| __timestamp | Automatic Data Processing, Inc. | Ferguson plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 5065428 |

| Thursday, January 1, 2015 | 2496900000 | 3127932 |

| Friday, January 1, 2016 | 2637000000 | 3992798135 |

| Sunday, January 1, 2017 | 2783200000 | 4237396470 |

| Monday, January 1, 2018 | 2971500000 | 4552000000 |

| Tuesday, January 1, 2019 | 3064200000 | 4819000000 |

| Wednesday, January 1, 2020 | 3003000000 | 4260000000 |

| Friday, January 1, 2021 | 3040500000 | 4721000000 |

| Saturday, January 1, 2022 | 3233200000 | 5635000000 |

| Sunday, January 1, 2023 | 3551400000 | 5920000000 |

| Monday, January 1, 2024 | 3778900000 | 6066000000 |

Unlocking the unknown

In the competitive landscape of corporate finance, optimizing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. This analysis delves into the SG&A cost management strategies of Automatic Data Processing, Inc. (ADP) and Ferguson plc over the past decade.

From 2014 to 2024, ADP has demonstrated a steady increase in SG&A expenses, starting at approximately $2.76 billion and reaching $3.74 billion. This represents a growth of about 36%, reflecting a consistent investment in operational efficiency. In contrast, Ferguson plc's SG&A expenses surged from a modest $5 million in 2014 to a substantial $6.07 billion in 2024, marking an exponential increase.

While ADP's approach indicates a controlled and strategic expansion, Ferguson's dramatic rise suggests aggressive scaling and market penetration. Understanding these trends offers valuable insights into how these giants navigate financial management in a dynamic market.

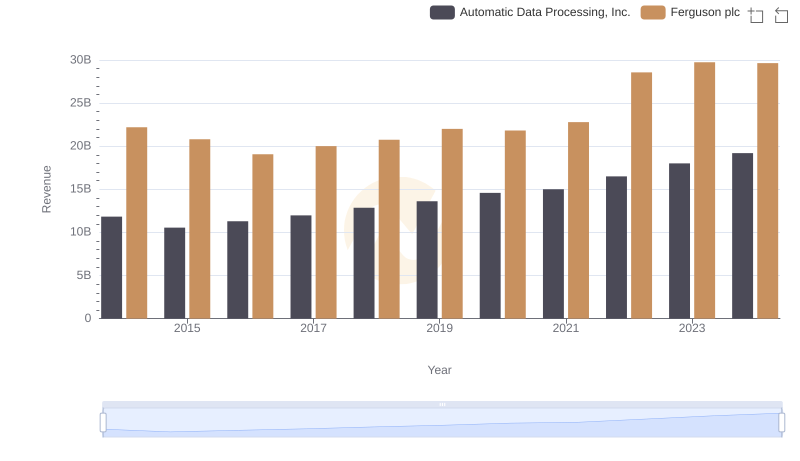

Annual Revenue Comparison: Automatic Data Processing, Inc. vs Ferguson plc

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Verisk Analytics, Inc.

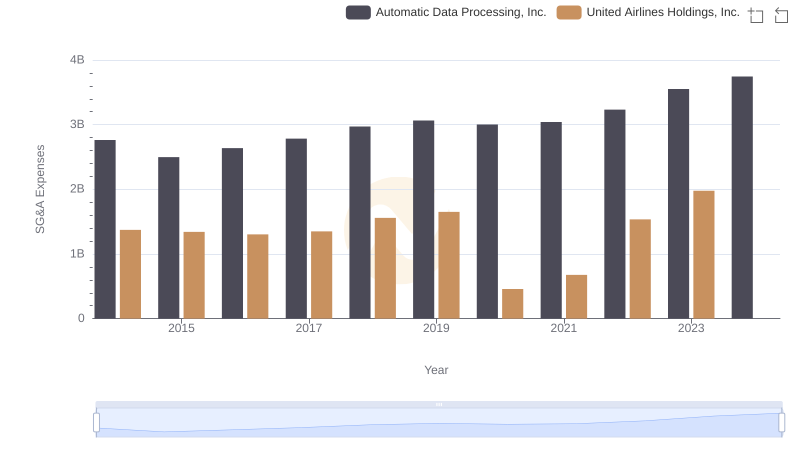

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs United Airlines Holdings, Inc.

