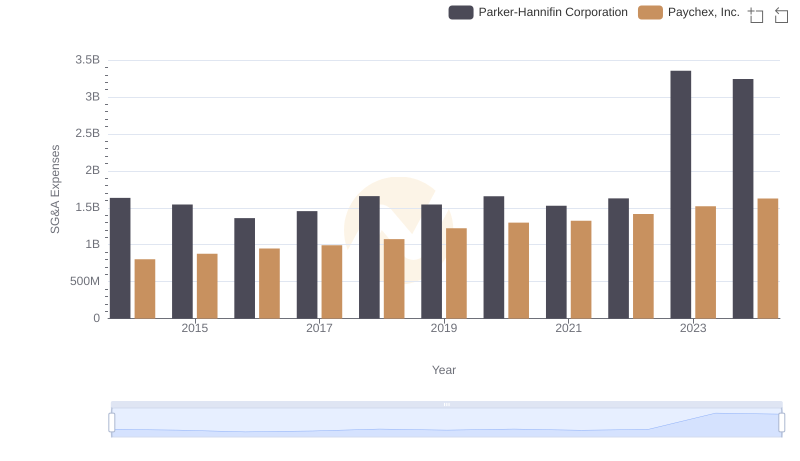

| __timestamp | Axon Enterprise, Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 1633992000 |

| Thursday, January 1, 2015 | 69698000 | 1544746000 |

| Friday, January 1, 2016 | 108076000 | 1359360000 |

| Sunday, January 1, 2017 | 138692000 | 1453935000 |

| Monday, January 1, 2018 | 156886000 | 1657152000 |

| Tuesday, January 1, 2019 | 212959000 | 1543939000 |

| Wednesday, January 1, 2020 | 307286000 | 1656553000 |

| Friday, January 1, 2021 | 515007000 | 1527302000 |

| Saturday, January 1, 2022 | 401575000 | 1627116000 |

| Sunday, January 1, 2023 | 496874000 | 3354103000 |

| Monday, January 1, 2024 | 3315177000 |

In pursuit of knowledge

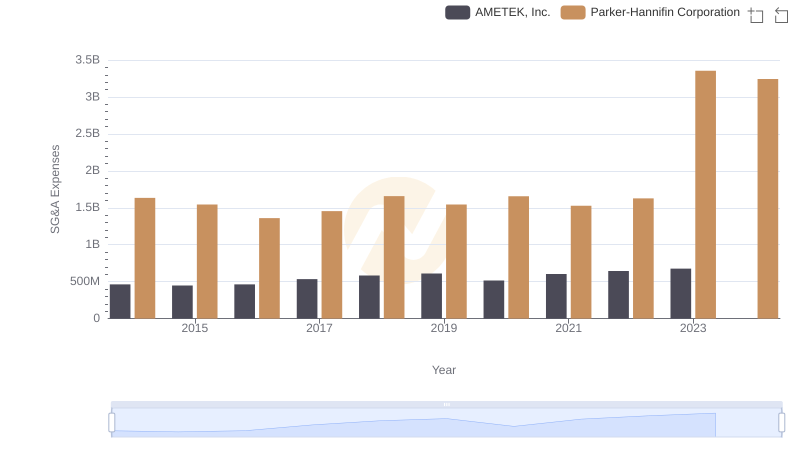

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a crucial indicator of a company's operational efficiency. This analysis compares the SG&A expenses of Parker-Hannifin Corporation and Axon Enterprise, Inc. from 2014 to 2023.

Parker-Hannifin, a leader in motion and control technologies, consistently reported higher SG&A expenses, peaking in 2023 with a staggering 3.35 billion dollars. This represents a 105% increase from its 2014 figures. Meanwhile, Axon Enterprise, known for its innovative public safety solutions, saw its SG&A expenses grow by over 800% during the same period, reaching nearly 515 million dollars in 2021.

Interestingly, 2023 data for Axon is missing, leaving room for speculation on its financial trajectory. This comparison highlights the contrasting growth strategies and operational scales of these two industry giants.

