| __timestamp | Infosys Limited | Western Digital Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 761000000 |

| Thursday, January 1, 2015 | 1176000000 | 773000000 |

| Friday, January 1, 2016 | 1020000000 | 997000000 |

| Sunday, January 1, 2017 | 1279000000 | 1445000000 |

| Monday, January 1, 2018 | 1220000000 | 1473000000 |

| Tuesday, January 1, 2019 | 1504000000 | 1317000000 |

| Wednesday, January 1, 2020 | 1223000000 | 1153000000 |

| Friday, January 1, 2021 | 1391000000 | 1105000000 |

| Saturday, January 1, 2022 | 1678000000 | 1117000000 |

| Sunday, January 1, 2023 | 1632000000 | 970000000 |

| Monday, January 1, 2024 | 828000000 |

Unleashing insights

In the competitive world of technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Infosys Limited and Western Digital Corporation, two industry leaders, have shown distinct strategies over the past decade. From 2014 to 2023, Infosys consistently maintained higher SG&A expenses, peaking at approximately 1.68 billion in 2022. This reflects a strategic investment in growth and innovation. In contrast, Western Digital's SG&A expenses peaked in 2018 at around 1.47 billion, followed by a steady decline, reaching about 970 million in 2023. This suggests a focus on cost efficiency and operational optimization. Notably, 2024 data for Infosys is missing, indicating potential reporting delays or strategic shifts. As these companies navigate the evolving tech landscape, their SG&A strategies offer valuable insights into their operational priorities and market positioning.

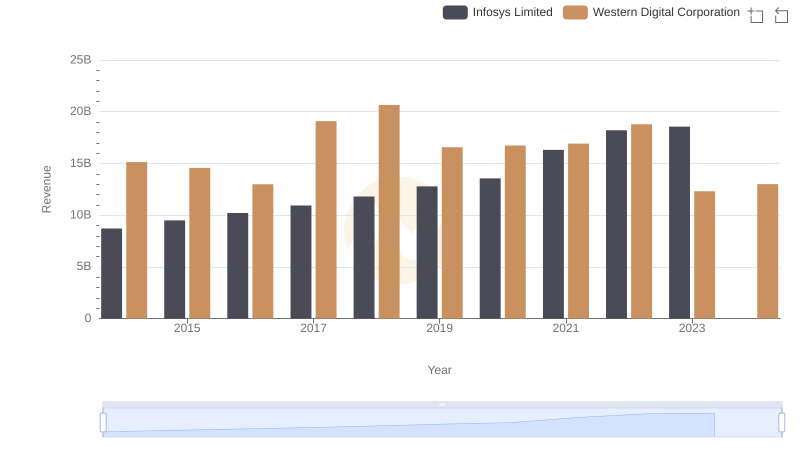

Infosys Limited and Western Digital Corporation: A Comprehensive Revenue Analysis

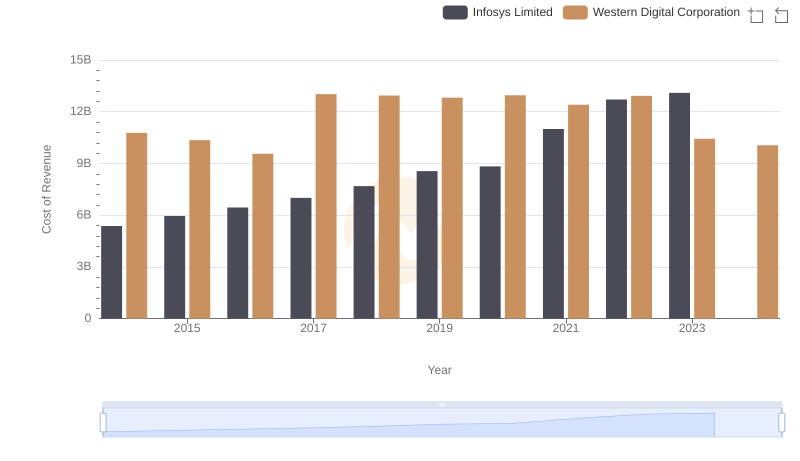

Cost Insights: Breaking Down Infosys Limited and Western Digital Corporation's Expenses

