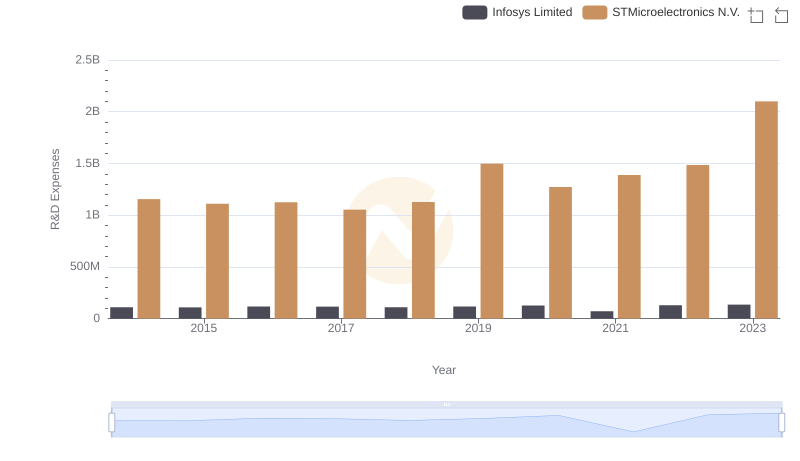

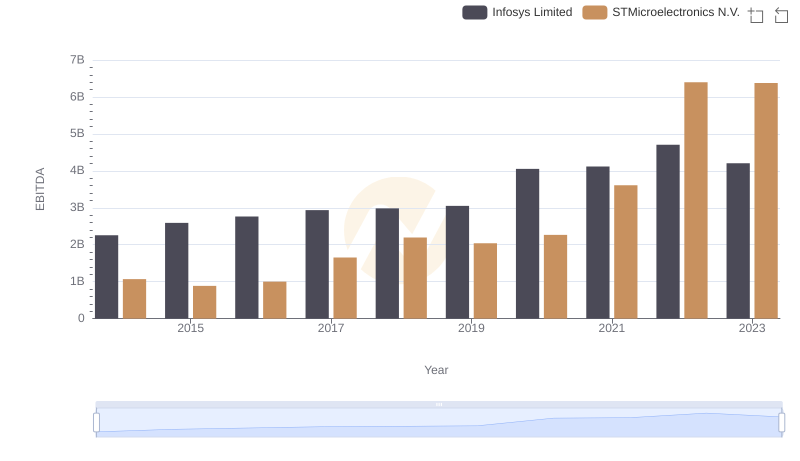

| __timestamp | Infosys Limited | STMicroelectronics N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 940000000 |

| Thursday, January 1, 2015 | 1176000000 | 891000000 |

| Friday, January 1, 2016 | 1020000000 | 933000000 |

| Sunday, January 1, 2017 | 1279000000 | 1001000000 |

| Monday, January 1, 2018 | 1220000000 | 1109000000 |

| Tuesday, January 1, 2019 | 1504000000 | 1093000000 |

| Wednesday, January 1, 2020 | 1223000000 | 1123000000 |

| Friday, January 1, 2021 | 1391000000 | 1319000000 |

| Saturday, January 1, 2022 | 1678000000 | 1428000000 |

| Sunday, January 1, 2023 | 1632000000 | 1650000000 |

Infusing magic into the data realm

In the ever-evolving landscape of global technology, managing operational costs is crucial for maintaining competitive advantage. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry titans: Infosys Limited and STMicroelectronics N.V., from 2014 to 2023.

Infosys has shown a consistent increase in SG&A expenses, peaking at approximately $1.68 billion in 2022, a 56% rise from 2014. Meanwhile, STMicroelectronics has demonstrated a more stable trajectory, with a notable 85% increase, reaching around $1.65 billion in 2023.

While both companies have seen their SG&A costs rise, STMicroelectronics' ability to maintain a steadier growth rate suggests a more efficient cost management strategy. As the tech industry continues to expand, these insights provide a glimpse into the financial strategies that drive success.

