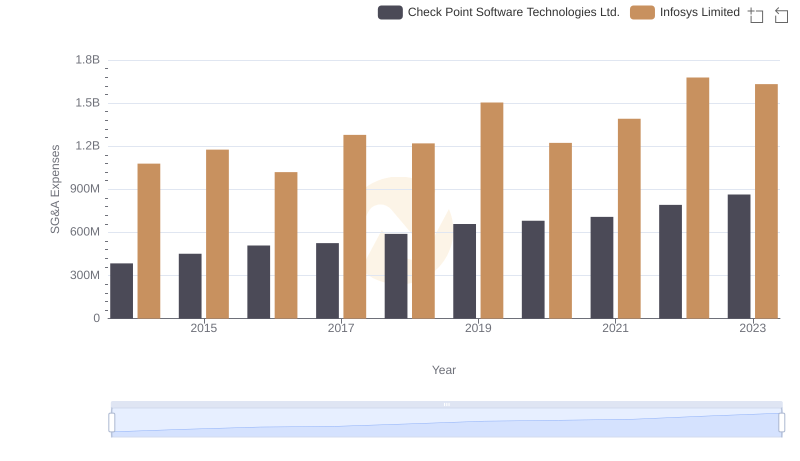

| __timestamp | Check Point Software Technologies Ltd. | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 812338000 | 2258000000 |

| Thursday, January 1, 2015 | 853687000 | 2590000000 |

| Friday, January 1, 2016 | 867006000 | 2765000000 |

| Sunday, January 1, 2017 | 940553000 | 2936000000 |

| Monday, January 1, 2018 | 934562000 | 2984000000 |

| Tuesday, January 1, 2019 | 905800000 | 3053000000 |

| Wednesday, January 1, 2020 | 931300000 | 4053342784 |

| Friday, January 1, 2021 | 938200000 | 4116000000 |

| Saturday, January 1, 2022 | 920500000 | 4707334610 |

| Sunday, January 1, 2023 | 1023000000 | 4206000000 |

In pursuit of knowledge

In the ever-evolving landscape of global technology, understanding financial health is crucial. This analysis delves into the EBITDA performance of two tech giants: Infosys Limited and Check Point Software Technologies Ltd., from 2014 to 2023.

Infosys Limited, a leader in IT services, has shown a remarkable growth trajectory, with its EBITDA increasing by approximately 86% over the decade. In contrast, Check Point Software Technologies Ltd., a cybersecurity powerhouse, experienced a more modest growth of around 26% in the same period.

The year 2020 marked a significant leap for Infosys, with a 33% increase in EBITDA, reflecting its strategic adaptability during global disruptions. Meanwhile, Check Point's EBITDA peaked in 2023, showcasing its resilience in the cybersecurity domain.

This comparative analysis highlights the dynamic nature of the tech industry and the diverse strategies employed by these companies to maintain financial robustness.

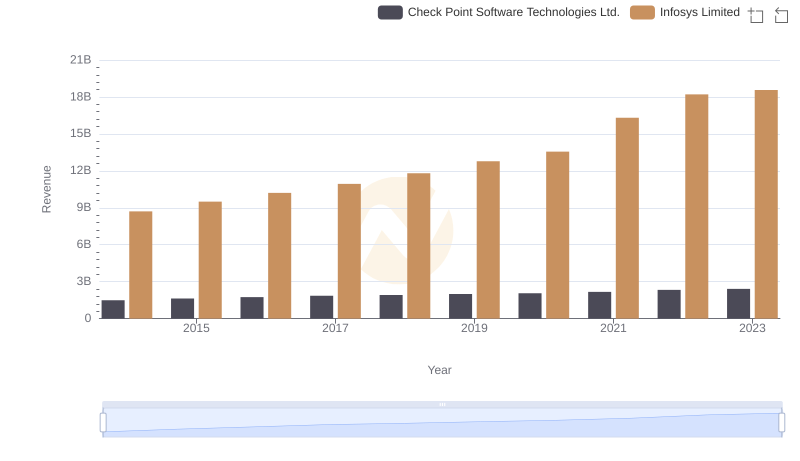

Annual Revenue Comparison: Infosys Limited vs Check Point Software Technologies Ltd.

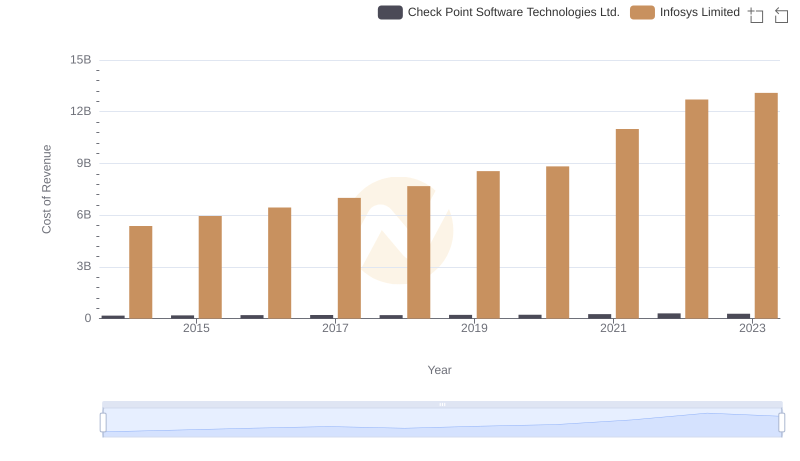

Cost of Revenue Comparison: Infosys Limited vs Check Point Software Technologies Ltd.

