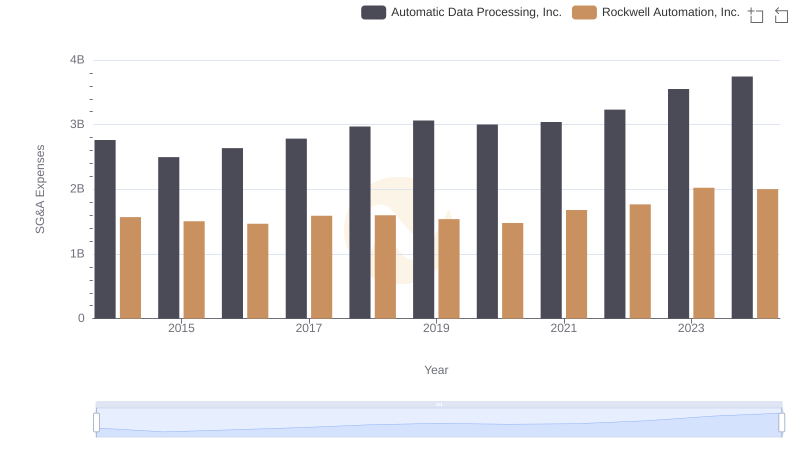

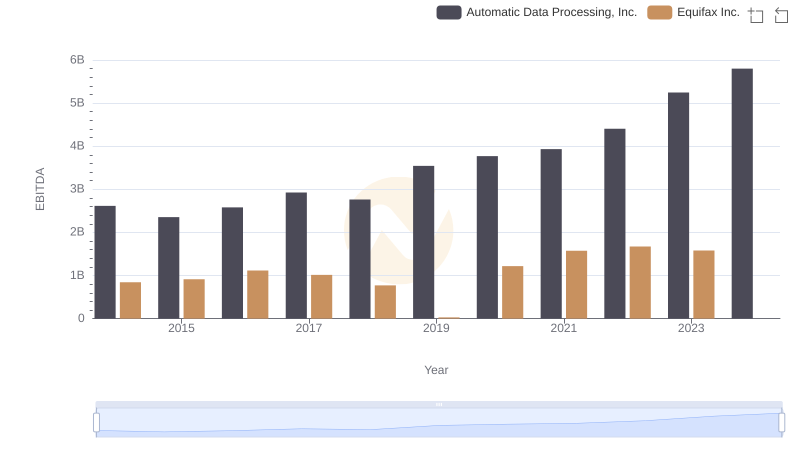

| __timestamp | Automatic Data Processing, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 751700000 |

| Thursday, January 1, 2015 | 2496900000 | 884300000 |

| Friday, January 1, 2016 | 2637000000 | 948200000 |

| Sunday, January 1, 2017 | 2783200000 | 1039100000 |

| Monday, January 1, 2018 | 2971500000 | 1213300000 |

| Tuesday, January 1, 2019 | 3064200000 | 1990200000 |

| Wednesday, January 1, 2020 | 3003000000 | 1322500000 |

| Friday, January 1, 2021 | 3040500000 | 1324600000 |

| Saturday, January 1, 2022 | 3233200000 | 1328900000 |

| Sunday, January 1, 2023 | 3551400000 | 1385700000 |

| Monday, January 1, 2024 | 3778900000 | 1450500000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Automatic Data Processing, Inc. (ADP) and Equifax Inc., from 2014 to 2023. Over this decade, ADP consistently outpaced Equifax in SG&A spending, with a notable 35% increase from 2014 to 2023. In contrast, Equifax's expenses grew by approximately 84% during the same period, highlighting a more aggressive cost expansion strategy.

This data underscores the strategic financial management differences between these two corporations.

