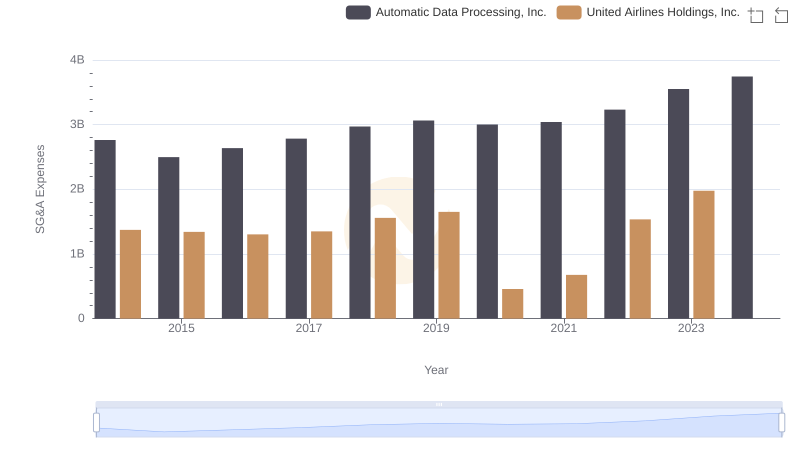

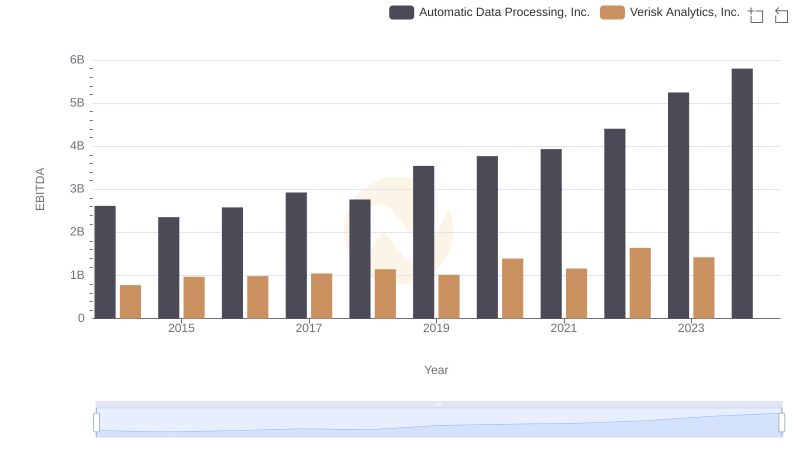

| __timestamp | Automatic Data Processing, Inc. | Verisk Analytics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 227306000 |

| Thursday, January 1, 2015 | 2496900000 | 312690000 |

| Friday, January 1, 2016 | 2637000000 | 301600000 |

| Sunday, January 1, 2017 | 2783200000 | 322800000 |

| Monday, January 1, 2018 | 2971500000 | 378700000 |

| Tuesday, January 1, 2019 | 3064200000 | 603500000 |

| Wednesday, January 1, 2020 | 3003000000 | 413900000 |

| Friday, January 1, 2021 | 3040500000 | 422700000 |

| Saturday, January 1, 2022 | 3233200000 | 381500000 |

| Sunday, January 1, 2023 | 3551400000 | 389300000 |

| Monday, January 1, 2024 | 3778900000 |

Cracking the code

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Automatic Data Processing, Inc. (ADP) and Verisk Analytics, Inc. are two industry leaders with distinct approaches to optimizing these costs. Over the past decade, ADP has consistently maintained higher SG&A expenses, peaking at approximately $3.7 billion in 2024, reflecting its expansive operations. In contrast, Verisk Analytics has kept its SG&A costs significantly lower, averaging around $375 million annually. This stark difference highlights ADP's broader scale and Verisk's leaner operational model. Notably, Verisk's expenses surged by 165% from 2014 to 2019, indicating strategic investments. However, data for 2024 is missing for Verisk, leaving room for speculation on its current strategy. As businesses navigate economic uncertainties, these insights into SG&A management offer valuable lessons in balancing growth and efficiency.

Automatic Data Processing, Inc. vs Verisk Analytics, Inc.: Examining Key Revenue Metrics

