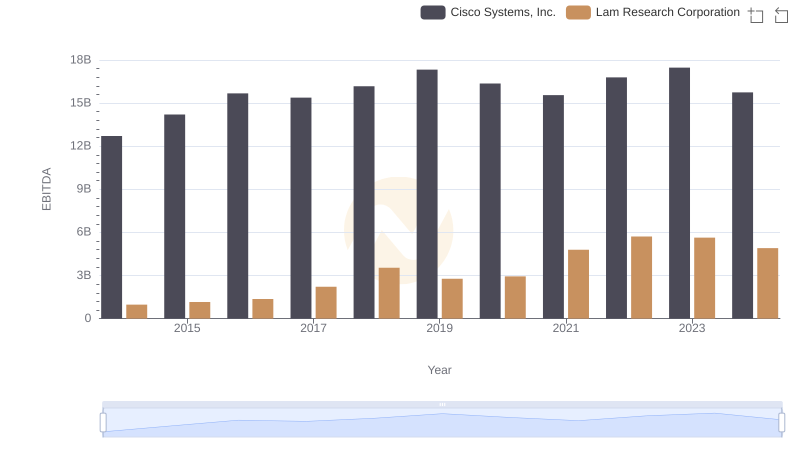

| __timestamp | Cisco Systems, Inc. | Lam Research Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 11437000000 | 613341000 |

| Thursday, January 1, 2015 | 11861000000 | 591611000 |

| Friday, January 1, 2016 | 11433000000 | 630954000 |

| Sunday, January 1, 2017 | 11177000000 | 667485000 |

| Monday, January 1, 2018 | 11386000000 | 762219000 |

| Tuesday, January 1, 2019 | 11398000000 | 702407000 |

| Wednesday, January 1, 2020 | 11094000000 | 682479000 |

| Friday, January 1, 2021 | 11411000000 | 829875000 |

| Saturday, January 1, 2022 | 11186000000 | 885737000 |

| Sunday, January 1, 2023 | 12358000000 | 832753000 |

| Monday, January 1, 2024 | 13177000000 | 868247000 |

Unleashing the power of data

In the competitive landscape of technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Cisco Systems, Inc. and Lam Research Corporation, two titans in their respective fields, have shown distinct strategies over the past decade. From 2014 to 2024, Cisco's SG&A expenses have seen a modest increase of about 15%, peaking in 2024. In contrast, Lam Research has maintained a more stable trajectory, with expenses rising by approximately 42% over the same period. This suggests that while Cisco is expanding its operational footprint, Lam Research is optimizing its cost structure more effectively. The data highlights the importance of strategic cost management in sustaining growth and competitiveness in the tech industry. As these companies continue to evolve, their ability to control SG&A costs will remain a key indicator of their financial health and operational efficiency.

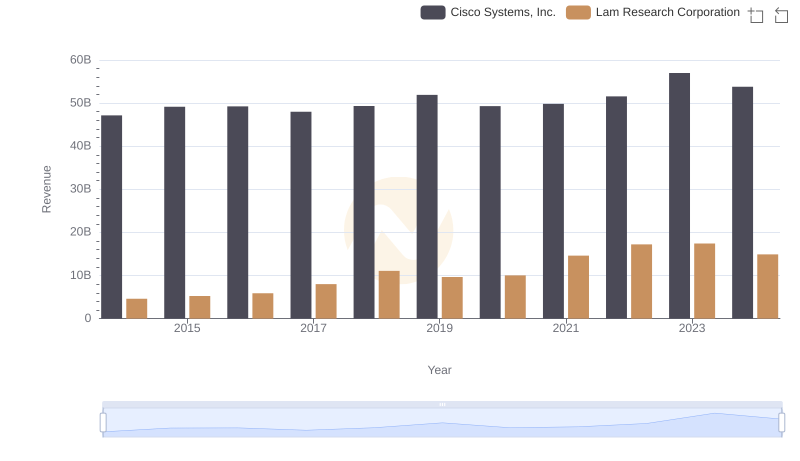

Cisco Systems, Inc. or Lam Research Corporation: Who Leads in Yearly Revenue?

