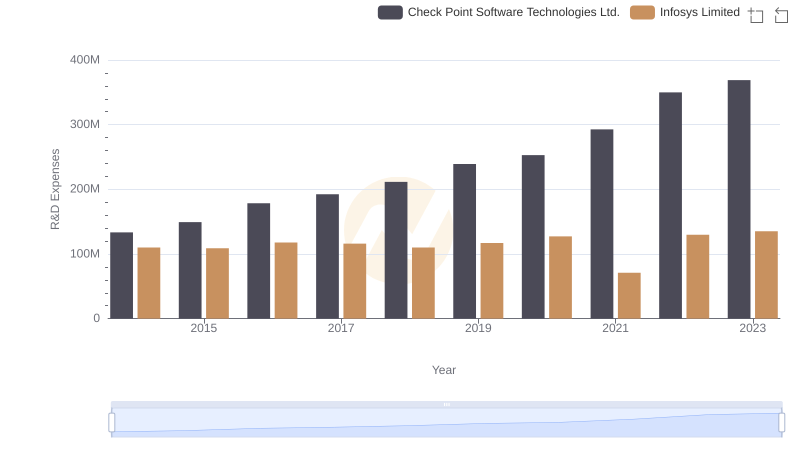

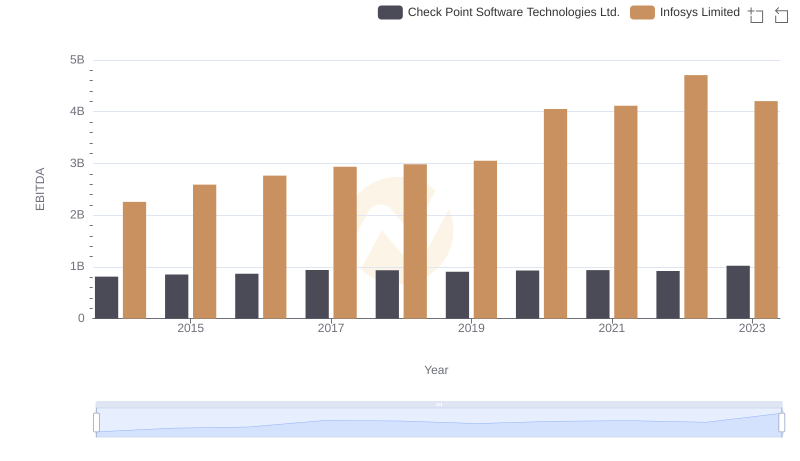

| __timestamp | Check Point Software Technologies Ltd. | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 384921000 | 1079000000 |

| Thursday, January 1, 2015 | 451785000 | 1176000000 |

| Friday, January 1, 2016 | 508656000 | 1020000000 |

| Sunday, January 1, 2017 | 525392000 | 1279000000 |

| Monday, January 1, 2018 | 589799000 | 1220000000 |

| Tuesday, January 1, 2019 | 658400000 | 1504000000 |

| Wednesday, January 1, 2020 | 681400000 | 1223000000 |

| Friday, January 1, 2021 | 708500000 | 1391000000 |

| Saturday, January 1, 2022 | 791300000 | 1678000000 |

| Sunday, January 1, 2023 | 864100000 | 1632000000 |

Infusing magic into the data realm

In the competitive world of technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis compares Infosys Limited and Check Point Software Technologies Ltd. over the past decade, from 2014 to 2023.

Infosys, a global leader in consulting and IT services, consistently reported higher SG&A expenses, averaging around 1.32 billion annually. Despite this, their expenses grew by approximately 51% over the period, reflecting strategic investments in growth and expansion.

Conversely, Check Point Software, a cybersecurity powerhouse, maintained a more conservative approach, with SG&A expenses averaging 616 million annually. Their expenses increased by about 124%, indicating a significant ramp-up in operational activities.

This data highlights the contrasting strategies of these tech giants: Infosys's expansive growth versus Check Point's focused scaling. Understanding these trends offers valuable insights into their operational efficiencies and market strategies.

