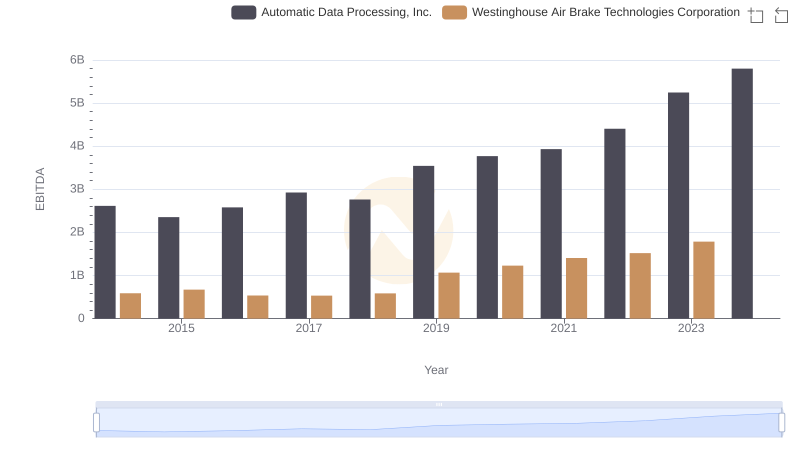

| __timestamp | Automatic Data Processing, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 324539000 |

| Thursday, January 1, 2015 | 2496900000 | 319173000 |

| Friday, January 1, 2016 | 2637000000 | 327505000 |

| Sunday, January 1, 2017 | 2783200000 | 482852000 |

| Monday, January 1, 2018 | 2971500000 | 573644000 |

| Tuesday, January 1, 2019 | 3064200000 | 936600000 |

| Wednesday, January 1, 2020 | 3003000000 | 877100000 |

| Friday, January 1, 2021 | 3040500000 | 1005000000 |

| Saturday, January 1, 2022 | 3233200000 | 1020000000 |

| Sunday, January 1, 2023 | 3551400000 | 1139000000 |

| Monday, January 1, 2024 | 3778900000 | 1248000000 |

Data in motion

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a critical measure of a company's operational efficiency. This chart offers a fascinating glimpse into the SG&A trends of two industry titans: Automatic Data Processing, Inc. (ADP) and Westinghouse Air Brake Technologies Corporation (WAB).

From 2014 to 2023, ADP's SG&A expenses have shown a steady upward trajectory, increasing by approximately 36% over the decade. This growth reflects ADP's strategic investments in expanding its operational capabilities. In contrast, WAB's SG&A expenses have more than tripled, highlighting its aggressive expansion and adaptation strategies. However, data for 2024 is missing for WAB, leaving a gap in the trend analysis.

These insights underscore the dynamic nature of corporate strategies and their impact on financial metrics, offering valuable lessons for investors and analysts alike.

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Verisk Analytics, Inc.

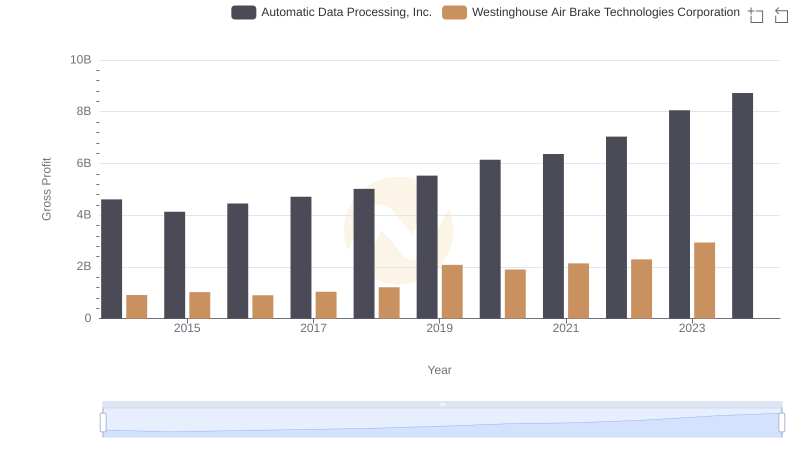

Gross Profit Comparison: Automatic Data Processing, Inc. and Westinghouse Air Brake Technologies Corporation Trends

