| __timestamp | Clean Harbors, Inc. | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 437921000 | 1295014000 |

| Thursday, January 1, 2015 | 414164000 | 1325567000 |

| Friday, January 1, 2016 | 422015000 | 1411096000 |

| Sunday, January 1, 2017 | 456648000 | 1488258000 |

| Monday, January 1, 2018 | 503747000 | 1534297000 |

| Tuesday, January 1, 2019 | 484054000 | 2046672000 |

| Wednesday, January 1, 2020 | 451044000 | 2878878000 |

| Friday, January 1, 2021 | 537962000 | 3391161000 |

| Saturday, January 1, 2022 | 627391000 | 3524578000 |

| Sunday, January 1, 2023 | 671161000 | 4073768000 |

| Monday, January 1, 2024 | 739629000 | 4285307000 |

In pursuit of knowledge

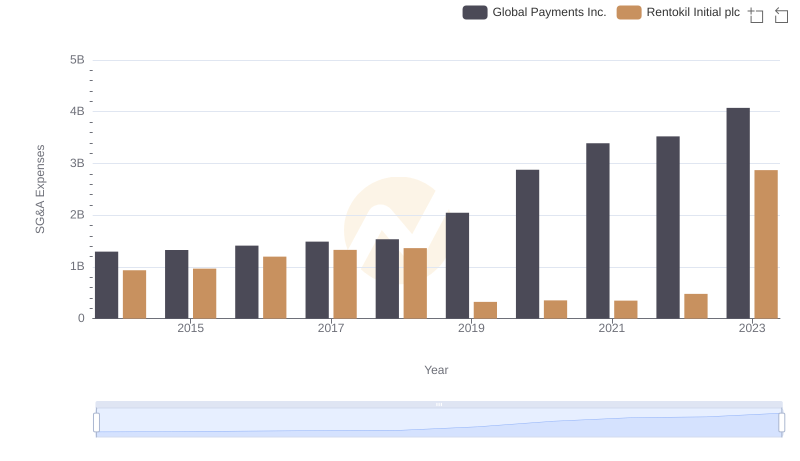

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Global Payments Inc. and Clean Harbors, Inc. have showcased contrasting strategies in this domain. From 2014 to 2023, Global Payments Inc. saw a staggering 214% increase in SG&A expenses, peaking in 2023. In contrast, Clean Harbors, Inc. experienced a more modest 53% rise over the same period.

While Global Payments Inc. has expanded its operations, reflected in its rising SG&A costs, Clean Harbors, Inc. has maintained a steadier growth trajectory. This divergence highlights the different operational strategies and market dynamics each company faces. As businesses navigate the complexities of cost management, these insights offer valuable lessons in balancing growth with efficiency.

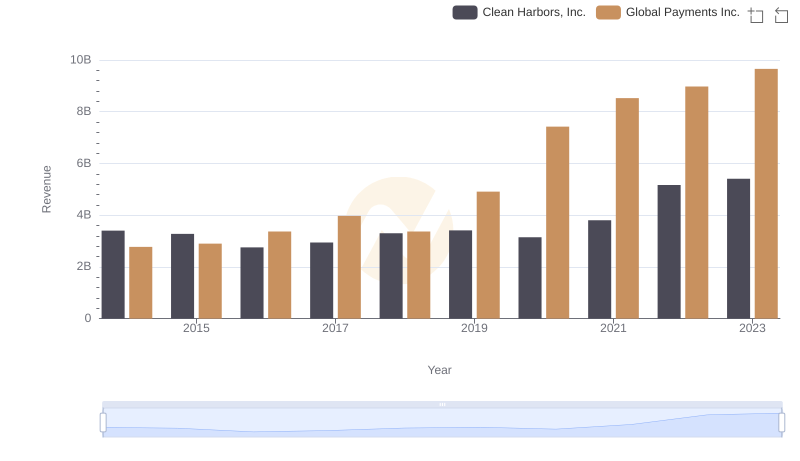

Global Payments Inc. or Clean Harbors, Inc.: Who Leads in Yearly Revenue?

