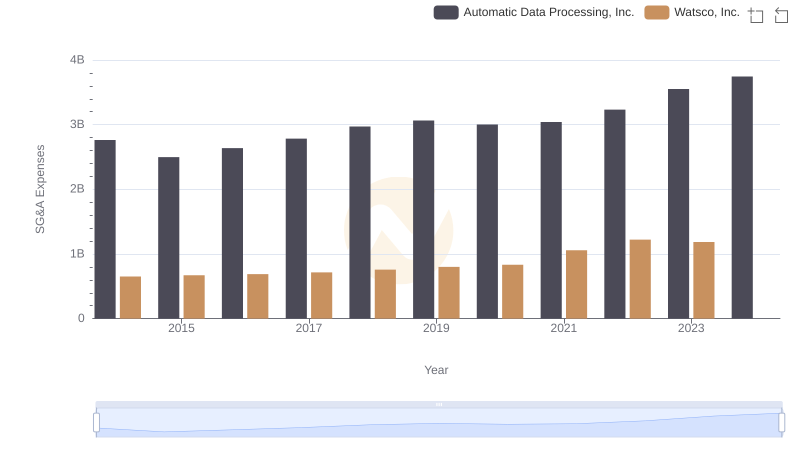

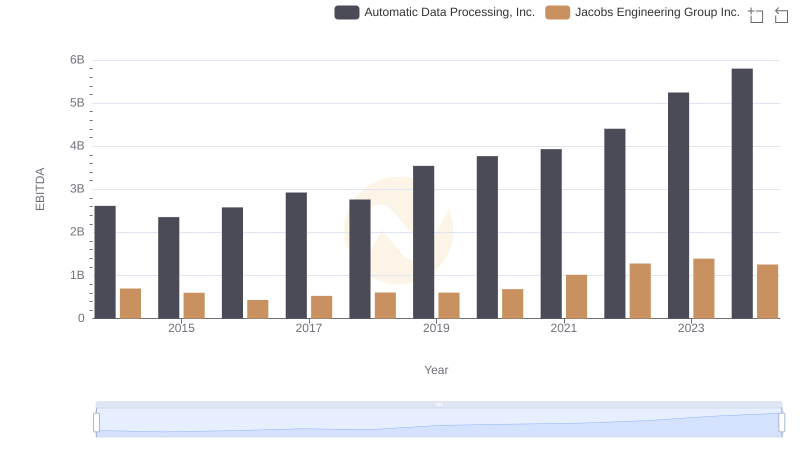

| __timestamp | Automatic Data Processing, Inc. | Jacobs Engineering Group Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 1545716000 |

| Thursday, January 1, 2015 | 2496900000 | 1522811000 |

| Friday, January 1, 2016 | 2637000000 | 1429233000 |

| Sunday, January 1, 2017 | 2783200000 | 1379983000 |

| Monday, January 1, 2018 | 2971500000 | 2180399000 |

| Tuesday, January 1, 2019 | 3064200000 | 2072177000 |

| Wednesday, January 1, 2020 | 3003000000 | 2050695000 |

| Friday, January 1, 2021 | 3040500000 | 2355683000 |

| Saturday, January 1, 2022 | 3233200000 | 2409190000 |

| Sunday, January 1, 2023 | 3551400000 | 2398078000 |

| Monday, January 1, 2024 | 3778900000 | 2140320000 |

Unlocking the unknown

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Automatic Data Processing, Inc. (ADP) and Jacobs Engineering Group Inc. have been at the forefront of this financial balancing act since 2014. Over the past decade, ADP has consistently maintained higher SG&A expenses, peaking at approximately $3.7 billion in 2024, a 36% increase from 2014. In contrast, Jacobs Engineering's SG&A expenses have shown a more modest growth, reaching around $2.1 billion in 2024, a 38% increase from their 2014 figures. This data suggests that while ADP has a larger SG&A footprint, Jacobs Engineering has been more efficient in managing its growth. As businesses navigate the post-pandemic economy, these insights into cost optimization strategies are more relevant than ever.