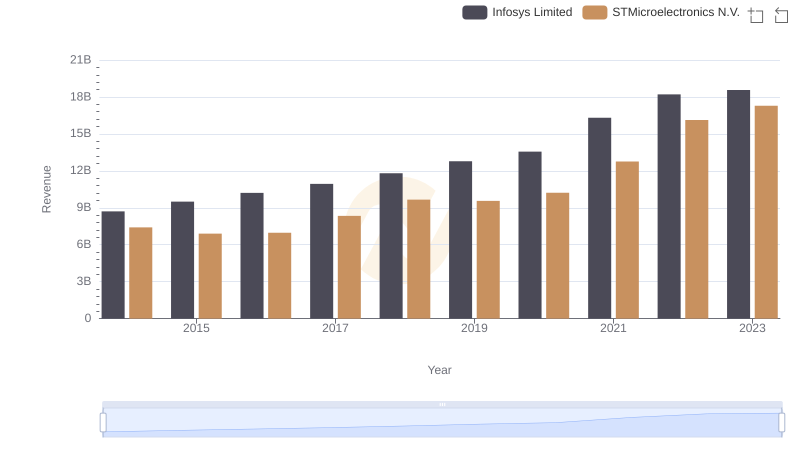

Infosys Limited vs STMicroelectronics N.V.: Examining Key Revenue Metrics

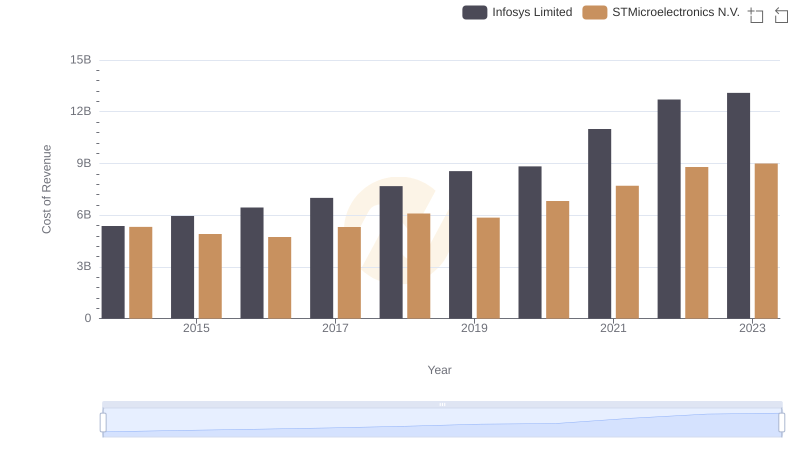

Infosys Limited vs STMicroelectronics N.V.: Efficiency in Cost of Revenue Explored

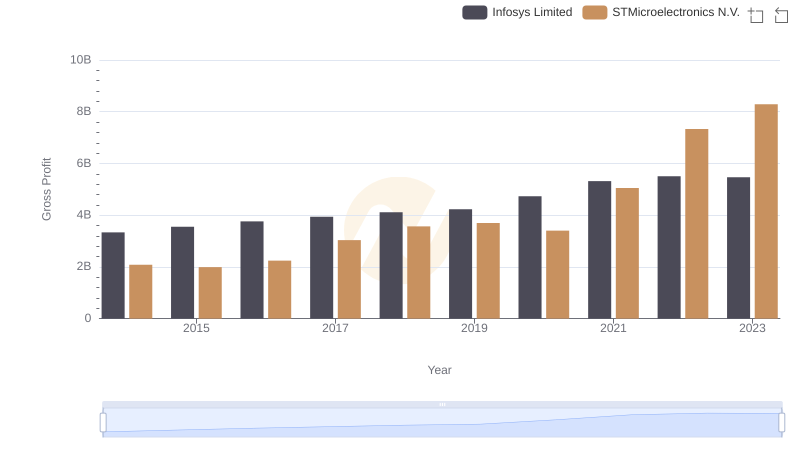

Infosys Limited and STMicroelectronics N.V.: A Detailed Gross Profit Analysis

Research and Development: Comparing Key Metrics for Infosys Limited and STMicroelectronics N.V.

