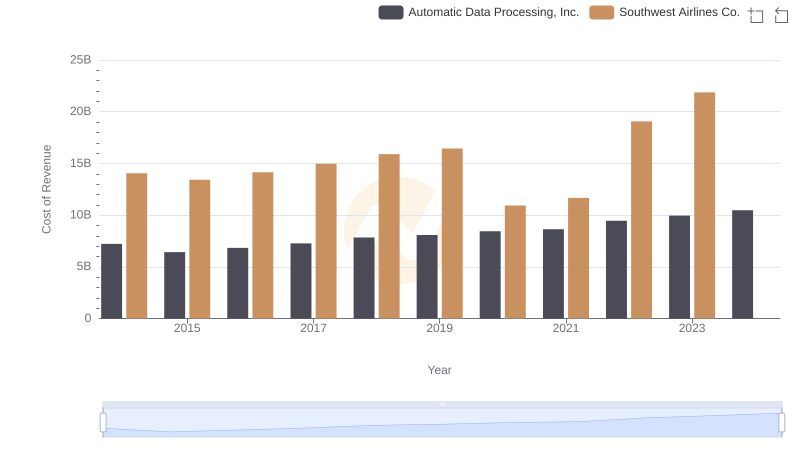

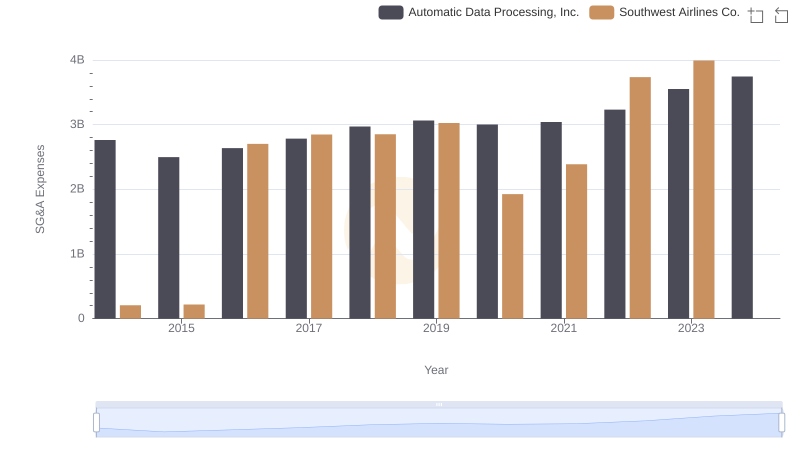

| __timestamp | Automatic Data Processing, Inc. | Southwest Airlines Co. |

|---|---|---|

| Wednesday, January 1, 2014 | 11832800000 | 18605000000 |

| Thursday, January 1, 2015 | 10560800000 | 19820000000 |

| Friday, January 1, 2016 | 11290500000 | 20425000000 |

| Sunday, January 1, 2017 | 11982400000 | 21171000000 |

| Monday, January 1, 2018 | 12859300000 | 21965000000 |

| Tuesday, January 1, 2019 | 13613300000 | 22428000000 |

| Wednesday, January 1, 2020 | 14589800000 | 9048000000 |

| Friday, January 1, 2021 | 15005400000 | 15790000000 |

| Saturday, January 1, 2022 | 16498300000 | 23814000000 |

| Sunday, January 1, 2023 | 18012200000 | 26091000000 |

| Monday, January 1, 2024 | 19202600000 | 27483000000 |

Cracking the code

In the ever-evolving landscape of American business, Automatic Data Processing, Inc. (ADP) and Southwest Airlines Co. have carved out significant niches. From 2014 to 2023, ADP's revenue soared by approximately 62%, reflecting its robust growth in the payroll and human resources sector. Meanwhile, Southwest Airlines, a stalwart in the aviation industry, experienced a 40% increase in revenue over the same period, despite the pandemic-induced dip in 2020.

ADP's consistent upward trajectory highlights its resilience and adaptability in a competitive market. In contrast, Southwest Airlines' revenue recovery post-2020 underscores its strategic agility in navigating turbulent skies. Notably, 2023 marked a peak for both companies, with ADP reaching nearly $19.2 billion and Southwest Airlines surpassing $26 billion. However, data for 2024 remains incomplete, leaving room for speculation on future trends.

Comparing Revenue Performance: Automatic Data Processing, Inc. or Lennox International Inc.?

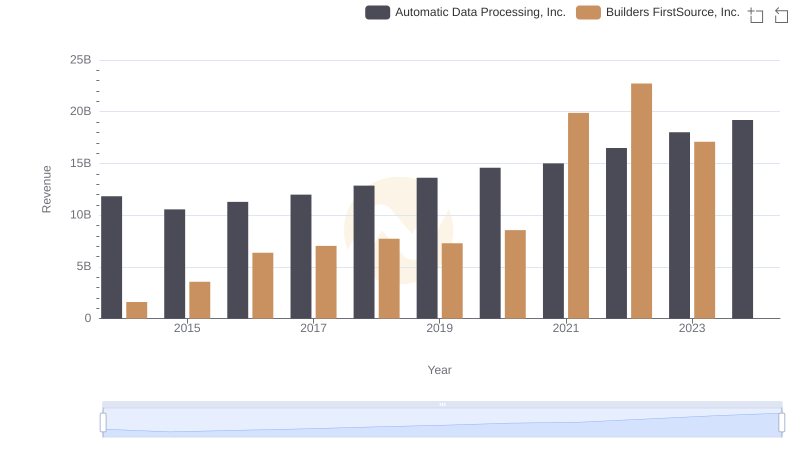

Who Generates More Revenue? Automatic Data Processing, Inc. or Builders FirstSource, Inc.