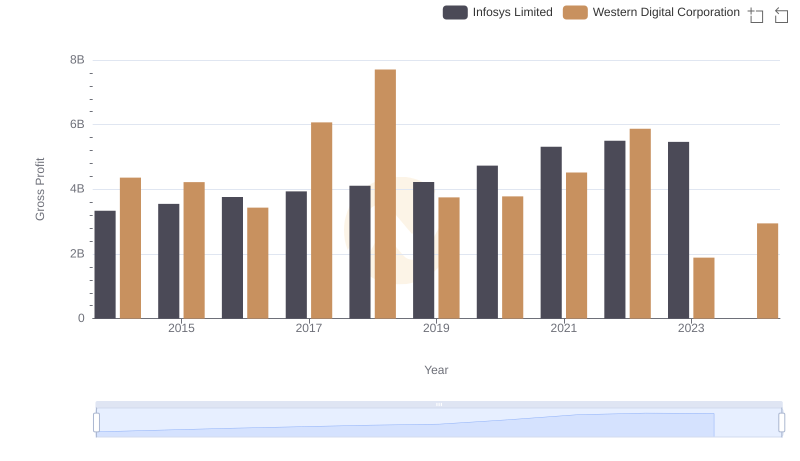

Infosys Limited and Western Digital Corporation: A Detailed Gross Profit Analysis

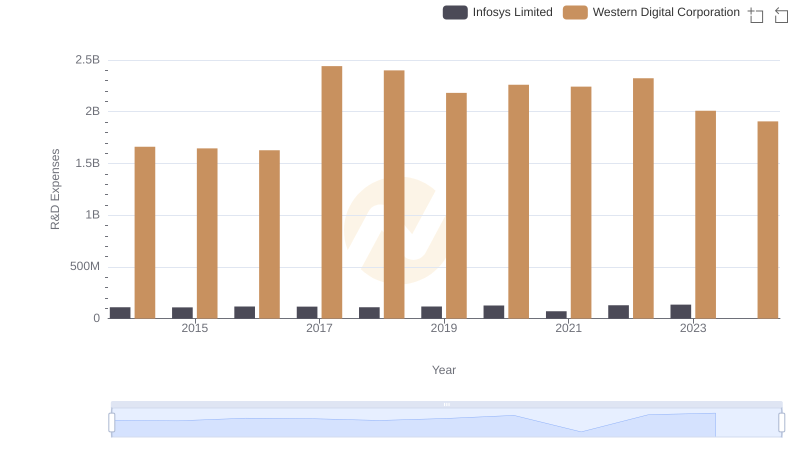

Analyzing R&D Budgets: Infosys Limited vs Western Digital Corporation

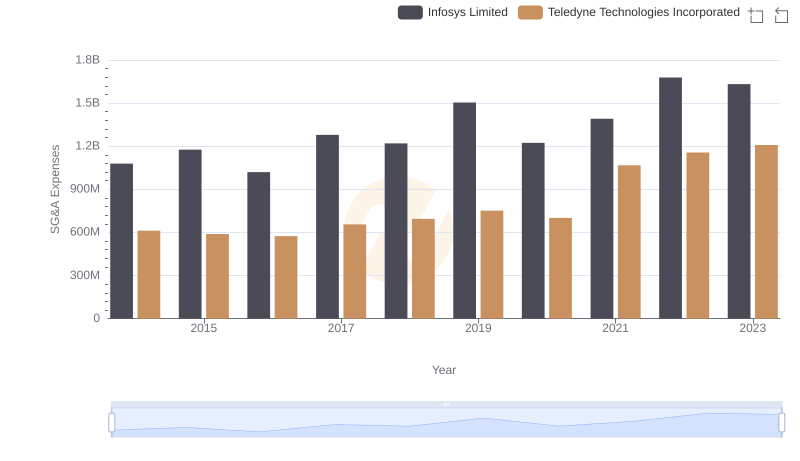

Operational Costs Compared: SG&A Analysis of Infosys Limited and Teledyne Technologies Incorporated