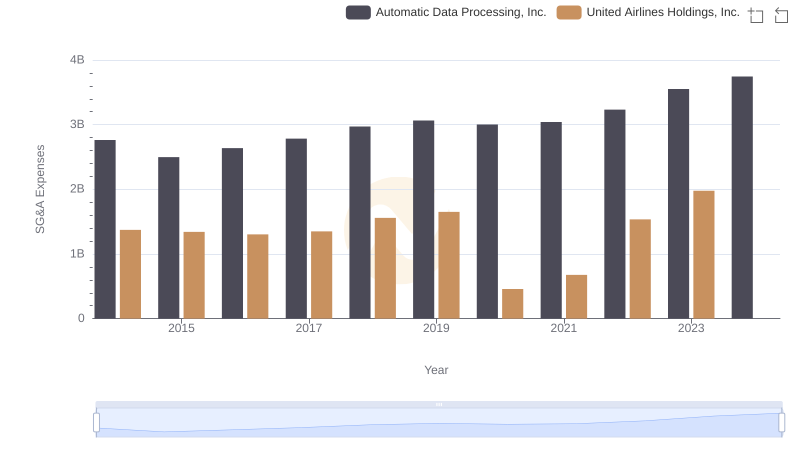

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs United Airlines Holdings, Inc.

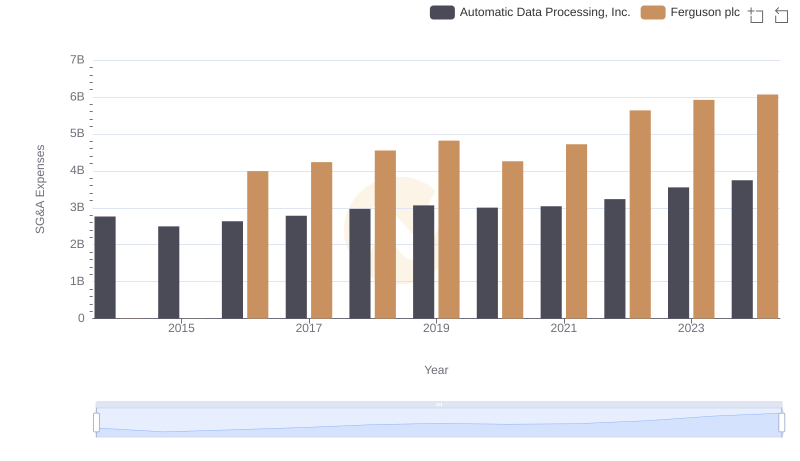

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Ferguson plc

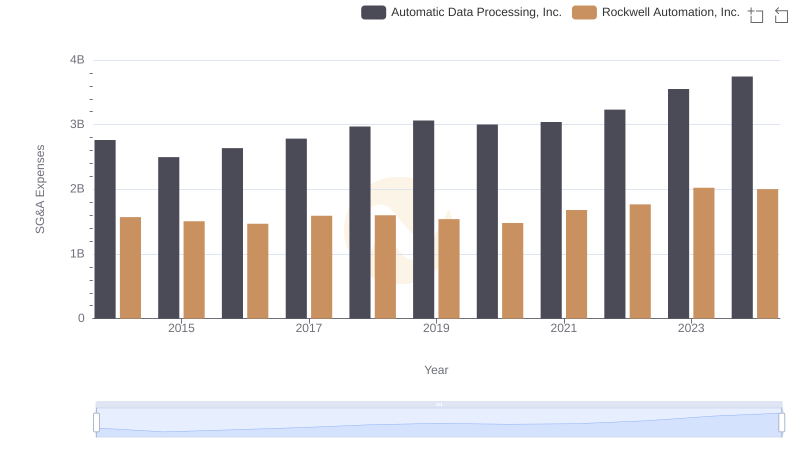

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Rockwell Automation, Inc.

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation