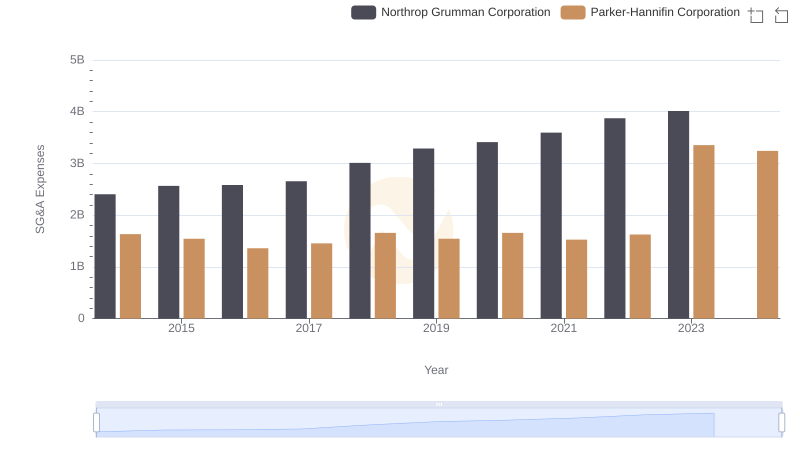

| __timestamp | Johnson Controls International plc | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4308000000 | 1633992000 |

| Thursday, January 1, 2015 | 3986000000 | 1544746000 |

| Friday, January 1, 2016 | 4190000000 | 1359360000 |

| Sunday, January 1, 2017 | 6158000000 | 1453935000 |

| Monday, January 1, 2018 | 6010000000 | 1657152000 |

| Tuesday, January 1, 2019 | 6244000000 | 1543939000 |

| Wednesday, January 1, 2020 | 5665000000 | 1656553000 |

| Friday, January 1, 2021 | 5258000000 | 1527302000 |

| Saturday, January 1, 2022 | 5945000000 | 1627116000 |

| Sunday, January 1, 2023 | 6181000000 | 3354103000 |

| Monday, January 1, 2024 | 5661000000 | 3315177000 |

Unleashing the power of data

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Parker-Hannifin Corporation and Johnson Controls International plc, two industry titans, have demonstrated contrasting approaches to SG&A cost management over the past decade.

From 2014 to 2024, Johnson Controls consistently reported higher SG&A expenses, peaking in 2019 with a 6% increase from the previous year. In contrast, Parker-Hannifin maintained a more stable SG&A cost structure, with a notable spike in 2023, doubling their expenses from the previous year. This sudden increase could indicate strategic investments or restructuring efforts.

While Johnson Controls' average SG&A expenses were approximately 2.9 times higher than Parker-Hannifin's, the latter's recent surge suggests a shift in strategy. As these companies navigate economic challenges, their ability to manage SG&A costs will be pivotal in sustaining competitive advantage.

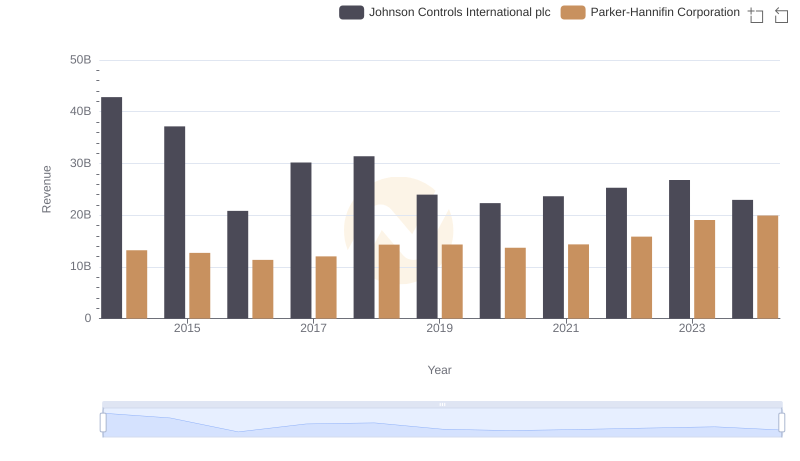

Who Generates More Revenue? Parker-Hannifin Corporation or Johnson Controls International plc

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and Northrop Grumman Corporation

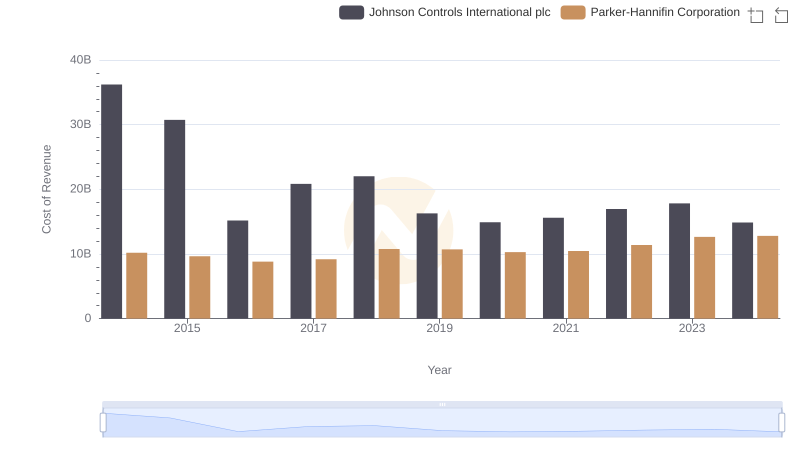

Cost of Revenue Comparison: Parker-Hannifin Corporation vs Johnson Controls International plc