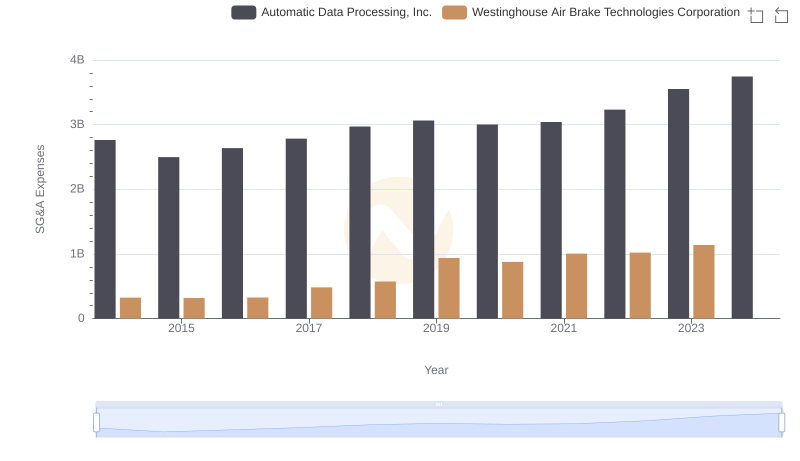

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation Trends and Insights

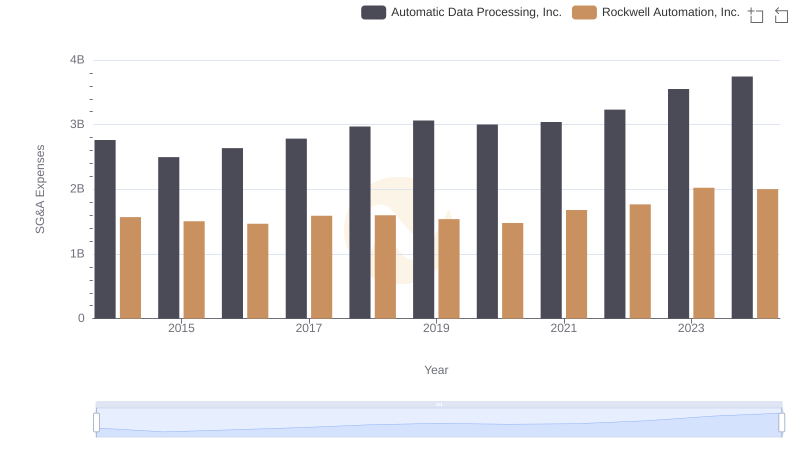

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Rockwell Automation, Inc.

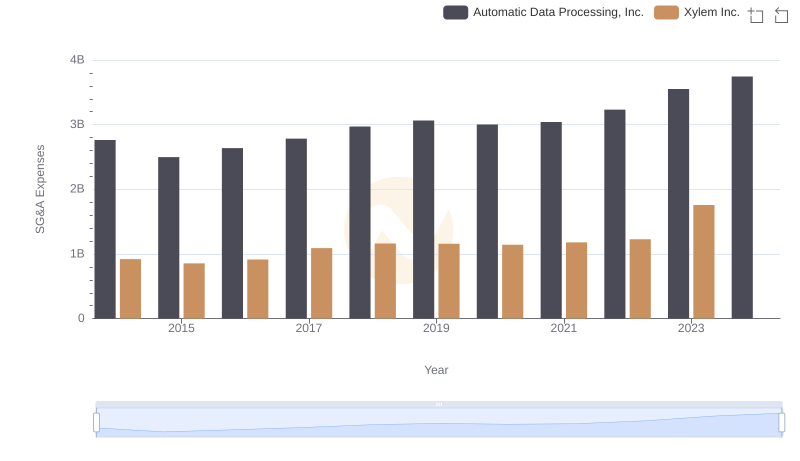

Cost Management Insights: SG&A Expenses for Automatic Data Processing, Inc. and Xylem Inc.

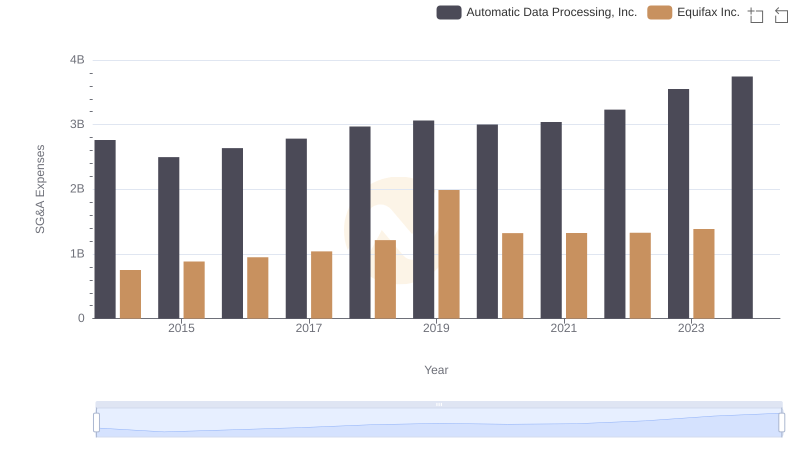

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Equifax Inc.