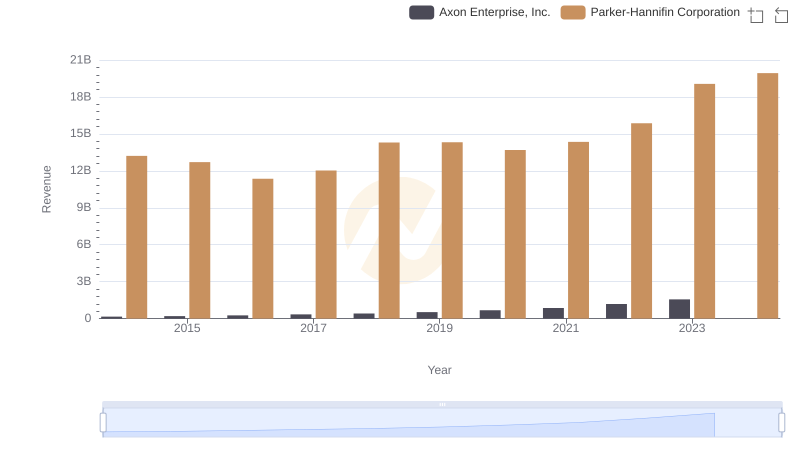

Breaking Down Revenue Trends: Parker-Hannifin Corporation vs Axon Enterprise, Inc.

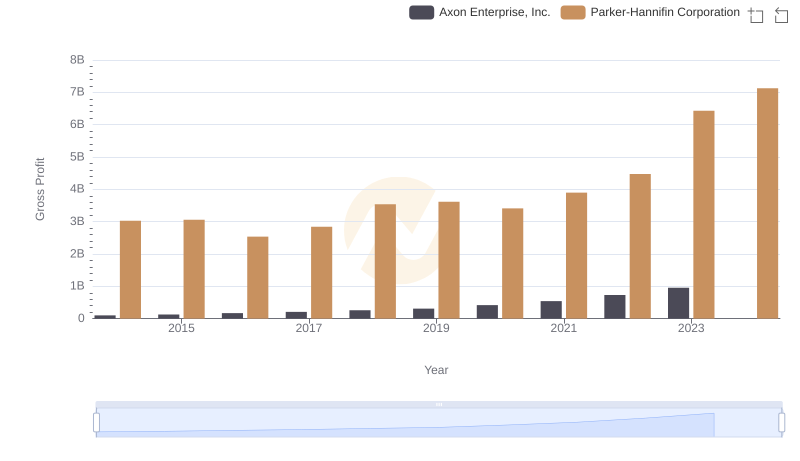

Gross Profit Comparison: Parker-Hannifin Corporation and Axon Enterprise, Inc. Trends

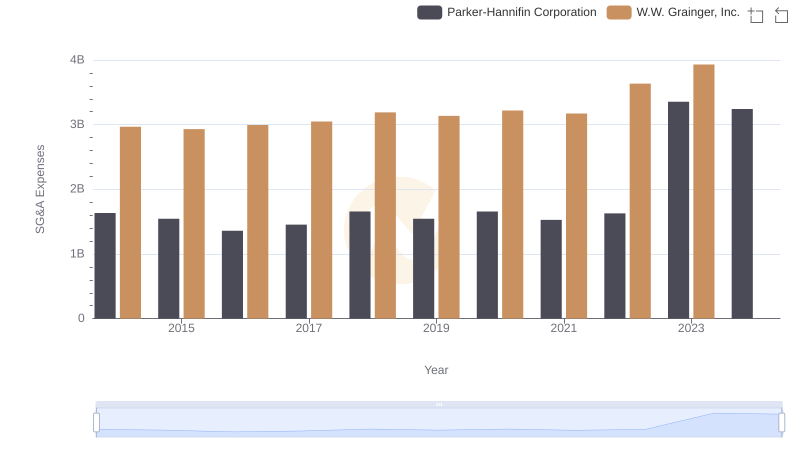

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs W.W. Grainger, Inc.

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and Paychex, Inc.

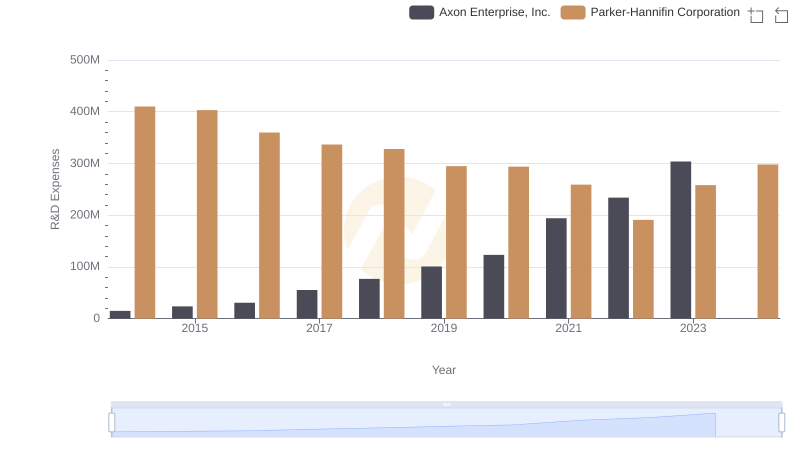

R&D Spending Showdown: Parker-Hannifin Corporation vs Axon Enterprise, Inc.