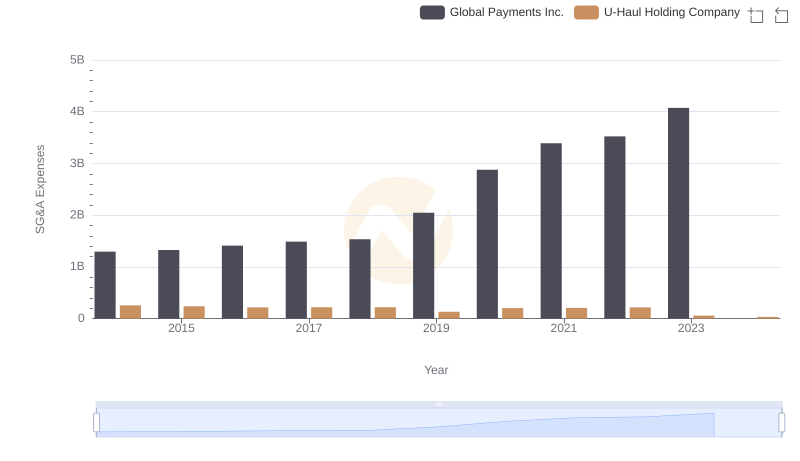

Cost Management Insights: SG&A Expenses for Global Payments Inc. and U-Haul Holding Company

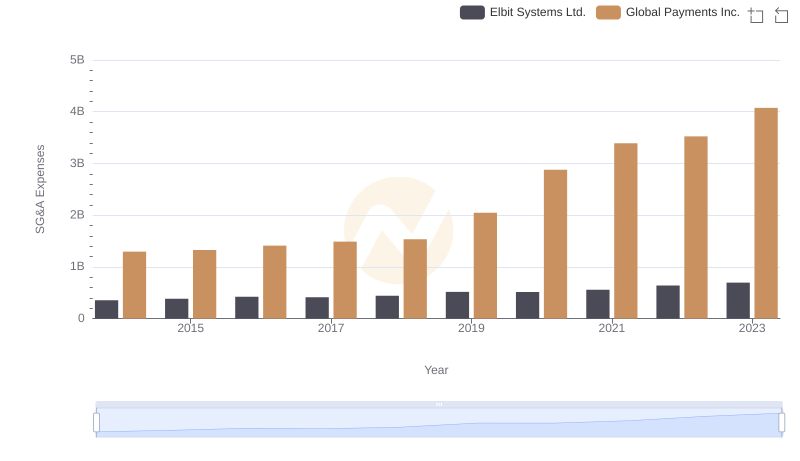

Global Payments Inc. or Elbit Systems Ltd.: Who Manages SG&A Costs Better?

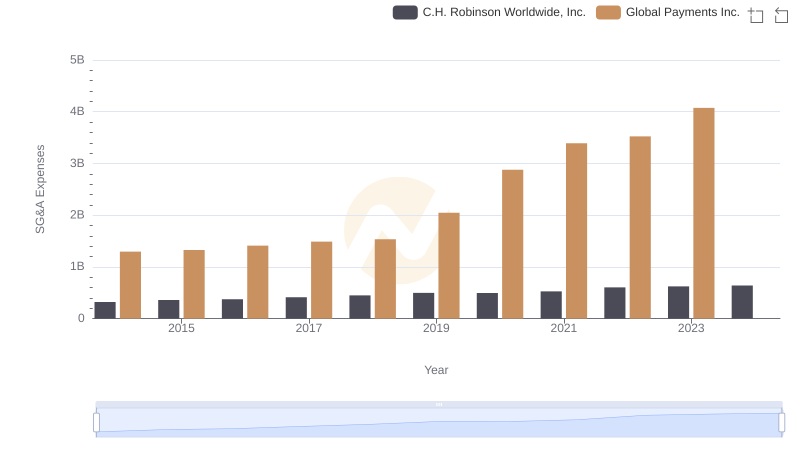

Who Optimizes SG&A Costs Better? Global Payments Inc. or C.H. Robinson Worldwide, Inc.

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Rentokil Initial plc

Global Payments Inc. or ITT Inc.: Who Manages SG&A Costs Better?