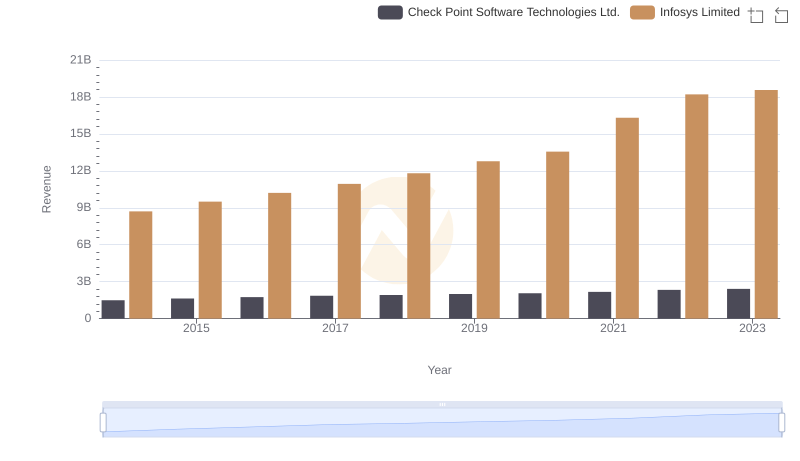

| __timestamp | Check Point Software Technologies Ltd. | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 1319275000 | 3337000000 |

