| __timestamp | PACCAR Inc | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 561400000 | 1633992000 |

| Thursday, January 1, 2015 | 541500000 | 1544746000 |

| Friday, January 1, 2016 | 540200000 | 1359360000 |

| Sunday, January 1, 2017 | 555000000 | 1453935000 |

| Monday, January 1, 2018 | 644700000 | 1657152000 |

| Tuesday, January 1, 2019 | 698500000 | 1543939000 |

| Wednesday, January 1, 2020 | 581400000 | 1656553000 |

| Friday, January 1, 2021 | 676800000 | 1527302000 |

| Saturday, January 1, 2022 | 726300000 | 1627116000 |

| Sunday, January 1, 2023 | 784600000 | 3354103000 |

| Monday, January 1, 2024 | 585000000 | 3315177000 |

Unveiling the hidden dimensions of data

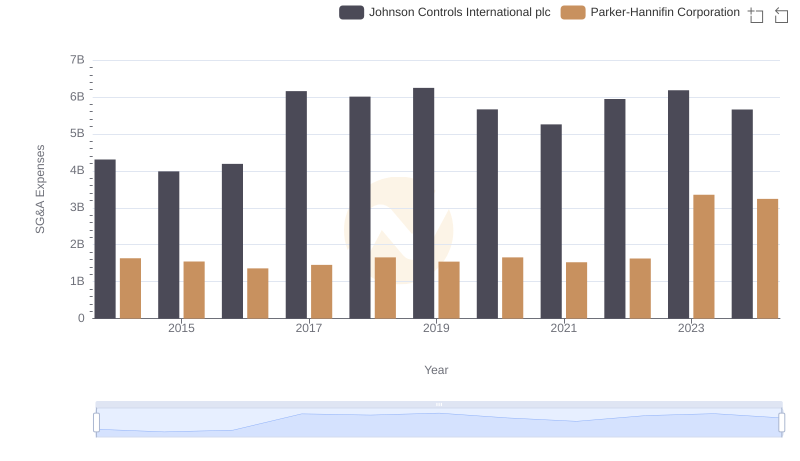

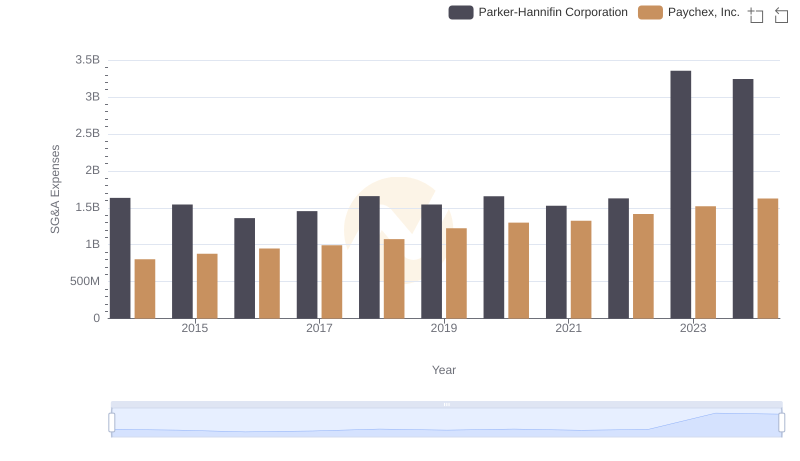

In the competitive landscape of industrial manufacturing, understanding the financial dynamics of major players is crucial. Parker-Hannifin Corporation and PACCAR Inc, two titans in their respective fields, have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses over the past decade.

From 2014 to 2023, Parker-Hannifin's SG&A expenses have seen a significant increase, peaking in 2023 with a staggering 3.35 billion dollars. This represents a growth of over 100% from their 2014 figures, reflecting strategic investments and expansion efforts.

PACCAR Inc, on the other hand, has maintained a more stable trajectory. Their SG&A expenses have grown by approximately 40% over the same period, reaching 784 million dollars in 2023. This steady growth underscores PACCAR's focus on efficient cost management.

These trends highlight the contrasting strategies of these industrial giants, offering valuable insights into their operational priorities and market positioning.

