| __timestamp | C.H. Robinson Worldwide, Inc. | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 320213000 | 1295014000 |

| Thursday, January 1, 2015 | 358760000 | 1325567000 |

| Friday, January 1, 2016 | 375061000 | 1411096000 |

| Sunday, January 1, 2017 | 413404000 | 1488258000 |

| Monday, January 1, 2018 | 449610000 | 1534297000 |

| Tuesday, January 1, 2019 | 497806000 | 2046672000 |

| Wednesday, January 1, 2020 | 496122000 | 2878878000 |

| Friday, January 1, 2021 | 526371000 | 3391161000 |

| Saturday, January 1, 2022 | 603415000 | 3524578000 |

| Sunday, January 1, 2023 | 624266000 | 4073768000 |

| Monday, January 1, 2024 | 639624000 | 4285307000 |

Infusing magic into the data realm

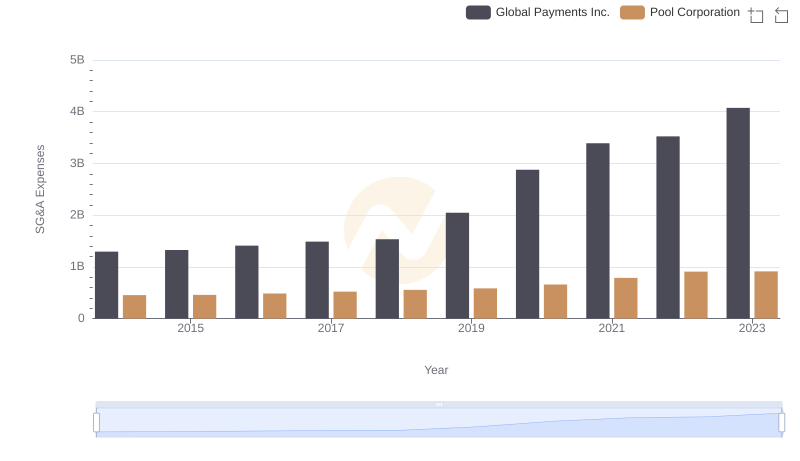

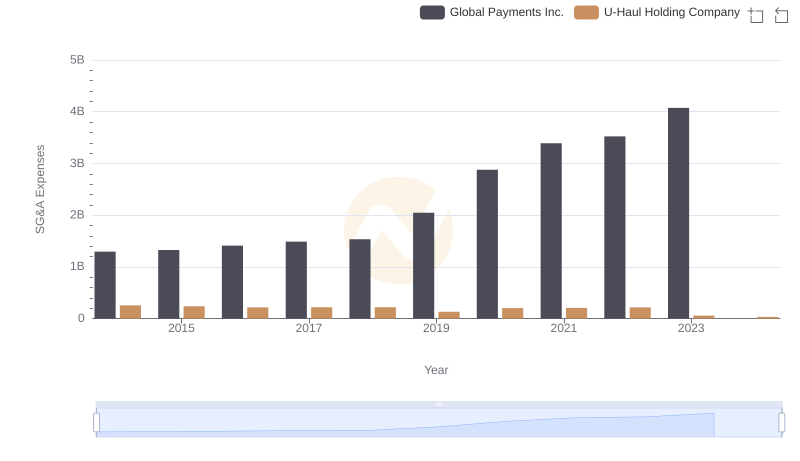

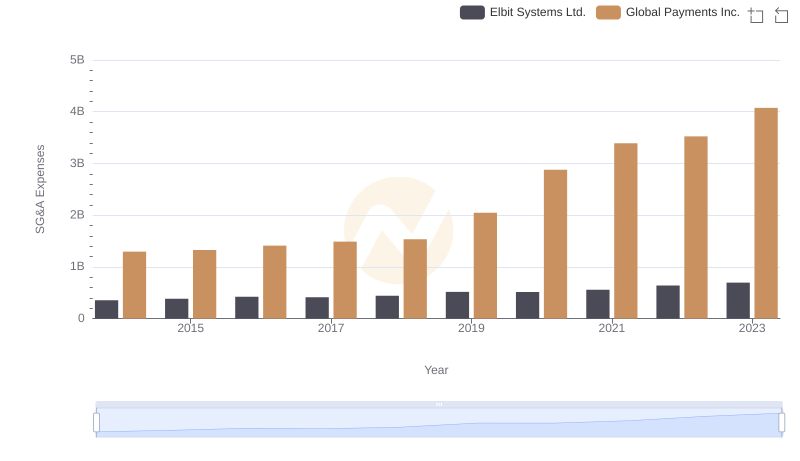

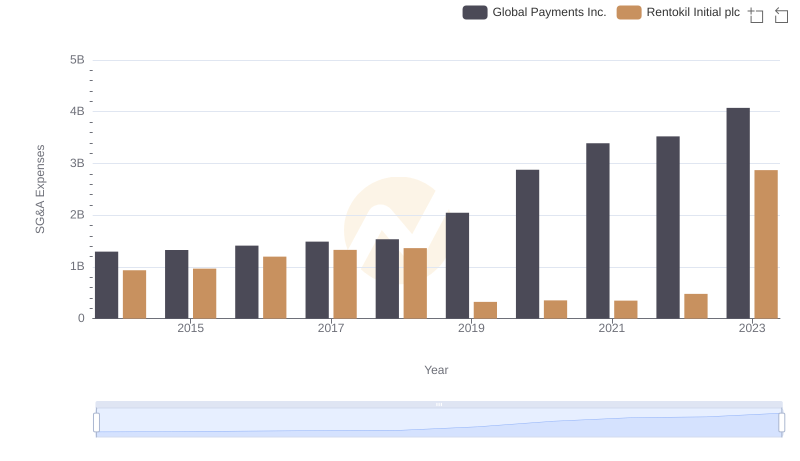

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Global Payments Inc. and C.H. Robinson Worldwide, Inc. have showcased contrasting strategies in this domain. From 2014 to 2023, Global Payments Inc. saw its SG&A expenses rise by approximately 215%, peaking in 2023. In contrast, C.H. Robinson Worldwide, Inc. experienced