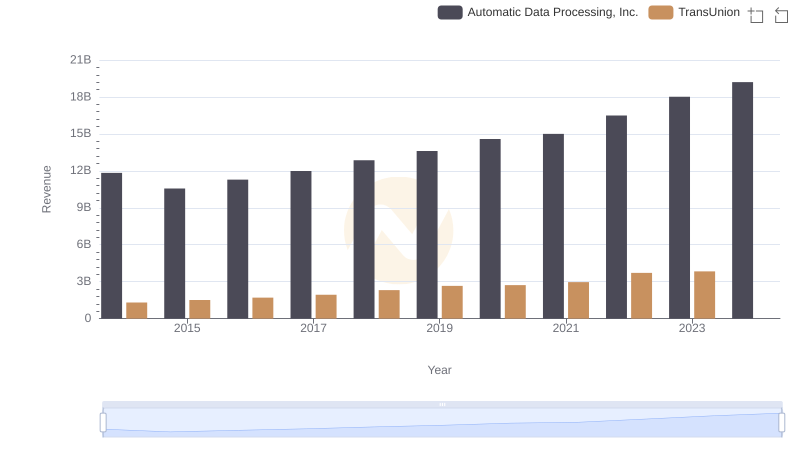

Comparing Revenue Performance: Automatic Data Processing, Inc. or TransUnion?

Revenue Showdown: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

Automatic Data Processing, Inc. vs Southwest Airlines Co.: Efficiency in Cost of Revenue Explored

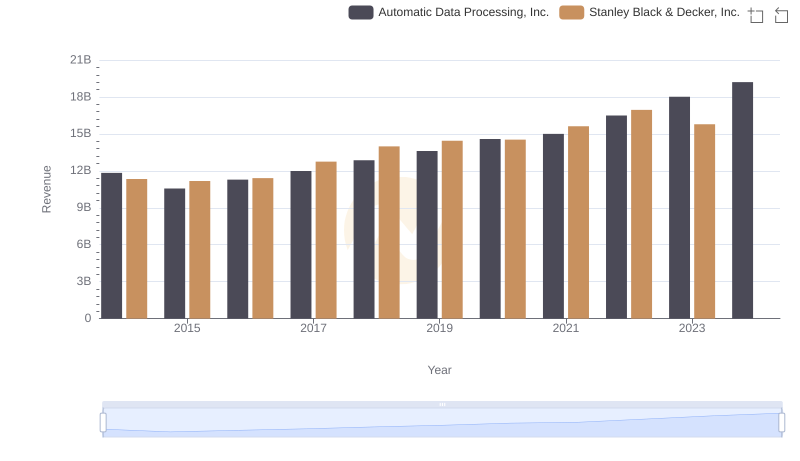

Revenue Insights: Automatic Data Processing, Inc. and Stanley Black & Decker, Inc. Performance Compared

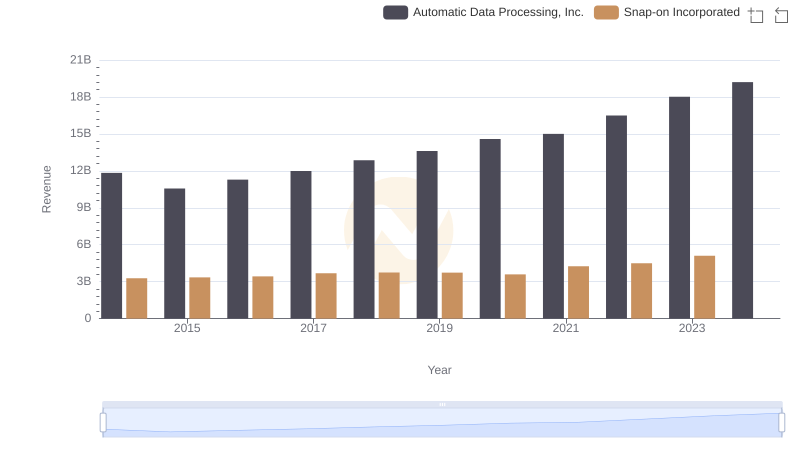

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs Snap-on Incorporated

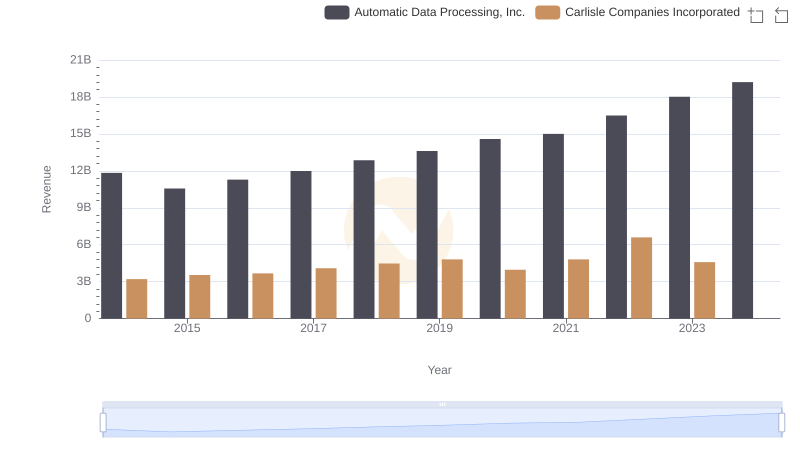

Automatic Data Processing, Inc. vs Carlisle Companies Incorporated: Examining Key Revenue Metrics

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Southwest Airlines Co.