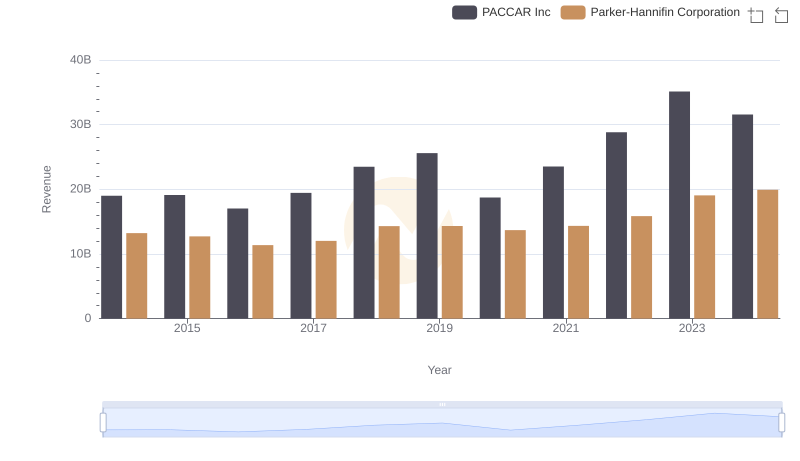

Comparing Revenue Performance: Parker-Hannifin Corporation or PACCAR Inc?

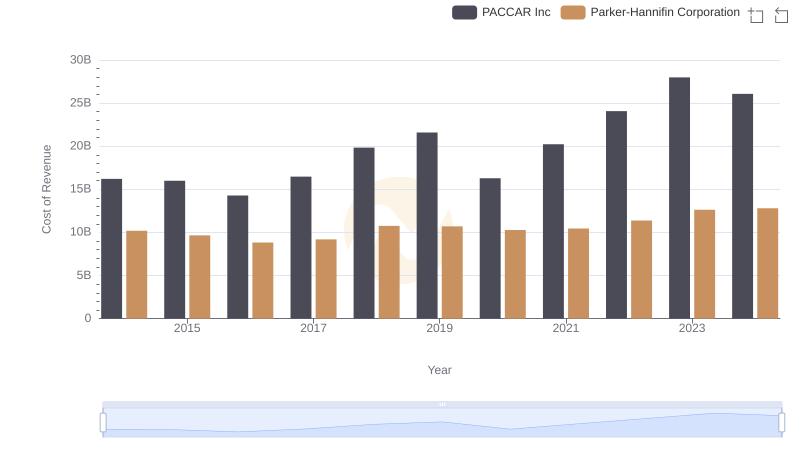

Comparing Cost of Revenue Efficiency: Parker-Hannifin Corporation vs PACCAR Inc

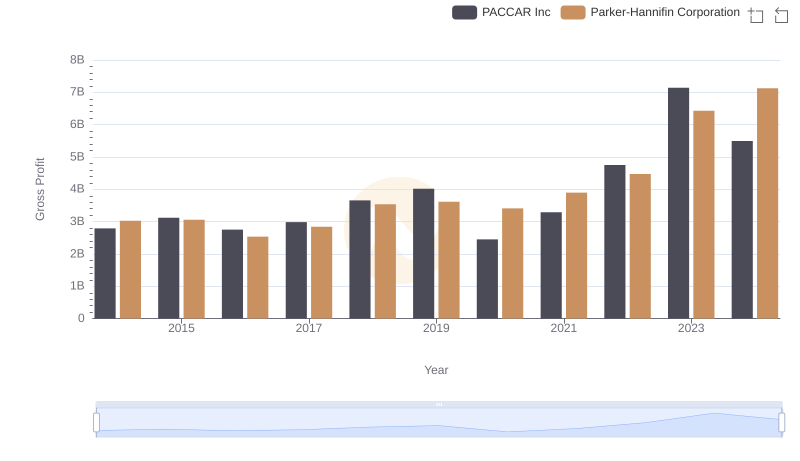

Key Insights on Gross Profit: Parker-Hannifin Corporation vs PACCAR Inc

Parker-Hannifin Corporation or Johnson Controls International plc: Who Manages SG&A Costs Better?

Parker-Hannifin Corporation and Roper Technologies, Inc.: SG&A Spending Patterns Compared