| Thursday, January 1, 2015 | 1440781000 | 3551000000 |

| Friday, January 1, 2016 | 1539298000 | 3762000000 |

| Sunday, January 1, 2017 | 1641695000 | 3938000000 |

| Monday, January 1, 2018 | 1715096000 | 4112000000 |

| Tuesday, January 1, 2019 | 1779400000 | 4228000000 |

| Wednesday, January 1, 2020 | 1838400000 | 4733000000 |

| Friday, January 1, 2021 | 1908700000 | 5315000000 |

| Saturday, January 1, 2022 | 2025500000 | 5503000000 |

| Sunday, January 1, 2023 | 2132100000 | 5466000000 |

Unveiling the hidden dimensions of data

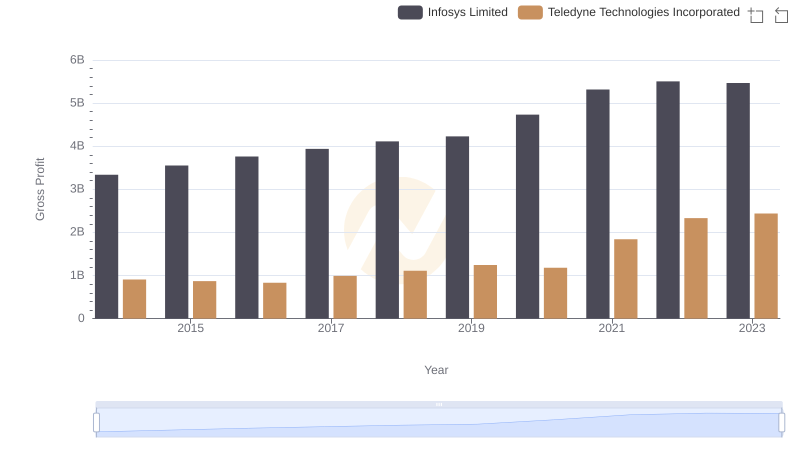

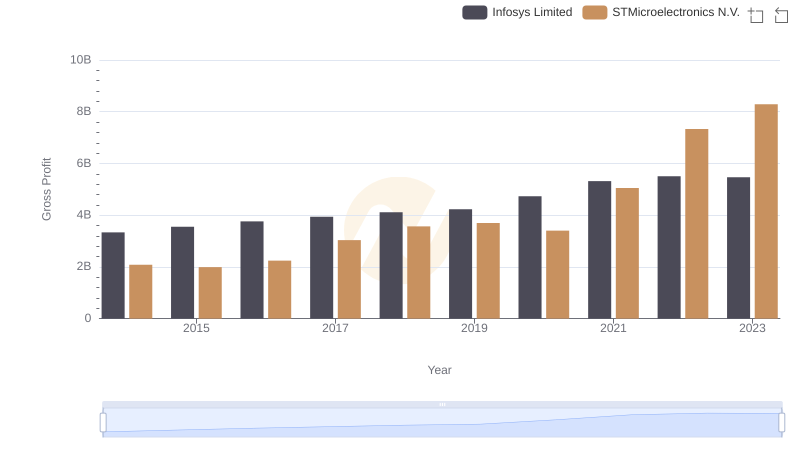

In the ever-evolving landscape of technology, two giants, Infosys Limited and Check Point Software Technologies Ltd., have showcased remarkable growth in gross profit over the past decade. From 2014 to 2023, Infosys has consistently outperformed, with its gross profit soaring by approximately 64%, from $3.34 billion to $5.47 billion. Meanwhile, Check Point Software has demonstrated a steady increase of around 62%, growing from $1.32 billion to $2.13 billion.

This data underscores the resilience and strategic prowess of these tech titans in navigating the competitive global market.

Annual Revenue Comparison: Infosys Limited vs Check Point Software Technologies Ltd.

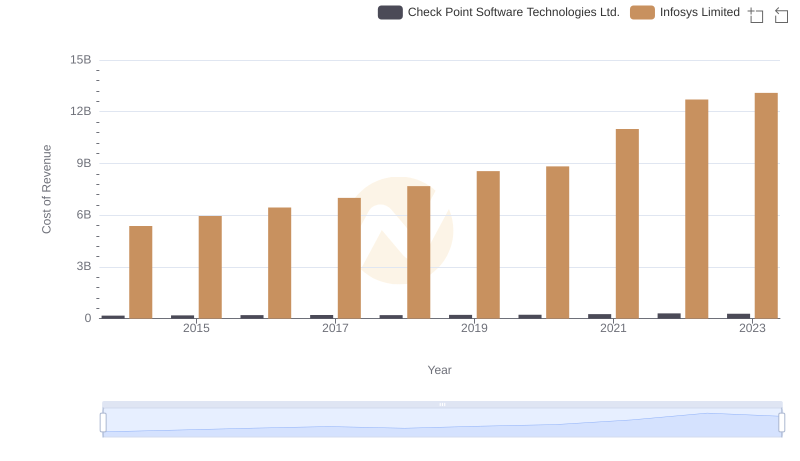

Cost of Revenue Comparison: Infosys Limited vs Check Point Software Technologies Ltd.

Gross Profit Comparison: Infosys Limited and Teledyne Technologies Incorporated Trends

Infosys Limited and STMicroelectronics N.V.: A Detailed Gross Profit Analysis

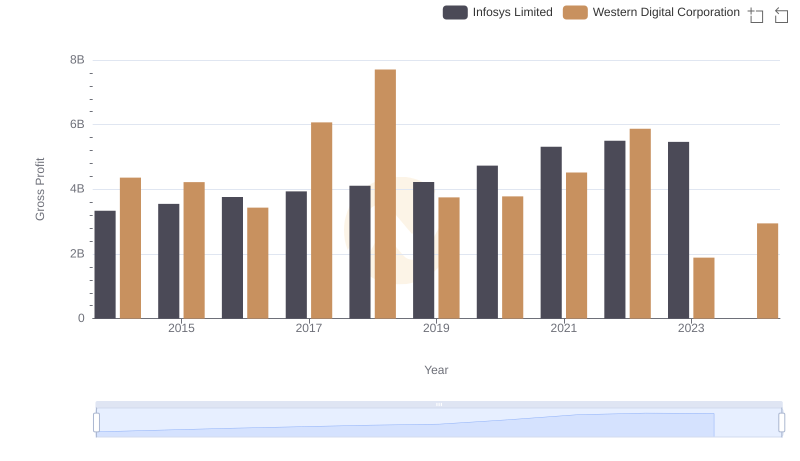

Infosys Limited and Western Digital Corporation: A Detailed Gross Profit Analysis