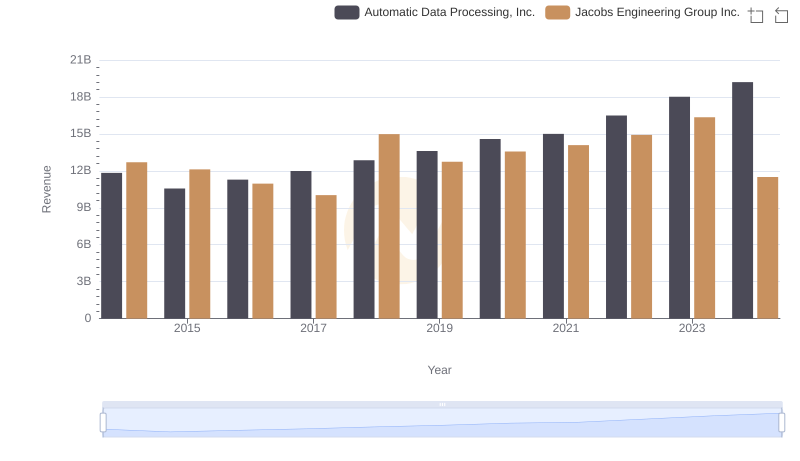

Automatic Data Processing, Inc. or Jacobs Engineering Group Inc.: Who Leads in Yearly Revenue?

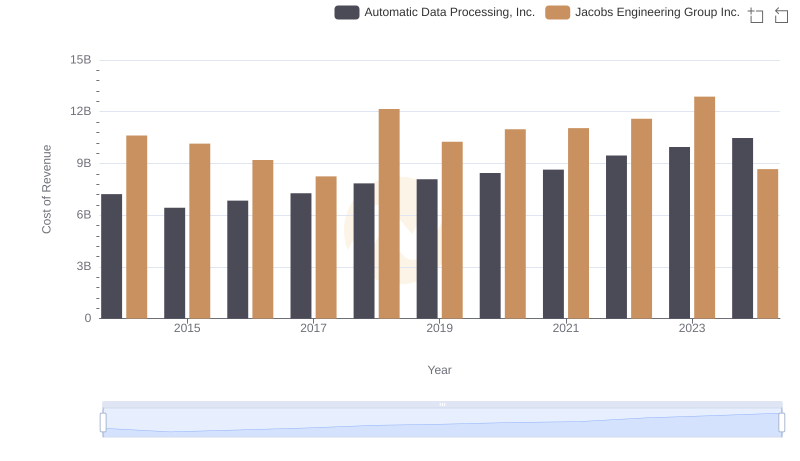

Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.: Efficiency in Cost of Revenue Explored

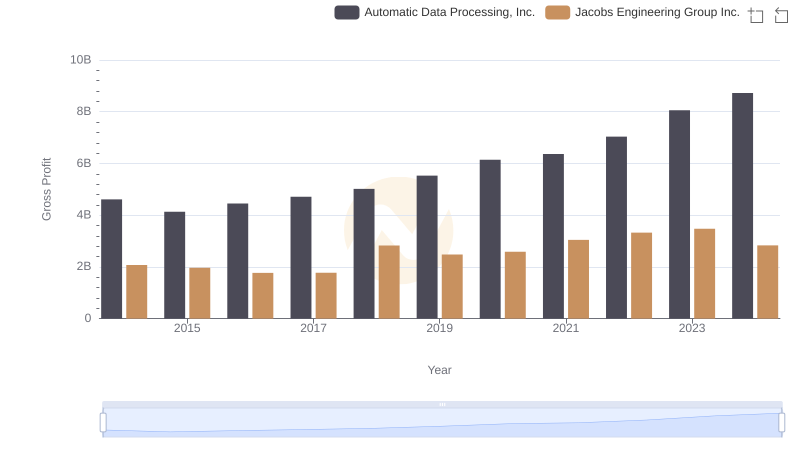

Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.: A Gross Profit Performance Breakdown

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Watsco, Inc.