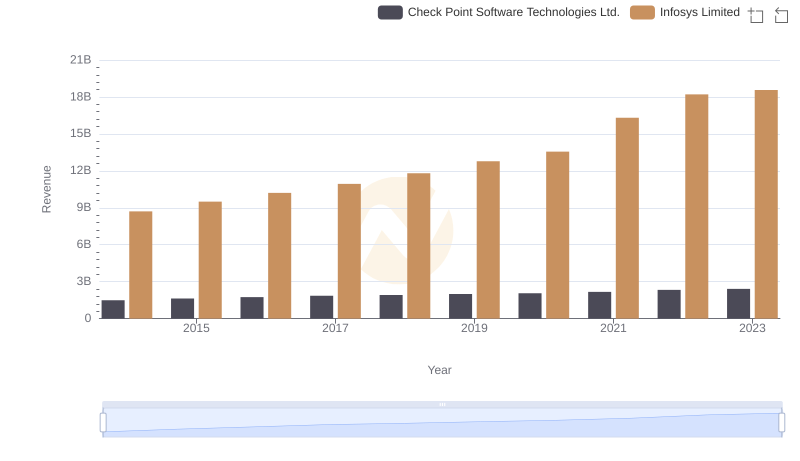

Annual Revenue Comparison: Infosys Limited vs Check Point Software Technologies Ltd.

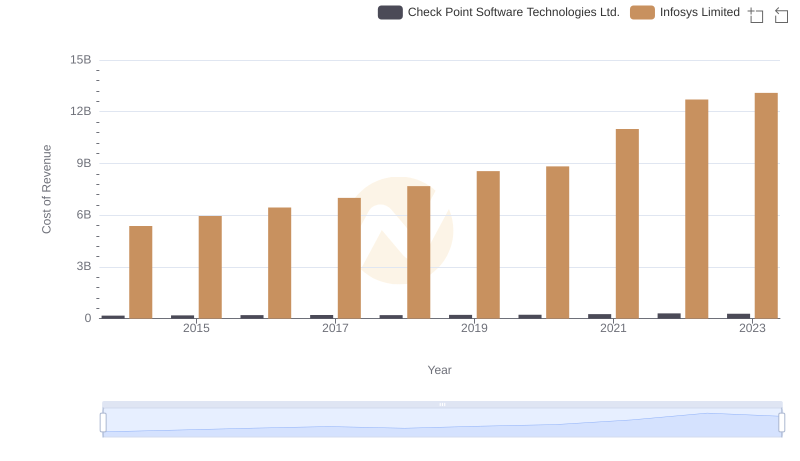

Cost of Revenue Comparison: Infosys Limited vs Check Point Software Technologies Ltd.

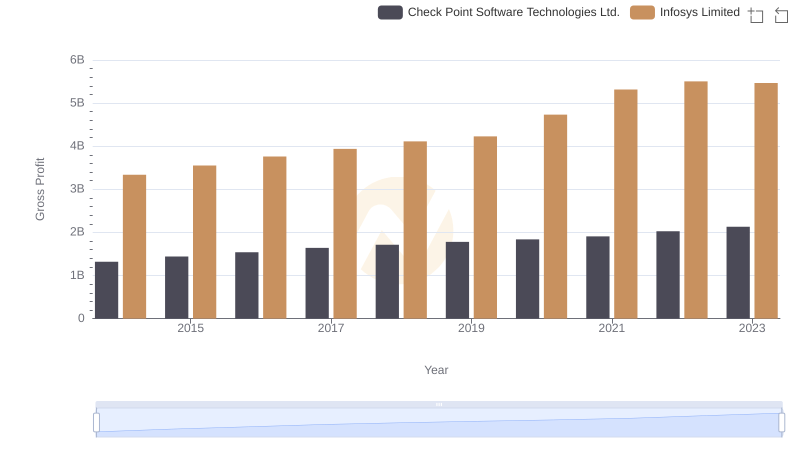

Infosys Limited vs Check Point Software Technologies Ltd.: A Gross Profit Performance Breakdown

Infosys Limited or Check Point Software Technologies Ltd.: Who Invests More in Innovation?

