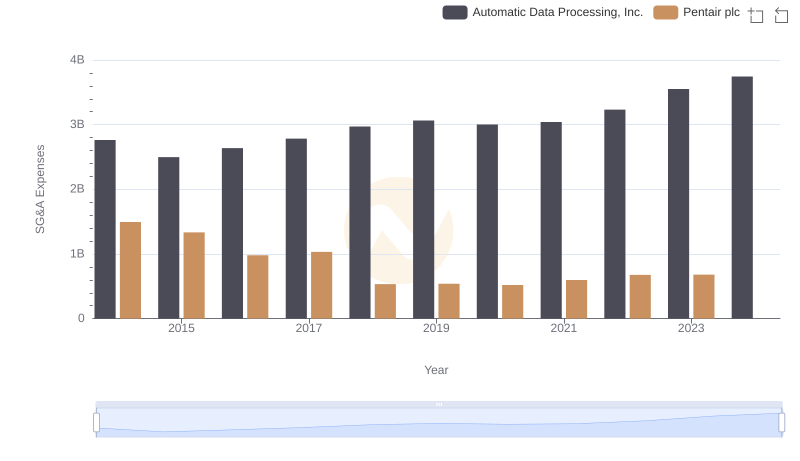

| __timestamp | Automatic Data Processing, Inc. | Carlisle Companies Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 379000000 |

| Thursday, January 1, 2015 | 2496900000 | 461900000 |

| Friday, January 1, 2016 | 2637000000 | 532000000 |

| Sunday, January 1, 2017 | 2783200000 | 589400000 |

| Monday, January 1, 2018 | 2971500000 | 625400000 |

| Tuesday, January 1, 2019 | 3064200000 | 667100000 |

| Wednesday, January 1, 2020 | 3003000000 | 603200000 |

| Friday, January 1, 2021 | 3040500000 | 698200000 |

| Saturday, January 1, 2022 | 3233200000 | 811500000 |

| Sunday, January 1, 2023 | 3551400000 | 625200000 |

| Monday, January 1, 2024 | 3778900000 | 722800000 |

Unlocking the unknown

In the world of corporate finance, understanding a company's spending patterns can reveal much about its strategic priorities. Over the past decade, Automatic Data Processing, Inc. (ADP) and Carlisle Companies Incorporated have showcased distinct trajectories in their Selling, General, and Administrative (SG&A) expenses.

ADP, a leader in human resources management, has seen its SG&A expenses grow steadily, peaking at an impressive 3.7 billion in 2024, marking a 36% increase since 2014. This upward trend reflects ADP's commitment to expanding its market presence and enhancing its service offerings.

Conversely, Carlisle Companies, a diversified manufacturer, experienced a more modest growth in SG&A expenses, with a notable peak in 2022. However, the data for 2024 remains incomplete, leaving room for speculation on future trends.

These spending patterns underscore the strategic differences between the two companies, offering valuable insights for investors and analysts alike.

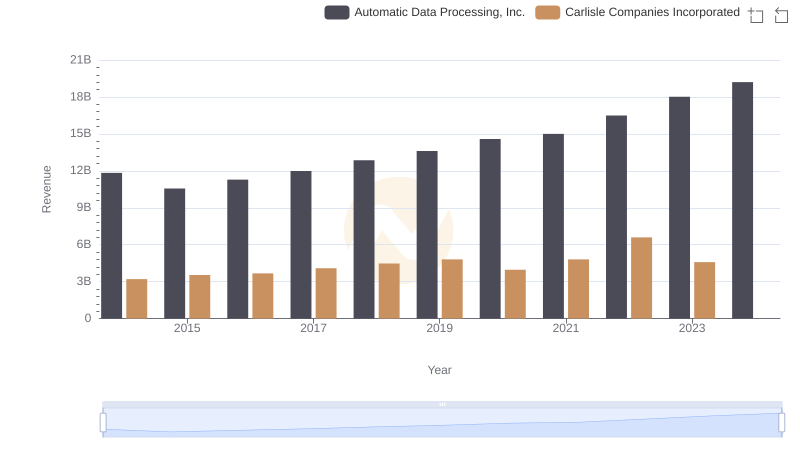

Automatic Data Processing, Inc. vs Carlisle Companies Incorporated: Examining Key Revenue Metrics

