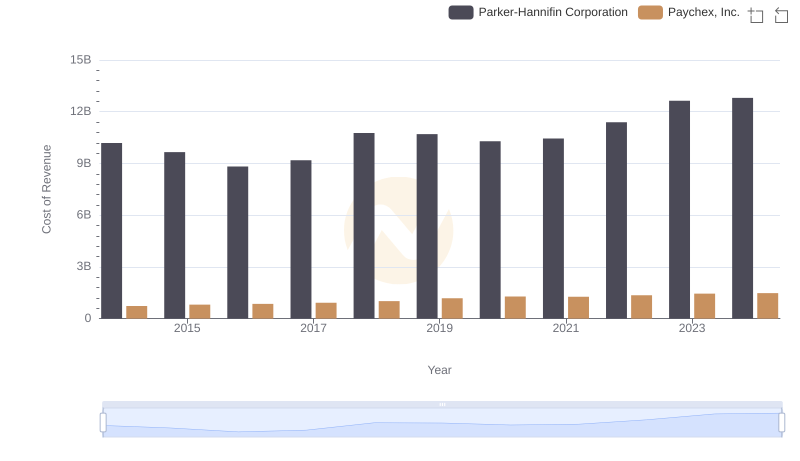

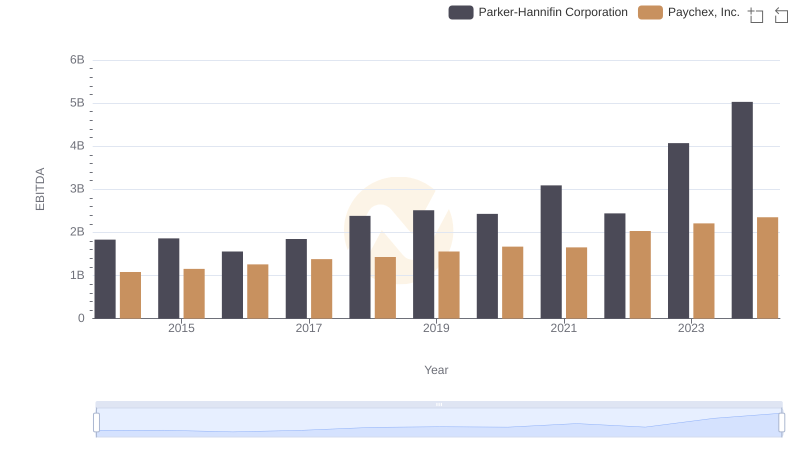

| __timestamp | Parker-Hannifin Corporation | Paychex, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1633992000 | 803700000 |