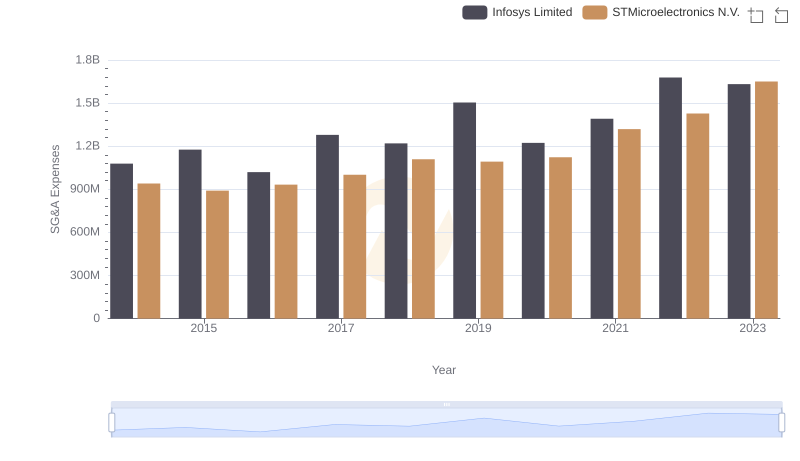

Infosys Limited or STMicroelectronics N.V.: Who Manages SG&A Costs Better?

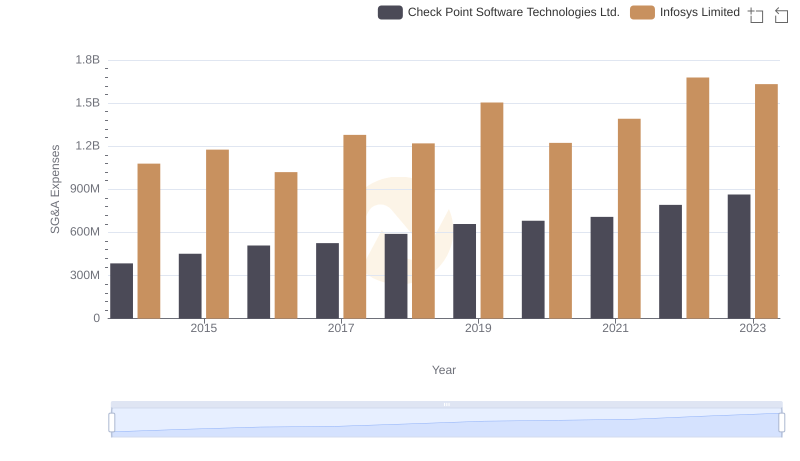

Who Optimizes SG&A Costs Better? Infosys Limited or Check Point Software Technologies Ltd.

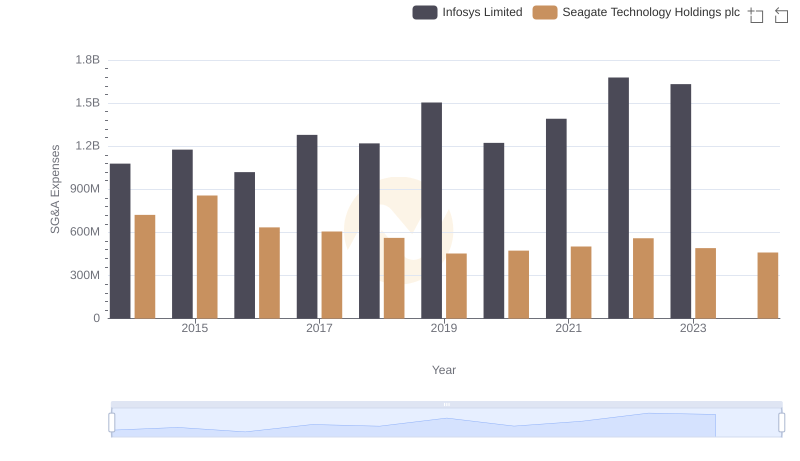

Infosys Limited or Seagate Technology Holdings plc: Who Manages SG&A Costs Better?

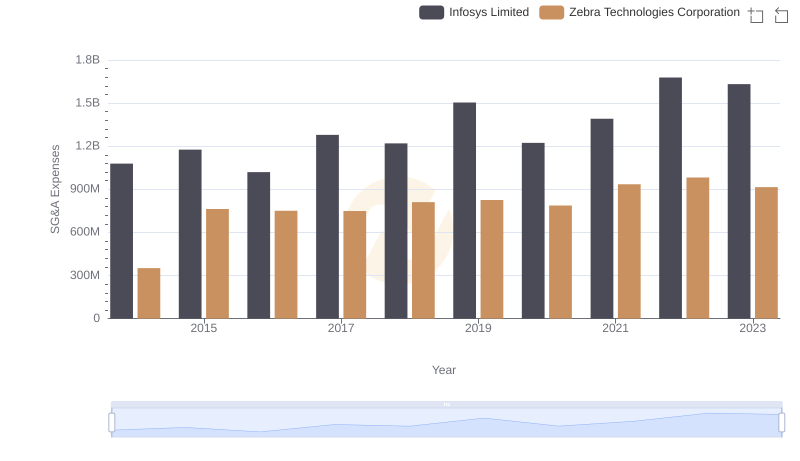

SG&A Efficiency Analysis: Comparing Infosys Limited and Zebra Technologies Corporation