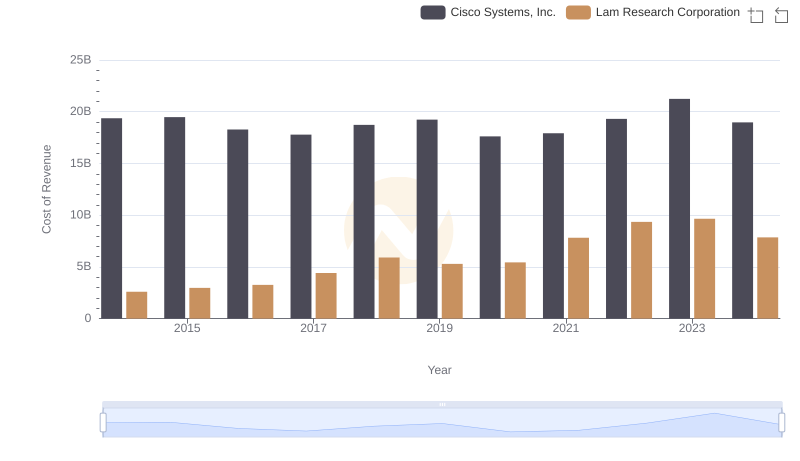

Analyzing Cost of Revenue: Cisco Systems, Inc. and Lam Research Corporation

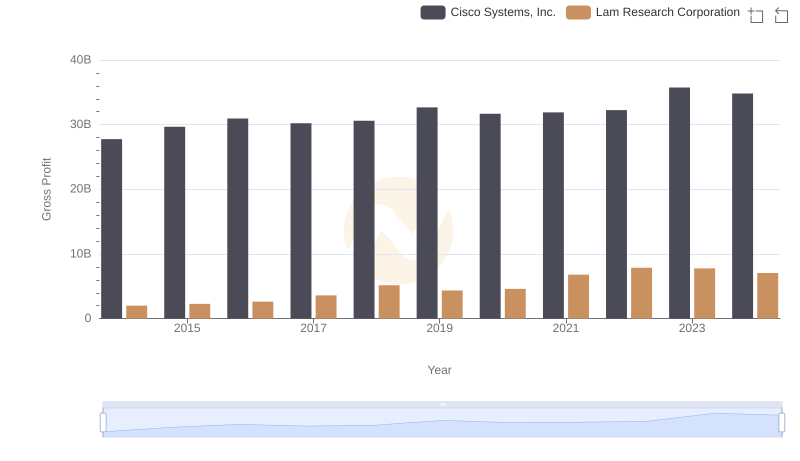

Who Generates Higher Gross Profit? Cisco Systems, Inc. or Lam Research Corporation

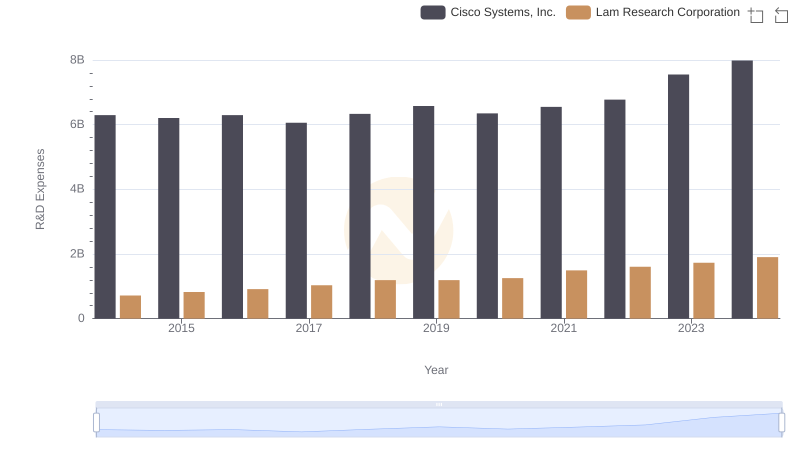

Research and Development Investment: Cisco Systems, Inc. vs Lam Research Corporation

