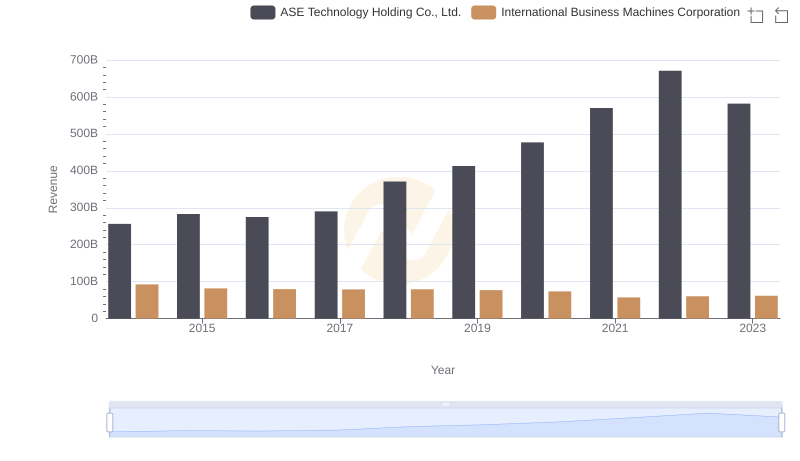

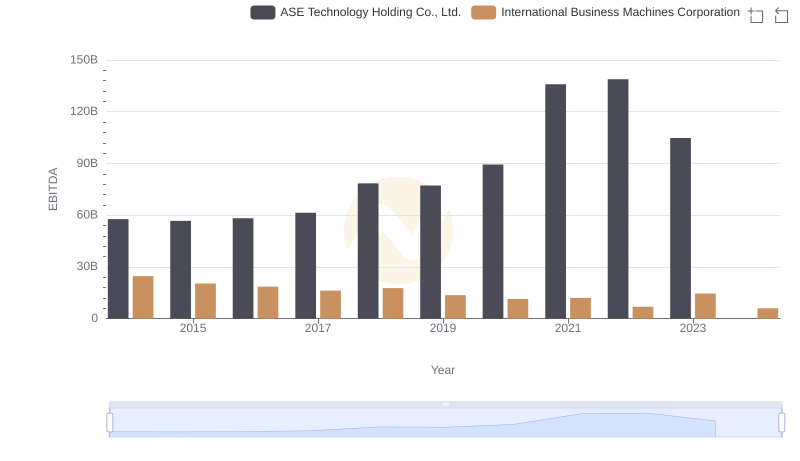

| __timestamp | ASE Technology Holding Co., Ltd. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 53540000000 | 46407000000 |

| Thursday, January 1, 2015 | 50149000000 | 40684000000 |

| Friday, January 1, 2016 | 53194000000 | 38516000000 |

| Sunday, January 1, 2017 | 52732000000 | 36943000000 |

| Monday, January 1, 2018 | 61163000000 | 36936000000 |

| Tuesday, January 1, 2019 | 64311000000 | 31533000000 |

| Wednesday, January 1, 2020 | 77984000000 | 30865000000 |

| Friday, January 1, 2021 | 110369000000 | 31486000000 |

| Saturday, January 1, 2022 | 134930000000 | 32687000000 |

| Sunday, January 1, 2023 | 91757132000 | 34300000000 |

| Monday, January 1, 2024 | 95687183000 | 35551000000 |

Unlocking the unknown

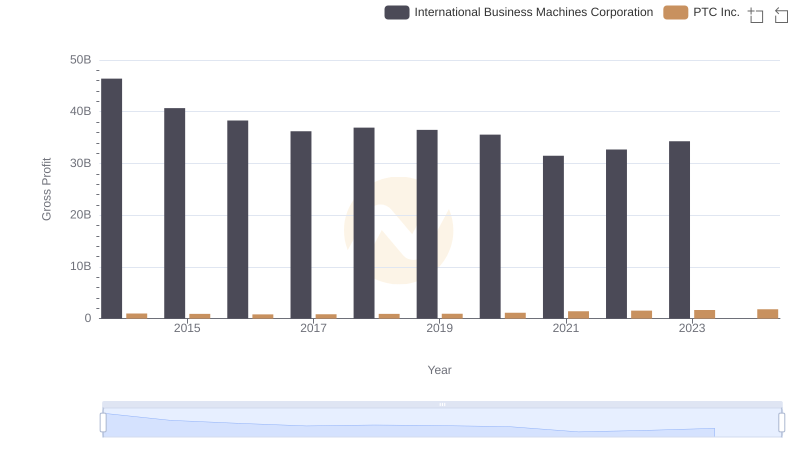

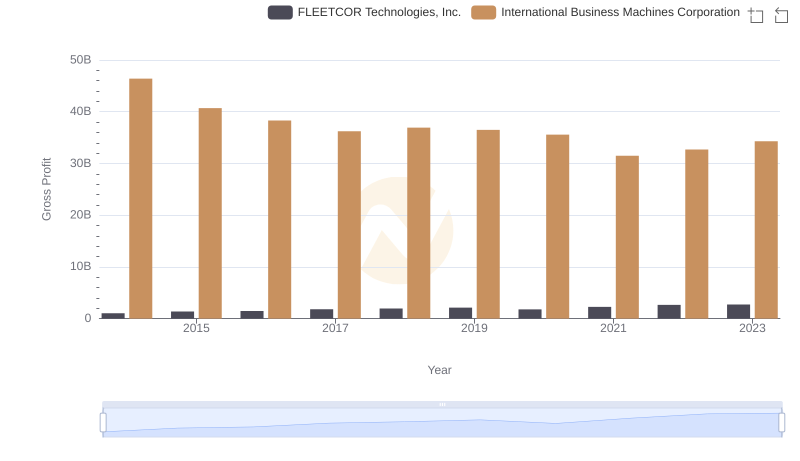

In the ever-evolving landscape of global technology, the financial performance of industry titans like International Business Machines Corporation (IBM) and ASE Technology Holding Co., Ltd. offers a fascinating glimpse into market dynamics. Over the past decade, ASE Technology has consistently outperformed IBM in terms of gross profit, showcasing a remarkable growth trajectory. From 2014 to 2023, ASE's gross profit surged by approximately 70%, peaking in 2022, while IBM experienced a decline of around 26% during the same period.

This trend highlights ASE's strategic prowess in capitalizing on emerging markets and technological advancements, whereas IBM's traditional business model faced challenges in adapting to the rapidly changing tech environment. As we look to the future, these insights underscore the importance of innovation and agility in maintaining competitive advantage in the tech industry.

Comparing Revenue Performance: International Business Machines Corporation or ASE Technology Holding Co., Ltd.?

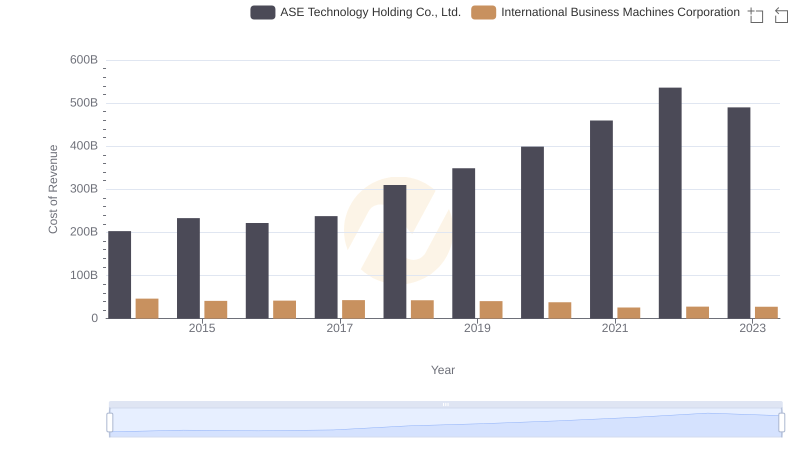

International Business Machines Corporation vs ASE Technology Holding Co., Ltd.: Efficiency in Cost of Revenue Explored

International Business Machines Corporation vs ON Semiconductor Corporation: A Gross Profit Performance Breakdown

Gross Profit Analysis: Comparing International Business Machines Corporation and PTC Inc.

Gross Profit Comparison: International Business Machines Corporation and FLEETCOR Technologies, Inc. Trends

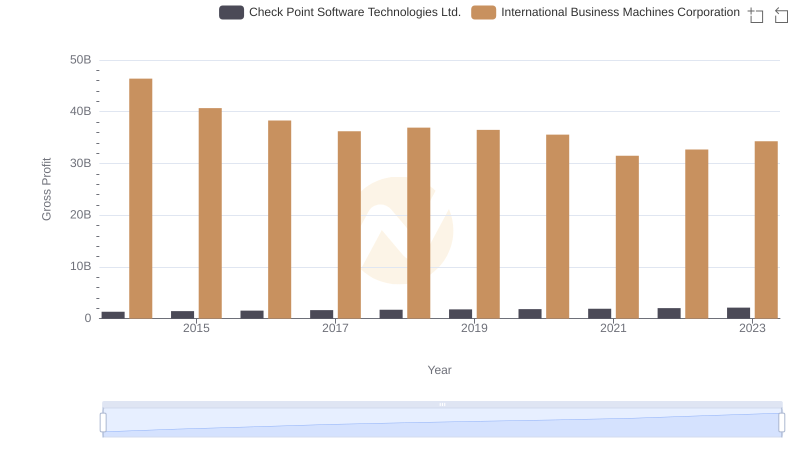

Key Insights on Gross Profit: International Business Machines Corporation vs Check Point Software Technologies Ltd.