Parker-Hannifin Corporation or Waste Connections, Inc.: Who Manages SG&A Costs Better?

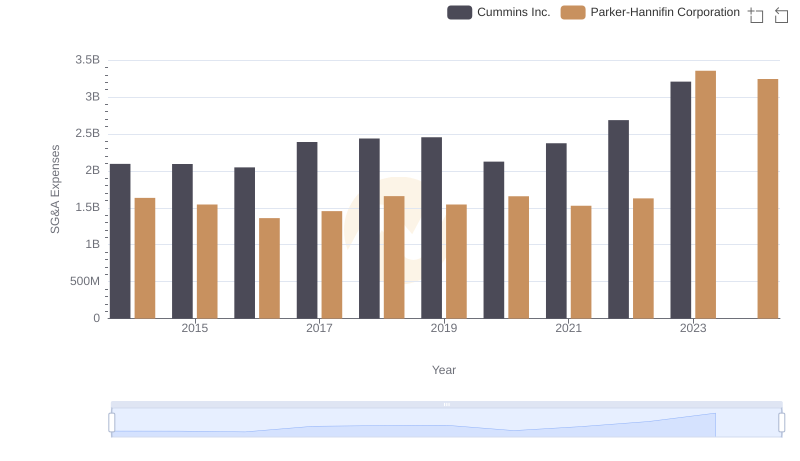

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs Cummins Inc.

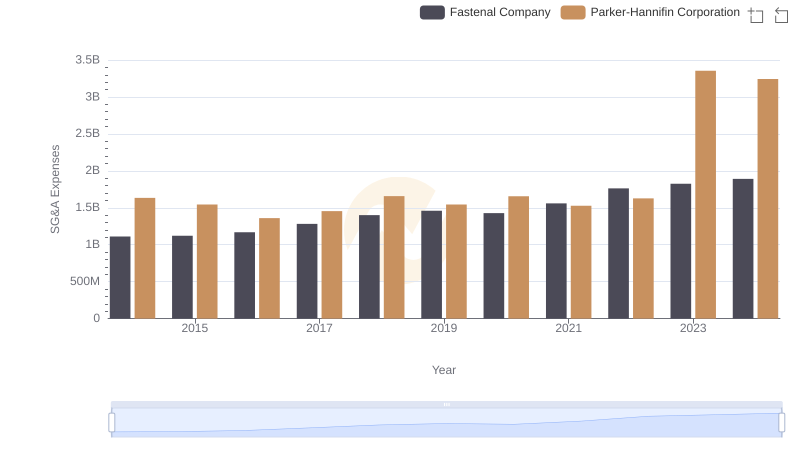

Cost Management Insights: SG&A Expenses for Parker-Hannifin Corporation and Fastenal Company

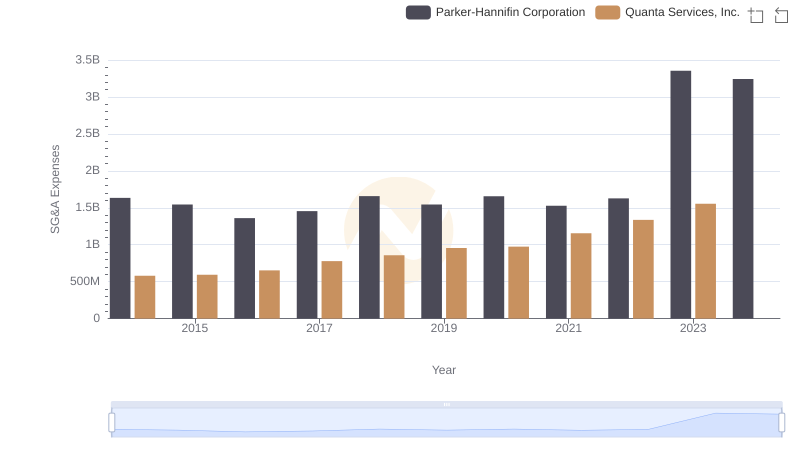

Parker-Hannifin Corporation vs Quanta Services, Inc.: SG&A Expense Trends

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs AMETEK, Inc.