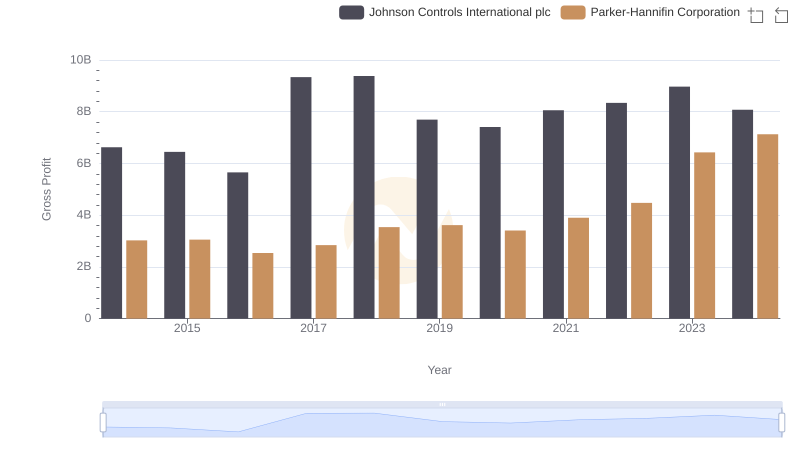

Gross Profit Comparison: Parker-Hannifin Corporation and Johnson Controls International plc Trends

Parker-Hannifin Corporation and Roper Technologies, Inc.: SG&A Spending Patterns Compared

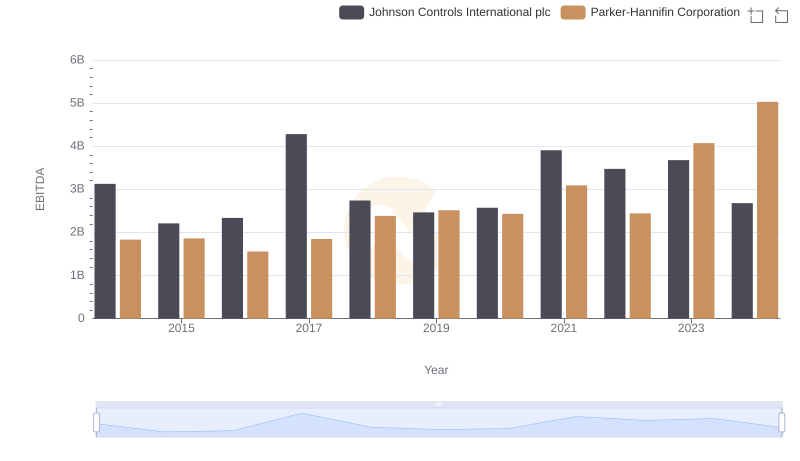

Professional EBITDA Benchmarking: Parker-Hannifin Corporation vs Johnson Controls International plc

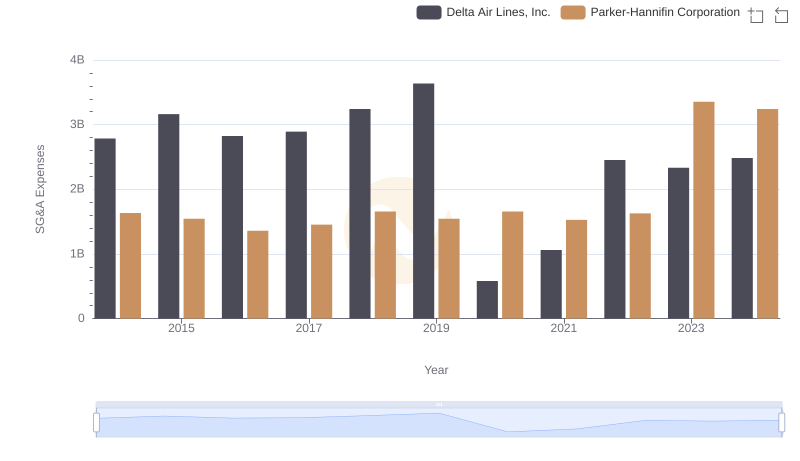

Comparing SG&A Expenses: Parker-Hannifin Corporation vs Delta Air Lines, Inc. Trends and Insights

