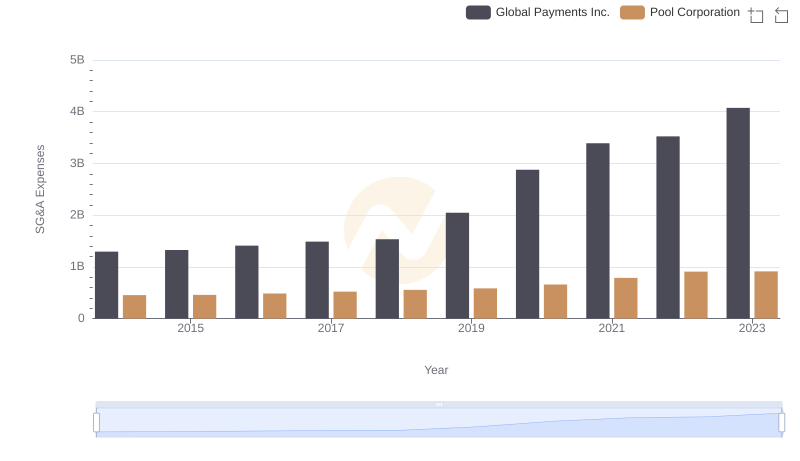

| __timestamp | Global Payments Inc. | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 1295014000 | 257168000 |

| Thursday, January 1, 2015 | 1325567000 | 238558000 |

| Friday, January 1, 2016 | 1411096000 | 217216000 |

| Sunday, January 1, 2017 | 1488258000 | 220053000 |

| Monday, January 1, 2018 | 1534297000 | 219271000 |

| Tuesday, January 1, 2019 | 2046672000 | 133435000 |

| Wednesday, January 1, 2020 | 2878878000 | 201718000 |

| Friday, January 1, 2021 | 3391161000 | 207982000 |

| Saturday, January 1, 2022 | 3524578000 | 216557000 |

| Sunday, January 1, 2023 | 4073768000 | 58753000 |

| Monday, January 1, 2024 | 4285307000 | 32654000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, effective cost management is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Global Payments Inc. and U-Haul Holding Company from 2014 to 2023. Over this period, Global Payments Inc. saw a staggering 214% increase in SG&A expenses, peaking in 2023. In contrast, U-Haul Holding Company experienced a more modest fluctuation, with a notable dip in 2023, reflecting a 77% decrease from its 2014 figures. This divergence highlights the distinct strategic approaches of these companies in managing operational costs. While Global Payments Inc. has expanded its operational footprint, U-Haul appears to be tightening its belt, possibly in response to market conditions or strategic realignment. Missing data for 2024 suggests a need for further analysis to understand future trends. This insight underscores the importance of adaptive cost strategies in maintaining competitive advantage.

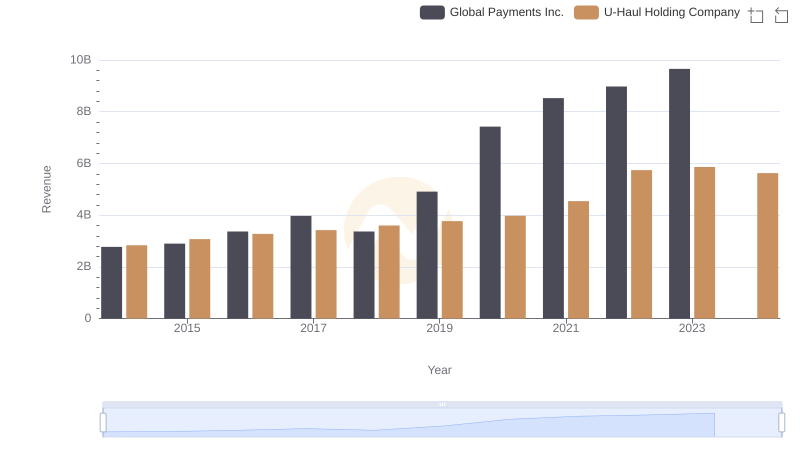

Comparing Revenue Performance: Global Payments Inc. or U-Haul Holding Company?

