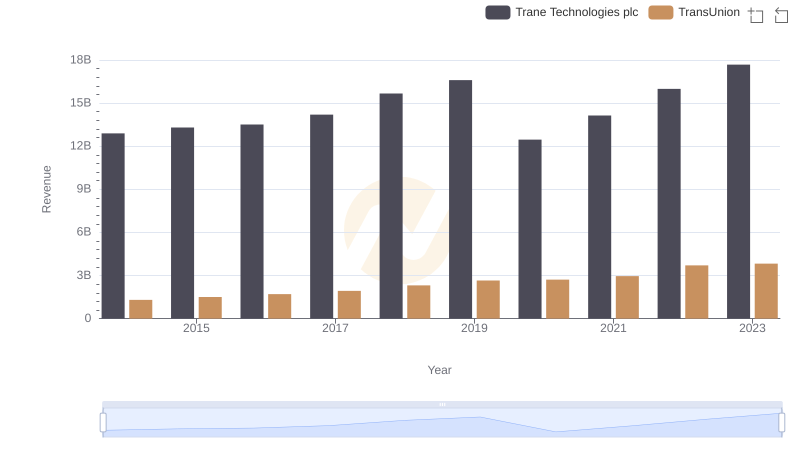

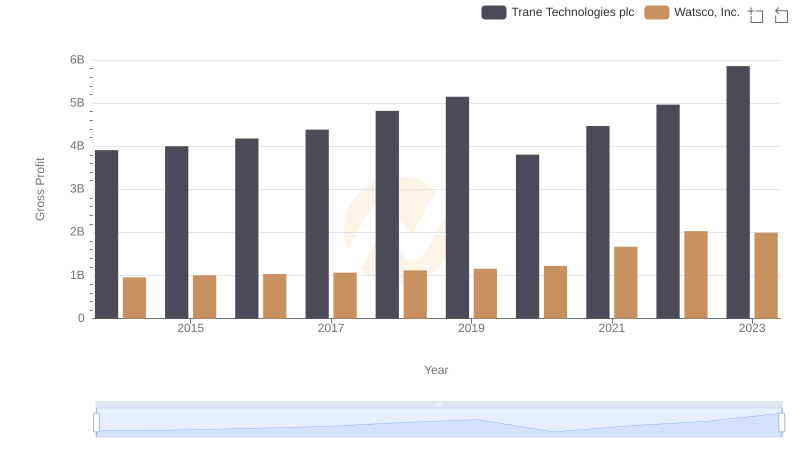

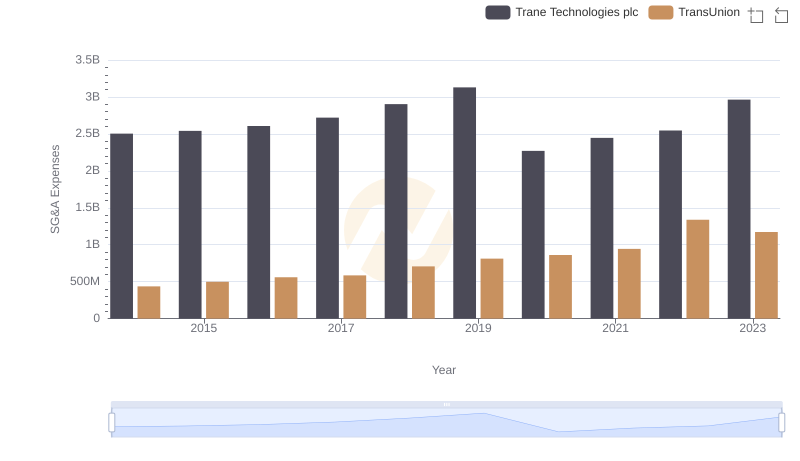

| __timestamp | Trane Technologies plc | TransUnion |

|---|---|---|

| Wednesday, January 1, 2014 | 3908600000 | 805600000 |

| Thursday, January 1, 2015 | 3999100000 | 975200000 |

| Friday, January 1, 2016 | 4179600000 | 1125800000 |

| Sunday, January 1, 2017 | 4386000000 | 1288100000 |

| Monday, January 1, 2018 | 4820600000 | 1527100000 |

| Tuesday, January 1, 2019 | 5147400000 | 1782000000 |

| Wednesday, January 1, 2020 | 3803400000 | 1796200000 |

| Friday, January 1, 2021 | 4469600000 | 1968600000 |

| Saturday, January 1, 2022 | 4964800000 | 2487000000 |

| Sunday, January 1, 2023 | 5857200000 | 2313900000 |

| Monday, January 1, 2024 | 7080500000 | 4183800000 |

Data in motion

In the competitive landscape of corporate America, the battle for higher gross profit is a testament to a company's operational efficiency and market prowess. Trane Technologies plc, a leader in climate solutions, has consistently outperformed TransUnion, a global information and insights company, in terms of gross profit from 2014 to 2023. Over