| __timestamp | Automatic Data Processing, Inc. | Xylem Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 920000000 |

| Thursday, January 1, 2015 | 2496900000 | 854000000 |

| Friday, January 1, 2016 | 2637000000 | 915000000 |

| Sunday, January 1, 2017 | 2783200000 | 1090000000 |

| Monday, January 1, 2018 | 2971500000 | 1161000000 |

| Tuesday, January 1, 2019 | 3064200000 | 1158000000 |

| Wednesday, January 1, 2020 | 3003000000 | 1143000000 |

| Friday, January 1, 2021 | 3040500000 | 1179000000 |

| Saturday, January 1, 2022 | 3233200000 | 1227000000 |

| Sunday, January 1, 2023 | 3551400000 | 1757000000 |

| Monday, January 1, 2024 | 3778900000 |

Cracking the code

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. This analysis delves into the SG&A expenses of Automatic Data Processing, Inc. (ADP) and Xylem Inc. over the past decade, offering insights into their cost management strategies.

From 2014 to 2023, ADP's SG&A expenses have shown a steady upward trend, increasing by approximately 36% over the period. This growth reflects the company's strategic investments in operational efficiency and market expansion. In contrast, Xylem Inc. experienced a more volatile trajectory, with a notable 105% increase in SG&A expenses from 2014 to 2023, highlighting potential challenges in cost control or strategic shifts.

Interestingly, the data for 2024 is incomplete, suggesting a need for further analysis to understand future trends. These insights underscore the importance of effective cost management in sustaining competitive advantage.

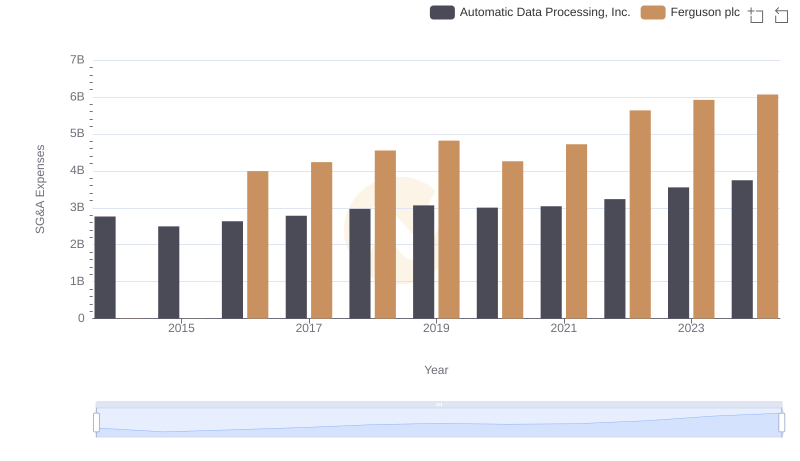

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Ferguson plc

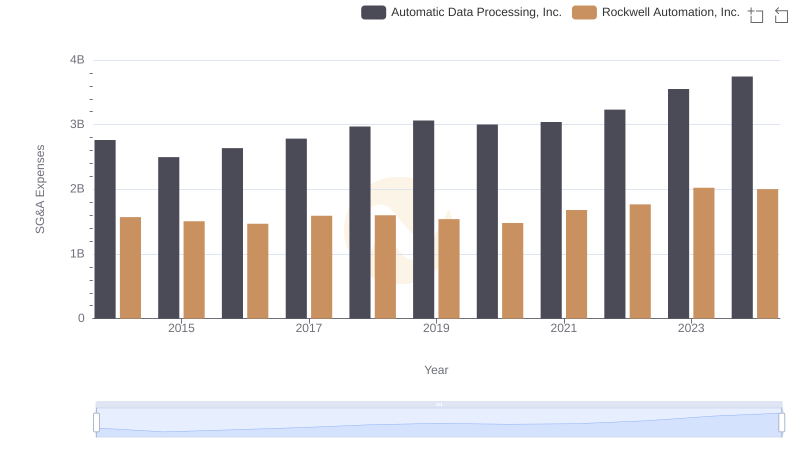

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Rockwell Automation, Inc.

