| __timestamp | Elbit Systems Ltd. | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 356171000 | 1295014000 |

| Thursday, January 1, 2015 | 385059000 | 1325567000 |

| Friday, January 1, 2016 | 422390000 | 1411096000 |

| Sunday, January 1, 2017 | 413560000 | 1488258000 |

| Monday, January 1, 2018 | 441362000 | 1534297000 |

| Tuesday, January 1, 2019 | 516149000 | 2046672000 |

| Wednesday, January 1, 2020 | 514638000 | 2878878000 |

| Friday, January 1, 2021 | 559113000 | 3391161000 |

| Saturday, January 1, 2022 | 639067000 | 3524578000 |

| Sunday, January 1, 2023 | 696022000 | 4073768000 |

| Monday, January 1, 2024 | 4285307000 |

In pursuit of knowledge

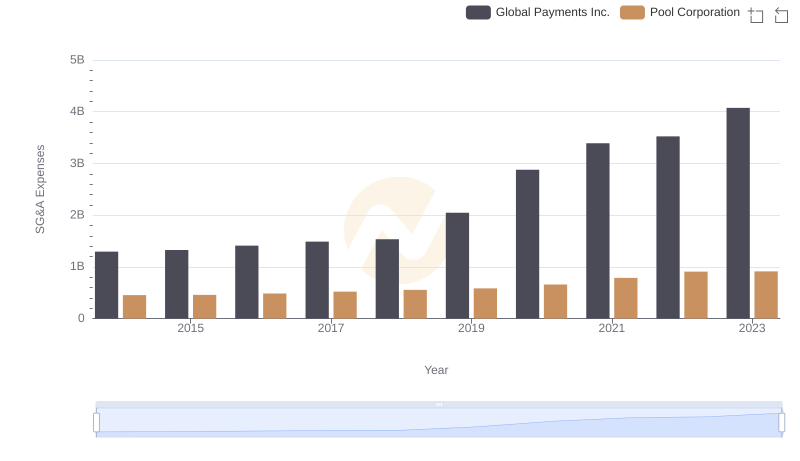

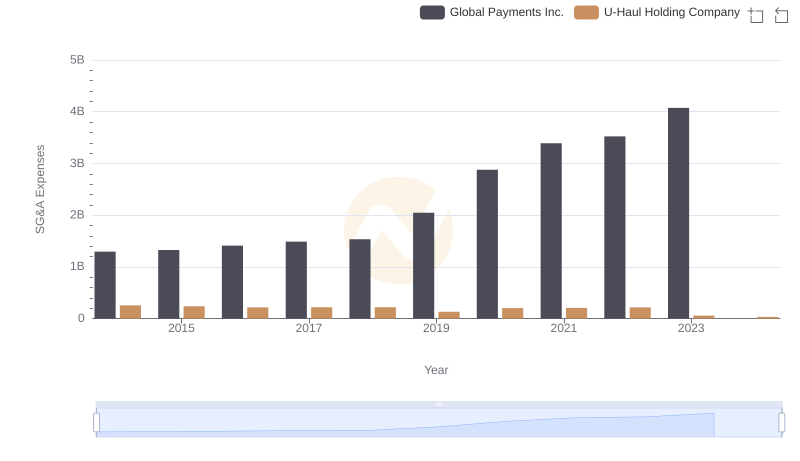

In the competitive landscape of global finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Global Payments Inc. and Elbit Systems Ltd. have demonstrated contrasting approaches to SG&A cost management.

From 2014 to 2023, Global Payments Inc. saw a staggering 214% increase in SG&A expenses, peaking at over $4 billion in 2023. This growth reflects the company's aggressive expansion strategy. In contrast, Elbit Systems Ltd. maintained a more conservative approach, with a 95% increase over the same period, reaching approximately $696 million in 2023.

While Global Payments Inc. has embraced higher costs to fuel growth, Elbit Systems Ltd. has focused on efficiency, keeping its SG&A expenses relatively stable. This comparison highlights the strategic choices companies make in balancing growth and cost management.

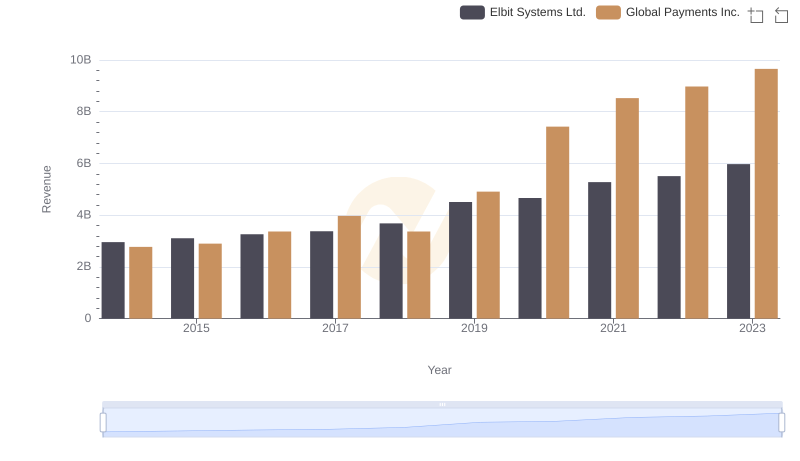

Global Payments Inc. vs Elbit Systems Ltd.: Annual Revenue Growth Compared

Comparing SG&A Expenses: Global Payments Inc. vs Pool Corporation Trends and Insights