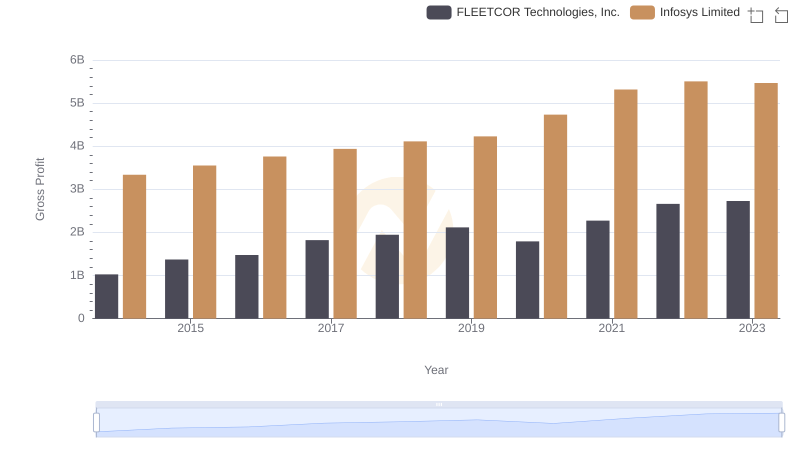

Infosys Limited and FLEETCOR Technologies, Inc.: A Detailed Gross Profit Analysis

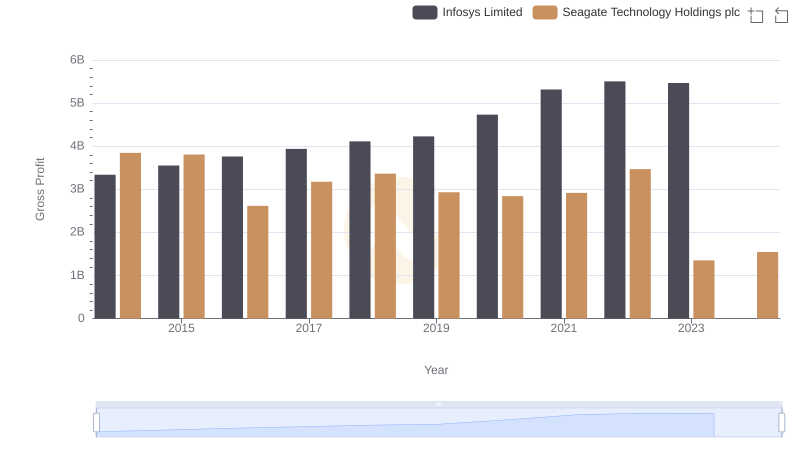

Gross Profit Comparison: Infosys Limited and Seagate Technology Holdings plc Trends

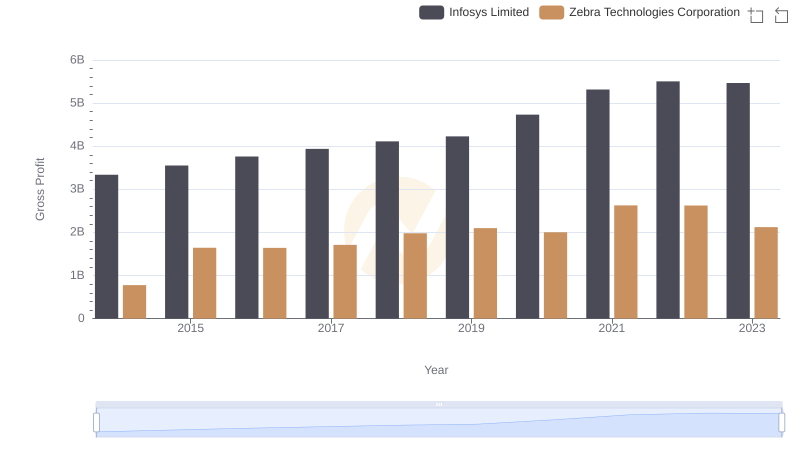

Infosys Limited vs Zebra Technologies Corporation: A Gross Profit Performance Breakdown

Gross Profit Trends Compared: Infosys Limited vs ASE Technology Holding Co., Ltd.