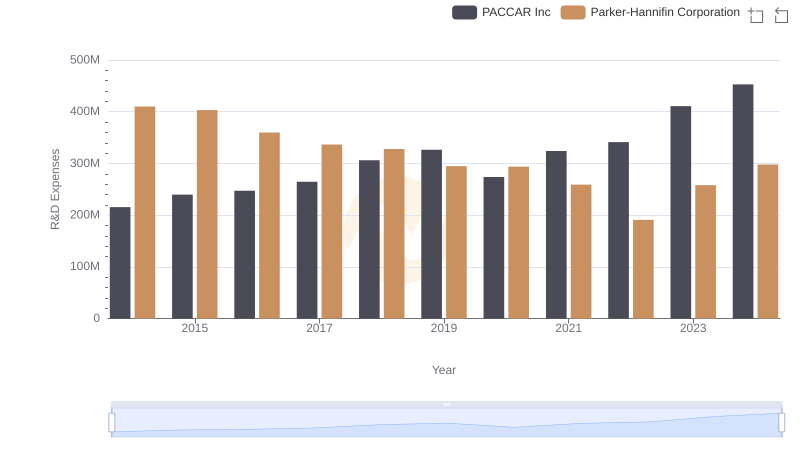

Parker-Hannifin Corporation vs PACCAR Inc: Strategic Focus on R&D Spending

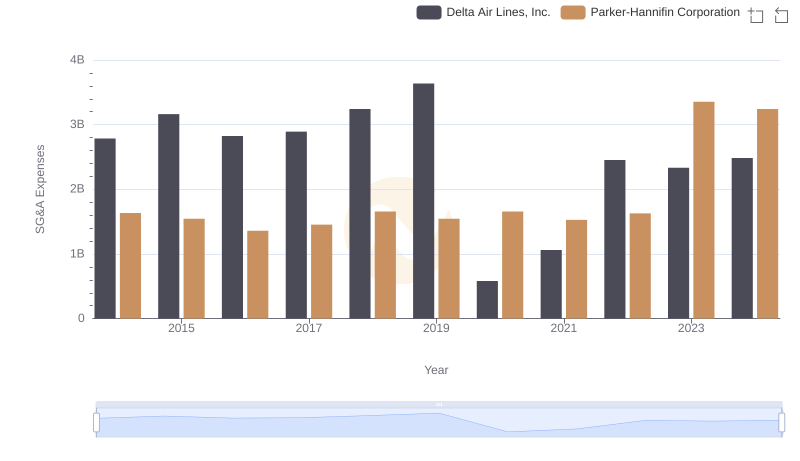

Comparing SG&A Expenses: Parker-Hannifin Corporation vs Delta Air Lines, Inc. Trends and Insights

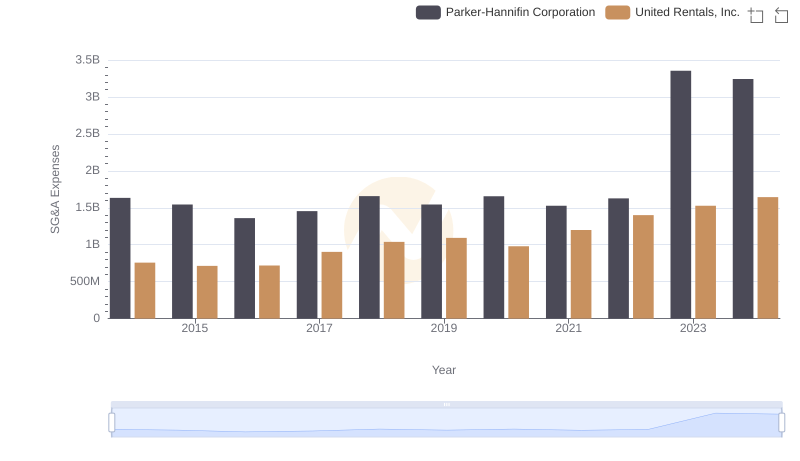

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or United Rentals, Inc.

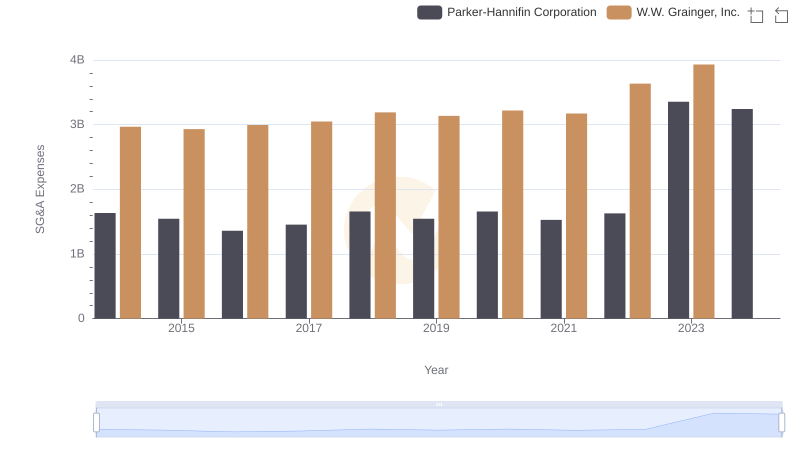

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs W.W. Grainger, Inc.

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and Paychex, Inc.

Parker-Hannifin Corporation or Waste Connections, Inc.: Who Manages SG&A Costs Better?