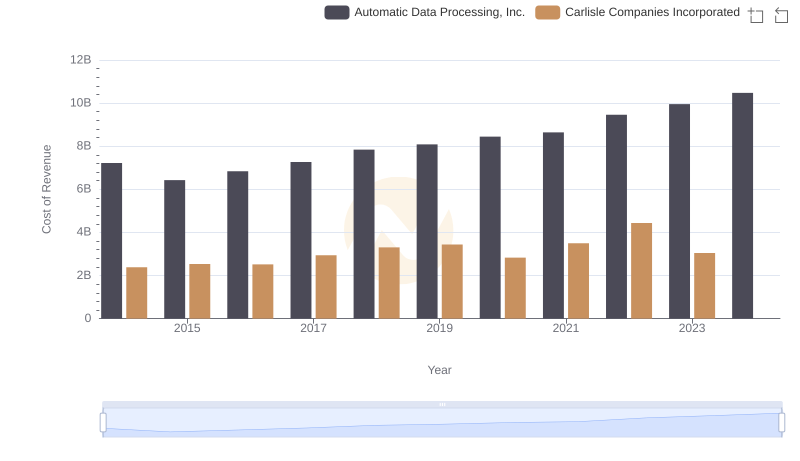

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Carlisle Companies Incorporated

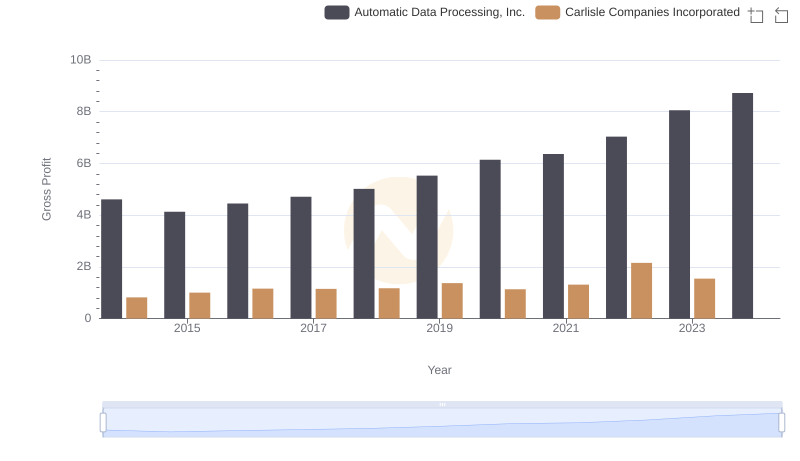

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or Carlisle Companies Incorporated

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Pentair plc

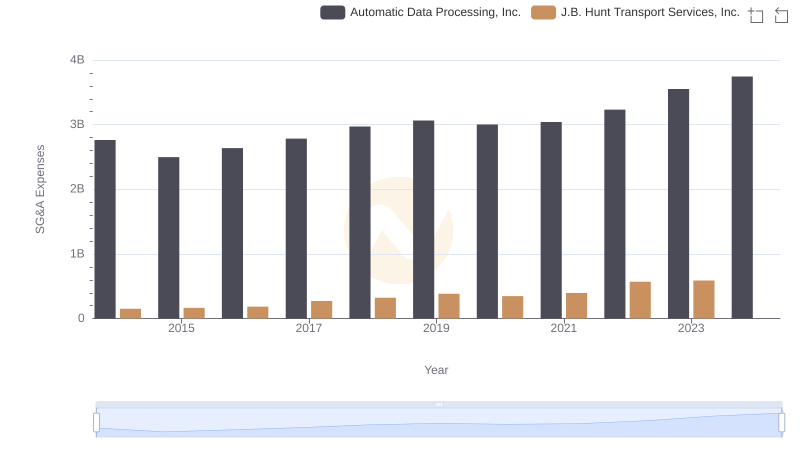

Selling, General, and Administrative Costs: Automatic Data Processing, Inc. vs J.B. Hunt Transport Services, Inc.

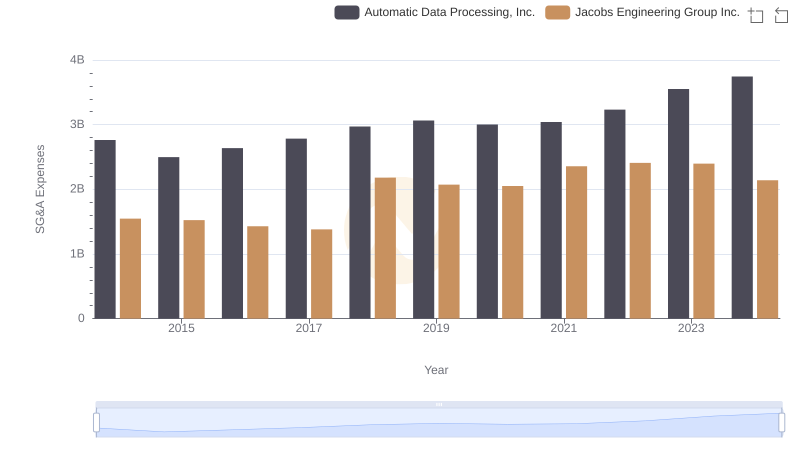

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Jacobs Engineering Group Inc.