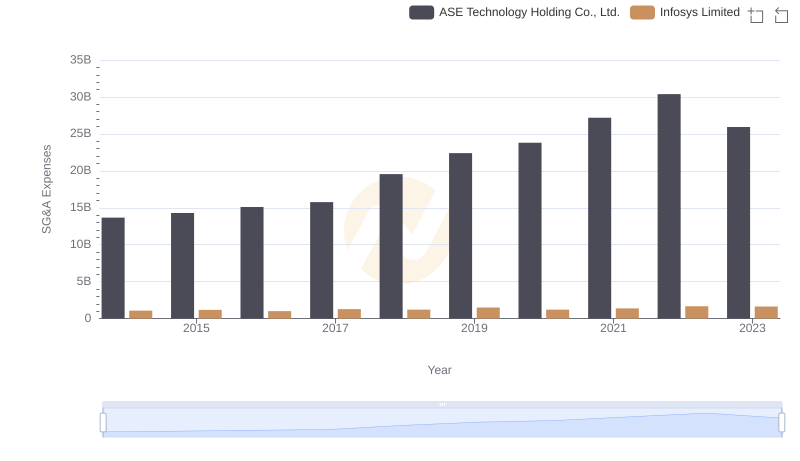

Selling, General, and Administrative Costs: Infosys Limited vs ASE Technology Holding Co., Ltd.

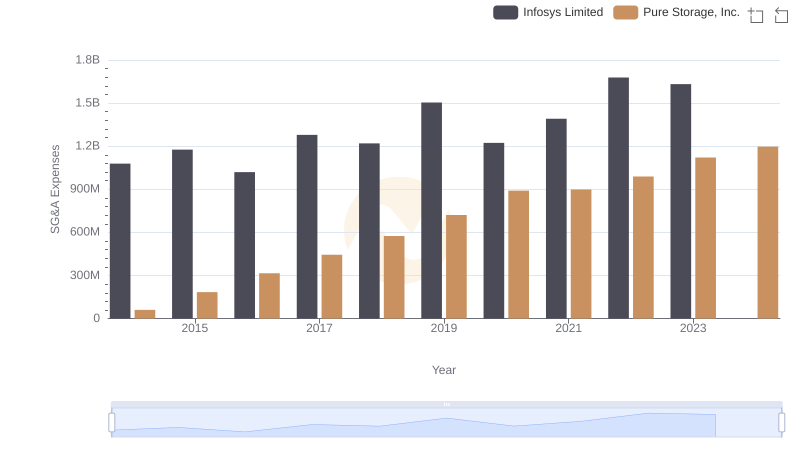

Infosys Limited and Pure Storage, Inc.: SG&A Spending Patterns Compared

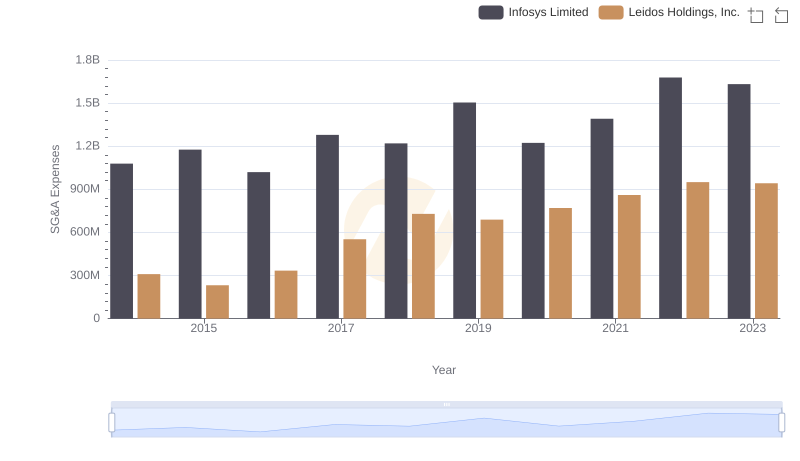

SG&A Efficiency Analysis: Comparing Infosys Limited and Leidos Holdings, Inc.