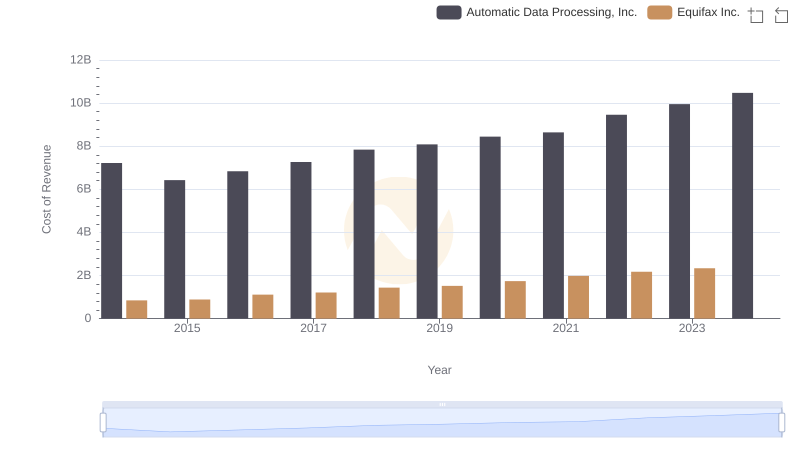

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Equifax Inc.

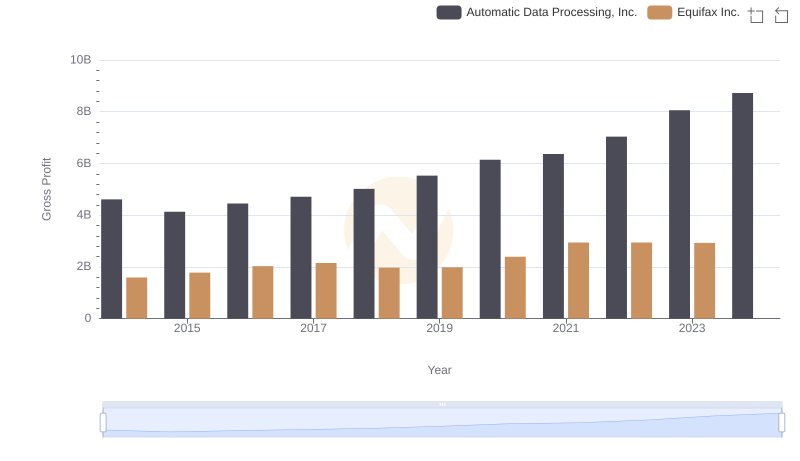

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Equifax Inc.

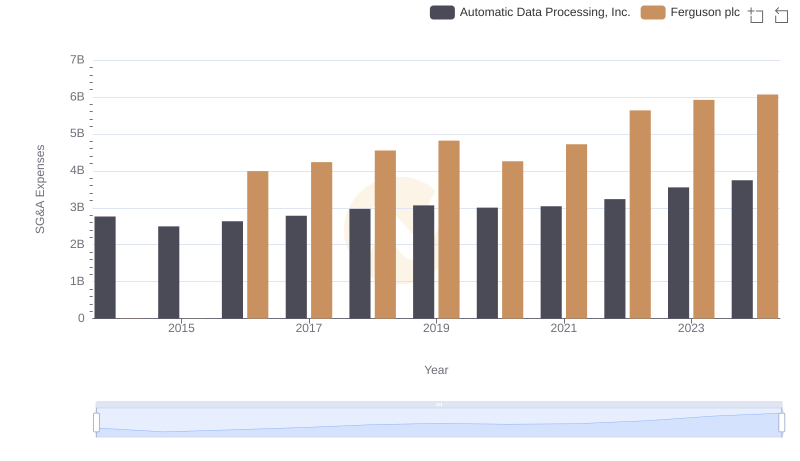

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Ferguson plc

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Rockwell Automation, Inc.

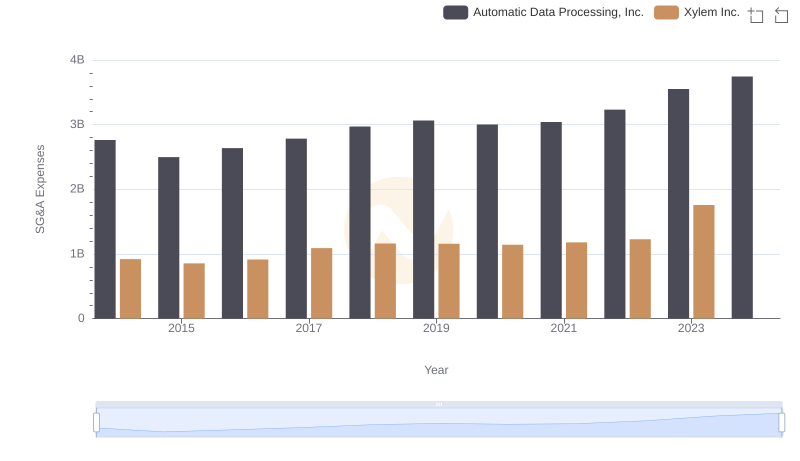

Cost Management Insights: SG&A Expenses for Automatic Data Processing, Inc. and Xylem Inc.