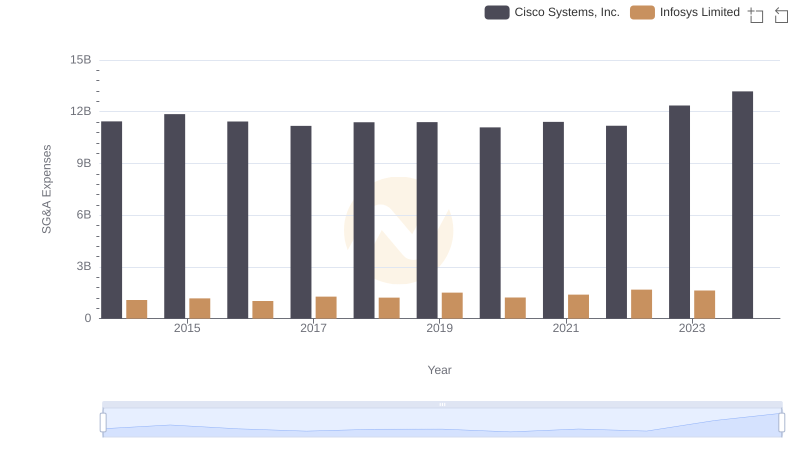

Cisco Systems, Inc. and Infosys Limited: SG&A Spending Patterns Compared

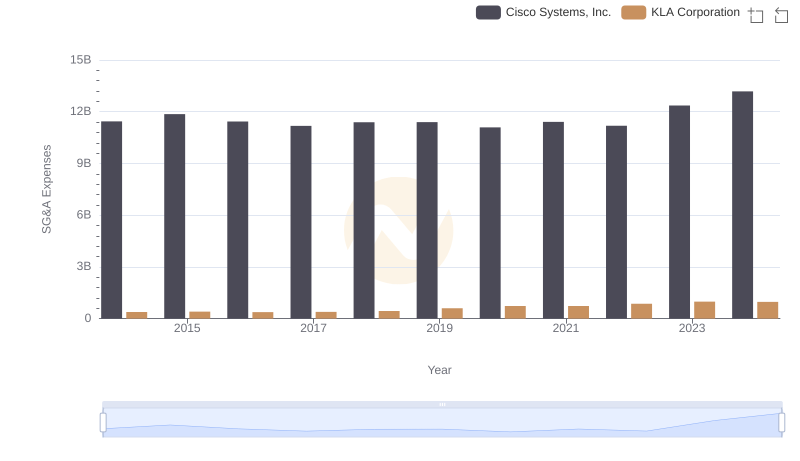

Who Optimizes SG&A Costs Better? Cisco Systems, Inc. or KLA Corporation

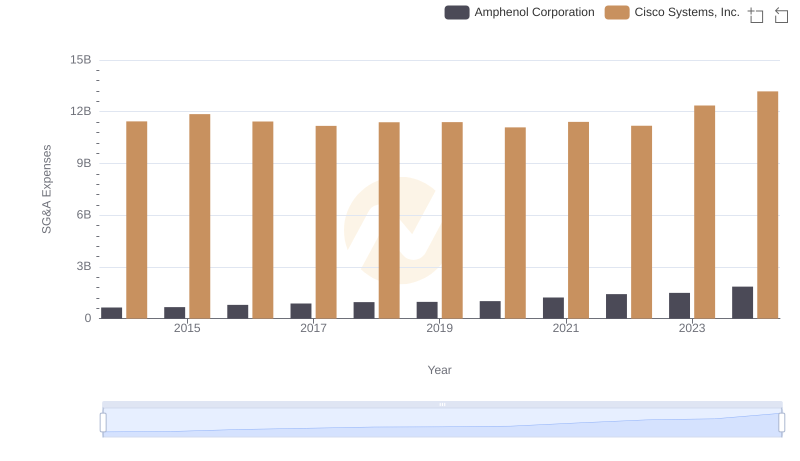

Operational Costs Compared: SG&A Analysis of Cisco Systems, Inc. and Amphenol Corporation

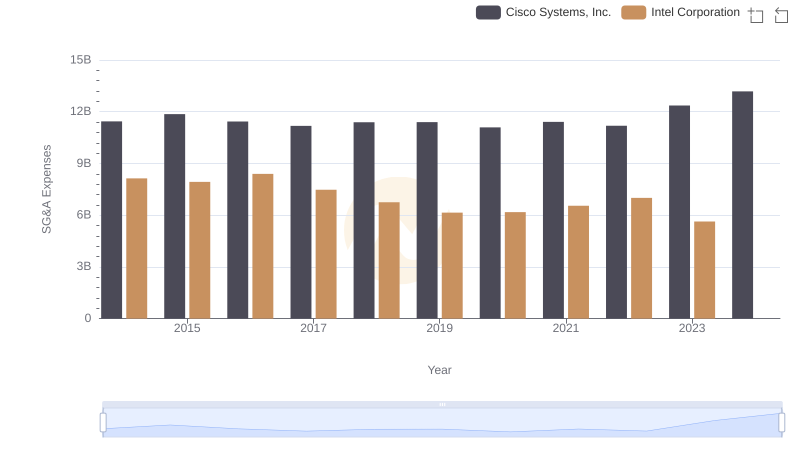

Operational Costs Compared: SG&A Analysis of Cisco Systems, Inc. and Intel Corporation