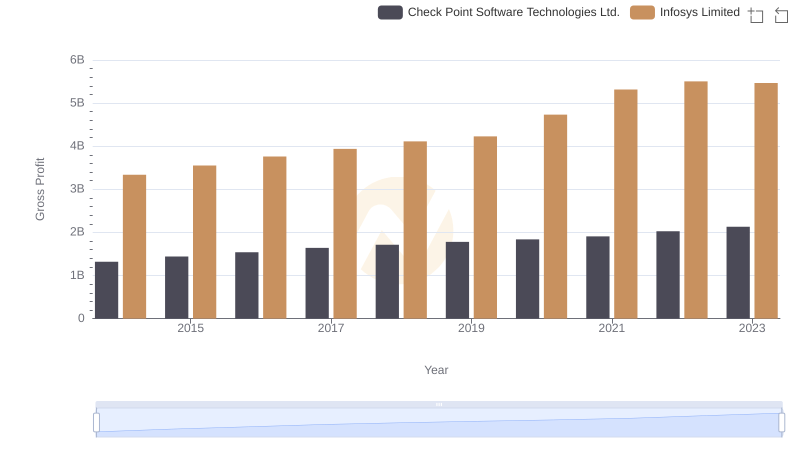

Infosys Limited vs Check Point Software Technologies Ltd.: A Gross Profit Performance Breakdown

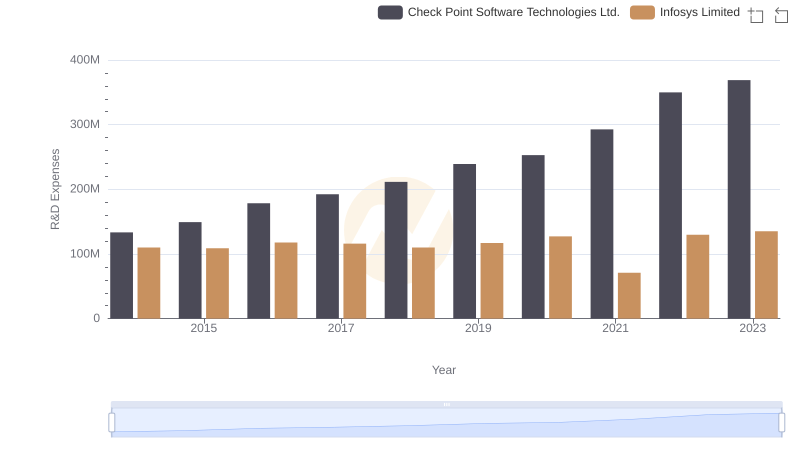

Infosys Limited or Check Point Software Technologies Ltd.: Who Invests More in Innovation?

Who Optimizes SG&A Costs Better? Infosys Limited or Check Point Software Technologies Ltd.

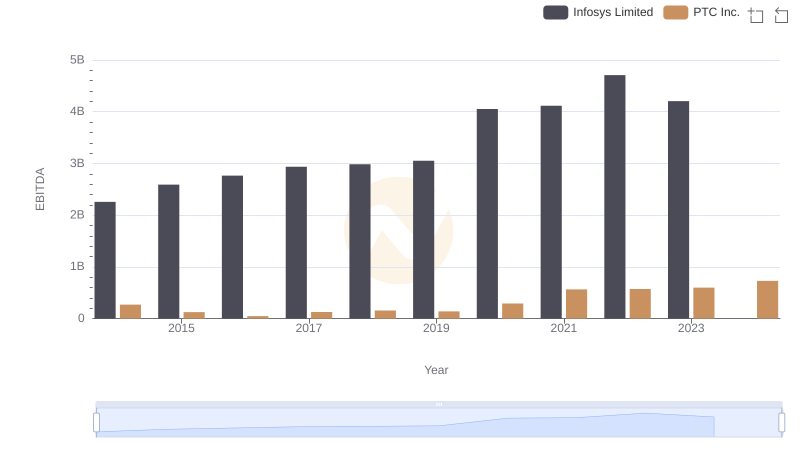

A Side-by-Side Analysis of EBITDA: Infosys Limited and PTC Inc.