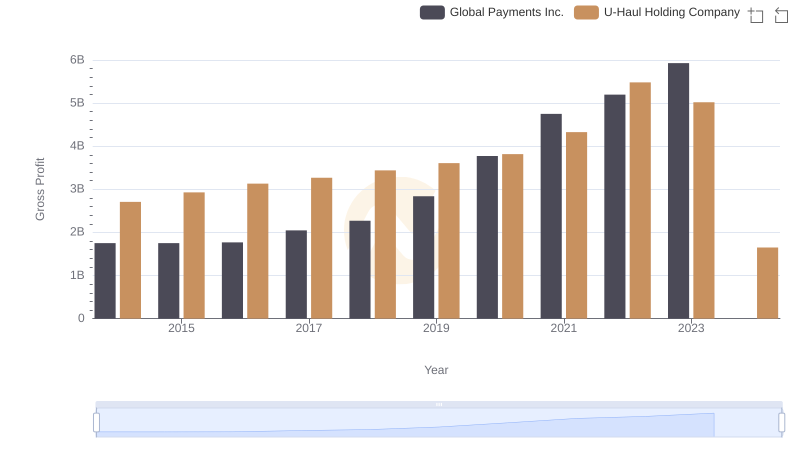

Analyzing Cost of Revenue: Global Payments Inc. and U-Haul Holding Company

Gross Profit Comparison: Global Payments Inc. and U-Haul Holding Company Trends

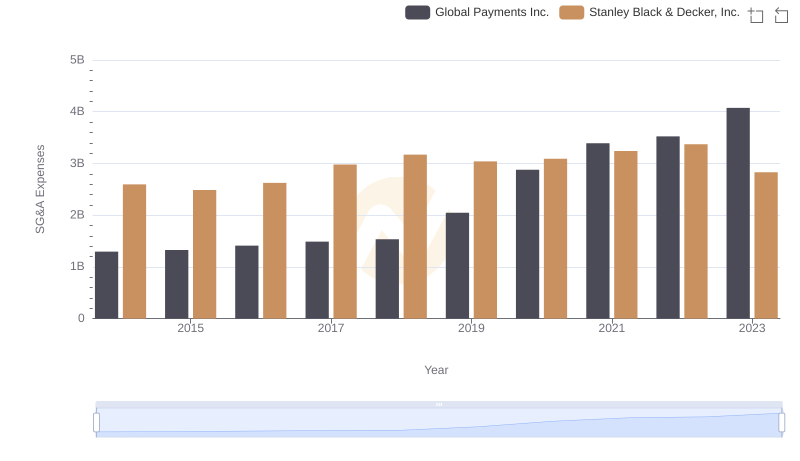

Breaking Down SG&A Expenses: Global Payments Inc. vs Stanley Black & Decker, Inc.

Comparing SG&A Expenses: Global Payments Inc. vs Pool Corporation Trends and Insights

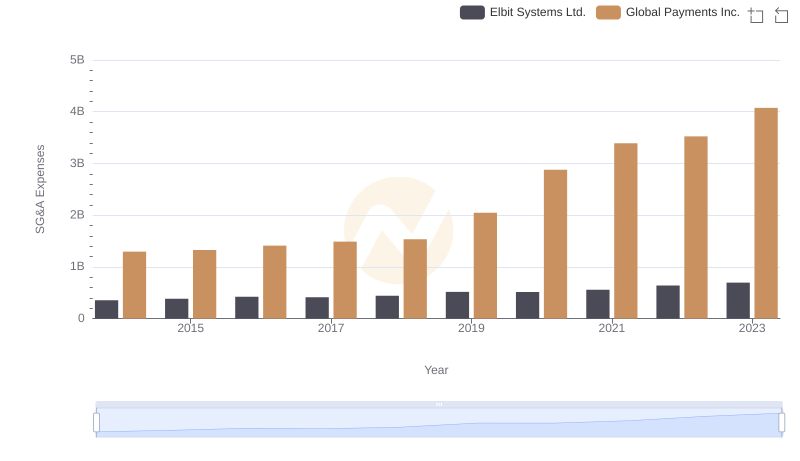

Global Payments Inc. or Elbit Systems Ltd.: Who Manages SG&A Costs Better?

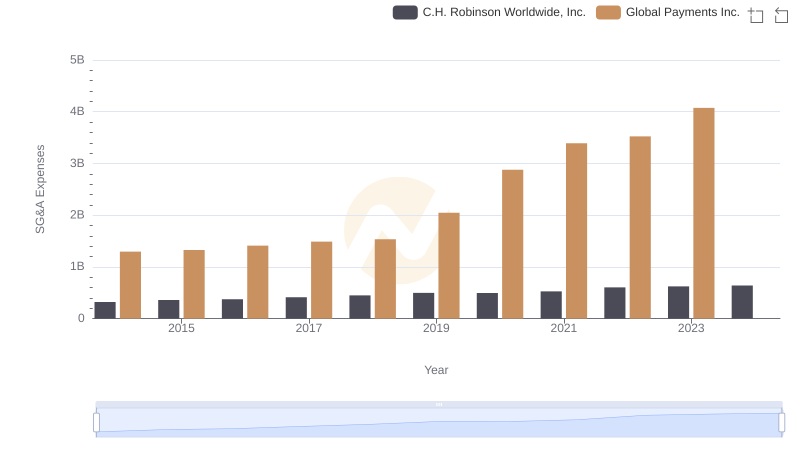

Who Optimizes SG&A Costs Better? Global Payments Inc. or C.H. Robinson Worldwide, Inc.

Who Optimizes SG&A Costs Better? Global Payments Inc. or Clean Harbors, Inc.