Infosys Limited and ON Semiconductor Corporation: SG&A Spending Patterns Compared

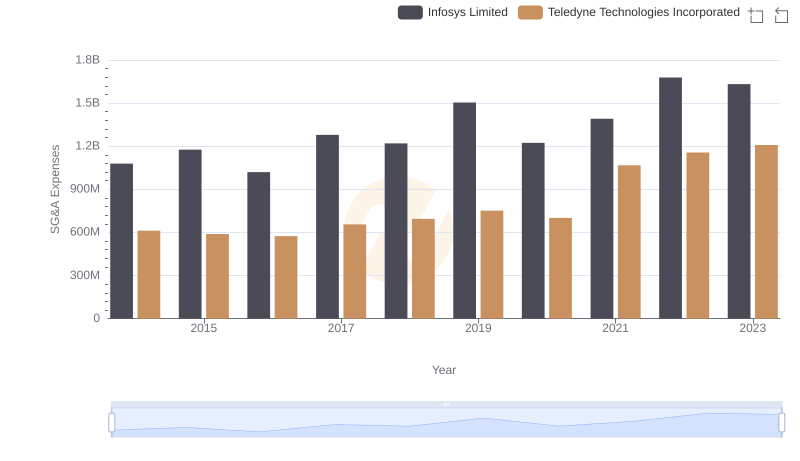

Operational Costs Compared: SG&A Analysis of Infosys Limited and Teledyne Technologies Incorporated

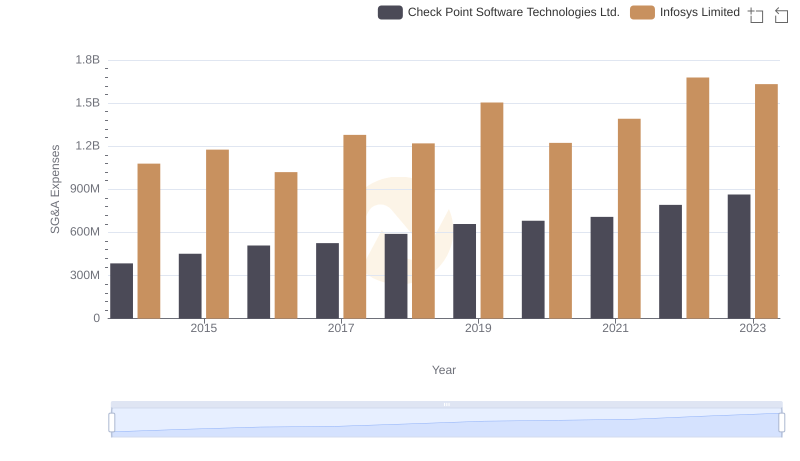

Who Optimizes SG&A Costs Better? Infosys Limited or Check Point Software Technologies Ltd.

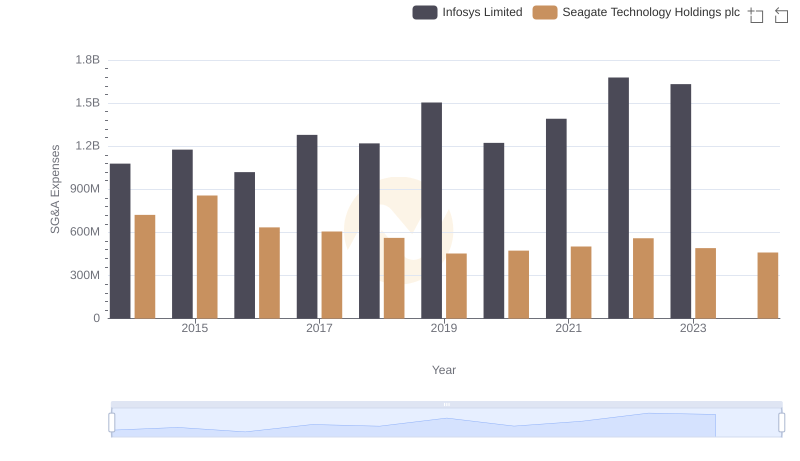

Infosys Limited or Seagate Technology Holdings plc: Who Manages SG&A Costs Better?