a more modest increase of around 100% over the same period. This divergence highlights differing operational strategies, with Global Payments Inc. potentially investing more aggressively in growth initiatives. Notably, data for 2024 is incomplete, leaving room for speculation on future trends. As businesses navigate economic uncertainties, the ability to optimize SG&A costs remains a key differentiator in sustaining competitive advantage.

Breaking Down Revenue Trends: Global Payments Inc. vs C.H. Robinson Worldwide, Inc.

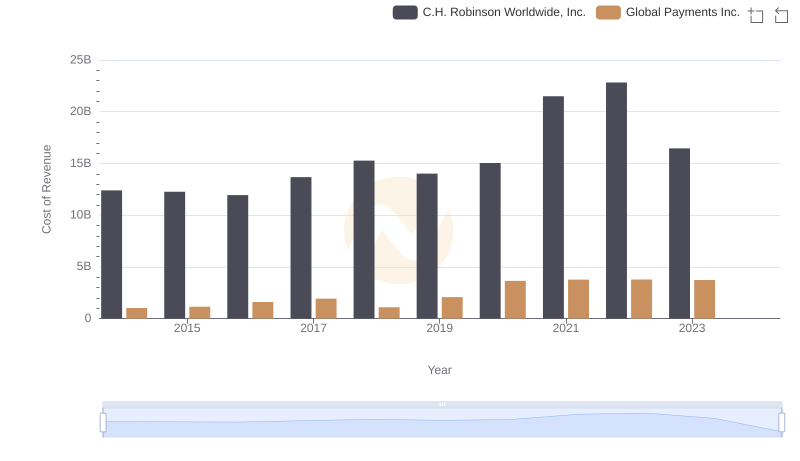

Cost of Revenue Trends: Global Payments Inc. vs C.H. Robinson Worldwide, Inc.

Comparing SG&A Expenses: Global Payments Inc. vs Pool Corporation Trends and Insights

Cost Management Insights: SG&A Expenses for Global Payments Inc. and U-Haul Holding Company

Global Payments Inc. or Elbit Systems Ltd.: Who Manages SG&A Costs Better?

Who Optimizes SG&A Costs Better? Global Payments Inc. or Clean Harbors, Inc.

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Rentokil Initial plc

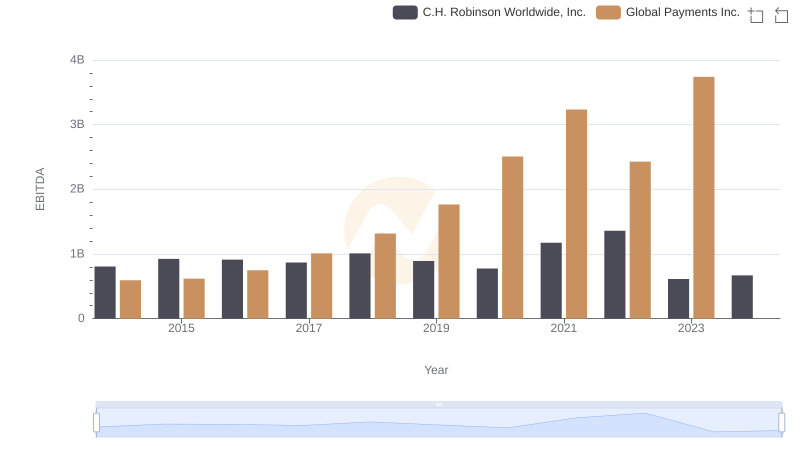

A Side-by-Side Analysis of EBITDA: Global Payments Inc. and C.H. Robinson Worldwide, Inc.