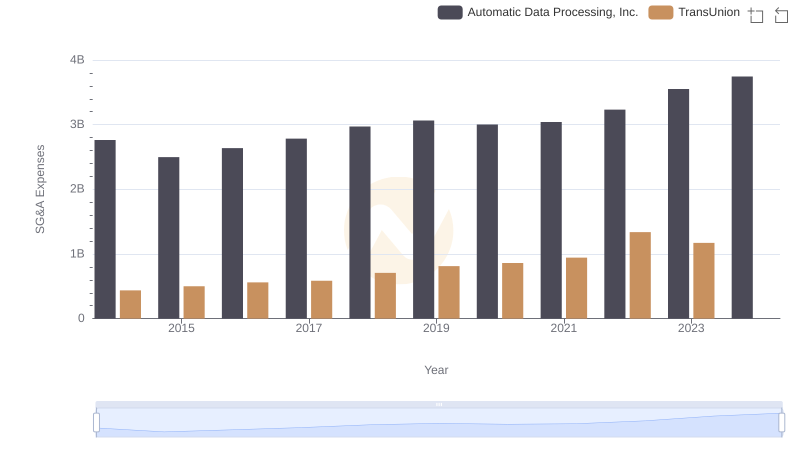

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or TransUnion

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Masco Corporation

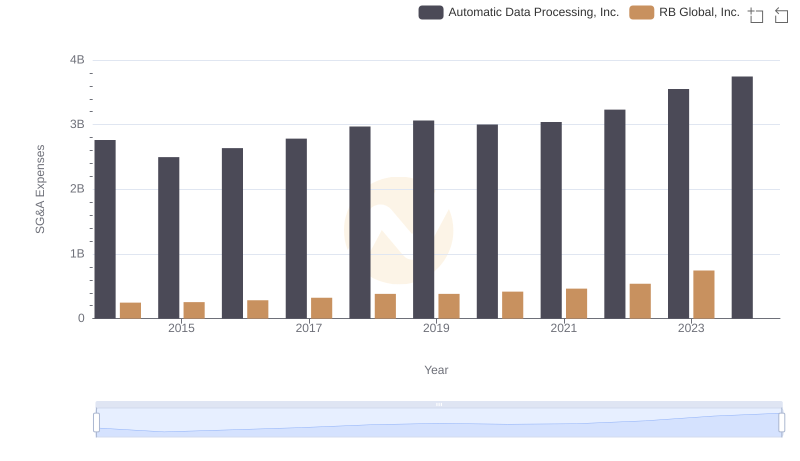

Cost Management Insights: SG&A Expenses for Automatic Data Processing, Inc. and RB Global, Inc.

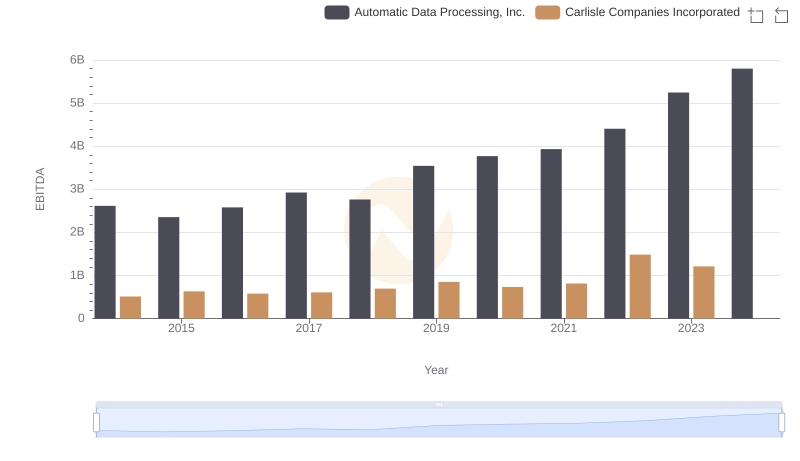

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Carlisle Companies Incorporated