this period, Trane Technologies' gross profit surged by approximately 50%, peaking in 2023 with a remarkable 5.86 billion USD. In contrast, TransUnion's gross profit, while growing, reached a high of 2.49 billion USD in 2022, marking a 209% increase from its 2014 figures. This stark difference highlights Trane Technologies' robust market strategy and operational excellence. As we delve into these figures, it becomes evident that while both companies have shown growth, Trane Technologies has maintained a significant lead, underscoring its dominance in the industry.

Revenue Insights: Trane Technologies plc and TransUnion Performance Compared

Gross Profit Trends Compared: Trane Technologies plc vs Hubbell Incorporated

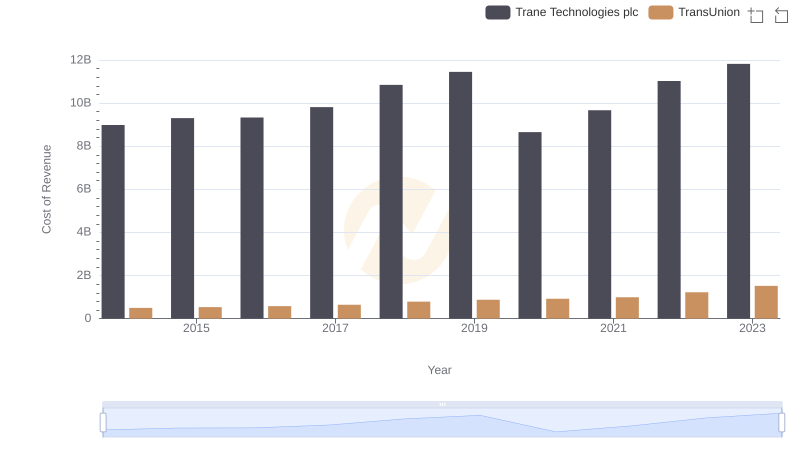

Cost of Revenue Comparison: Trane Technologies plc vs TransUnion

Trane Technologies plc vs Watsco, Inc.: A Gross Profit Performance Breakdown

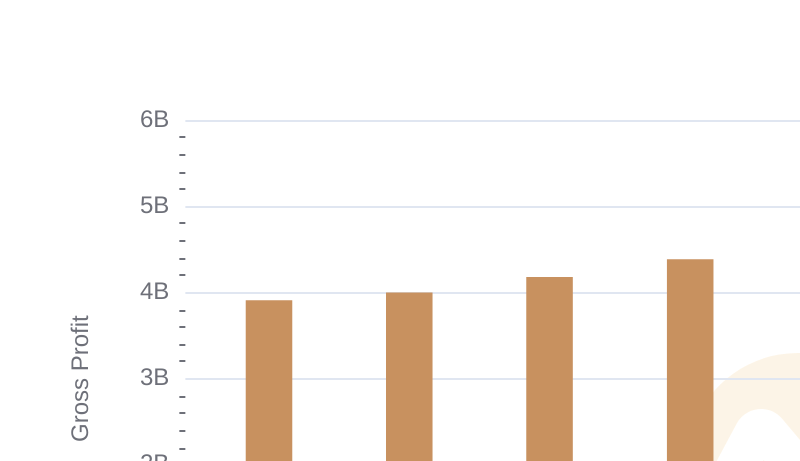

Gross Profit Trends Compared: Trane Technologies plc vs AerCap Holdings N.V.

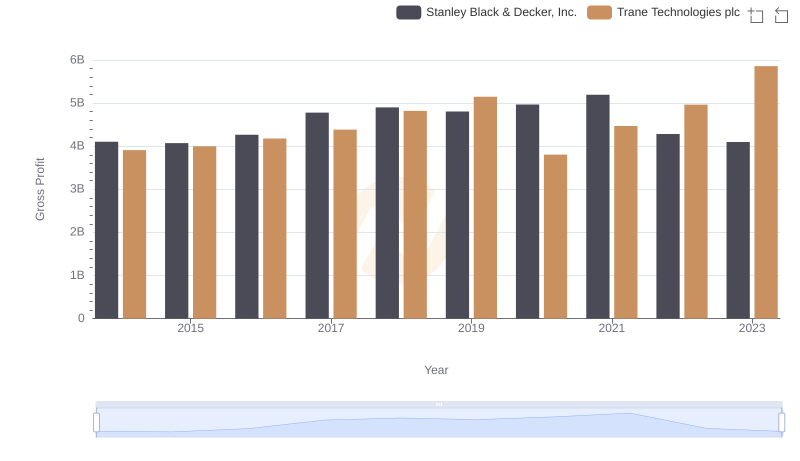

Gross Profit Comparison: Trane Technologies plc and Stanley Black & Decker, Inc. Trends

Breaking Down SG&A Expenses: Trane Technologies plc vs TransUnion

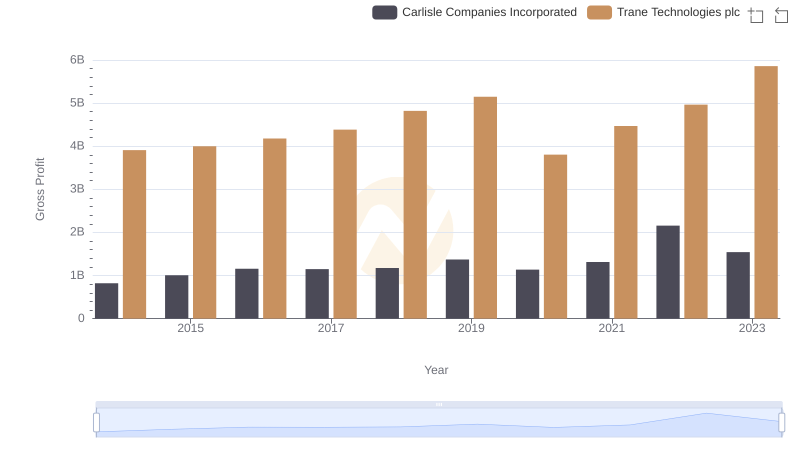

Key Insights on Gross Profit: Trane Technologies plc vs Carlisle Companies Incorporated

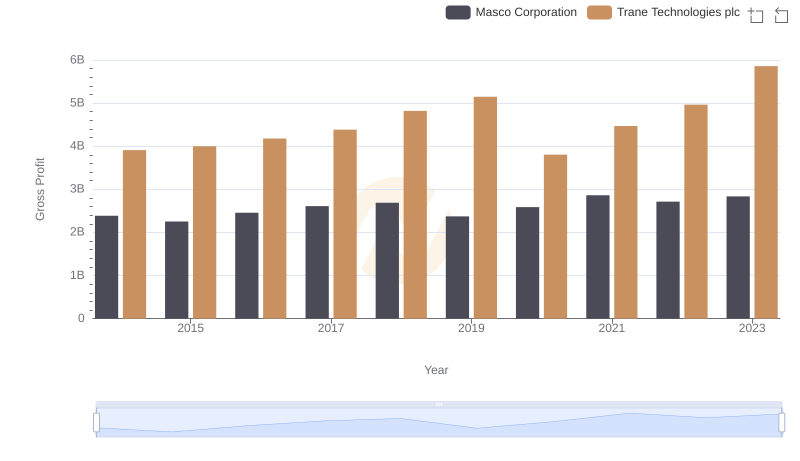

Trane Technologies plc vs Masco Corporation: A Gross Profit Performance Breakdown

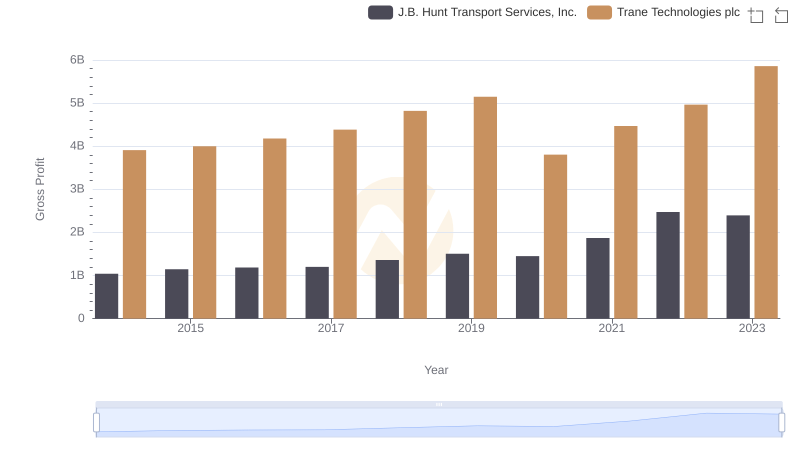

Gross Profit Comparison: Trane Technologies plc and J.B. Hunt Transport Services, Inc. Trends

Trane Technologies plc vs TransUnion: In-Depth EBITDA Performance Comparison