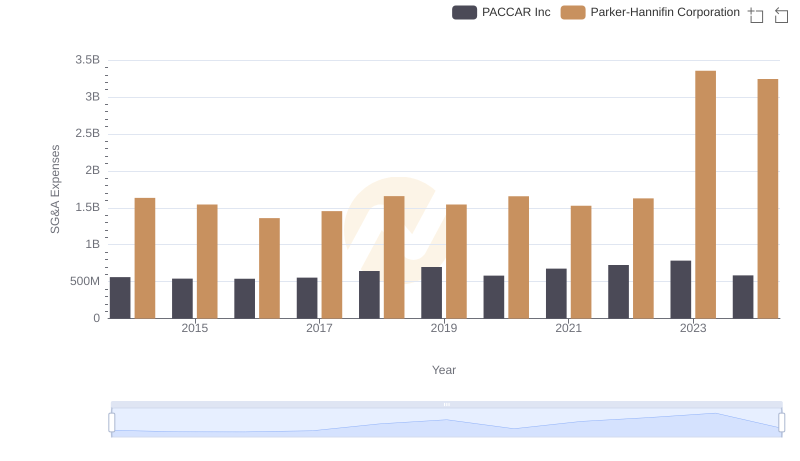

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs PACCAR Inc

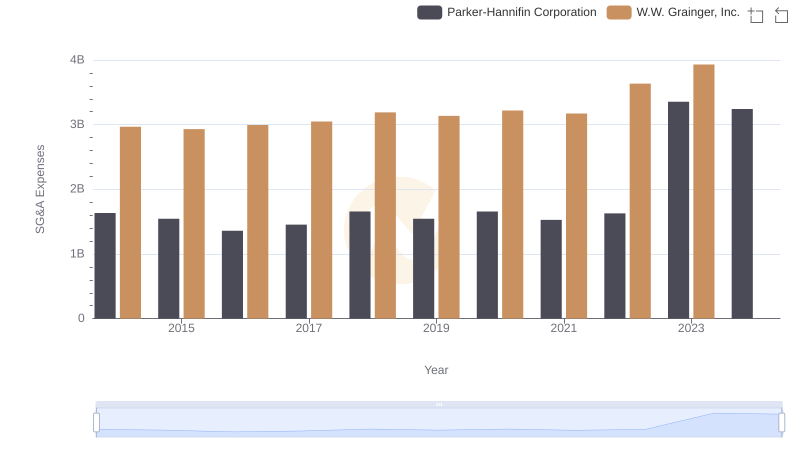

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs W.W. Grainger, Inc.

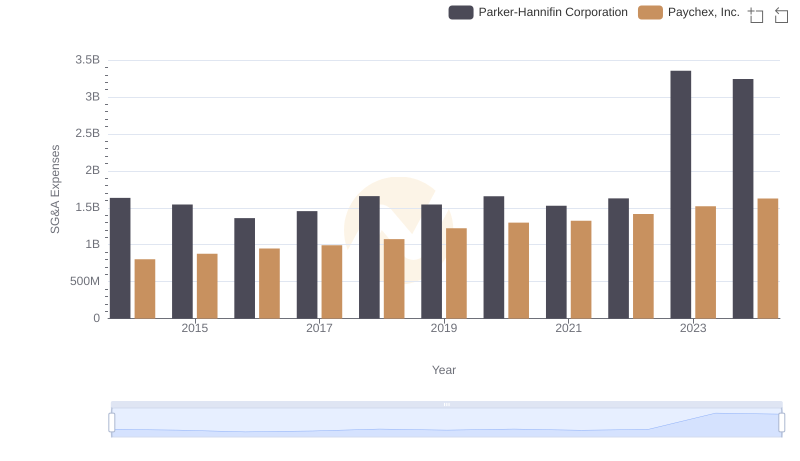

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and Paychex, Inc.

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to United Rentals, Inc.

Parker-Hannifin Corporation or Waste Connections, Inc.: Who Manages SG&A Costs Better?

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs Axon Enterprise, Inc.