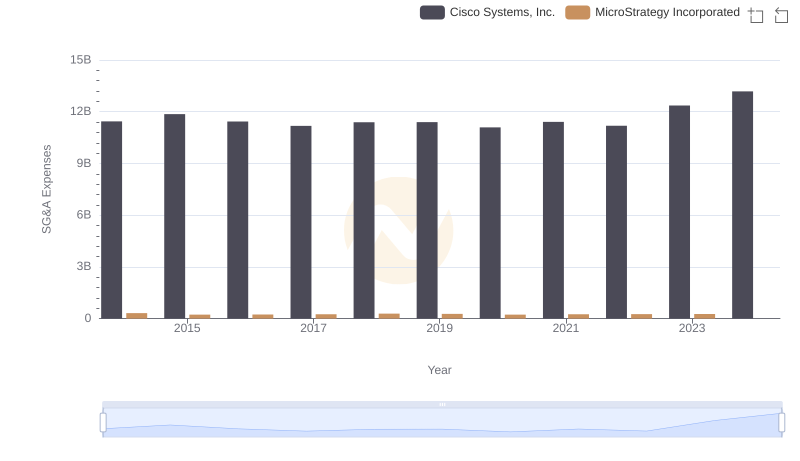

Comparing SG&A Expenses: Cisco Systems, Inc. vs MicroStrategy Incorporated Trends and Insights

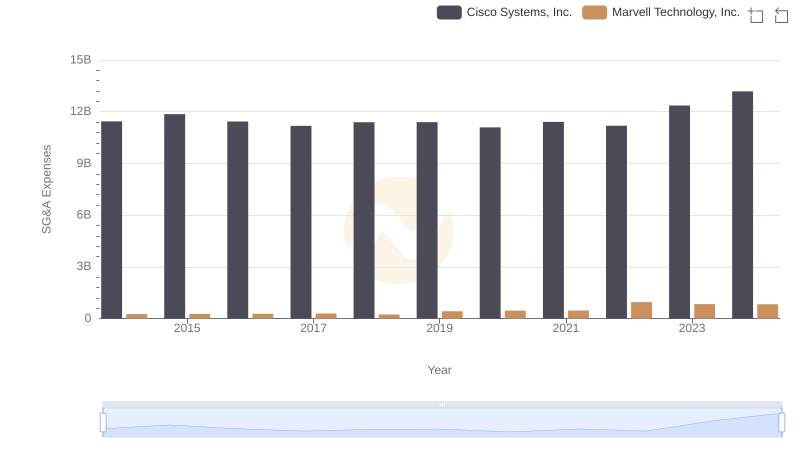

SG&A Efficiency Analysis: Comparing Cisco Systems, Inc. and Marvell Technology, Inc.

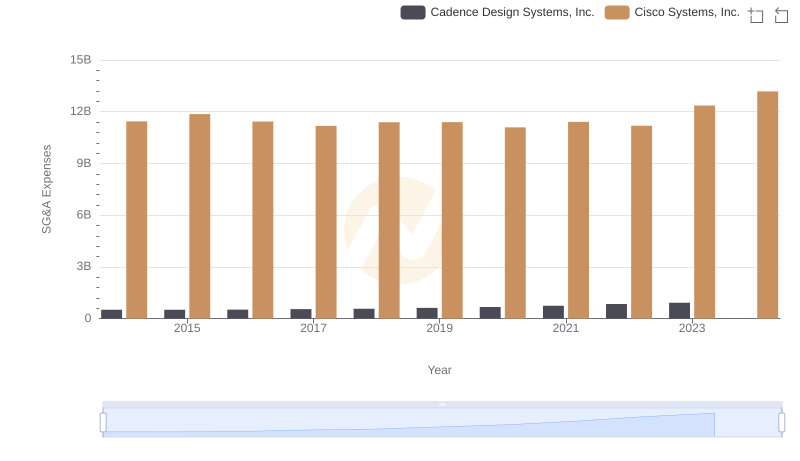

Cisco Systems, Inc. vs Cadence Design Systems, Inc.: SG&A Expense Trends

Professional EBITDA Benchmarking: Cisco Systems, Inc. vs Lam Research Corporation