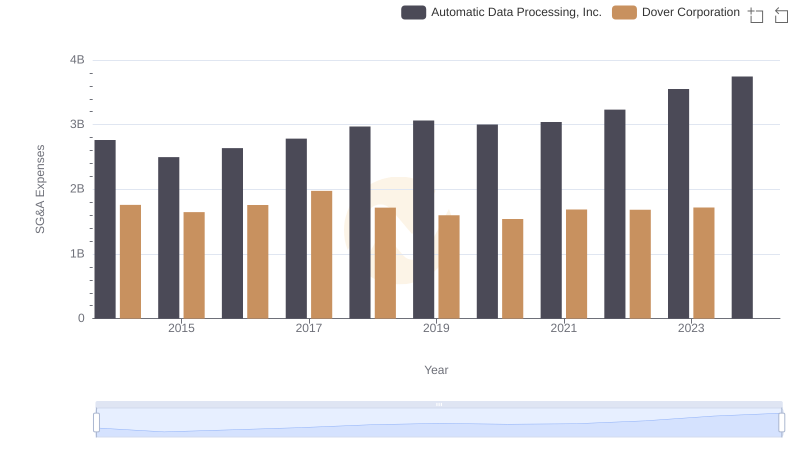

Automatic Data Processing, Inc. and Dover Corporation: SG&A Spending Patterns Compared

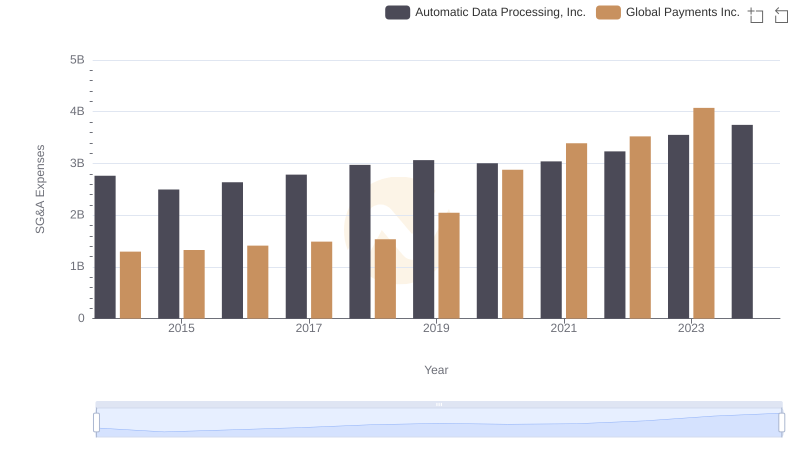

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Global Payments Inc.

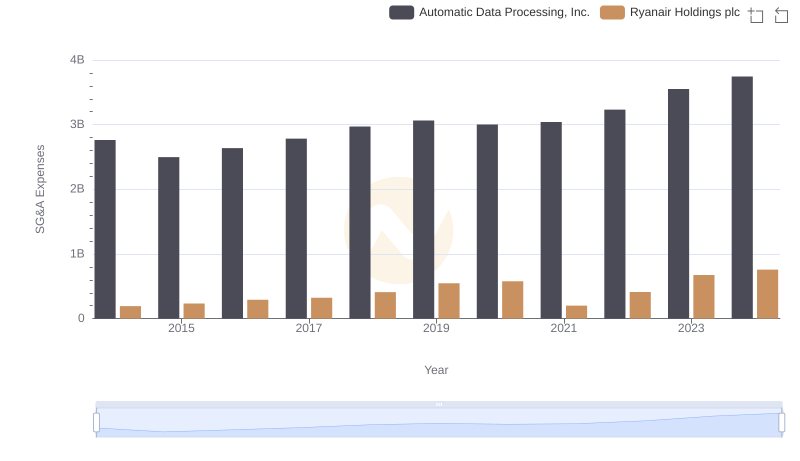

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Ryanair Holdings plc

EBITDA Performance Review: Automatic Data Processing, Inc. vs Equifax Inc.