Infosys Limited and ON Semiconductor Corporation: SG&A Spending Patterns Compared

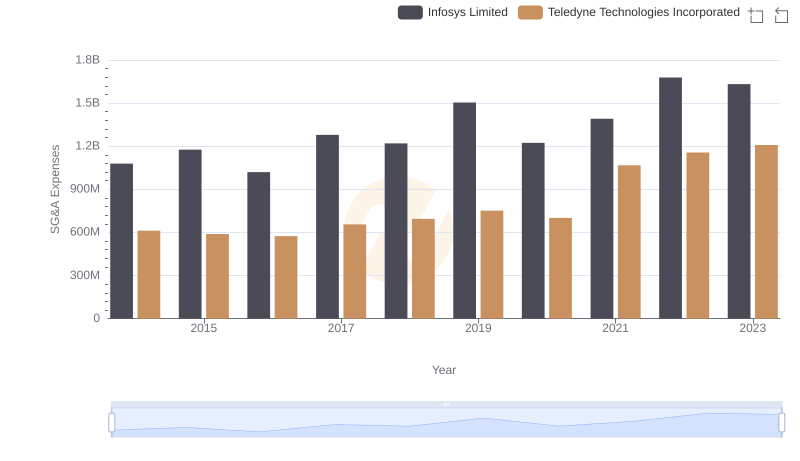

Operational Costs Compared: SG&A Analysis of Infosys Limited and Teledyne Technologies Incorporated

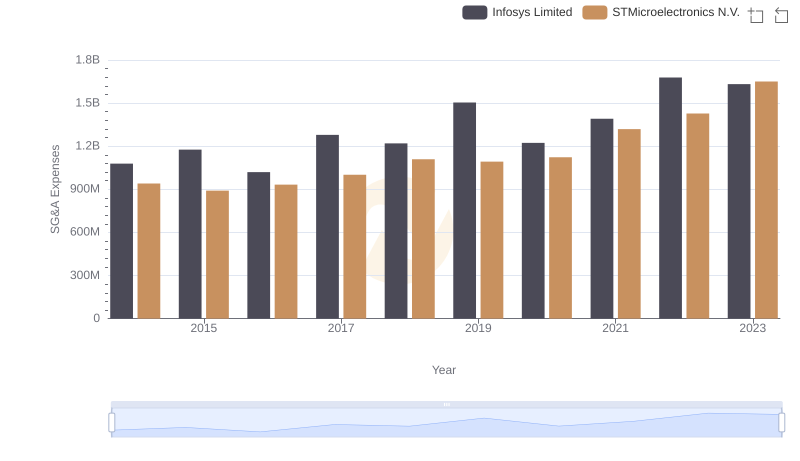

Infosys Limited or STMicroelectronics N.V.: Who Manages SG&A Costs Better?

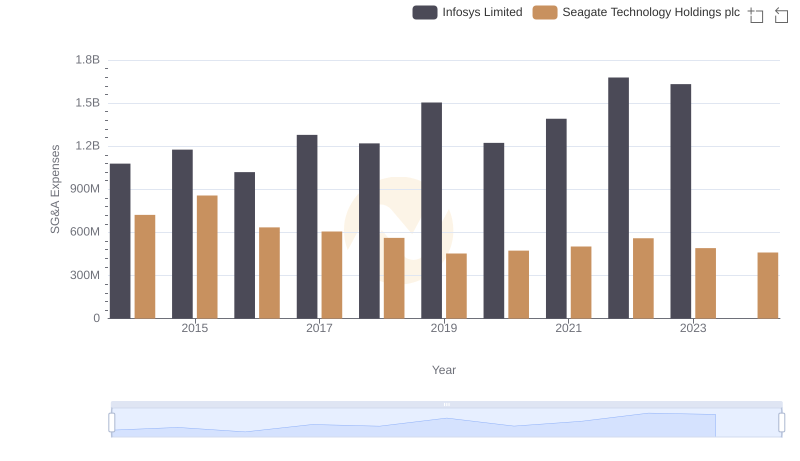

Infosys Limited or Seagate Technology Holdings plc: Who Manages SG&A Costs Better?