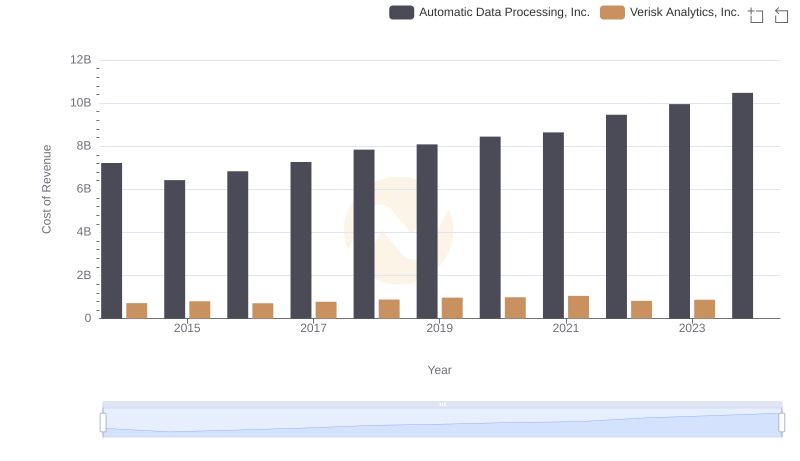

Cost of Revenue Trends: Automatic Data Processing, Inc. vs Verisk Analytics, Inc.

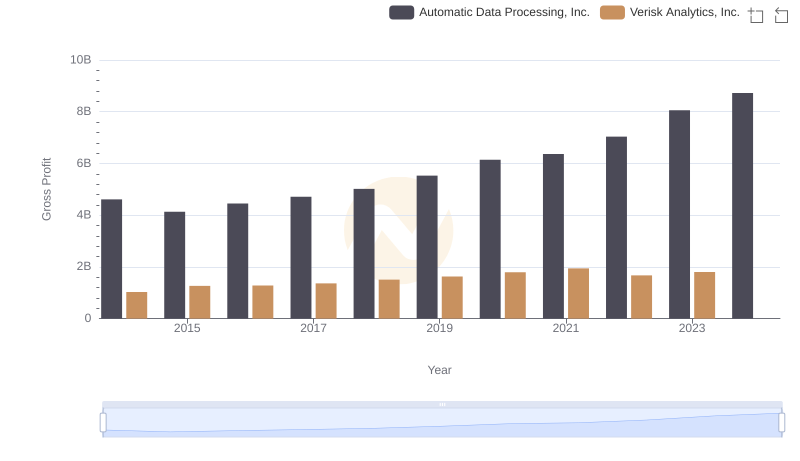

Gross Profit Analysis: Comparing Automatic Data Processing, Inc. and Verisk Analytics, Inc.

Automatic Data Processing, Inc. vs Fastenal Company: SG&A Expense Trends

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs United Airlines Holdings, Inc.

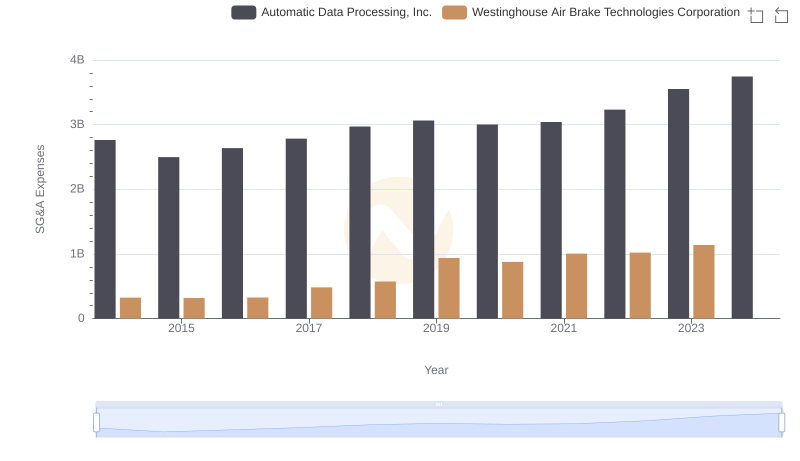

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation Trends and Insights

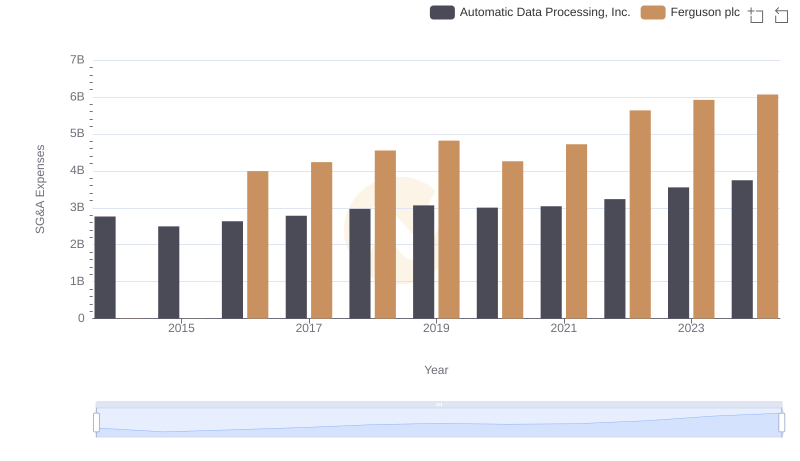

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Ferguson plc

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Verisk Analytics, Inc.