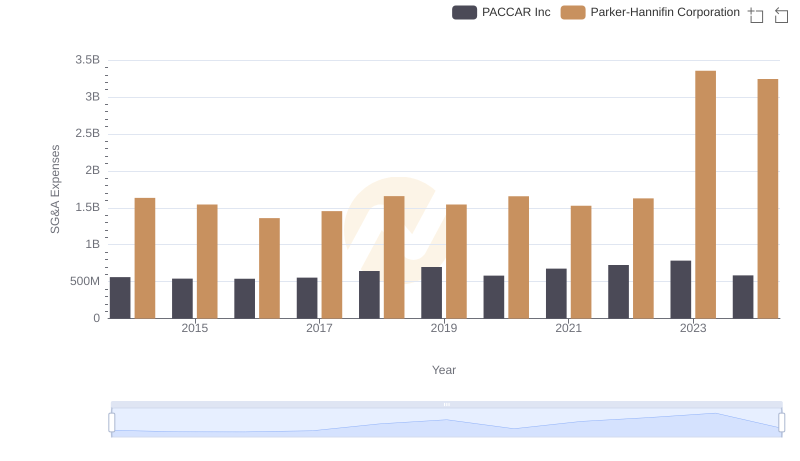

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs PACCAR Inc

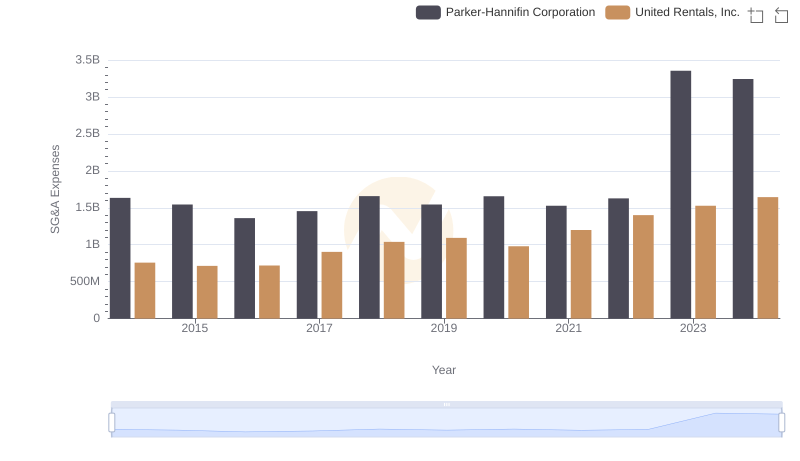

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or United Rentals, Inc.

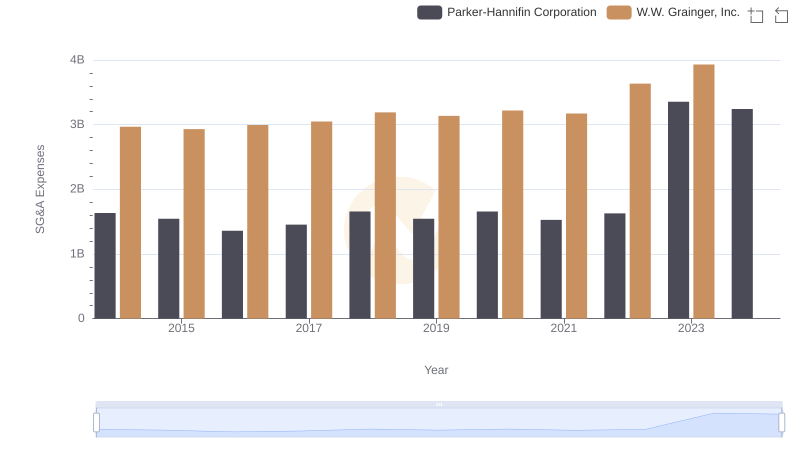

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs W.W. Grainger, Inc.

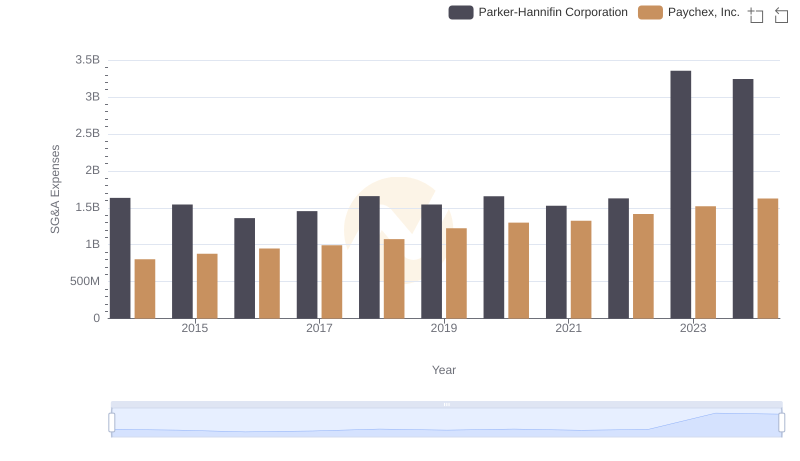

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and Paychex, Inc.