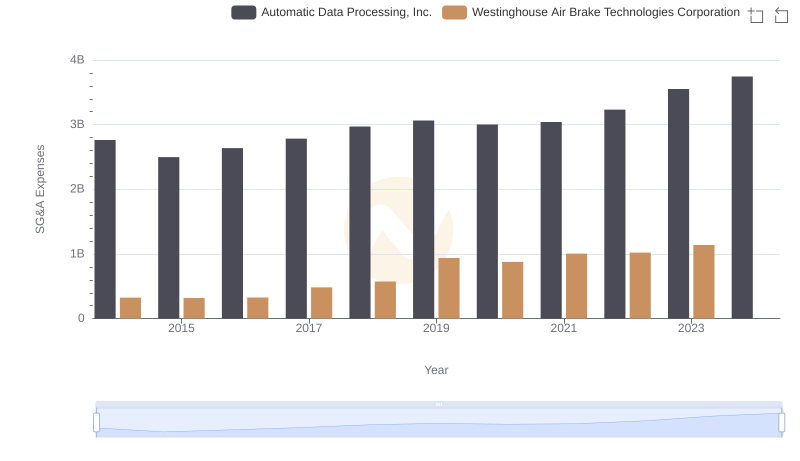

| __timestamp | Automatic Data Processing, Inc. | United Airlines Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 1373000000 |

| Thursday, January 1, 2015 | 2496900000 | 1342000000 |

| Friday, January 1, 2016 | 2637000000 | 1303000000 |

| Sunday, January 1, 2017 | 2783200000 | 1349000000 |

| Monday, January 1, 2018 | 2971500000 | 1558000000 |

| Tuesday, January 1, 2019 | 3064200000 | 1651000000 |

| Wednesday, January 1, 2020 | 3003000000 | 459000000 |

| Friday, January 1, 2021 | 3040500000 | 677000000 |

| Saturday, January 1, 2022 | 3233200000 | 1535000000 |

| Sunday, January 1, 2023 | 3551400000 | 1977000000 |

| Monday, January 1, 2024 | 3778900000 | 2231000000 |

Cracking the code

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a critical measure of operational efficiency. Over the past decade, Automatic Data Processing, Inc. (ADP) and United Airlines Holdings, Inc. have showcased contrasting trends in their SG&A expenses.

ADP, a leader in human resources management, has consistently increased its SG&A expenses, reflecting a robust growth strategy. From 2014 to 2023, ADP's expenses rose by approximately 36%, peaking in 2023. This upward trend underscores ADP's commitment to expanding its market presence and enhancing service delivery.

Conversely, United Airlines experienced a more volatile pattern, with a significant dip in 2020, likely due to the pandemic's impact on the aviation industry. However, by 2023, United Airlines had rebounded, with SG&A expenses increasing by 44% from their 2020 low. This recovery highlights the airline's resilience and strategic adjustments in a challenging market.

The data for 2024 remains incomplete, offering a glimpse into the uncertainties and opportunities that lie ahead for these industry titans.

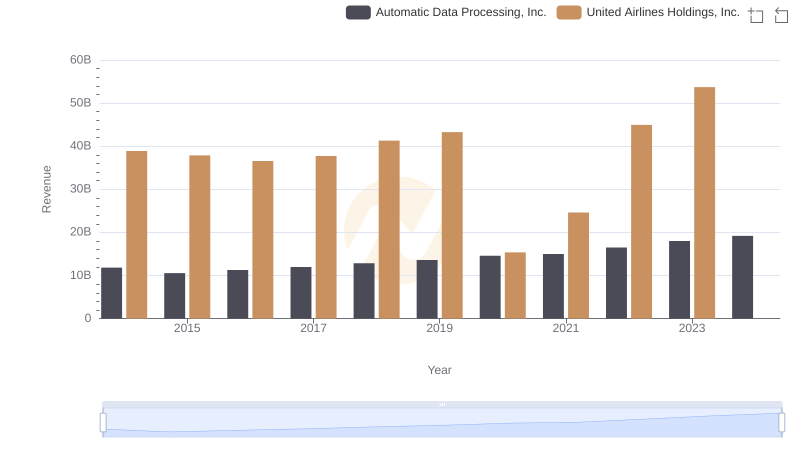

Automatic Data Processing, Inc. vs United Airlines Holdings, Inc.: Examining Key Revenue Metrics

Automatic Data Processing, Inc. vs Fastenal Company: SG&A Expense Trends

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Verisk Analytics, Inc.

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation Trends and Insights

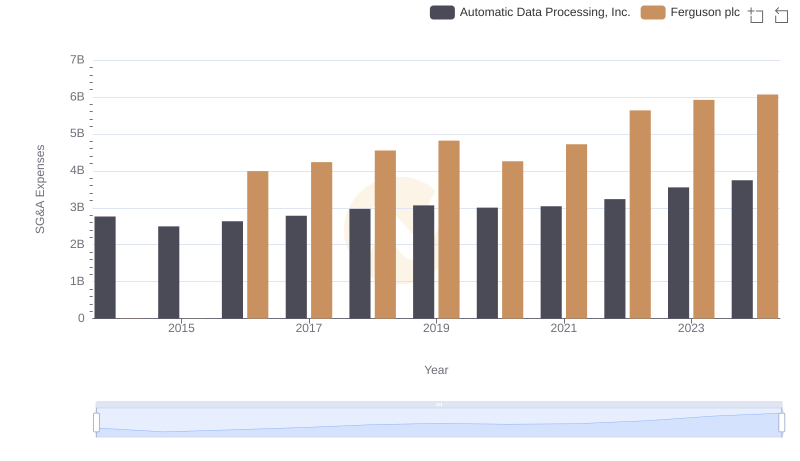

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Ferguson plc

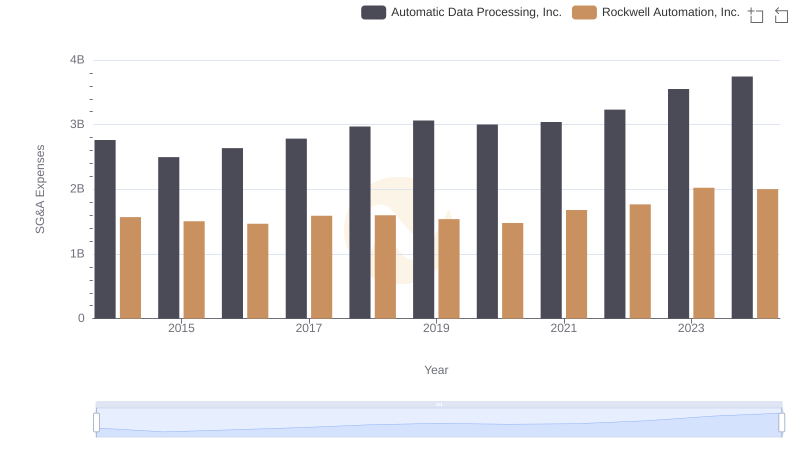

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Rockwell Automation, Inc.