| Thursday, January 1, 2015 | 1544746000 | 878000000 |

| Friday, January 1, 2016 | 1359360000 | 948200000 |

| Sunday, January 1, 2017 | 1453935000 | 992100000 |

| Monday, January 1, 2018 | 1657152000 | 1075600000 |

| Tuesday, January 1, 2019 | 1543939000 | 1223400000 |

| Wednesday, January 1, 2020 | 1656553000 | 1299200000 |

| Friday, January 1, 2021 | 1527302000 | 1324900000 |

| Saturday, January 1, 2022 | 1627116000 | 1415400000 |

| Sunday, January 1, 2023 | 3354103000 | 1521000000 |

| Monday, January 1, 2024 | 3315177000 | 1624900000 |

Infusing magic into the data realm

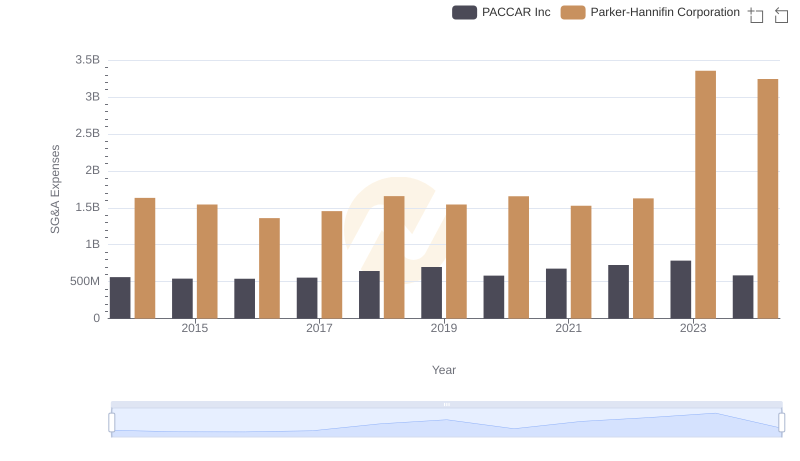

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. Over the past decade, Parker-Hannifin Corporation and Paychex, Inc. have demonstrated distinct trends in their Selling, General, and Administrative (SG&A) expenses. Parker-Hannifin, a leader in motion and control technologies, saw its SG&A expenses rise by approximately 98% from 2014 to 2023, peaking in 2023. This surge reflects strategic investments and expansions. Meanwhile, Paychex, a prominent player in payroll and HR services, experienced a steadier increase of around 101% over the same period, indicating consistent growth and adaptation to market demands. Notably, 2023 marked a significant year for both companies, with Parker-Hannifin's expenses nearly doubling compared to previous years, while Paychex continued its upward trajectory. These trends underscore the dynamic nature of operational costs and their impact on corporate strategy.

Comparing Cost of Revenue Efficiency: Parker-Hannifin Corporation vs Paychex, Inc.

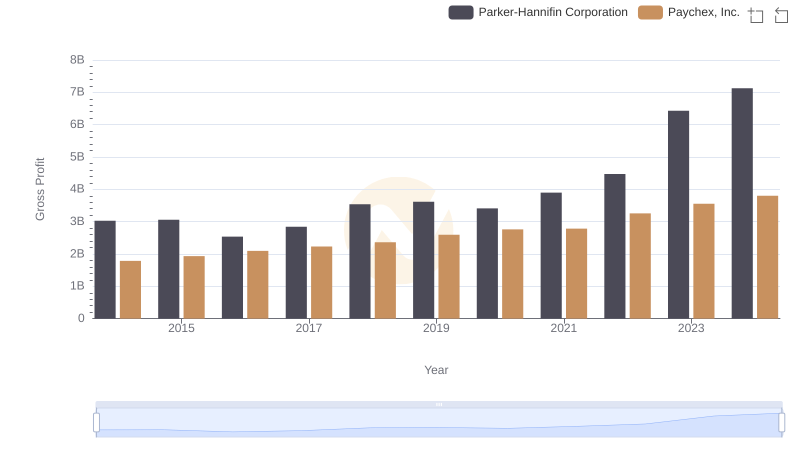

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Paychex, Inc.

Parker-Hannifin Corporation and Roper Technologies, Inc.: SG&A Spending Patterns Compared

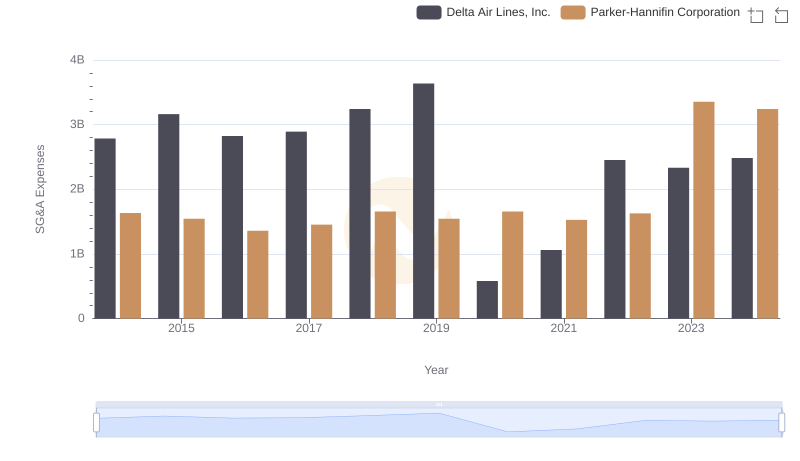

Comparing SG&A Expenses: Parker-Hannifin Corporation vs Delta Air Lines, Inc. Trends and Insights

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs PACCAR Inc

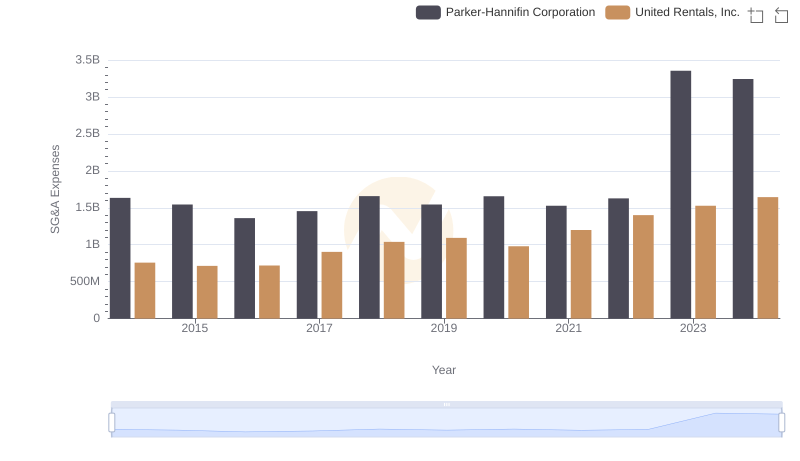

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or United Rentals, Inc.

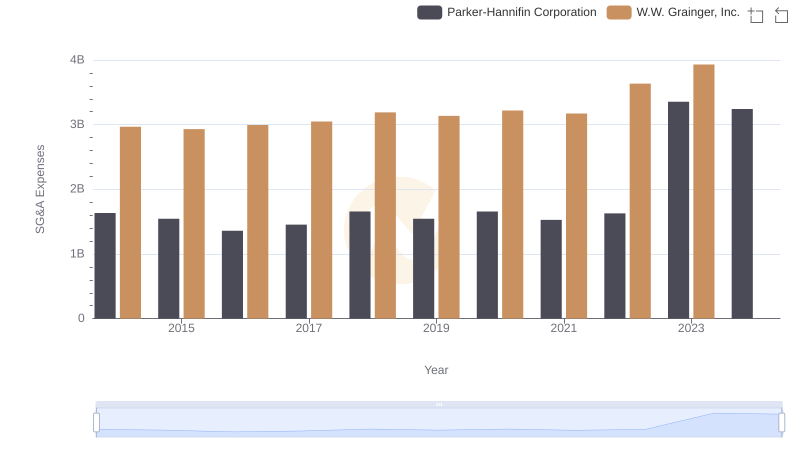

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs W.W. Grainger, Inc.

Parker-Hannifin Corporation or Waste Connections, Inc.: Who Manages SG&A Costs Better?

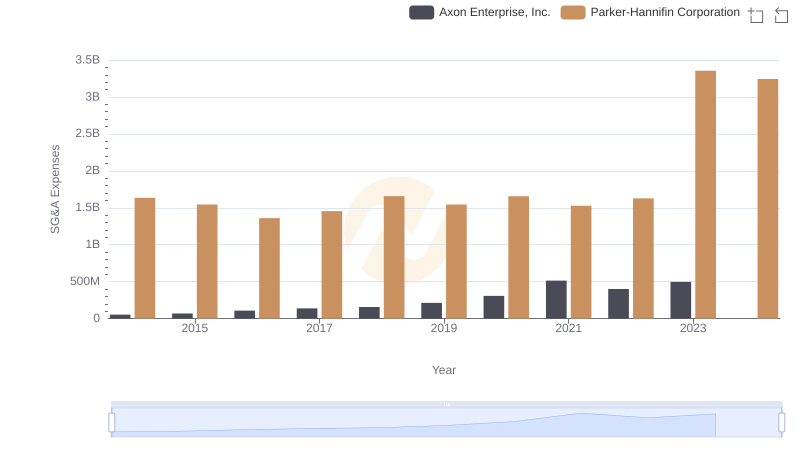

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs Axon Enterprise, Inc.

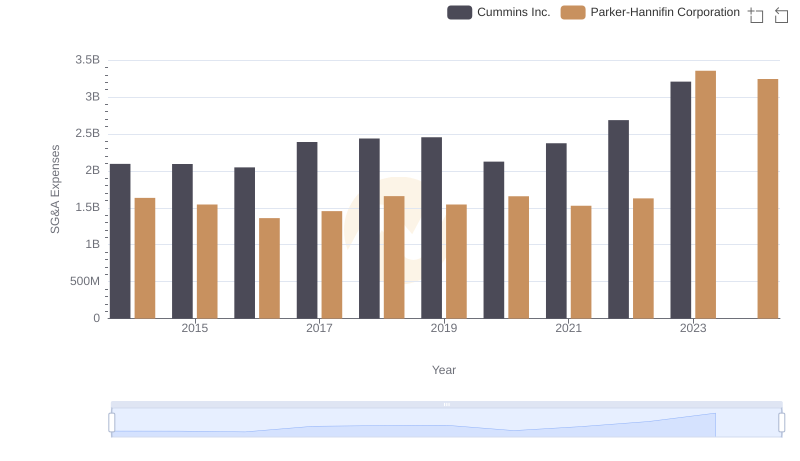

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs Cummins Inc.

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to Paychex, Inc.