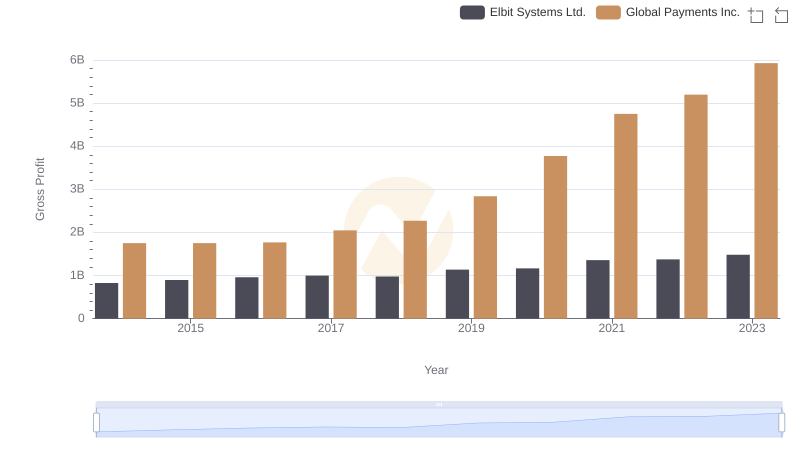

Gross Profit Analysis: Comparing Global Payments Inc. and Elbit Systems Ltd.

Cost Management Insights: SG&A Expenses for Global Payments Inc. and U-Haul Holding Company

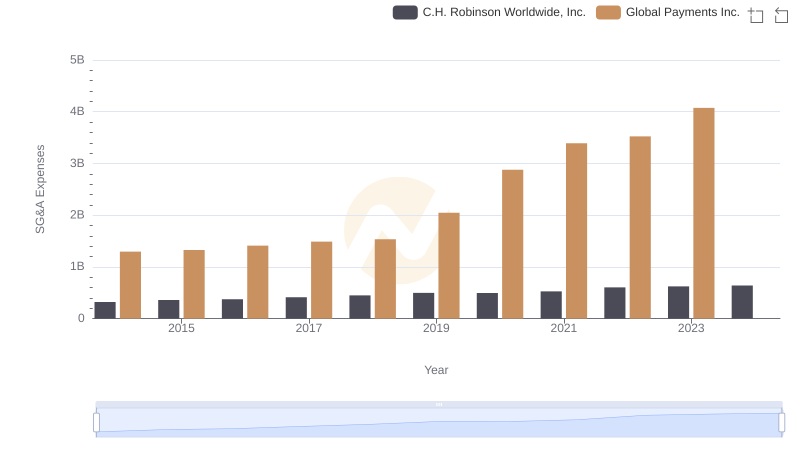

Who Optimizes SG&A Costs Better? Global Payments Inc. or C.H. Robinson Worldwide, Inc.

Who Optimizes SG&A Costs Better? Global Payments Inc. or Clean Harbors, Inc.

EBITDA Metrics Evaluated: Global Payments Inc. vs Elbit Systems Ltd.

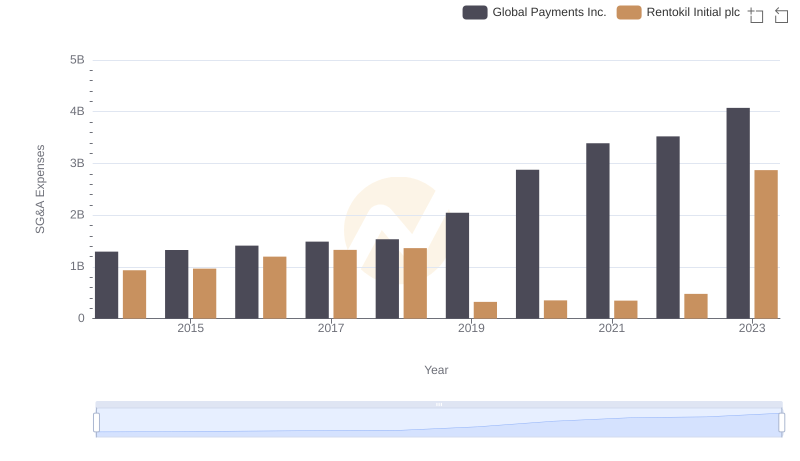

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Rentokil Initial plc