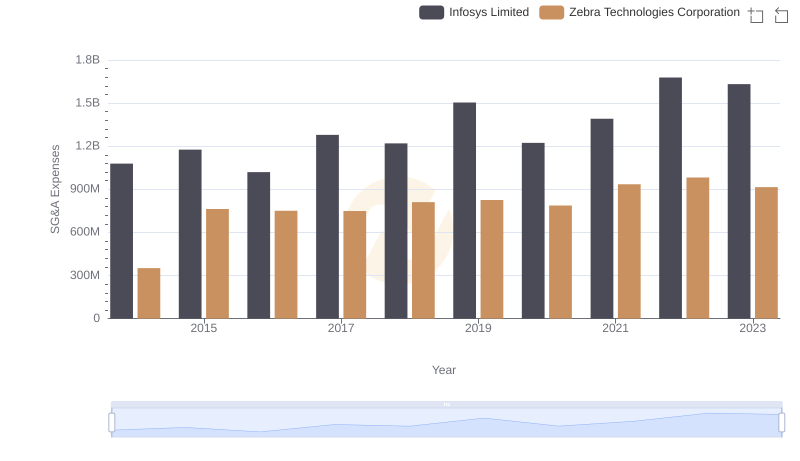

SG&A Efficiency Analysis: Comparing Infosys Limited and Zebra Technologies Corporation

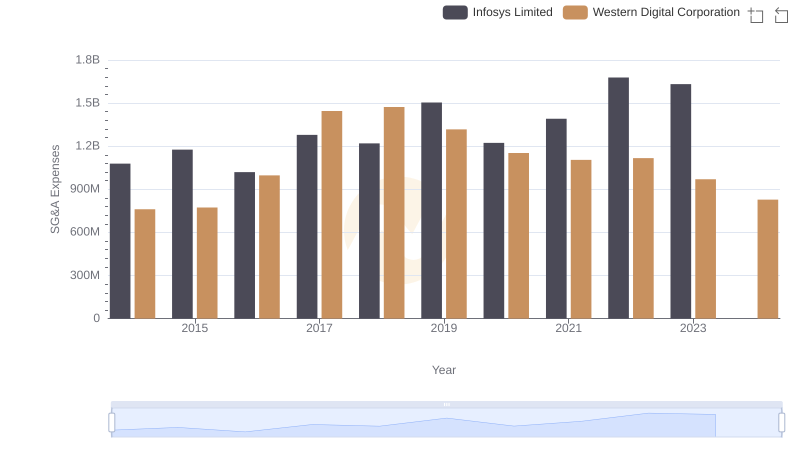

Who Optimizes SG&A Costs Better? Infosys Limited or Western Digital Corporation

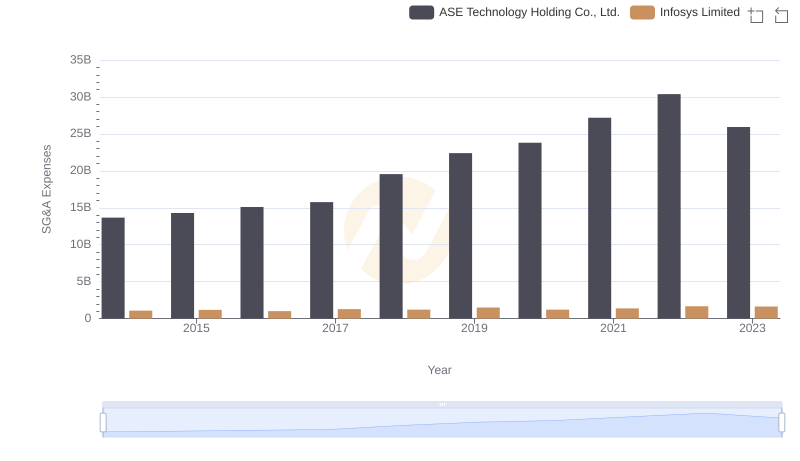

Selling, General, and Administrative Costs: Infosys Limited vs ASE Technology Holding Co., Ltd.

EBITDA Analysis: Evaluating Infosys Limited Against Check Point Software Technologies Ltd.