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Snap-on Incorporated

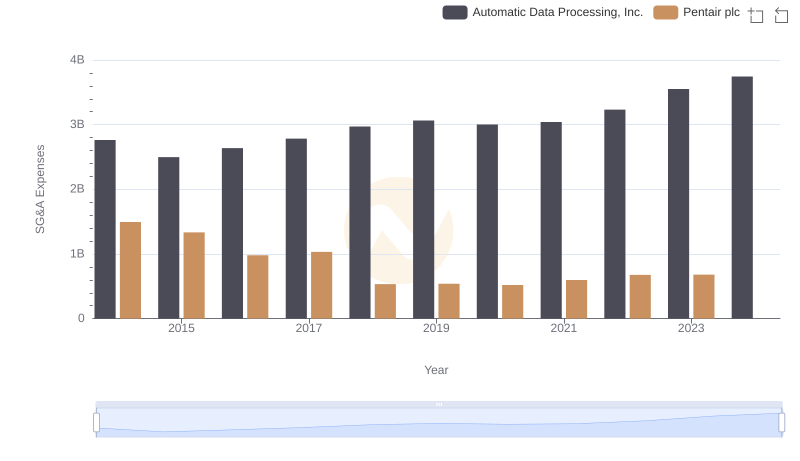

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Pentair plc

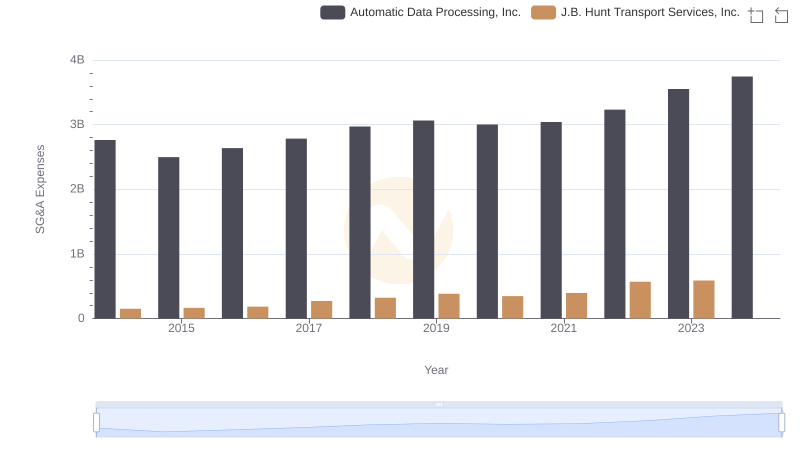

Selling, General, and Administrative Costs: Automatic Data Processing, Inc. vs J.B. Hunt Transport Services, Inc.

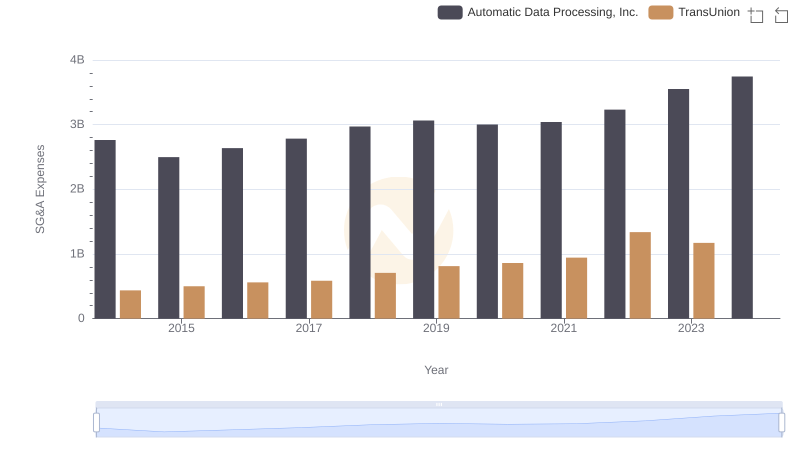

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or TransUnion

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Masco Corporation

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.