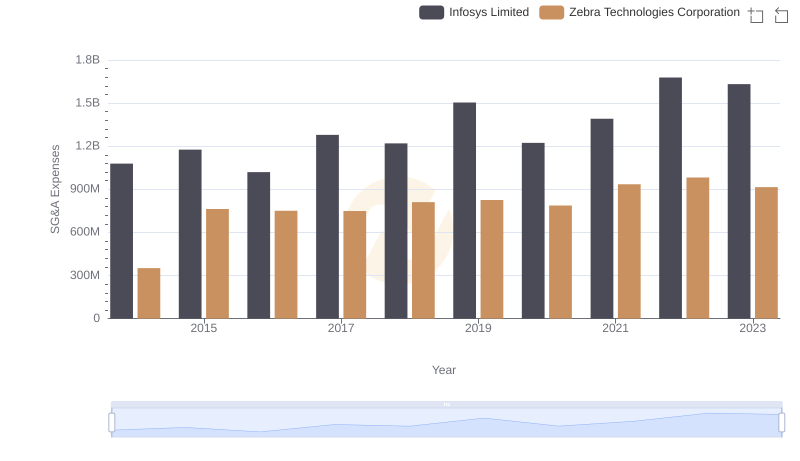

SG&A Efficiency Analysis: Comparing Infosys Limited and Zebra Technologies Corporation

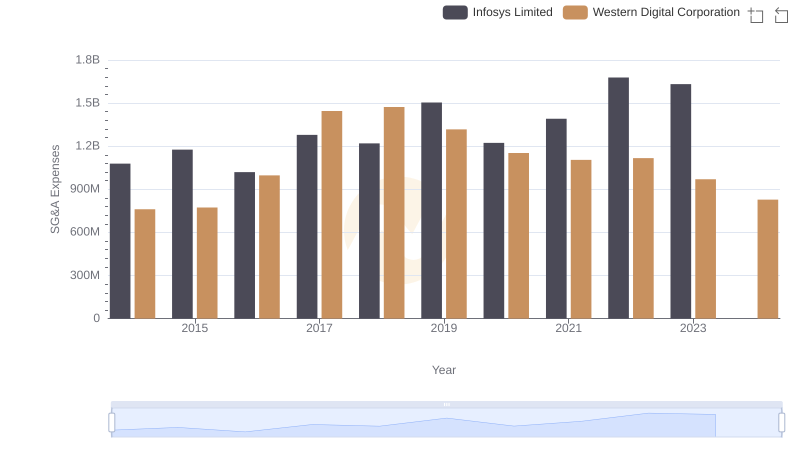

Who Optimizes SG&A Costs Better? Infosys Limited or Western Digital Corporation

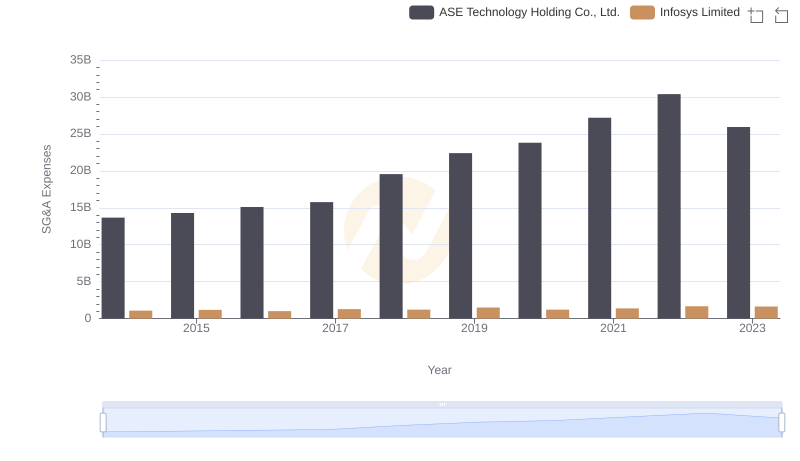

Selling, General, and Administrative Costs: Infosys Limited vs ASE Technology Holding Co., Ltd.

Professional EBITDA Benchmarking: Infosys Limited vs STMicroelectronics N.V.