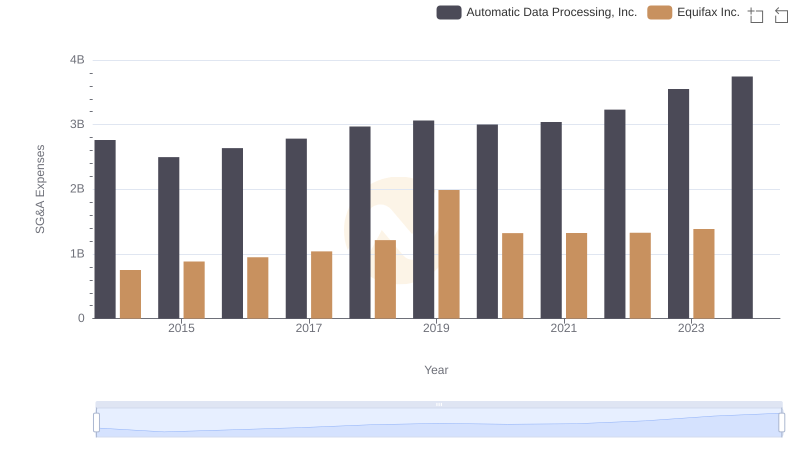

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Equifax Inc.

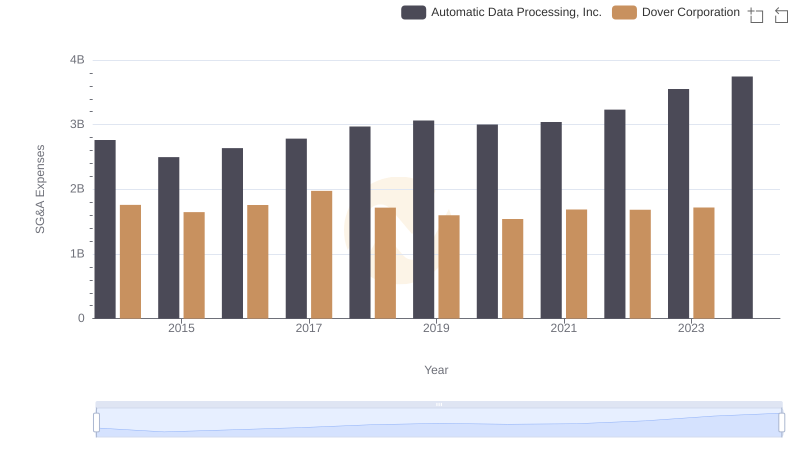

Automatic Data Processing, Inc. and Dover Corporation: SG&A Spending Patterns Compared

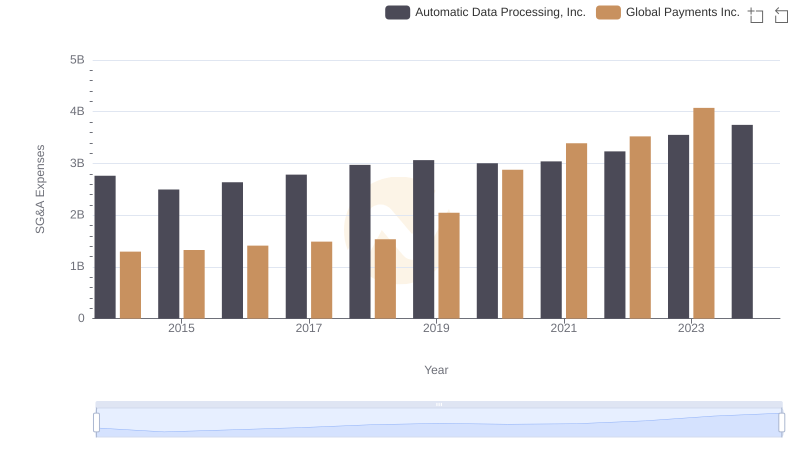

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Global Payments Inc.

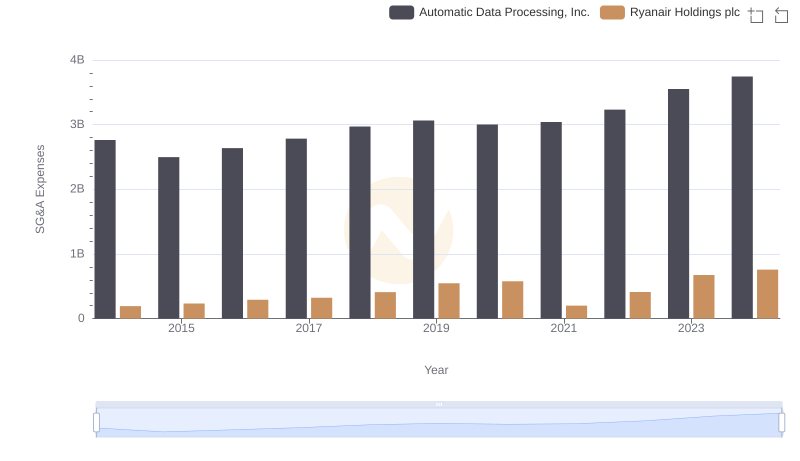

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Ryanair Holdings plc