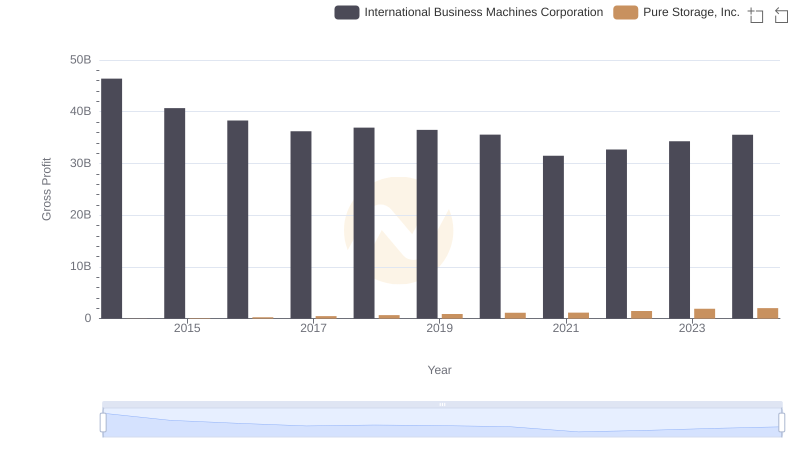

Gross Profit Trends Compared: International Business Machines Corporation vs Pure Storage, Inc.

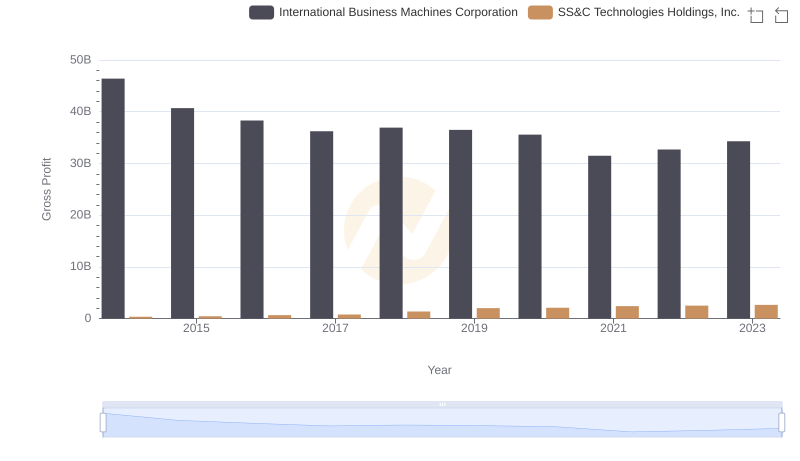

Who Generates Higher Gross Profit? International Business Machines Corporation or SS&C Technologies Holdings, Inc.

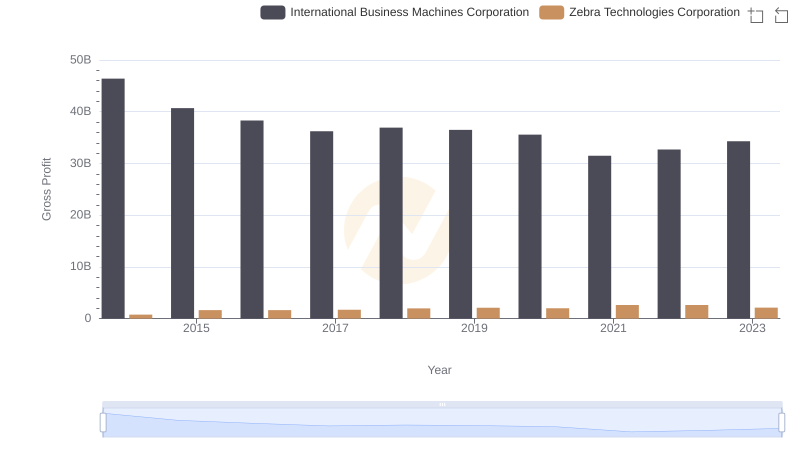

Gross Profit Trends Compared: International Business Machines Corporation vs Zebra Technologies Corporation

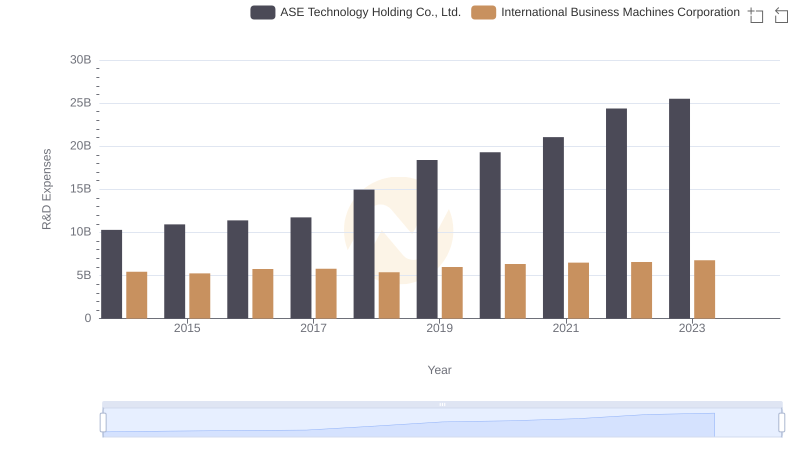

Who Prioritizes Innovation? R&D Spending Compared for International Business Machines Corporation and ASE Technology Holding Co., Ltd.

Comparing SG&A Expenses: International Business Machines Corporation vs ASE Technology Holding Co., Ltd. Trends and Insights

EBITDA Performance Review: International Business Machines Corporation vs ASE Technology Holding Co., Ltd.