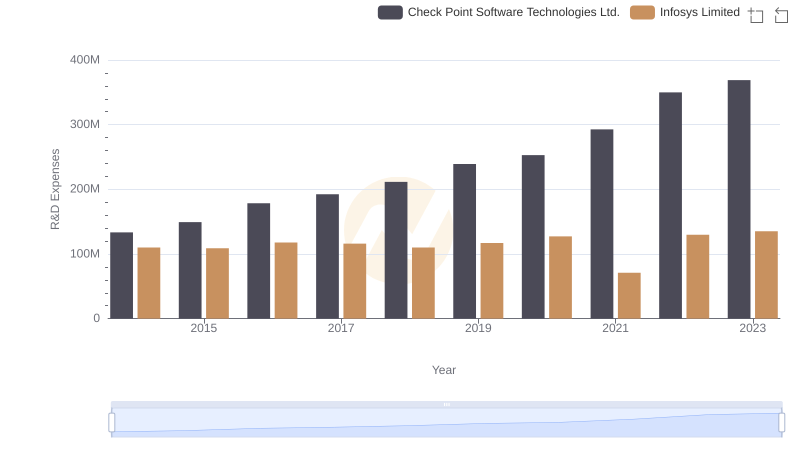

Infosys Limited or Check Point Software Technologies Ltd.: Who Invests More in Innovation?

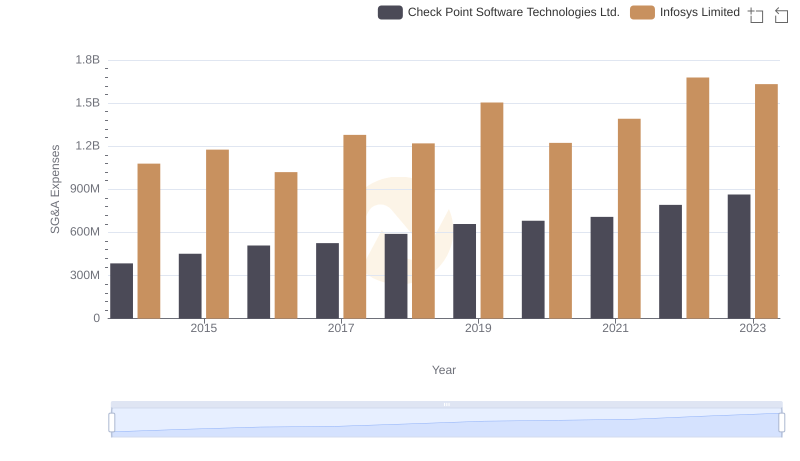

Who Optimizes SG&A Costs Better? Infosys Limited or Check Point Software Technologies Ltd.

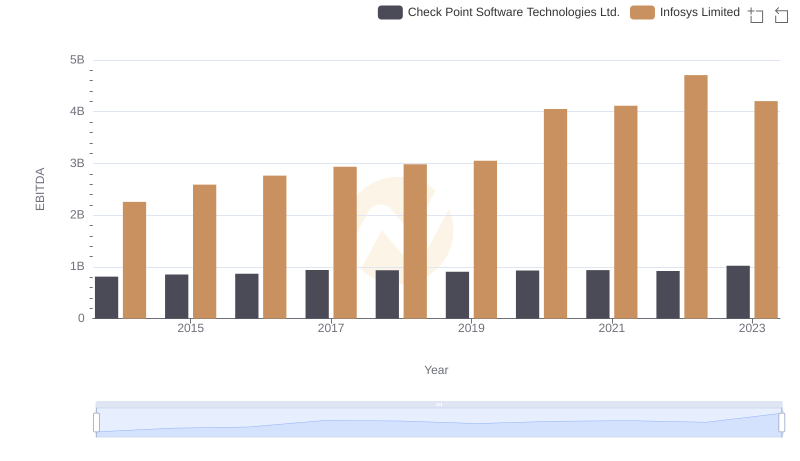

EBITDA Analysis: Evaluating Infosys Limited Against Check Point Software Technologies Ltd.