A Professional Review of EBITDA: Infosys Limited Compared to ON Semiconductor Corporation

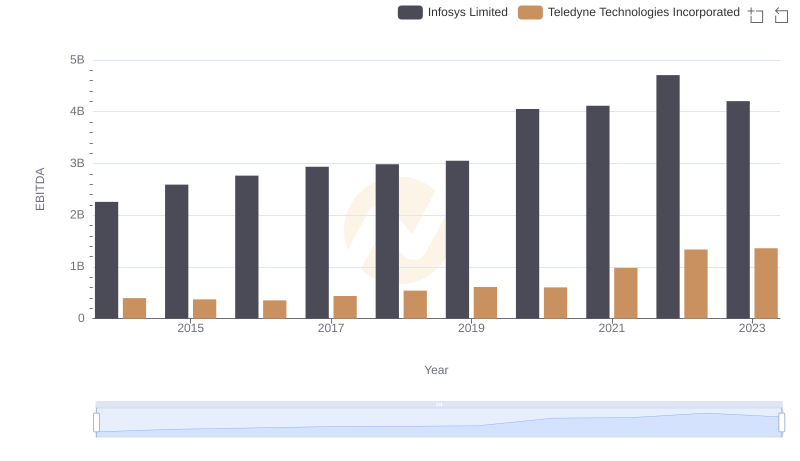

EBITDA Performance Review: Infosys Limited vs Teledyne Technologies Incorporated

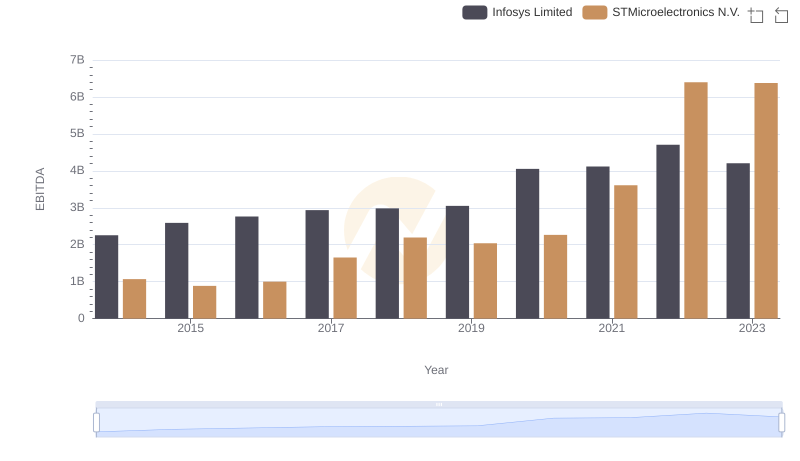

Professional EBITDA Benchmarking: Infosys Limited vs STMicroelectronics N.V.

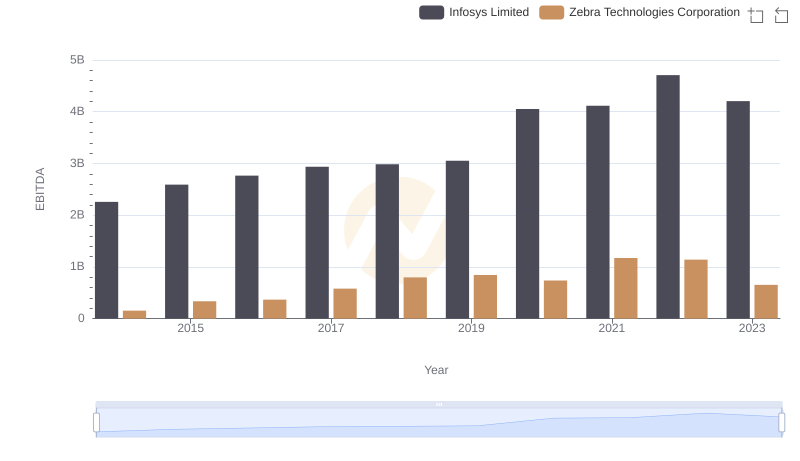

Comprehensive EBITDA Comparison: Infosys Limited vs Zebra Technologies Corporation

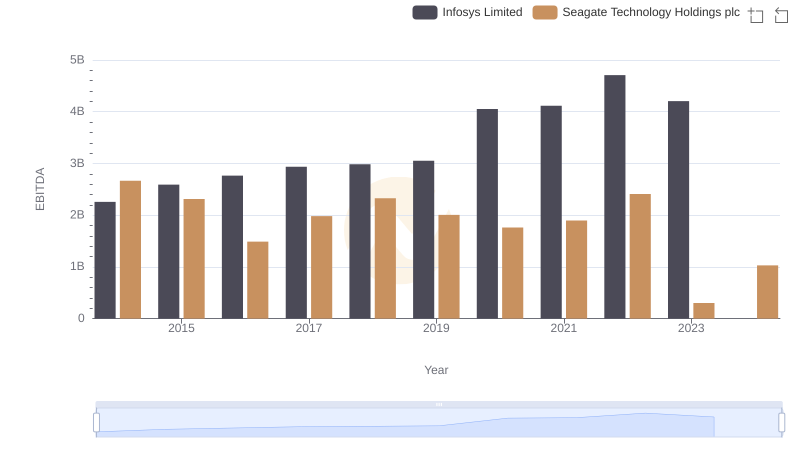

Comparative EBITDA Analysis: Infosys Limited vs Seagate Technology Holdings plc

Infosys Limited and ASE Technology Holding Co., Ltd.: A Detailed Examination of EBITDA Performance